Investments in private credit and related strategies involve significant risks, including limited liquidity and potential loss of capital. These strategies may include exposure to low and unrated credit instruments, structured products, and derivatives, all of which carry heightened credit, market, valuation, and liquidity risks. Investors should consult with their financial professional when considering such strategies for their portfolios.

Seasoned managers, new opportunities

Capital Group and KKR have partnered to open a new world of opportunities to investors. This global, exclusive partnership brings experience, depth and scale that few others can match to offer public and private investments in holistic investment solutions.

Capital Group

KKR

Why did Capital Group and KKR partner?

"It was clear we were meant to get together and try to figure out how we can deliver more for our clients. It was culture that won out."

— Mike Gitlin, Capital Group CEO

Watch the video to learn more.

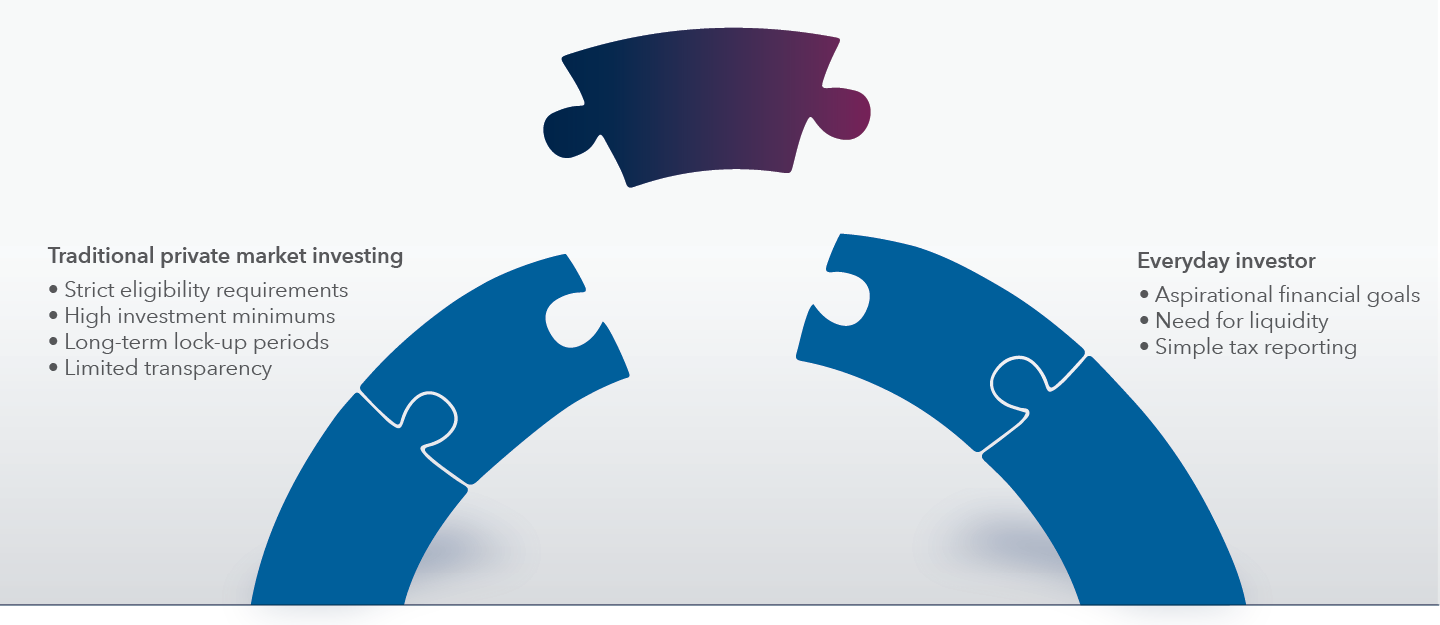

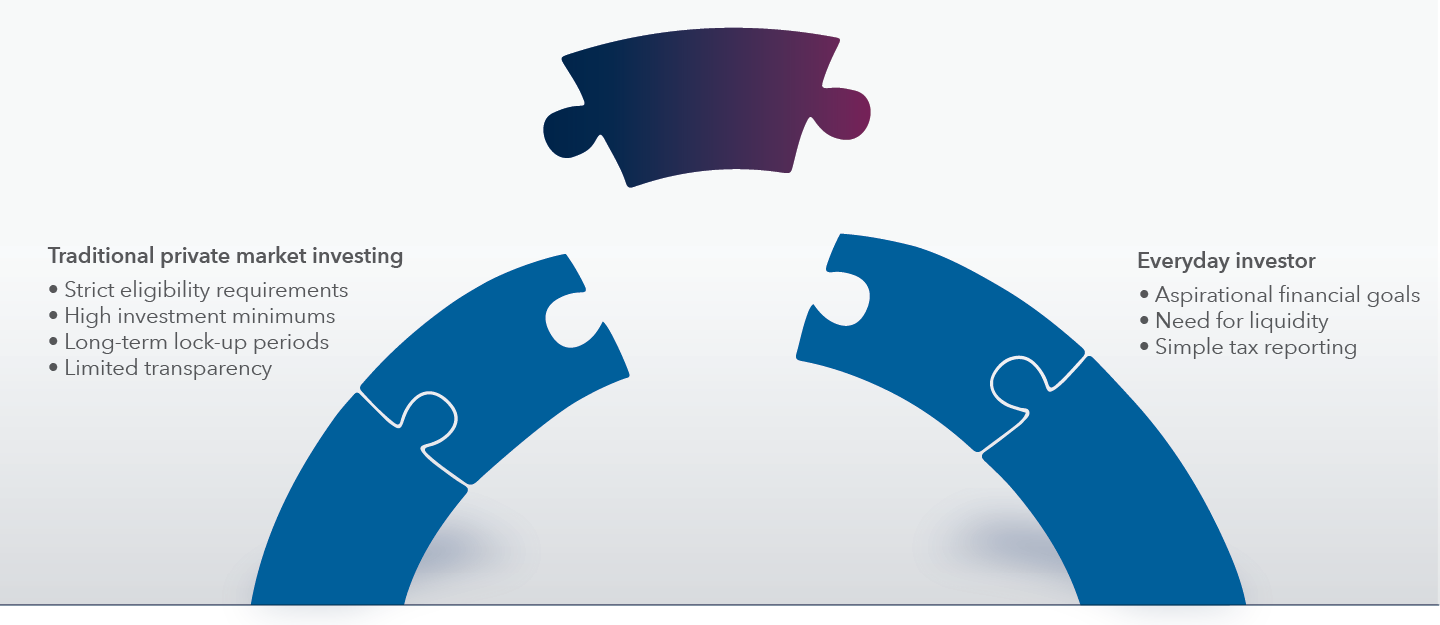

Bridging the access gap

Private market investments have typically been accessible to investors that meet strict eligibility requirements — such as substantial investible assets — and have the means to handle the complexity of tax reporting, long lock-up periods and potential risks. With a shared thoughtful approach to offering these investments to the everyday investor, Capital Group and KKR seek to enhance the tools available to investors to pursue their long-term investment goals.

Dig deeper into Capital Group and KKR

A balanced public-private narrative

In the race to make private markets more accessible to individual investors, a misleading narrative has taken hold — one that pits the public and private markets against each other.

Private markets and macro outlook

Join our webinar with KKR to get macro and private market insights to help you bolster client portfolios ahead of 2026.

What are private markets? And should investors consider these investment opportunities?

Explore the growing private market landscape, including private credit and asset-based finance, to understand investment opportunities and risks.