Past results are not predictive of results in future periods.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

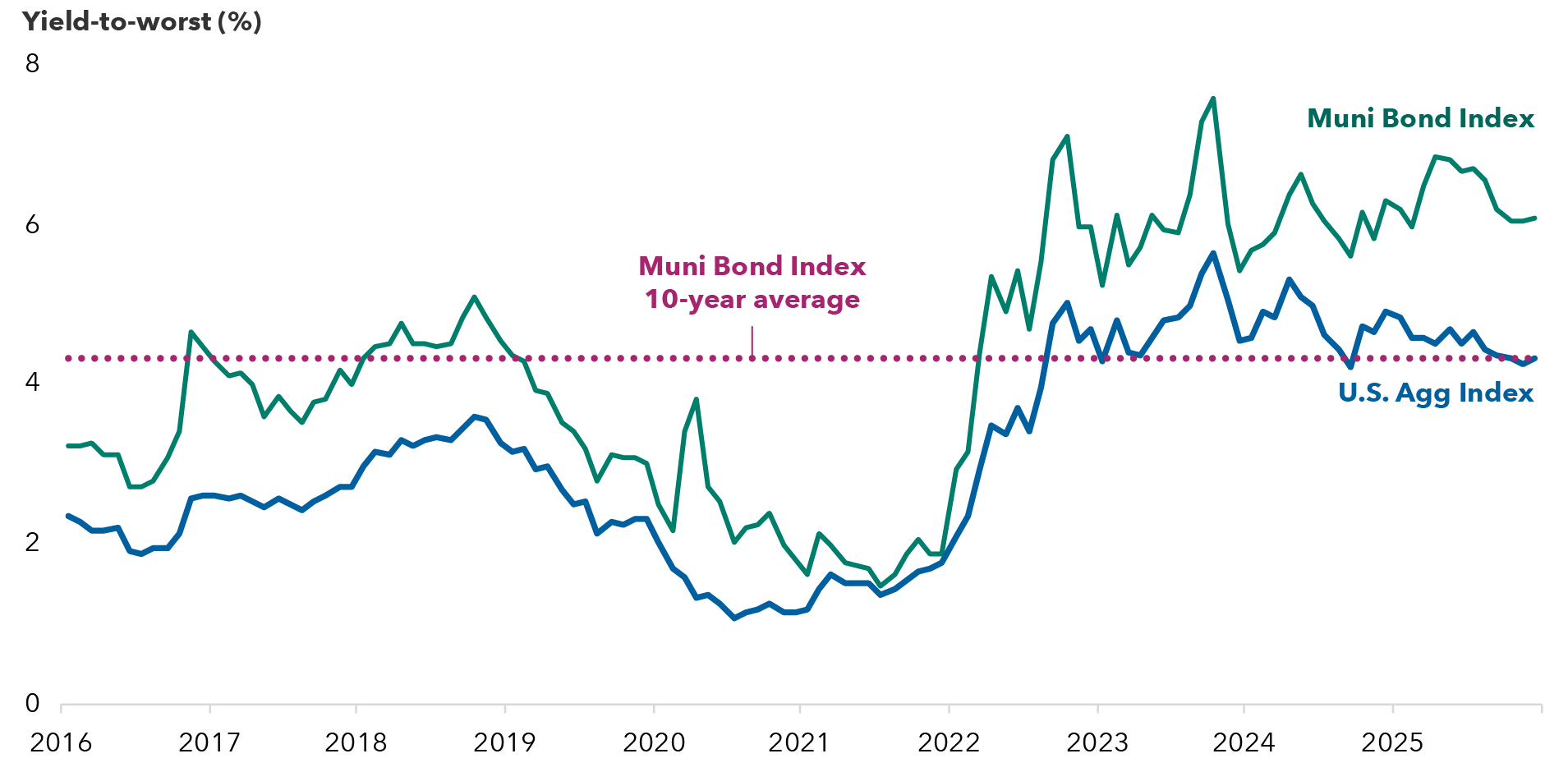

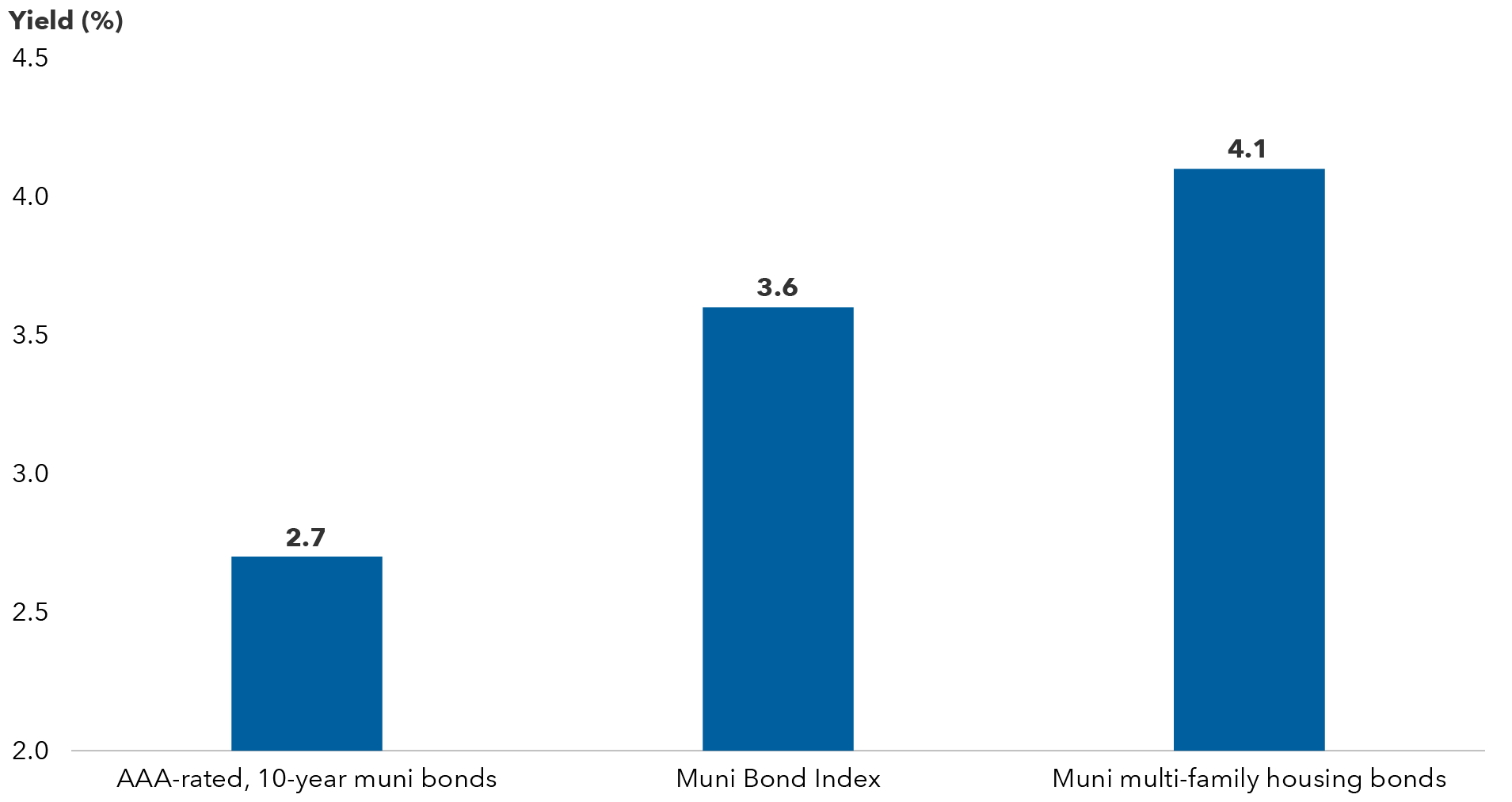

The Bloomberg Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

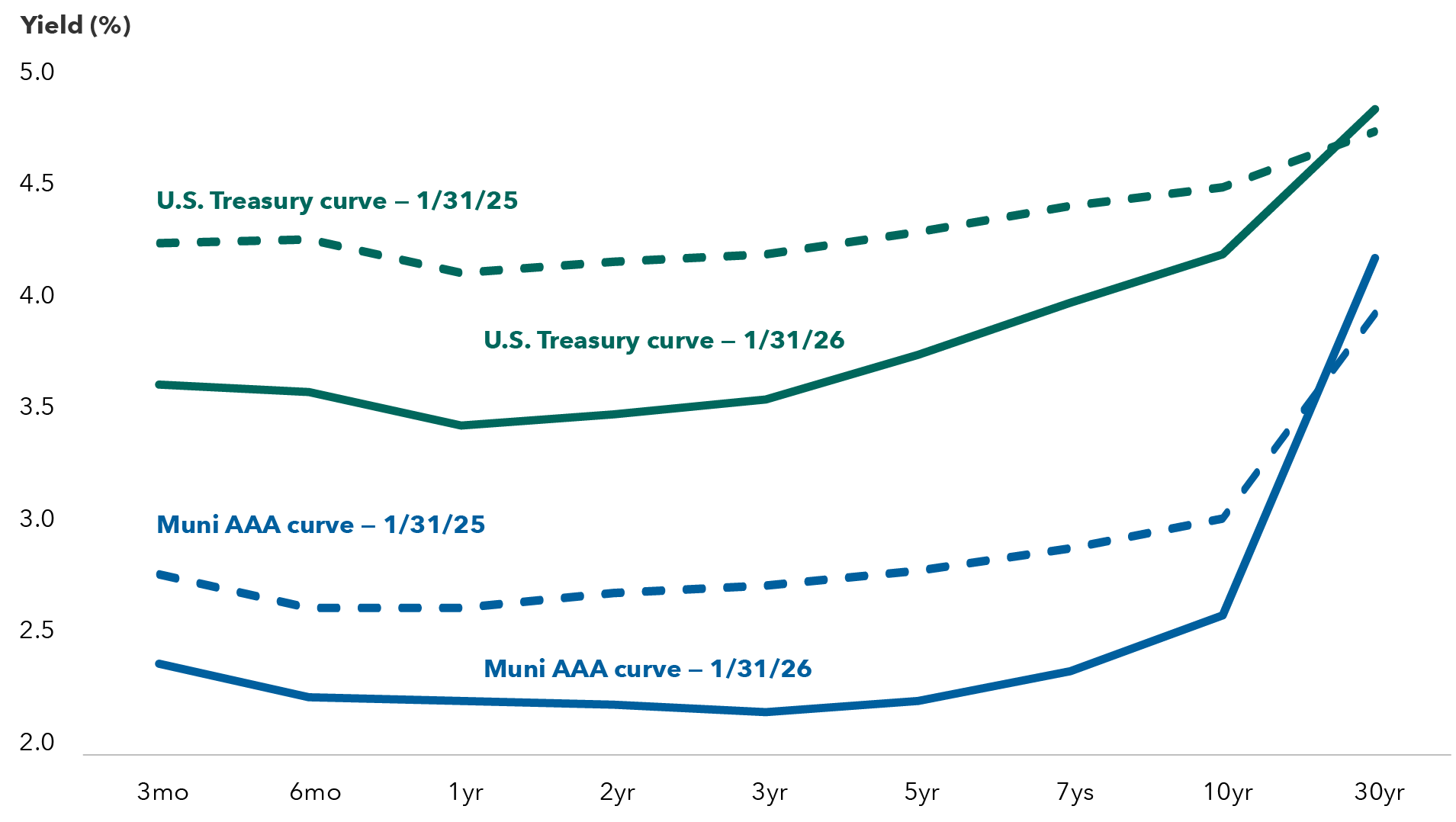

The Bloomberg U.S. Treasury Index represents the public obligations of the U.S. Treasury with a remaining maturity of one year or more.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

The after-tax (or tax-equivalent) yield of a municipal bond investment is the yield a taxable bond would have to offer to equal the same amount as the tax-exempt bond. Highest federal tax rate assumes the 3.8% Medicare tax and the top federal marginal tax rate for 2026 of 37%, for a total federal tax rate of 40.8%. Tax-equivalent yield calculation is yield to worst/(1-(federal tax rate)).

Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity.

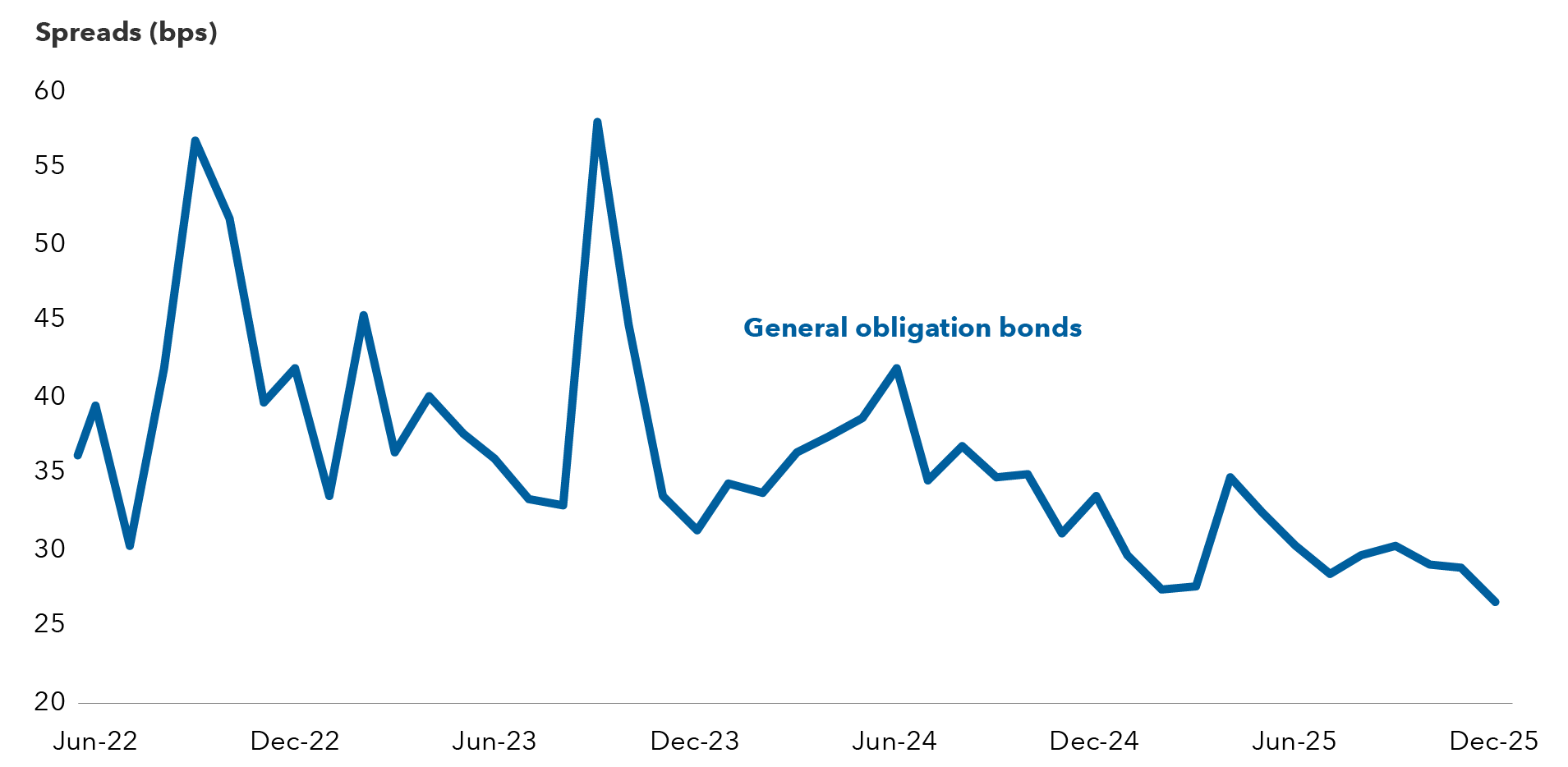

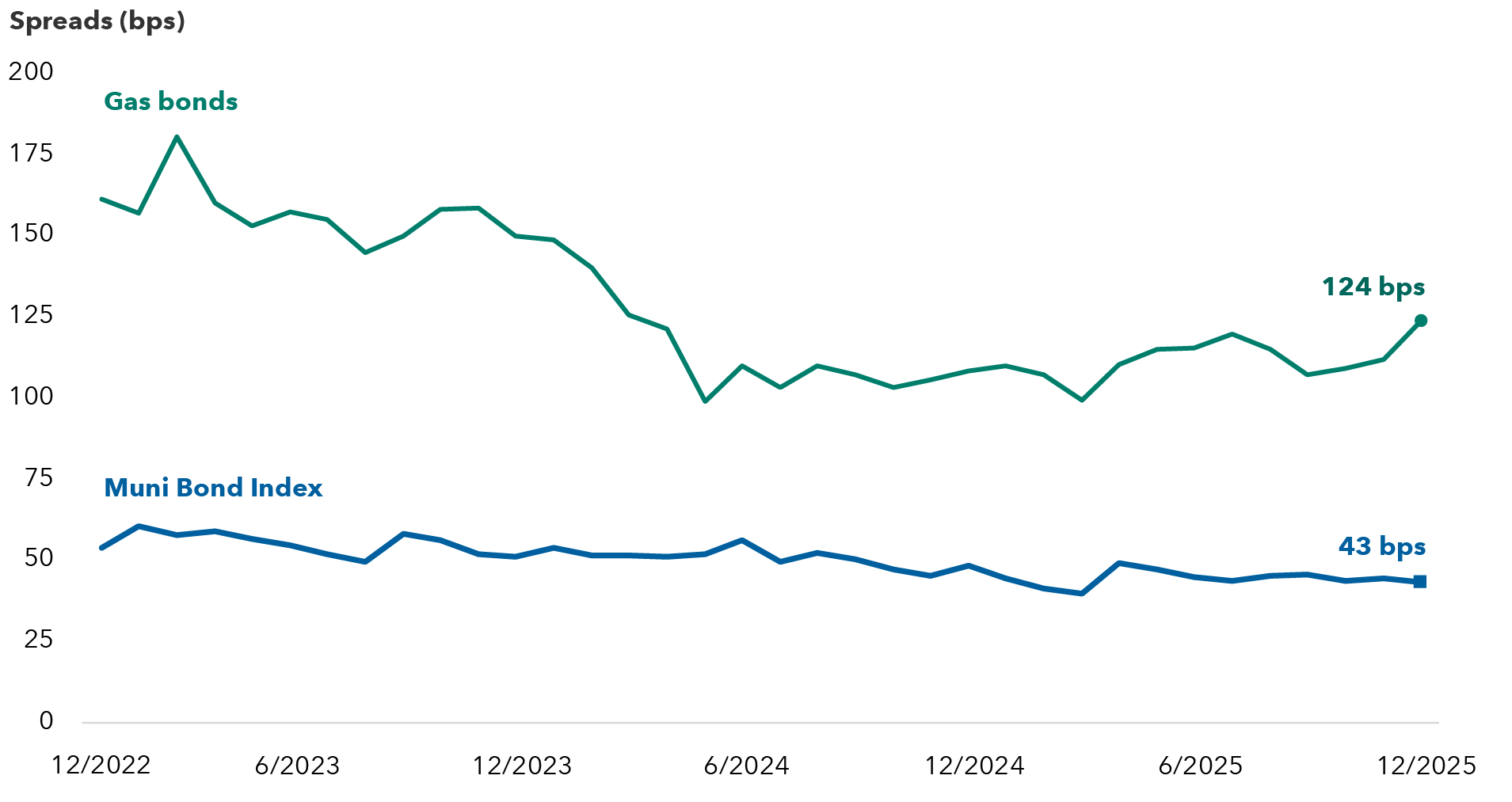

A spread is the difference between the yield of a bond and the yield of a similar maturity Treasury bond.

Duration measures a bond’s sensitivity to changes in interest rates. Generally speaking, a bond's price will go up 1% for every year of duration if interest rates fall by 1% or down 1% for every year of duration if interest rates rise by 1%.

Carry refers to the income or cost from holding an investment. Positive carry is the return an investor earns simply by holding a bond over time, assuming market prices and yields remain unchanged.