Fundamentals remain strong, but selectivity is key

That early 2025 dislocation was driven by technical factors — not a deterioration in issuer fundamentals. Most municipal issuers remained solid. State and local governments reported record tax revenues, defaults were rare and overall credit quality stabilized. Recent legislation preserving the tax-exempt status of munis also removed a major policy risk. However, not all issuers are equally positioned. The end of COVID-era stimulus makes assessing individual issuer fundamentals more critical than ever. Those that used federal aid to bolster reserves or invest in infrastructure are in stronger shape, while those that relied on stimulus for recurring expenses now face renewed budget pressure.

Sector-specific risks remain a focus

In some sectors, selectivity is crucial. For example, hospitals have delivered positive results year to date, yet credit fundamentals remain mixed across issuers. The impact of consolidation varies, with some hospital systems benefiting from increased scale and operational efficiencies, while others face challenges related to integration and local market dynamics. Additionally, political risk is elevated as policymakers consider potential reductions in Medicaid and other federal subsidies, which could affect revenue streams for certain issuers.

The education sector has also delivered positive results this year, but credit quality varies widely. Some issuers in this sector may be exposed to policy changes at the federal level, including potential adjustments to funding and subsidies. Shifts in enrollment trends and state budget priorities may also influence the financial health of some education-related issuers. Colleges will be fighting a long-term demographic headwind as the number of college-age students declines over the next decade. Competing budget priorities could also result in less money allocated to higher education for states that have burned through excess reserves from fiscal stimulus.

Active management can play a notable role in navigating risks in these sectors, with disciplined credit selection and yield curve positioning helping to avoid pitfalls and identify opportunities.

Portfolio positioning and how our managers are navigating the opportunity

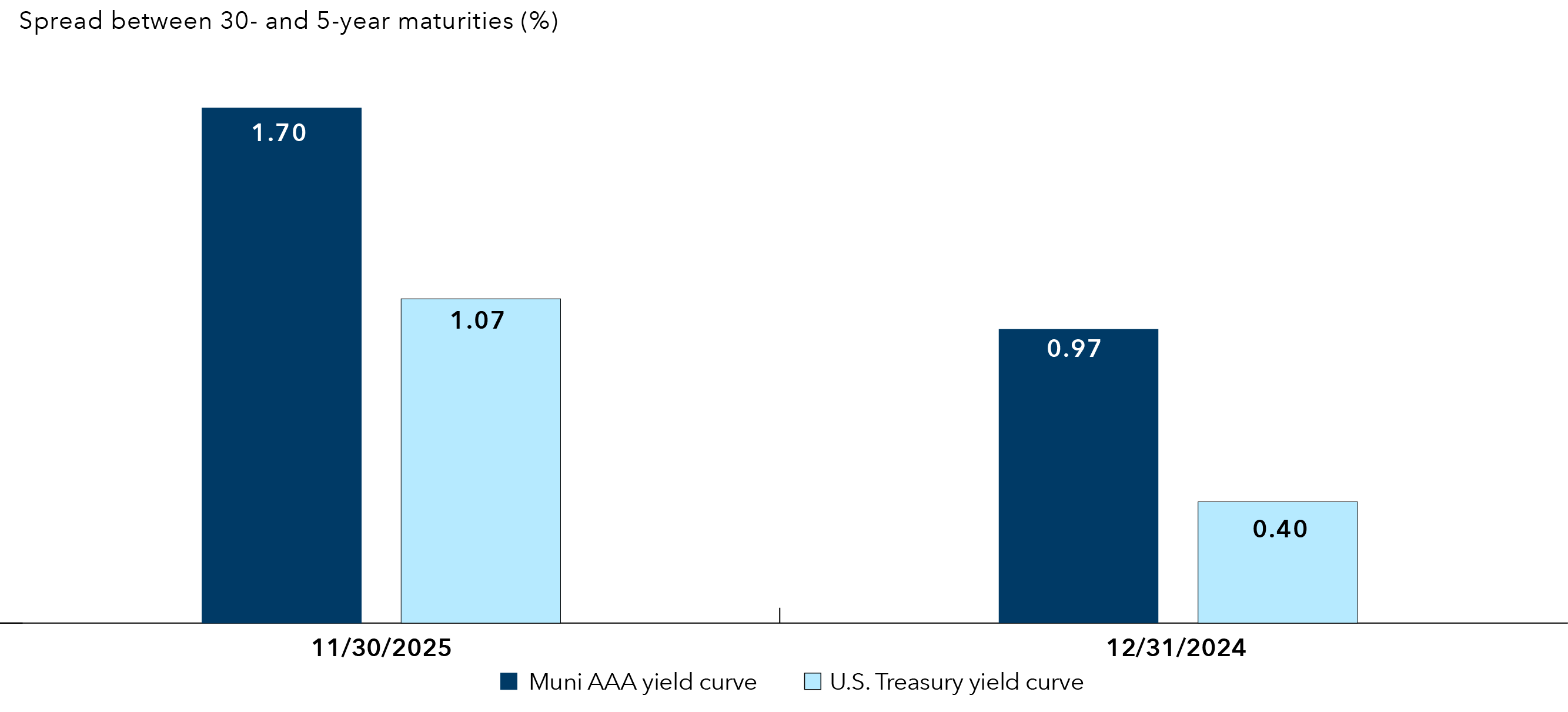

The steepness of the municipal yield curve relative to Treasuries continues to provide compelling relative value. Our managers have positioned portfolios with greater relative exposure to longer dated bonds, which may be beneficial as yield curves potentially converge.

To capture attractive yields, our managers focus on investment-grade bonds (BBB/Baa and above) with maturities of 10 to 20 years. For those seeking greater total return potential, our managers consider longer duration high-yield strategies as the market has increasingly rewarded duration exposure.

While sectors like higher education and health care require caution, we’re finding opportunities in toll roads, transportation and single-family housing — areas with solid fundamentals and attractive relative value.

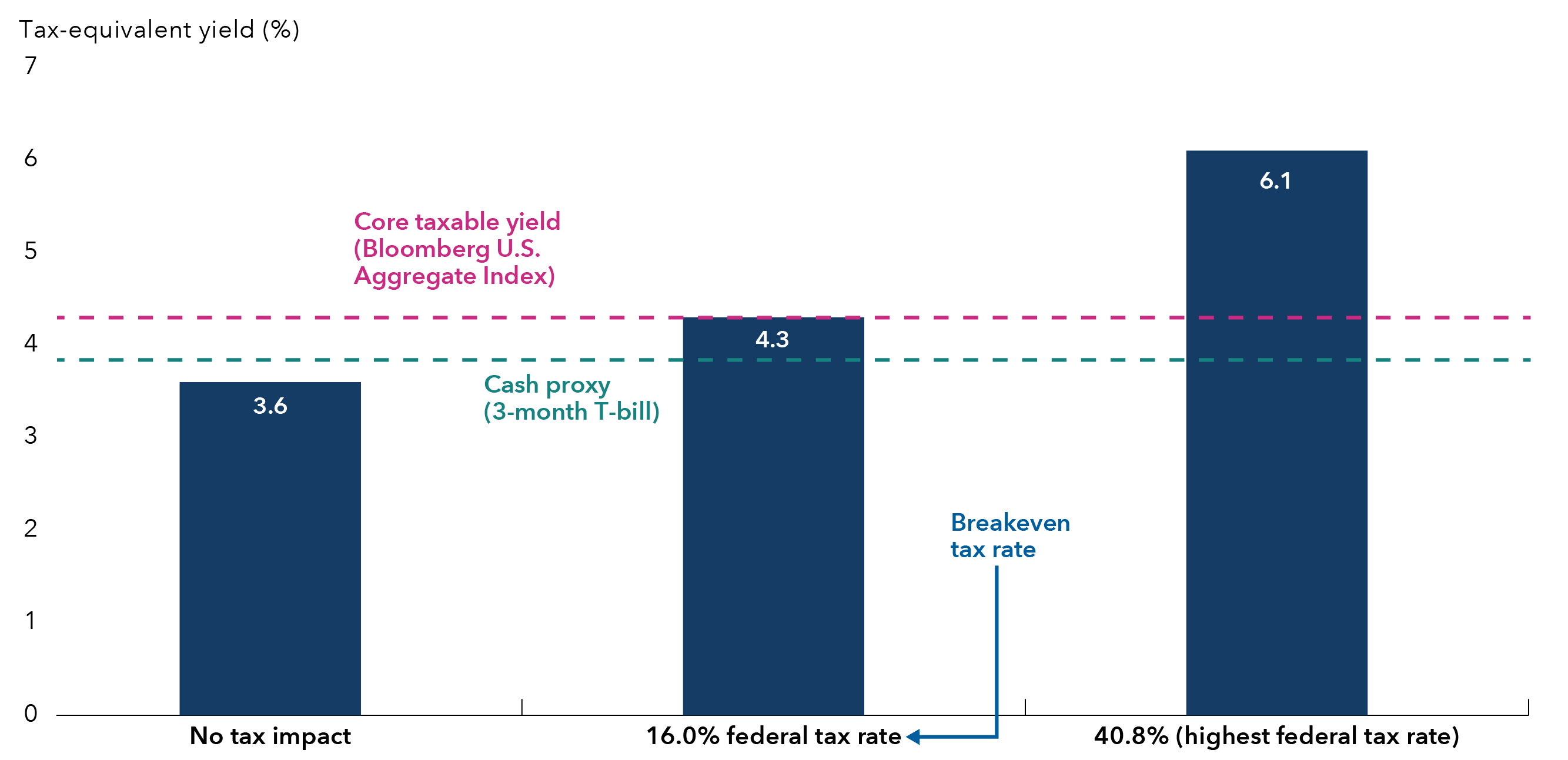

Why munis appeal to a broader range of investors

Yields are now in the top quartile of their historical range. For investors in the highest federal tax bracket, taxable-equivalent yields for core municipal bonds (as measured by the Bloomberg Municipal Bond Index) have reached 6.1%, while those with an effective federal tax rate of 16% can capture taxable equivalent yields of 4.3%. The breakeven tax rate for munis to surpass comparable Treasury yields has fallen, widening the appeal beyond traditional high-tax investors.