Unleash the power of private markets

Explore a thoughtful approach to purusing long-term success for your clients.

How much liquidity does your portfolio need?

Explore the role of liquidity in an investment portfolio, and how much illiquidity a given portfolio might be able to withstand in exchange for potentially higher returns.

- Fixed income plus

- Equity plus

FUND DETAILS

Our Public-Private+ offerings

Fixed Income

Capital Group KKR Core Plus+

Blending public fixed income and private credit to pursue higher income than a traditional core plus strategy.

Fixed Income

Capital Group KKR Multi-Sector+

Blending public fixed income and private credit to pursue high income.

GAME CHANGER: INTERVAL INVESTING

What to expect

Capital Group and KKR's exclusive partnership aims to unlock access to private markets through investment solutions, delivered via an interval fund structure, that feature:

Simplified due diligence and streamlined tax reporting (IRS 1099 forms)

A compelling fee structure

OUR EDUCATION HUB

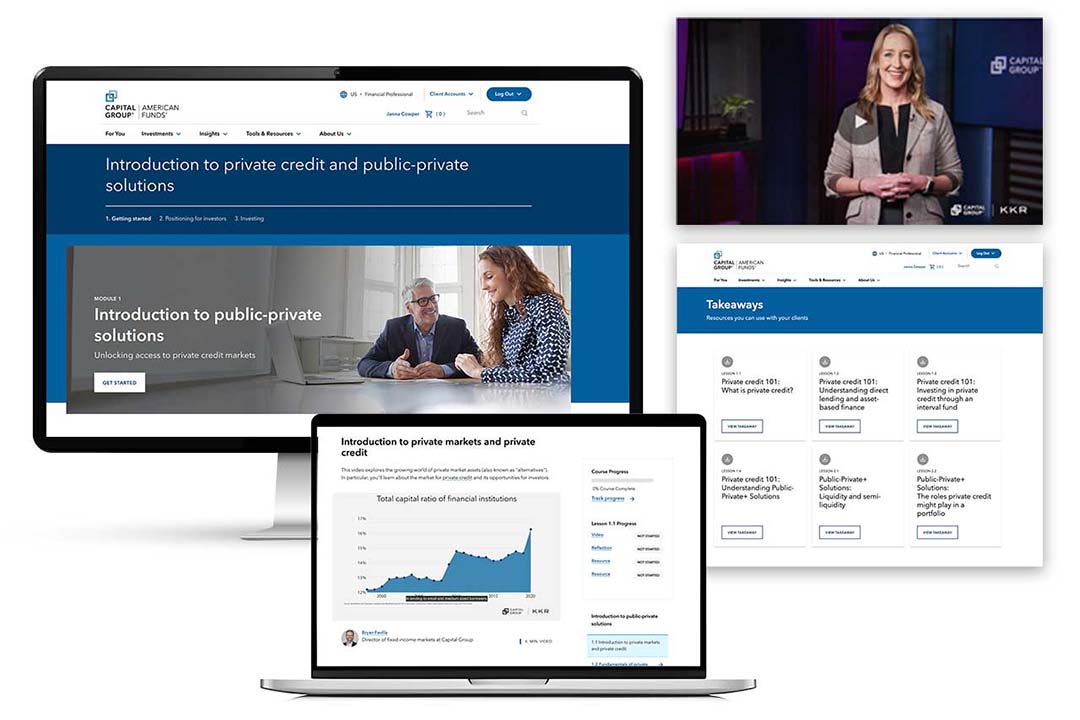

Enhance your public-private knowledge

Sharpen your understanding of private markets and how they may benefit investor portfolios.

We've introduced a self-guided educational program that will help enhance financial professionals' knowledge of private markets, public-private investment solutions and how to consider using these solutions in portfolios.

- Hear from professionals at Capital Group and KKR

- Download materials to use with your clients

- Eligible advisors may receive CE credit

“We’re developing an investment solution that integrates both public equity and private equity strategies – a hybrid approach which offers our clients a smoother entry point into private market investing.”

- Mike Gitlin, President and CEO, Capital Group

Explore our insights

THE DETAILS

Unpacking Public-Private+ Funds

Curious about Capital Group and KKR's partnership and its offerings? Our brochure has the details. We'll also fill you in on our investment process and why we opted for interval funds.

Deep knowledge

Why Capital Group KKR Public-Private+ Funds

An investment solution from two leading firms with extensive experience in public and private markets.

Capital Group

KKR

“Our goal is to broaden access to alternative investments, including opportunities normally found in private equity funds. We’re uniting what we believe are best-in-class firms to deliver client-focused solutions rather than just products.”

- Mike Gitlin, President and CEO, Capital Group

An exclusive partnership

Our shared values

FREQUENTLY ASKED QUESTIONS

Your public-private solutions questions, answered

We share the latest questions our specialists are answering for financial professionals.

Alternative assets (or "alts") are investments that fall outside of traditional asset classes like stocks, bonds and cash equivalents. They may include real estate, commodities, private equity, private credit and other non-traditional investments. Investments in these assets have risks that investors should consider.

Private credit refers to non-bank lending where investors provide loans or other financing options directly to private companies or projects, outside of traditional public markets. Private credit is typically used by businesses seeking capital without issuing public debt or equity.

Private equity involves investment firms acquiring ownership stakes in private companies, often with the goal of restructuring, growing or eventually selling the businesses for a profit. These investments are typically long-term and involve active management to enhance the value of the company before an exit strategy, such as a sale or initial public offering (IPO), is executed.

An interval fund is a closed-end, registered investment company that offers liquidity to investors at pre-scheduled “repurchase windows,” up to an amount between 5% and 25% of the fund’s total outstanding shares. These funds are used as a mechanism to provide periodic, interval-based liquidity to investors while holding illiquid assets such as private credit or private equity.

Private credit exposure can be obtained in several ways. Typically, eligible investors would access it through a private credit fund. In partnership with KKR, we now offer interval funds that contain both public and private credit.

Private equity is traditionally accessed through investments in private equity funds overseen by private equity managers. These funds have strict eligibility requirements. Strategies that bundle private equity with other holdings may not have the same restrictions.

Private credit investments are subject to the usual risks inherent to any investing, including the risk of capital loss. Investing in pure private markets strategies also comes with greater illiquidity and typically higher investment minimums. Private credit investments may have less transparency compared to publicly traded bonds, whose issuers may be required to disclose more information. Due to less frequent independent pricing and the relative illiquidity, valuations may be skewed.

Private equity investments are subject to the usual risks inherent to any investing, including the risk of capital loss. Investing in pure private markets strategies also comes with greater illiquidity and typically higher investment minimums. Private equity investments may have less transparency compared to public equity, where companies are required to make regular disclosures. Due to less frequent independent pricing and the relative illiquidity, valuations may be skewed. Additionally, there is typically a wide dispersion in returns among managers in the private market space, making manager selection a key part of due diligence.

Traditionally, private markets investments have been accessible only to investors that met strict eligibility requirements. By partnering with KKR, Capital Group aims to broaden that access to more investors.

We have compiled a glossary of private markets terms that can be accessed here.

Investment strategies are not guaranteed to meet their objectives and are subject to loss. Investing in the fund is not suitable for all investors. Investors should consult their investment professional before making an investment decision and evaluate their ability to invest for the long term. Because of the nature of the fund's investments, the results of the fund's operations may be volatile. Accordingly, investors should understand that past performance is not indicative of future results.

Bond investments may be worth more or less than the original cost when redeemed. High‐yield, lower‐rated, securities involve greater risk than higher‐rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. The fund may invest in structured products, which generally entail risks associated with derivative instruments and bear risks of the underlying investments, index or reference obligation. These securities include asset-based finance securities, mortgage-related assets and other asset-backed instruments, which may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market's perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. While not directly correlated to changes in interest rates, the values of inflation-linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. For example, the fund may purchase and write call and put options on futures, giving the holder the right to assume a long (call) or short (put) position in a futures contract at a specified price. There is no assurance of a liquid market for any futures or futures options contract at any time. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

The fund invests in private, illiquid credit securities, consisting primarily of loans and asset-backed finance securities. The fund may invest in or originate senior loans, which hold the most senior position in a business's capital structure. Some senior loans lack an active trading market and are subject to resale restrictions, leading to potential illiquidity. The fund may need to sell other investments or borrow to meet obligations. The fund may also invest in mezzanine debt, which is generally unsecured and subordinated, carrying higher credit and liquidity risk than investment-grade corporate obligations. Default rates for mezzanine debt have historically been higher than for investment-grade securities. Bank loans are often less liquid than other types of debt instruments and general market and financial conditions may affect the prepayment of bank loans, as such the prepayments cannot be predicted with accuracy.

Illiquid assets are more difficult to sell and may become impossible to sell in volatile market conditions. Reduced liquidity may have an adverse impact on the market price of such holdings, and the fund may be unable to sell such holdings when necessary to meet its liquidity needs or to try to limit losses, or may be forced to sell at a loss. Illiquid assets are also generally difficult to value because they rarely have readily available market quotations. Such securities require fair value pricing, which is based on subjective judgments and may differ materially from the value that would be realized if the security were to be sold.

The fund is a non-diversified fund that has the ability to invest a larger percentage of assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor results by a single issuer could adversely affect fund results more than if the fund were invested in a larger number of issuers. The fund intends to declare daily dividends from net investment income and distribute the accrued dividends, which may fluctuate, to investors each month. Generally, dividends begin accruing on the day payment for shares is received by the fund. In the event the fund's distribution of net investment income exceeds its income and capital gains paid by the fund's underlying investments for tax purposes, a portion of such distribution may be classified as return of capital. The fund's current intention not to use borrowings other than for temporary and/or extraordinary purposes may result in a lower yield than it could otherwise achieve by using such strategies and may make it more difficult for the fund to achieve its investment objective, than if the fund used leverage on an ongoing basis. There can be no assurance that a change in market conditions or other factors will not result in a change in the fund distribution rate at a future time.