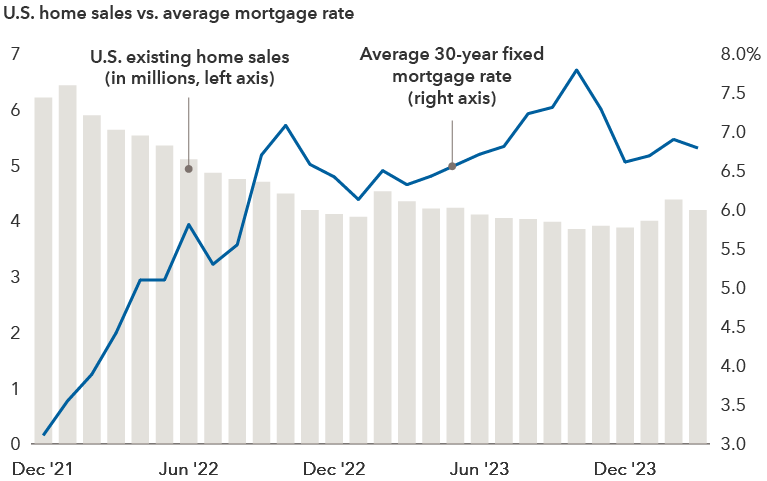

Many investors, economists and policymakers have doubted the strength of the U.S. housing market, largely due to skyrocketing mortgage rates and plummeting affordability.

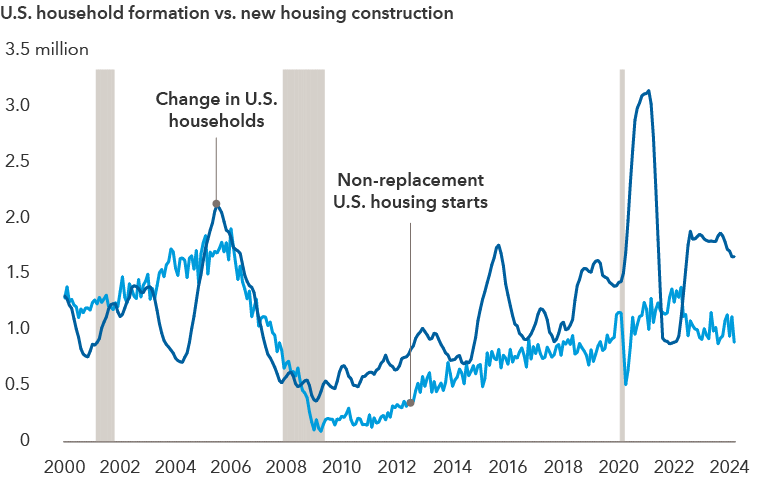

The near-term dynamics that drive the housing cycle are sending mixed signals today, with prices higher even as sales have been depressed. But I believe longer term trends point to solid growth in housing over the next decade. People need a place to live, and home ownership remains a centerpiece of the American dream.

As an equity portfolio manager for AMCAP Fund, a growth strategy, I focus much of my time on megatrends like artificial intelligence, cloud computing, productivity and globalization.

But I also spend time looking for the lonely investment idea. And in my view, housing stands out as one of the more underappreciated growth markets in the U.S. economy today. Here are three reasons why: