Portfolios composed to help you focus on what matters

Years of fundamental research, a long-term track record and skilled investment experience are brought together to create the American Funds Portfolio Series. Our turnkey portfolios help balance your offerings so you can focus on expanding your practice while helping you meet the targeted needs of your clients, without missing a beat.

Objective-based

Pursue a wide range of goals based on time frame, risk tolerance and clients' needs.

Trusted

Invest in a blend of funds with proven track records carefully selected by senior investment professionals.

Monitored

Benefit from regular reviews by the Portfolio Solutions Committee to ensure underlying funds and allocations are aligned with fund objectives.

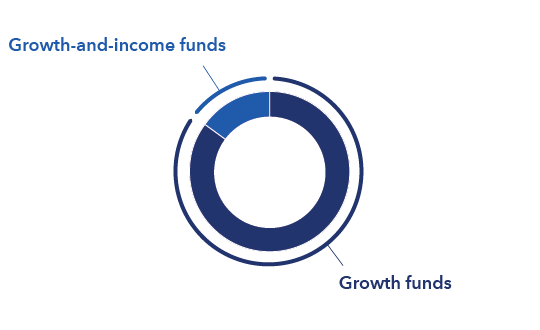

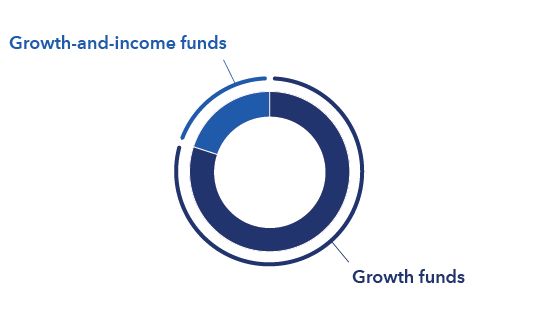

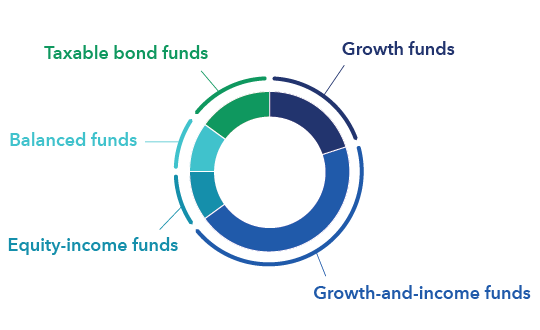

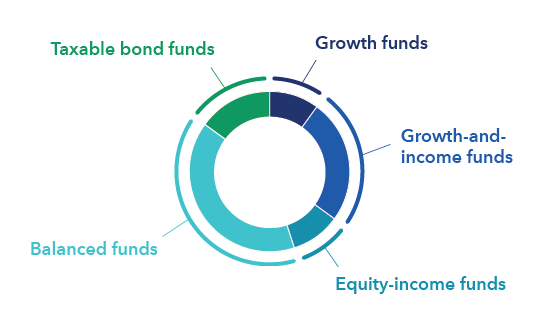

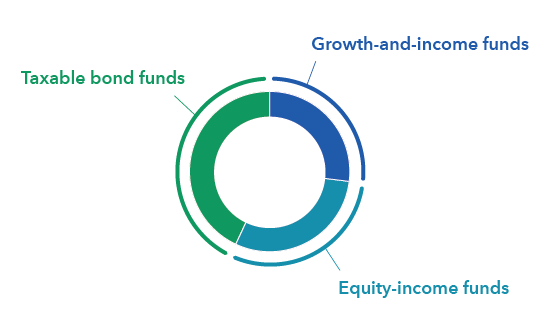

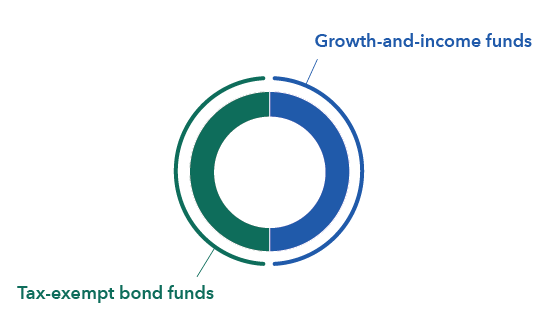

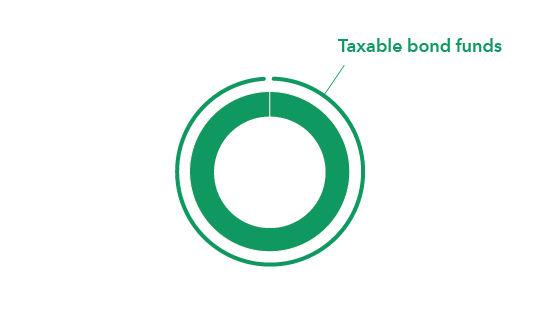

Portfolio series funds

Create balance in your practice with turnkey portfolios.

The American Funds Portfolio Series is designed to help investors pursue long‐term investment success.

Consider what these funds offer:

Flexibility

Easily incorporate the funds into your client's investment portfolio based on common objectives.

Choice

Portfolios are designed to meet distinct objectives, ranging from growth to preservation, for near-term and long-term goals.

Convenience

Purchase a diversified portfolio in a single transaction.

Share classes

Case studies

Here are examples of how you can use the funds to address real-life investor needs that you may encounter in your practice.

Portfolio oversight

Your investment, our priority

A group of senior investment professionals with varied backgrounds and investment approaches and decades of industry experience regularly review the funds' results and holdings.

Active management of funds

The Portfolio Solutions Committee may add or remove underlying funds or change the current underlying fund weightings to help the funds meet their objectives.

Staying aligned with your objectives

Investors should meet regularly with their financial professional to determine if their investments continue to meet their needs.

Morningstar weighs in on American Funds Portfolio Series

Several of our model portfolios and Portfolio Series funds recently received analyst ratings from Morningstar.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.