- Investments

- / American Funds® Retirement Income Portfolio — Enhanced

Investment Fund

American Funds® Retirement Income Portfolio — Enhanced (FGFWX)

Purchase Restrictions: Class F-2 shares are available through certain registered investment advisor and fee-based programs, but are not available for purchase in most employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

Targeting higher growth potential for retirees.

This portfolio is designed for retirees who seek a potentially higher level of income and growth of capital in exchange for potentially greater downside risk.

Price at NAV

$15.55

as of 3/09/2026 (updated daily)

Fund Assets (millions)

$2,235.6

Portfolio Solutions

Committee Members

7

Expense Ratio

(Gross/Net %)

0.41 / 0.41%

(Gross/Net %)

Underlying Funds

| Growth | 4.9% | |

| AMCAP Fund® | 4.9% | |

| Growth-and-Income | 15.1% | |

| American Mutual Fund® | 5% | |

| Capital World Growth and Income Fund® | 10.1% | |

| Equity-Income/Balanced | 63.1% | |

| Capital Income Builder® | 18.1% | |

| The Income Fund of America® | 20.1% | |

| American Balanced Fund® | 19.9% | |

| American Funds® Global Balanced Fund | 5% | |

| Bond | 17% | |

| American Funds® Multi-Sector Income Fund | 7% | |

| American High-Income Trust® | 5% | |

| The Bond Fund of America® | 5% |

As of 1/31/2026

(updated monthly)

Asset Mix

| U.S. Equities43.3% | Non-U.S. Equities20.6% | ||

| U.S. Bonds26.9% | Non-U.S. Bonds4.0% | ||

| Cash & Equivalents |

| U.S. Equities43.3% | |

| Non-U.S. Equities20.6% | |

| U.S. Bonds26.9% | |

| Non-U.S. Bonds4.0% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Equities

Standard Deviation as of 02/28/2026

(updated monthly)

. Annualized return as of 02/28/2026

(updated monthly)

.

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 2/28/26 (updated monthly).

Yield as of 2/28/26 (updated monthly).

Read important investment disclosures

Returns as of 2/28/26 (updated monthly).

Yield as of 2/28/26 (updated monthly).

Description

Objective

The fund strives for the accomplishment of three investment objectives: current income, long-term growth of capital and conservation of capital, with an emphasis on income and growth of capital.

Distinguishing Characteristics

The fund will attempt to achieve its investment objectives by investing in a mix of American Funds in varying combinations and weightings over time. In comparison to the other two portfolios in the American Funds Retirement Income Portfolio Series, the Enhanced Portfolio seeks somewhat higher long-term growth that also entails greater volatility, which in turn results in higher potential downside risk.

Types of Investments

The underlying American Funds will predominately consist of equity funds in the equity-income, balanced and growth-and-income fund categories. The enhanced portfolio will be weighted more toward equity holdings that generate both income and capital appreciation. The fund may also invest in fixed-income funds. Through its investments in the underlying funds, the fund will have significant exposure to both dividend-paying and growth-oriented common stocks.

Fund Facts

| Fund Inception | 8/28/2015 |

|

Fund Assets (millions) As of 2/28/2026

|

$2,235.6 |

|

Companies/Issuers

Holdings are as of 2/28/2026 (updated monthly).

|

2539+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

3,934 |

|

Regular Dividends Paid |

Mar, Jun, Sep, Dec |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 4% |

| Fiscal Year-End | Oct |

| Prospectus Date | 01/01/2026 |

| CUSIP | 02631L 66 8 |

| Fund Number | 36111 |

Returns

Internal Prompt

-

Month-End Returns as of 2/28/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 2/28/26

Quarter-End Returns as of 12/31/25

-

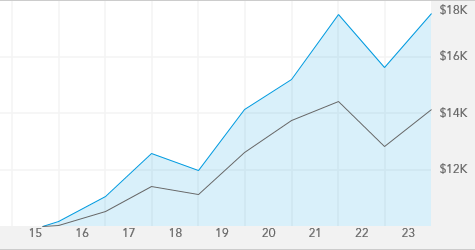

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class F-2 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class F-2 Shares, this chart tracks the high and low prices at NAV for FGFWX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 3/09/2026.

Portfolio Solutions Committee

LEARN ABOUT THE CAPITAL SYSTEMSM

Brittain Ezzes

28

4

2

Samir Mathur

33

13

6

Damien McCann

26

26

10

Wesley Phoa

33

27

10

John Queen

36

24

6

Andrew Suzman

32

32

10

Michelle Black

31

24

6

| Brittain Ezzes | 2 | 4 | 28 | |

| Samir Mathur | 6 | 13 | 33 | |

| Damien McCann | 10 | 26 | ||

| Wesley Phoa | 10 | 27 | 33 | |

| John Queen | 6 | 24 | 36 | |

| Andrew Suzman | 10 | 32 | ||

| Michelle Black | 6 | 24 | 31 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 2/28/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(82) |

(82) |

(77) |

(59) |

|

Expense Within Category Funds Rated |

(36) |

(36) |

(36) |

(33) |

|

Preservation Within Category Funds Rated |

(4130) |

(4130) |

(3873) |

(2775) |

|

Tax Efficiency Within Category Funds Rated |

(82) |

(82) |

(77) |

(59) |

|

Total Return Within Category Funds Rated |

(82) |

(82) |

(77) |

(59) |

Category | Ret Income Funds |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | |||

|

Standard Deviation

|

9.43 | ||

|

Sharpe Ratio

|

0.74 | ||

|

For the 10 Years ending 2/28/26

(updated monthly).

|

|||

|

American Funds Benchmark |

Morningstar Benchmark |

||

|

S&P Target Date Retirement Income Index

|

Morningstar Mod Tgt Risk TR USD

|

||

| R-squared | 88 | 96 | |

| Beta | 0.59 | 0.94 | |

| Capture Ratio (Downside/Upside) | 62/60 | 93/99 | |

|

American Funds Benchmark for the 10 Years ending 1/31/26

(updated monthly).

Morningstar Benchmark for the 10 Years ending 2/28/26

(updated monthly).

|

|||

Quality Summary

U.S. Treasuries/Agencies

5.7%

AAA/Aaa

1.7%

AA/Aa

5.3%

A

3.5%

BBB/Baa

5.2%

BB/Ba

5.5%

B

2.5%

CCC & Below

0.9%

Unrated

0.7%

Cash & equivalents

5.0%

%

of net assets as of 2/28/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

19.0%

5-9.9 Years

9.1%

10-19.9 Years

1.3%

20-29.9 Years

1.8%

30+ Years

0.1%

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

-

Equities Breakdown

-

Bonds Breakdown

Equities Breakdown

Equity Fund Holdings

| Information technology 12.2% | |

| Financials 9.4% | |

| Industrials 7.8% | |

| Health care 7.5% | |

| Consumer staples 5.2% | |

| Consumer discretionary 5.1% | |

| Communication services 4.4% | |

| Materials 3.9% | |

| Energy 3.8% | |

| Utilities 3.5% | |

| Real estate 1.1% |

% of net assets as of 2/28/2026 (updated monthly)

Semiconductors & semiconductor equipment

8.1%

Banks

4.3%

Oil, gas & consumable fuels

3.3%

Aerospace & defense

3.3%

Tobacco

2.9%

Biotechnology

2.8%

Metals & mining

2.7%

Pharmaceuticals

2.5%

Interactive media & services

2.2%

Insurance

2.2%

% of net assets as of 2/28/2026 (updated monthly)

Bonds Breakdown

Bond Details

Total bond holdings

Corporate bonds, notes & loans

+

16.6%

|

|||||||||||||||||||||||

Mortgage-backed obligations

+

6.2%

|

|||||||||||||||||||||||

| U.S. Treasury bonds & notes 5.5% | |||||||||||||||||||||||

| Asset-backed obligations 1.7% | |||||||||||||||||||||||

| Non-U.S. government/agency securities 1.3% |

% of net assets as of 12/31/2025 (updated quarterly)

Go to the underlying fund pages to see detailed holdings information.

- Growth Funds

- Growth-and-Income Funds

- Equity-Income/Balanced Funds

- Bond Funds

Top Fixed-Income Issuers

U.S. Treasury

5.8%

Fannie Mae

1.6%

Federal Home Loan Mortgage

1.3%

UMBS

0.6%

Ford Motor

0.5%

Charter Communications

0.4%

PG&E

0.3%

EchoStar

0.3%

Ginnie Mae II

0.2%

Morgan Stanley

0.2%

% of net assets as of 1/31/2026 (updated monthly)

Geographic Breakdown

United States

70.0%

Europe

12.2%

Asia & Pacific Basin

6.7%

Other (Including Canada & Latin America)

6.1%

Cash & equivalents

5.0%

%

of net assets as of 2/28/2026

(updated monthly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| 03/27/25 | 03/27/25 | 03/28/25 | $0.089 | $0.00 | $0.00 | $0.00 | $13.97 |

| 06/26/25 | 06/26/25 | 06/27/25 | $0.098 | $0.00 | $0.00 | $0.00 | $14.70 |

| 09/26/25 | 09/26/25 | 09/29/25 | $0.0984 | $0.00 | $0.00 | $0.00 | $15.30 |

| 12/29/25 | 12/29/25 | 12/30/25 | $0.191 | $0.00 | $0.4293 | $0.00 | $15.24 |

| 2025 Year-to-Date: | Dividends Subtotal: $0.4764 | Cap Gains Subtotal: $0.4293 | |||||

| Total Distributions: $0.9057 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| 0.00000000 | 02/23/2026 |

| 0.00000000 | 02/24/2026 |

| 0.00000000 | 02/25/2026 |

| 0.00000000 | 02/26/2026 |

| 0.00000000 | 02/27/2026 |

| 0.00000000 | 03/02/2026 |

| 0.00000000 | 03/03/2026 |

| 0.00000000 | 03/04/2026 |

| 0.00000000 | 03/05/2026 |

| 0.00000000 | 03/06/2026 |

| 0.00000000 | 03/09/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 | |

| 0.00000000 | 02/23/2026 | |

| 0.00000000 | 02/24/2026 | |

| 0.00000000 | 02/25/2026 | |

| 0.00000000 | 02/26/2026 | |

| 0.00000000 | 02/27/2026 | |

| 0.00000000 | 03/02/2026 | |

| 0.00000000 | 03/03/2026 | |

| 0.00000000 | 03/04/2026 | |

| 0.00000000 | 03/05/2026 | |

| 0.00000000 | 03/06/2026 | |

| 0.00000000 | 03/09/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.00% |

| Other Expenses | 0.11% |

| Acquired (Underlying) Fund Fees and Expenses | 0.30% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| FGFWX | 0.41% |

|

Lipper Retirement Income

Funds Average

|

0.70% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for FGFWX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class F-2 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class F-2 Shares, this chart tracks the total returns since the fund's inception date (Friday, August 28, 2015) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (2015), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.