- Investments

- / American High-Income Municipal Bond Fund®

Investment Fund

American High-Income Municipal Bond Fund® (AHMFX)

Purchase Restrictions: Tax-exempt funds should generally not serve as investments for tax-deferred retirement plans and accounts. Class F-2 shares are available through certain registered investment advisor and fee-based programs, but are not available for purchase in most employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

A well-researched, broadly diversified approach for high tax-exempt income.

With a strong focus on risk management, it provides exposure to a well-researched, broadly diversified portfolio of bond investments that are typically not available to retail investors, emphasizing higher yielding and lower rated municipal bonds.

Price at NAV

$15.52

as of 2/23/2026 (updated daily)

Fund Assets (millions)

$13,906.3

Portfolio Managers

3

Expense Ratio

(Gross/Net %)

0.42 / 0.42%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Asset Mix

| U.S. Equities0.0% | Non-U.S. Equities0.0% | ||

| U.S. Bonds91.4% | Non-U.S. Bonds0.1% | ||

| Cash & Equivalents |

| U.S. Equities0.0% | |

| Non-U.S. Equities0.0% | |

| U.S. Bonds91.4% | |

| Non-U.S. Bonds0.1% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Fixed-Income

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Description

Objective

The fund's investment objective is to provide you with a high level of current income exempt from regular federal income tax.

Distinguishing Characteristics

This strategy offers investors opportunities for high federally tax-exempt income with a strong focus on risk management. It provides exposure to a well-researched, broadly diversified portfolio of bond investments that are typically not available to retail investors, emphasizing higher yielding and lower rated municipal bonds.

Types of Investments

Primarily invests in state, municipal and public authority bonds and notes. Normally, at least 80% of assets will be invested in tax-exempt securities. (May invest up to 100% of assets in bonds subject to the alternative minimum tax.) The fund will generally invest at least 50% of assets in debt securities rated Baa/BBB or below at the time of purchase, and 65% in securities rated A or below at the time of purchase, or unrated, but determined by the fund’s investment adviser to be of equivalent quality.

Maturity

Typically, the fund will be invested in intermediate- to long-term securities.

Fund Facts

| Fund Inception | 9/26/1994 |

|

Fund Assets (millions) As of 1/31/2026

|

$13,906.3 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

1398+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

55,421 |

|

Regular Dividends Paid |

Monthly |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 28% |

| Fiscal Year-End | Jul |

| Prospectus Date | 10/01/2025 |

| CUSIP | 026545 60 8 |

| Fund Number | 640 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

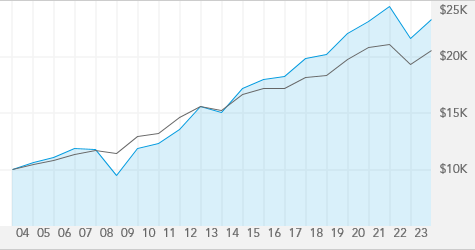

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class F-2 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class F-2 Shares, this chart tracks the high and low prices at NAV for AHMFX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/23/2026.

Portfolio Management

LEARN ABOUT THE CAPITAL SYSTEMSM

Lee Chu

17

17

1

Chad Rach

30

21

14

Jerry Solomon

34

17

9

| Lee Chu | 1 | 17 | ||

| Chad Rach | 14 | 21 | 30 | |

| Jerry Solomon | 9 | 17 | 34 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(170) |

(170) |

(166) |

(123) |

|

Expense Within Category Funds Rated |

(76) |

(76) |

(75) |

(46) |

|

Preservation Within Category Funds Rated |

(5993) |

(5993) |

(5574) |

(4238) |

|

Tax Efficiency Within Category Funds Rated |

(170) |

(170) |

(166) |

(123) |

|

Total Return Within Category Funds Rated |

(170) |

(170) |

(166) |

(123) |

Category | Hi Yld Muni Debt Funds |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | ||

|

Standard Deviation

|

6.45 | |

|

Sharpe Ratio

|

0.24 | |

|

For the 10 Years ending 1/31/26

(updated monthly).

|

||

|

American Funds/ Morningstar Benchmark |

||

|

Bloomberg Municipal TR USD

|

||

| R-squared | 88 | |

| Beta | 1.17 | |

| Capture Ratio (Downside/Upside) | 109/124 | |

|

American Funds and Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

||

Quality Summary

AAA/Aaa

1.3%

AA/Aa

10.8%

A

11.0%

BBB/Baa

15.1%

BB/Ba

12.5%

B

1.4%

CCC & Below

0.6%

Unrated

38.8%

Cash & equivalents

8.4%

%

of net assets as of 1/31/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

24.7%

5-9.9 Years

24.7%

10-19.9 Years

19.5%

20-29.9 Years

18.9%

30+ Years

3.1%

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

Bonds Breakdown

Bond Details

Total bond holdings

Revenue bonds

+

87.0%

|

|||||||||||||||||||||||

| General obligation bonds 3.6% | |||||||||||||||||||||||

| Corporate bonds, notes & loans 0.2% | |||||||||||||||||||||||

| Mortgage-backed obligations 0.1% |

% of net assets as of 12/31/2025 (updated quarterly)

Top Fixed-Income Issuers

Commonwealth of Puerto Rico

2.4%

Chicago Board of Education

2.4%

United Airlines Inc

2.1%

Black Belt Energy Gas Dist

1.2%

New Hampshire St Business Fin

1.1%

Delta Air Lines

1.1%

State of Illinois McCormick Place Expansion Pr ...

0.9%

Puerto Rico Commonwealth Aqueduct & Sewer Auth ...

0.9%

Puerto Rico Electric Power Authority

0.8%

California Community Choice Financing Authorit ...

0.7%

% of net assets as of 12/31/2025 (updated monthly)

Geographic Breakdown

Colorado

9.7%

California

7.1%

Texas

6.9%

New York

6.5%

Illinois

6.1%

Florida

5.0%

Wisconsin

4.9%

Pennsylvania

3.1%

Arizona

2.8%

Alabama

2.6%

% of net assets as of 12/31/2025

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 02/23/26

Historical Distributions as of 02/23/26

| 2026 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| Daily | 01/30/26 | 02/02/26 | $0.0499979 | $0.00 | $0.00 | $0.00 | $15.37 |

| 2026 Year-to-Date: | Dividends Subtotal: $0.04999788 | Cap Gains Subtotal: $0.00 | |||||

| Total Distributions: $0.04999788 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00361962 | 02/02/2026 |

| 0.00165642 | 02/03/2026 |

| 0.00170126 | 02/04/2026 |

| 0.00167994 | 02/05/2026 |

| 0.00211474 | 02/06/2026 |

| 0.00634012 | 02/09/2026 |

| 0.00164101 | 02/10/2026 |

| 0.00167998 | 02/11/2026 |

| 0.00169431 | 02/12/2026 |

| 0.00171513 | 02/13/2026 |

| 0.00676924 | 02/17/2026 |

| 0.00166722 | 02/18/2026 |

| 0.00167364 | 02/19/2026 |

| 0.00165489 | 02/20/2026 |

| 0.00464775 | 02/23/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00361962 | 02/02/2026 | |

| 0.00165642 | 02/03/2026 | |

| 0.00170126 | 02/04/2026 | |

| 0.00167994 | 02/05/2026 | |

| 0.00211474 | 02/06/2026 | |

| 0.00634012 | 02/09/2026 | |

| 0.00164101 | 02/10/2026 | |

| 0.00167998 | 02/11/2026 | |

| 0.00169431 | 02/12/2026 | |

| 0.00171513 | 02/13/2026 | |

| 0.00676924 | 02/17/2026 | |

| 0.00166722 | 02/18/2026 | |

| 0.00167364 | 02/19/2026 | |

| 0.00165489 | 02/20/2026 | |

| 0.00464775 | 02/23/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.27% |

| Other Expenses | 0.15% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| AHMFX | 0.42% |

|

Lipper High Yield Municipal Debt

Funds Average

|

0.51% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for AHMFX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class F-2 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class F-2 Shares, this chart tracks the total returns since the fund's inception date (Monday, September 26, 1994) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (1994), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.