TODAY’S CHALLENGE

Federal funds target rate: 3.75 - 4.00%*

Steady rates and a cautious Federal Reserve create a need for careful positioning in fixed income.

Federal funds target rate: 3.50 - 3.75%*

OUR STRATEGY

50+ years of fixed income investing

Capital Group offers bond funds to help investors generate meaningful income. Our research-driven, active approach allows for allocations to shift based on market conditions and investment insights (subject to fund guidelines).

*Source: The New York Federal Reserve. As of 12/31/25.

OUR TAKE

On a historical basis, opportunities for high income should continue if the U.S. economy maintains its strength.

For investors willing to add risk, allocations to multi-sector, high-yield or emerging markets debt funds can complement core funds and help provide income.

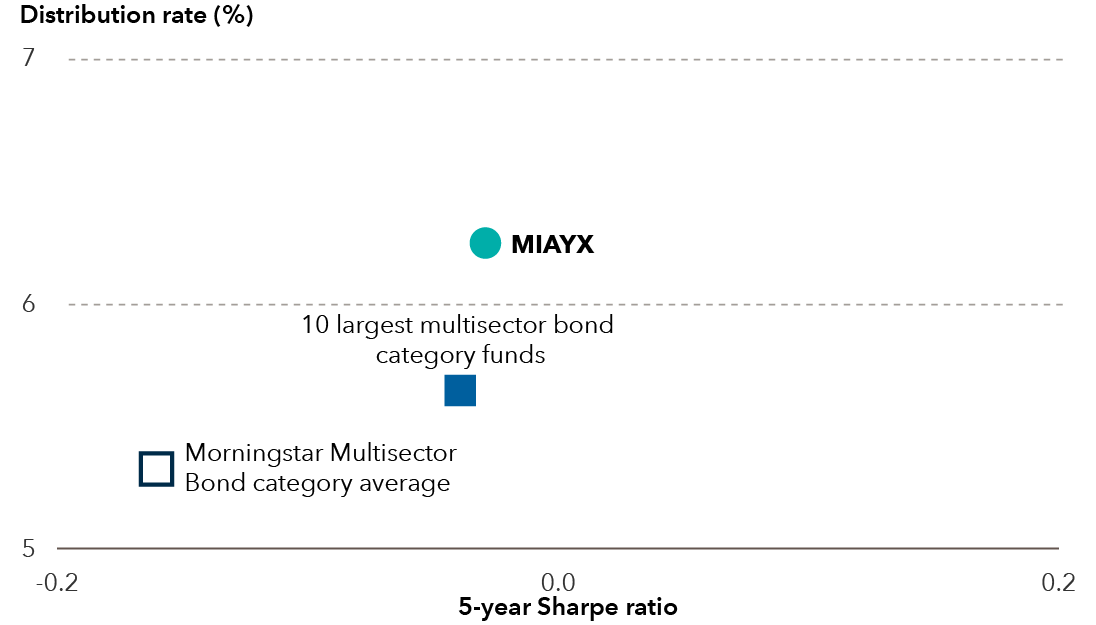

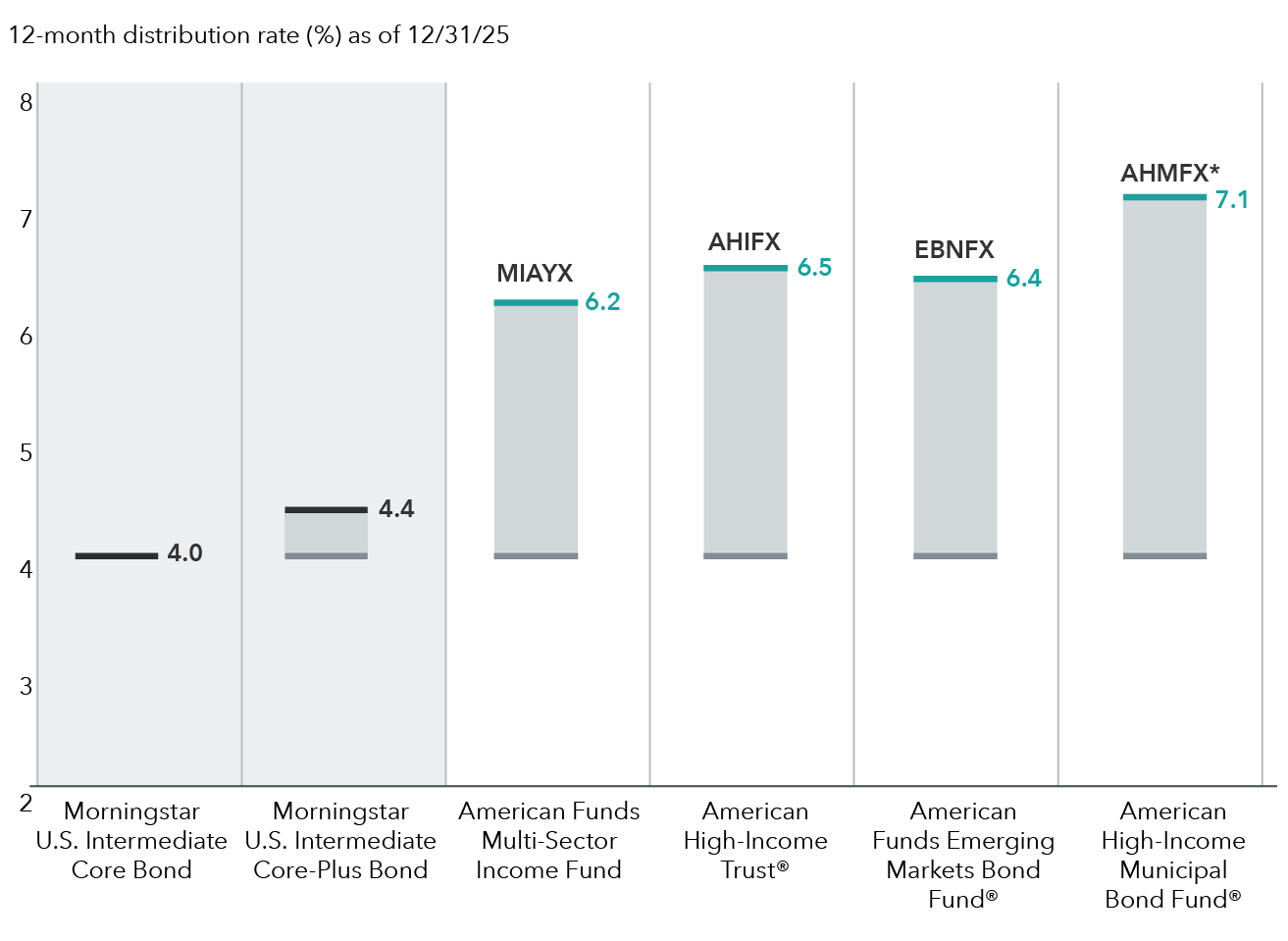

Income-seeking funds offered higher distributions, complemented core (F-2 shares)

*Tax-equivalent 12-month distribution rate: Highest tax rate assumes the 3.8% Medicare tax and the top federal marginal tax rate for 2025 of 37%. Morningstar Intermediate Core Bond and Morningstar Intermediate Core-Plus Bond are category averages. Sources: Morningstar. Bloomberg.

American Funds Multi-Sector Income Fund (F-2)

MIAYX

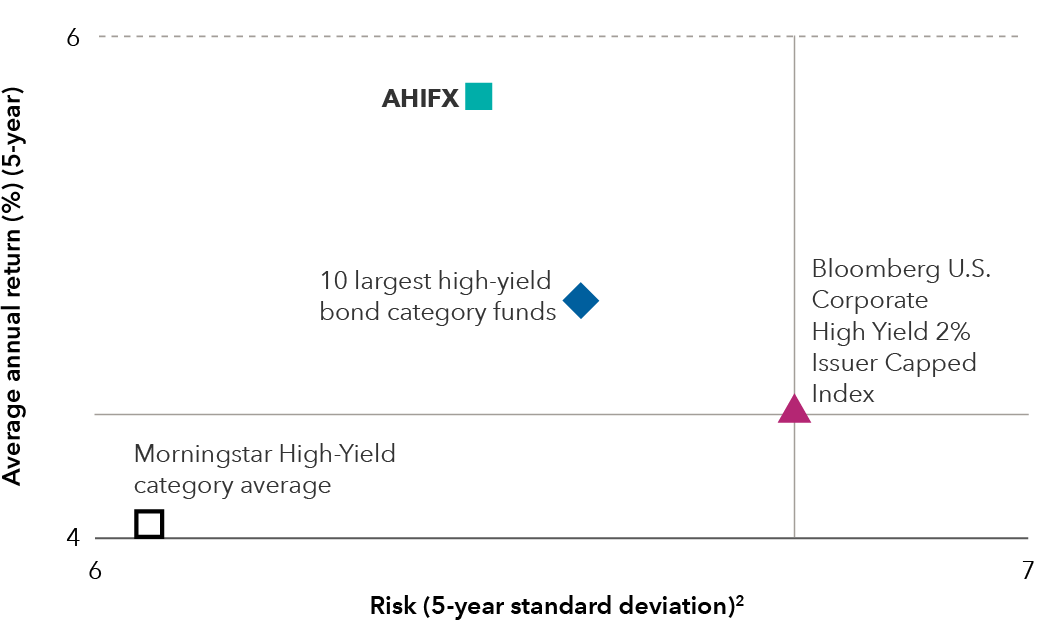

American High-Income Trust (F-2)

AHIFX

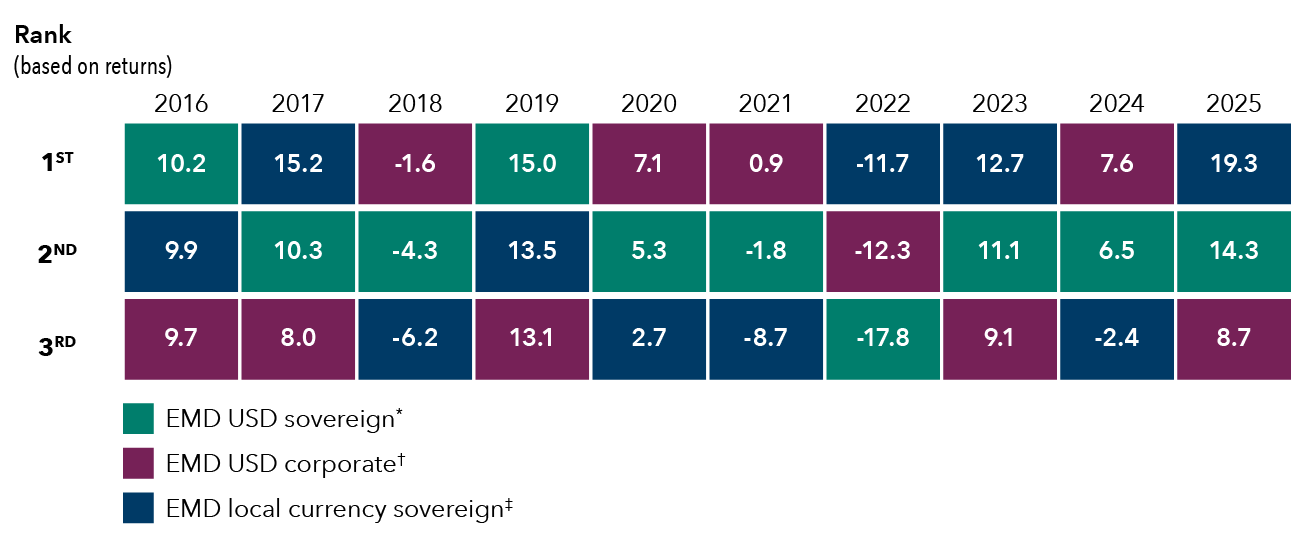

American Funds Emerging Markets Bond Fund (F-2)

EBNFX

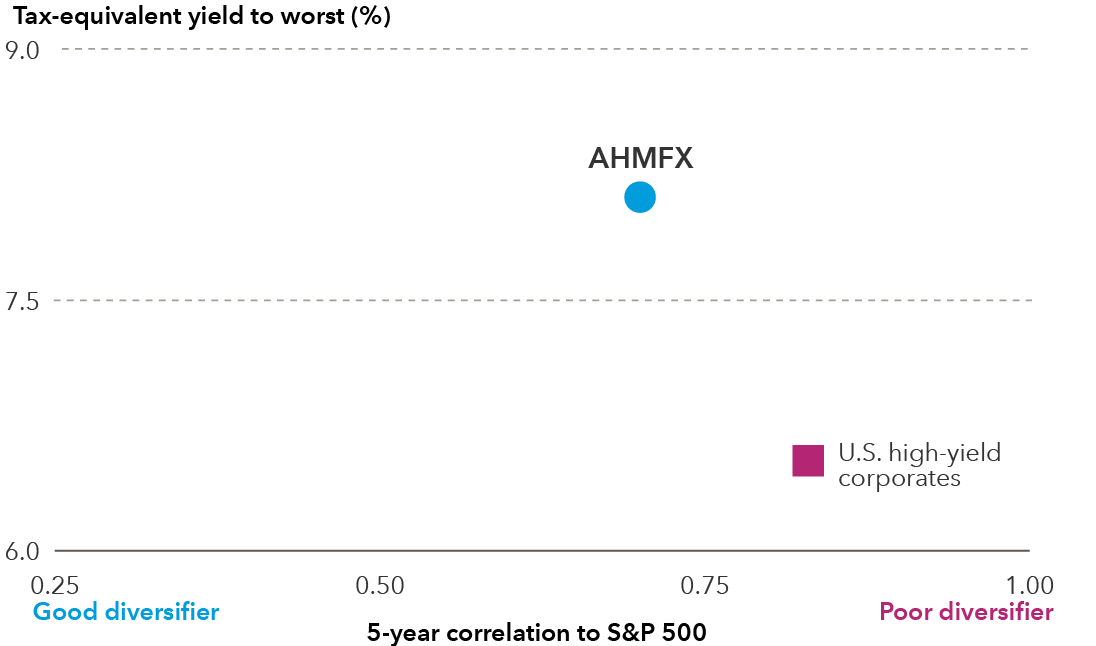

American High-Income Municipal Bond Fund (F-2)

AHMFX

Featured fund: American Funds Multi-Sector Income Fund

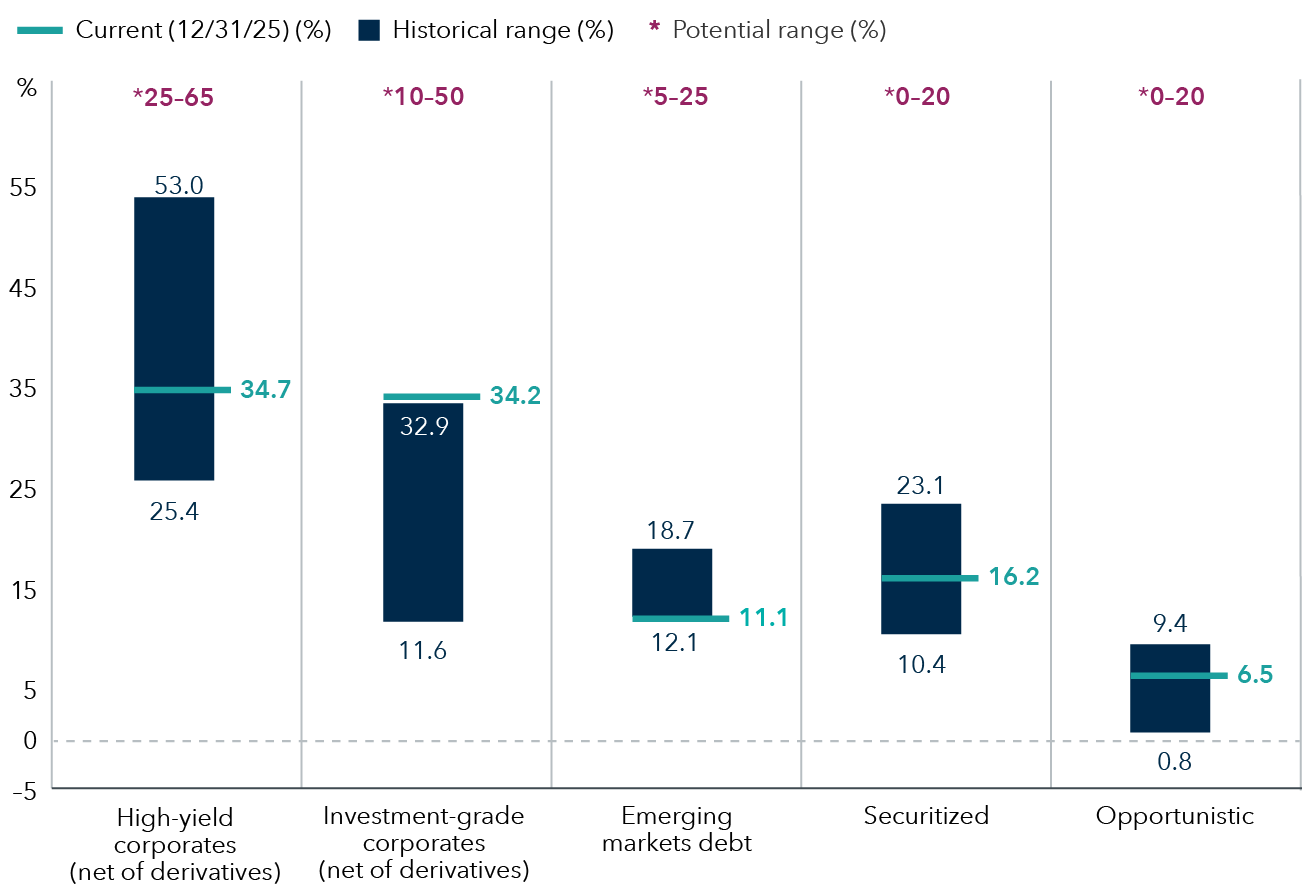

American Funds Multi-Sector Income Fund invests across higher income sectors. The fund is designed to provide less volatility than a standalone high-yield or emerging markets debt fund, without meaningfully reducing income.

-

-

Positioning

Fund tilted toward higher quality sectors

Monthly allocations since fund inception (March 22, 2019)

Opportunistic includes U.S. Treasuries, municipal bonds, noncorporate credit and other debt instruments. Securitized includes financial securities that are created by securitizing individual loans (debt). Source: Capital Group. Data as of 12/31/25. Investment-grade = BBB/Baa and above.

Overweight

Securitized

The fund’s largest overweight remained securitized credit as fundamentals continued to be supportive and yields in this sector remained attractive relative to corporate credit alternatives. This was especially the case in commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS). Meanwhile, the fund modestly reduced its exposure to agency mortgage-backed securities (MBS), an opportunistic allocation.

Investment-grade credit

Throughout the quarter, investment-grade (IG) corporates remained attractive on a relative value basis, supported by strong credit fundamentals and attractive all-in yields. The fund’s managers modestly increased its exposure to the sector but remained almost neutral relative to the benchmark. Additionally, the market continued to offer idiosyncratic opportunities in the IG corporate space.

Underweight

High yield

During the first half of the quarter, the fund took advantage of strong credit fundamentals and idiosyncratic opportunities by increasing its exposure to high-yield assets. This included direct investments in high-yield bonds and selling high-yield credit default swaps (CDX). Later in the quarter, as volatility rose, the fund’s managers modestly reduced its exposure to high-yield assets.

Emerging markets

The fund’s emerging markets debt (EMD) allocation remained underweight relative to the benchmark. While the sector’s fundamentals continued to be broadly supportive, we believe valuations were not as attractive as in other sectors. The fund modestly reduced its exposure to the high-yield portion of the EMD market while maintaining positions in IG assets.

Weightings are relative to the American Funds Multi-Sector Income Fund Custom Index. As of 12/31/25.

-

Strategy

Remaining selective with relative value opportunities across sectors

- Credit markets remained strong during the quarter, even as market volatility increased and as investors continued to be wary of artificial intelligence (AI) and data center build-out financing. Growing concerns around corporate defaults and the longest federal government shutdown in U.S. history added to the uncertainty.

- Even with valuations at the tighter end of their historical range for this part of the economic cycle, robust credit fundamentals and elevated yields drove demand and supported fixed income markets.

- Broadly speaking, we expect U.S. economic growth to remain positive, albeit with some softening of the labor market and heightened volatility around geopolitical and/or trade risks. Growth drivers may include ongoing AI investments and broad regulatory initiatives by the Trump administration.

Source: Capital Group. As of 12/31/25.

-

Featured fund: American High-Income Trust

A diversified portfolio of lower rated, higher yielding bonds seeking to provide you with a high level of current income

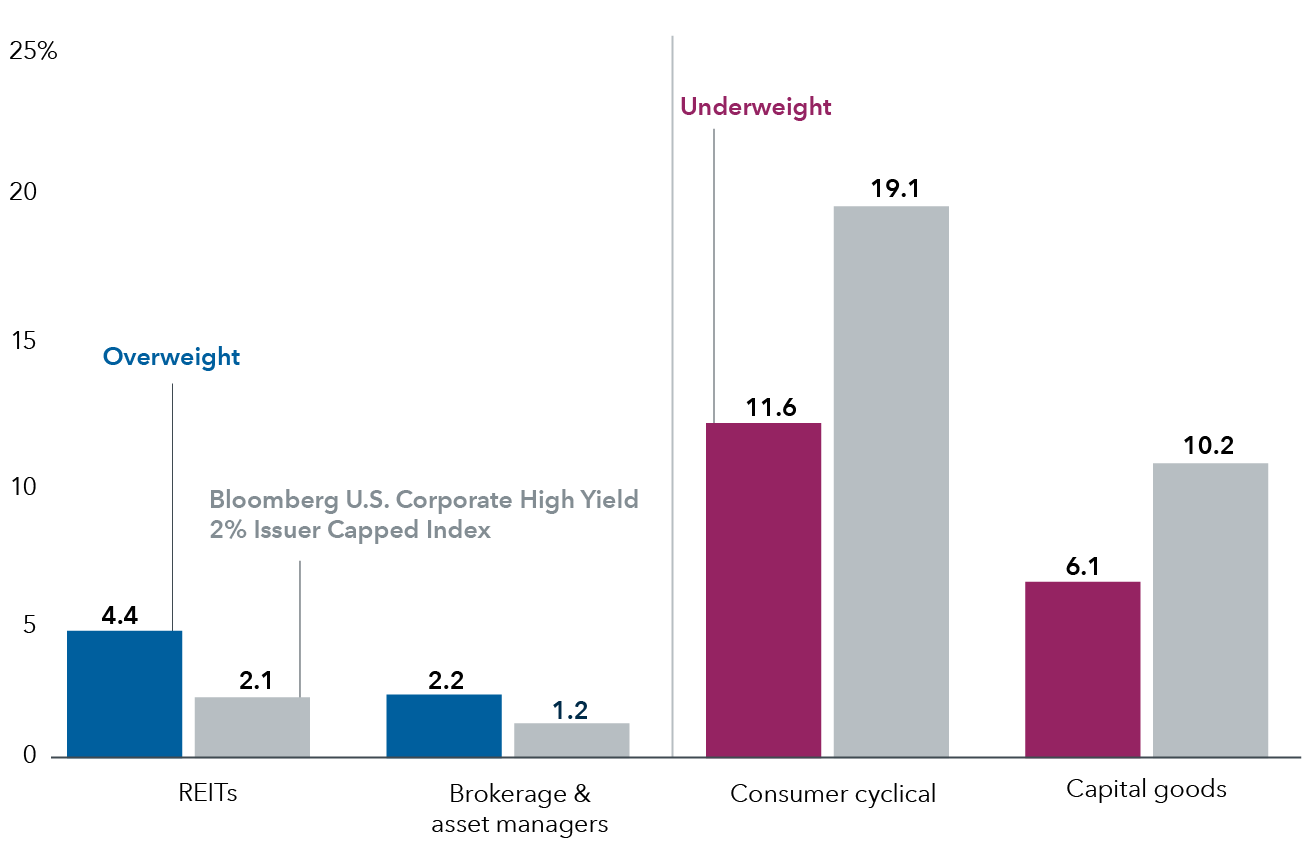

Fund is slightly defensively positioned as growth moderates

Industries shown below are among the fund's notable overweights and underweights relative to the index

Sources: Capital Group, Bloomberg. Data as of 12/31/25.

Overweight

REITs

Our American High-Income Trust portfolio maintains a modest overweight to REITs due to their strong fundamentals, including resilient free cash flow and REITs' generally stable leverage profile. These assets offer defensive yields and diversification potential.

Brokerage, asset managers & exchanges

Financial advisory platforms are growing via consolidation and should benefit from elevated interest rates. Investments across the sector have produced an attractive level of cash flow despite recent concerns about cash sweep considerations.

Underweight

Consumer cyclical

Although the fund remains broadly underweight the sector, we maintain idiosyncratic positions in retailers, gaming and leisure. These investments skew toward higher quality issues within these subsectors.

Capital goods

The fundamental outlook is stable across industries like diversified manufacturing. The largest underweight within the sector comes from building materials, which has been the most impacted by decreasing home sales in recent years.

Weightings are relative to the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index as of 12/31/25.

Some say

Spreads among credit sectors are historically tight.

Insight

While most credit spreads are tight on a historical basis, many starting yields are near or above their five-year average. With the Fed likely on hold for the early part of 2026, we believe income-oriented sectors can effectively complement a core bond allocation.

In our view, high yield, emerging markets bonds, investment-grade corporates and other sectors can potentially enable income investors to achieve long-term excess returns even if the federal funds target rate holds steady.

Some say

Investors only need dividend-paying stocks to generate income.

Insight

In addition to dividend-paying stocks, investments in higher income bonds can help income-seeking investors fund a longer retirement. Higher income bonds include investment-grade and high-yield corporates, emerging markets and securitized debt. In addition to diversification, most of these bonds offer steady coupon payments. However, they also carry the risk of defaulting on their obligations.

Depending on their circumstances, income-seeking investors may want to consider allocating a portion of their investments to these riskier assets.

Some say

Current high-yield spreads are tight versus their historical average.

Insight

While it’s natural for fixed income investors to be concerned with tight spreads, indicators such as starting yield to worst (YTW)4, credit quality and the likely direction of U.S. corporate earnings suggest that high yield may continue to outpace other fixed income sectors in 2026. With a starting YTW of 6.5% and with more than 50%* of the high-yield market rated BB/Ba, we believe high yield can continue to complement a core bond allocation and potentially offer greater long-term income than dividend-paying stocks.

Source: Bloomberg. Data as of 12/31/25. *Based on the Bloomberg U.S. High Yield 2% Issuer Capped Index.

Some say

Only speculative investors should buy emerging markets debt.

Insight

Emerging markets bonds can offer high income with currency and geographic diversification.

Many emerging markets sovereign bonds are investment-grade-rated, and the asset class comprises some of the fastest growing economies in the world. Still, idiosyncratic and geopolitical risks tied to emerging markets are real, and we believe a capable investment manager with disciplined risk-management processes in place is essential for investors to achieve long-term success.

Some say

Municipal bonds are only for wealthy investors.

Insight

Investors across multiple tax brackets can benefit from allocations to municipal bonds. Munis are typically exempt from federal taxes and sometimes state and local taxes, which means investors can keep more of their interest income.

Beyond tax advantages, munis typically have lower risk compared to high-yield bonds and equities. They can also serve to diversify a portfolio.

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Investing for short periods makes losses more likely. Prices and returns will vary, so investors may lose money. View mutual fund expense ratios and returns. View current mutual fund SEC yields and tax-equivalent SEC yields.

1. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ. For American Funds Emerging Markets Bond Fund, a portion of the fund's distribution may be classified as a return of capital. Please refer to the fund's Annual Report for details.

2. Calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

3. Expense ratios are as of each fund’s prospectus/characteristics statement, as applicable, available at the time of publication.

4. Yield to worst is defined as the lowest possible yield that an investor would receive if all the issuers in a fixed income fund fulfilled their payment obligations.

© 2026 Morningstar, Inc. All Rights Reserved. Some of the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

Duration indicates a bond fund’s sensitivity to interest rates. Higher duration indicates more sensitivity.

Sharpe ratio uses standard deviation and excess return to determine reward per unit of risk. The higher the number, the better the portfolio's historical risk-adjusted performance.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

Correlation to S&P 500 is a measurement of how returns for the fund and S&P 500 move in relation to each other. A correlation ranges from -1 to 1. A positive correlation close to 1 implies that as one moved, either up or down, the other moved in “lockstep,” in the same direction. A negative correlation close to -1 indicates the two have moved in the opposite direction.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

American Funds Multi-Sector Income Fund Custom Index comprises: 45% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 30% Bloomberg U.S. Corporate Investment Grade Index, 15% J.P. Morgan EMBI Global Diversified Index, 8% Bloomberg CMBS Ex AAA Index, 2% Bloomberg ABS Ex AAA Index and blends the respective indices by weighting their cumulative total returns according to the weights described. This assumes the blend is rebalanced monthly.

J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

J.P. Morgan CEMBI Broad Diversified Index tracks the performance of US dollar-denominated bonds issued by emerging market corporate entities.

JP Morgan Government Bond Index – Emerging Markets Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

Bloomberg CMBS Ex AAA Index: tracks investment-grade (Baa3/BBB- or higher, excluding Aaa/AAA) commercial mortgage backed securities that are included in the Bloomberg U.S. Aggregate Index. These securities have a minimum life of at least one year and must be fixed-rated weighted average coupon or capped weighted average coupon securities.

Bloomberg ABS Ex AAA Index: covers fixed-rated investment-grade (Baa3/BBB- or higher, excluding Aaa/AAA) asset backed securities that are included in the Bloomberg U.S. Aggregate Index. The index has three subsectors, which includes credit and charge cards, autos, and utility. These securities are ERISA-eligible and must have an average life of at least one year and must be senior class, tranche B or C of the deal.