Insights

Why the sequence of returns matters in retirement

Watch this short video to learn 3 ways you can help clients mitigate this risk and work with them to plan for the long term.

Latest insights

Focus on retirement

Shareable thoughts from our Retirement Income Strategy team

Insights

Active RILAs: Pairing growth with a level of protection

INSIGHTS

Guiding confident retirement conversations

Retirement Income

3 big risks retirees underestimate in retirement

Tools

Visualize outcomes

Hypothetical calculators for impactful conversations

American Funds Insurance Series®

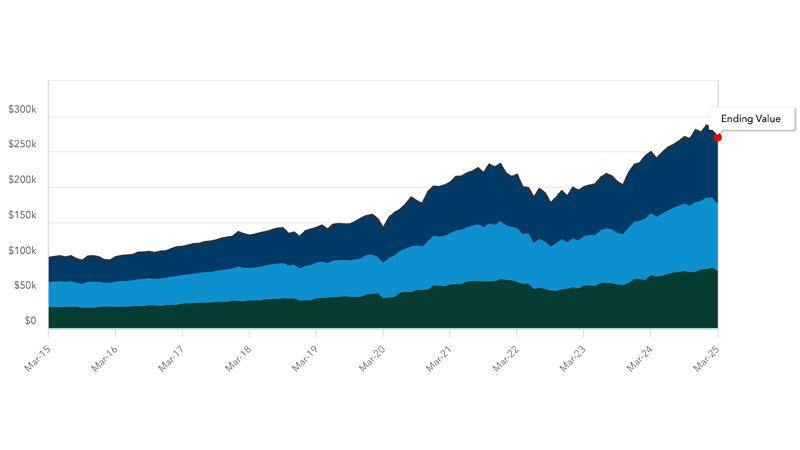

Historical illustrator

Model a strong portfolio of variable annuity investments

Client Tools

Portfolio Reliance Calculator

Quickly illustrate the potential impact of protected income sources on clients' portfolio withdrawal rates and their investment portfolios

INSURANCE SERIES FUNDS

Build portfolios to scale

As one of America's largest variable annuity asset managers,* we offer a core 19 insurance-dedicated funds — 11 of which are aligned with their retail American Funds mutual fund counterparts.

*Source: ISS Market Intelligence Simfund, as of 12/31/24. Variable annuities not including fixed accounts.

†Our aligned funds share identical investment objectives, portfolio manager teams and management expenses to their retail counterparts.

INSURANCE PARTNERS

One of the first

Capital Group was one of the first in the industry to offer funds exclusively to insurance companies. Learn more from some of the over 20 companies we work for:

Variable annuities may impose a variety of fees that may affect the growth of your client's portfolio. Variable annuities have investment and/or withdrawal limitation requirements. Early withdrawals may incur a fee. Guarantees are subject to the claims-paying ability of the issuing insurance company.