- Investments

- / Capital World Growth and Income Fund®

Investment Fund

Capital World Growth and Income Fund® (CWGIX)

Summary

Internal Prompt

Global growth with a dividend focus.

Invests primarily in seasoned companies, including those paying consistent dividends and those with attractive growth prospects, which may lead to low volatility and relative downside protection.

Price at NAV

$76.57

as of 2/25/2026 (updated daily)

Fund Assets (millions)

$147,995.2

Portfolio Managers

10

Expense Ratio

(Gross/Net %)

0.73 / 0.73%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Asset Mix

| U.S. Equities52.5% | Non-U.S. Equities46.5% | ||

| U.S. Bonds0.0% | Non-U.S. Bonds0.0% | ||

| Cash & Equivalents |

| U.S. Equities52.5% | |

| Non-U.S. Equities46.5% | |

| U.S. Bonds0.0% | |

| Non-U.S. Bonds0.0% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Equities

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Market Capitalization

87.3%

Large

11.2%

Medium

1.6%

Small

$705,251.00 Million

Weighted Average

As of

12/31/2025 (updated quarterly).

FactSet data as of

12/31/2025 (updated quarterly).

Morningstar Ownership ZoneTM

Global Large-Stock Blend

Global Large-Stock Blend

Weighted average of holdings

75% of fund's stock holdings

Morningstar data as

of 12/31/25

(updated quarterly)

Description

Objective

The fund's investment objective is to provide you with long-term growth of capital while providing current income.

Distinguishing Characteristics

This fund has the flexibility to seek growth and income opportunities around the world. It invests primarily in seasoned companies, including those paying regular dividends and those with attractive growth prospects. This diverse fund may have the potential to provide low volatility as well as downside protection.

Types of Investments

Primarily invests in common stocks, government and corporate bonds, and cash and equivalents.

Portfolio Restrictions

May invest up to 5% of assets in bonds rated below investment grade (BB/Ba and below, or unrated, but determined by the fund’s investment adviser to be of equivalent quality).

Fund Facts

| Fund Inception | 3/26/1993 |

|

Fund Assets (millions) As of 1/31/2026

|

$147,995.2 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

326+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

1,718,995 |

|

Regular Dividends Paid |

Mar, Jun, Sep, Dec |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 44% |

| Fiscal Year-End | Nov |

| Prospectus Date | 02/01/2026 |

| CUSIP | 140543 10 9 |

| Fund Number | 33 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

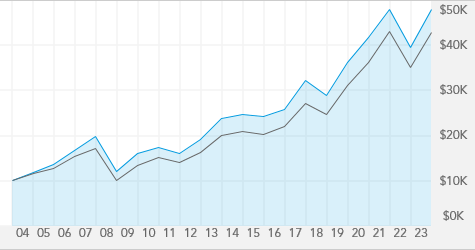

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class A Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class A Shares, this chart tracks the high and low prices at NAV for CWGIX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/25/2026.

Portfolio Management

LEARN ABOUT THE CAPITAL SYSTEMSM

Alfonso Barroso

32

31

19

Michael Beckwith

27

7

1

Michael Cohen

34

26

13

Nick Grace

36

32

4

Leo Hee

33

21

7

Sung Lee

32

31

19

Jin Lee

30

29

7

Lara Pellini

24

24

7

Renaud Samyn

29

24

6

Diana Wagner

30

24

3

| Alfonso Barroso | 19 | 31 | 32 | |

| Michael Beckwith | 1 | 7 | 27 | |

| Michael Cohen | 13 | 26 | 34 | |

| Nick Grace | 4 | 32 | 36 | |

| Leo Hee | 7 | 21 | 33 | |

| Sung Lee | 19 | 31 | 32 | |

| Jin Lee | 7 | 29 | 30 | |

| Lara Pellini | 7 | 24 | ||

| Renaud Samyn | 6 | 24 | 29 | |

| Diana Wagner | 3 | 24 | 30 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(125) |

(125) |

(124) |

(82) |

|

Expense Within Category Funds Rated |

(37) |

(37) |

(36) |

(25) |

|

Preservation Within Category Funds Rated |

(11976) |

(11976) |

(11087) |

(8551) |

|

Tax Efficiency Within Category Funds Rated |

(125) |

(125) |

(124) |

(82) |

|

Total Return Within Category Funds Rated |

(125) |

(125) |

(124) |

(82) |

Category | Global Large-Cap Core |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | ||

|

Standard Deviation

|

13.98 | |

|

Sharpe Ratio

|

0.72 | |

|

For the 10 Years ending 1/31/26

(updated monthly).

|

||

|

American Funds/ Morningstar Benchmark |

||

|

MSCI ACWI NR USD

|

||

| R-squared | 97 | |

| Beta | 0.96 | |

| Capture Ratio (Downside/Upside) | 97/96 | |

|

American Funds and Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

||

Holdings

Equities Breakdown

Equity Fund Holdings

| Information technology 24.3% | |

| Industrials 16.7% | |

| Financials 14.0% | |

| Communication services 8.8% | |

| Health care 8.1% | |

| Consumer discretionary 7.6% | |

| Materials 7.1% | |

| Consumer staples 4.9% | |

| Energy 4.2% | |

| Utilities 2.5% | |

| Real estate 0.8% |

% of net assets as of 1/31/2026 (updated monthly)

Semiconductors & semiconductor equipment

17.0%

Aerospace & defense

7.9%

Banks

6.8%

Metals & mining

5.3%

Interactive media & services

5.1%

Oil, gas & consumable fuels

3.9%

Pharmaceuticals

3.9%

Software

3.5%

Tobacco

3.4%

Insurance

3.1%

% of net assets as of 1/31/2026 (updated monthly)

Top Equities

TSMC

5.2%

Broadcom

4.0%

Alphabet

3.6%

Microsoft

2.9%

NVIDIA

2.4%

Philip Morris International

2.2%

Micron Technology

1.8%

Eli Lilly

1.7%

Amazon.com

1.7%

Apple

1.6%

% of net assets as of 1/31/2026 (updated monthly)

Geographic Breakdown

United States

54.8%

Europe

23.4%

Asia & Pacific Basin

13.3%

Other (Including Canada & Latin America)

5.8%

Cash & equivalents

2.7%

%

of net assets as of 11/30/2025

(updated monthly)

United States

54.3%

United Kingdom

7.7%

France

5.1%

Taiwan

5.1%

Japan

4.2%

Canada

3.6%

Germany

2.4%

China

2.1%

Italy

2.0%

Switzerland

1.9%

Percentage of net assets as of 12/31/2025 (updated quarterly)

The New Geography of Investing ®

Fund Breakdown by Domicile

| Regions | Fund | |

| United States | 52.6% | 63.0% |

| Canada | 4.1% | 3.0% |

| Europe & Middle East | 25.7% | 15.1% |

| Japan | 4.2% | 5.0% |

| Asia-Pacific ex. Japan | 1.2% | 2.3% |

| China | 1.9% | 3.1% |

| Emerging markets ex. China | 9.4% | 8.5% |

| Other | 0.0% | 0.0% |

|

Cash & equivalents

|

0.9% | -- |

| Fixed Income | 0.0% | -- |

% of net assets as of 1/31/2026 (updated monthly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| 03/10/25 | 03/10/25 | 03/11/25 | $0.20 | $0.00 | $0.00 | $0.00 | $63.71 |

| 06/09/25 | 06/09/25 | 06/10/25 | $0.35 | $0.00 | $0.00 | $0.00 | $68.91 |

| 09/15/25 | 09/15/25 | 09/16/25 | $0.20 | $0.00 | $0.00 | $0.00 | $75.10 |

| 12/16/25 | 12/16/25 | 12/17/25 | $0.13 | $0.315 | $6.3418 | $0.00 | $70.15 |

| 2025 Year-to-Date: | Dividends Subtotal: $1.195 | Cap Gains Subtotal: $6.3418 | |||||

| Total Distributions: $7.5368 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/17/2025 |

| 0.00000000 | 12/18/2025 |

| 0.00000000 | 12/19/2025 |

| 0.00000000 | 12/22/2025 |

| 0.00000000 | 12/23/2025 |

| 0.00000000 | 12/24/2025 |

| 0.00000000 | 12/26/2025 |

| 0.00000000 | 12/29/2025 |

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| 0.00000000 | 02/23/2026 |

| 0.00000000 | 02/24/2026 |

| 0.00000000 | 02/25/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/17/2025 | |

| 0.00000000 | 12/18/2025 | |

| 0.00000000 | 12/19/2025 | |

| 0.00000000 | 12/22/2025 | |

| 0.00000000 | 12/23/2025 | |

| 0.00000000 | 12/24/2025 | |

| 0.00000000 | 12/26/2025 | |

| 0.00000000 | 12/29/2025 | |

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 | |

| 0.00000000 | 02/23/2026 | |

| 0.00000000 | 02/24/2026 | |

| 0.00000000 | 02/25/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.37% |

| Other Expenses | 0.12% |

| Service 12b-1 | 0.24% |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| CWGIX | 0.73% |

|

Lipper Global

Funds Average

|

1.11% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for CWGIX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class A share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class A Shares, this chart tracks the total returns since the fund's inception date (Friday, March 26, 1993) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (1993), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.