- Investments

- / American Funds® Growth and Income Portfolio

Investment Fund

American Funds® Growth and Income Portfolio (GAIOX)

Summary

Internal Prompt

Focuses on growth potential with income.

Seeks to help investors build assets over time through exposure to a variety of stock investments as well as income from dividend-paying companies and fixed-income securities.

Price at NAV

$22.04

as of 2/27/2026 (updated daily)

Fund Assets (millions)

$22,385.1

Portfolio Solutions

Committee Members

7

Expense Ratio

(Gross/Net %)

0.65 / 0.65%

(Gross/Net %)

Underlying Funds

| Growth | 19.9% | |

| American Funds® Global Insight Fund | 5% | |

| The Growth Fund of America® | 7% | |

| SMALLCAP World Fund® | 7.9% | |

| Growth-and-Income | 44.9% | |

| Capital World Growth and Income Fund® | 14.9% | |

| The Investment Company of America® | 20% | |

| Washington Mutual Investors Fund | 10% | |

| Equity-Income | 10% | |

| Capital Income Builder® | 10% | |

| Balanced | 10% | |

| American Balanced Fund® | 10% | |

| Bond | 15.2% | |

| American Funds® Multi-Sector Income Fund | 5.1% | |

| American Funds® Strategic Bond Fund | 5% | |

| The Bond Fund of America® | 5.1% |

As of 1/31/2026

(updated monthly)

Asset Mix

| U.S. Equities57.0% | Non-U.S. Equities20.6% | ||

| U.S. Bonds16.3% | Non-U.S. Bonds2.4% | ||

| Cash & Equivalents |

| U.S. Equities57.0% | |

| Non-U.S. Equities20.6% | |

| U.S. Bonds16.3% | |

| Non-U.S. Bonds2.4% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Equities

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Description

Objective

The fund's investment objective is to provide long-term growth of capital while providing current income.

Distinguishing Characteristics

Pursues its investment objectives by investing in a mix of American Funds in different combinations and weightings.

Types of Investments

The underlying American Funds may represent a variety of fund categories such as growth funds, growth-and-income funds, equity-income funds, balanced funds and bond funds.

Fund Facts

| Fund Inception | 5/18/2012 |

|

Fund Assets (millions) As of 1/31/2026

|

$22,385.1 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

3213+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

291,472 |

|

Regular Dividends Paid |

Mar, Jun, Sep, Dec |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 2% |

| Fiscal Year-End | Oct |

| Prospectus Date | 01/01/2026 |

| CUSIP | 02630R 20 3 |

| Fund Number | 51 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

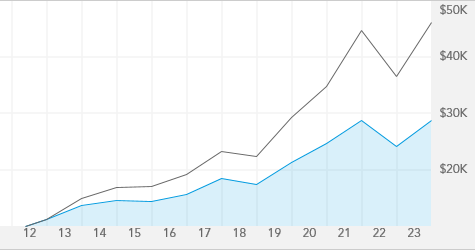

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class A Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class A Shares, this chart tracks the high and low prices at NAV for GAIOX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/27/2026.

Portfolio Solutions Committee

LEARN ABOUT THE CAPITAL SYSTEMSM

Michelle Black

31

24

6

Brittain Ezzes

28

4

2

Samir Mathur

33

13

6

Damien McCann

26

26

14

Wesley Phoa

33

27

13

John Queen

36

24

6

Andrew Suzman

32

32

13

| Michelle Black | 6 | 24 | 31 | |

| Brittain Ezzes | 2 | 4 | 28 | |

| Samir Mathur | 6 | 13 | 33 | |

| Damien McCann | 14 | 26 | ||

| Wesley Phoa | 13 | 27 | 33 | |

| John Queen | 6 | 24 | 36 | |

| Andrew Suzman | 13 | 32 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

|

Expense Within Category Funds Rated |

(122) |

(122) |

(117) |

(104) |

|

Preservation Within Category Funds Rated |

(4130) |

(4130) |

(3873) |

(2775) |

|

Tax Efficiency Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

|

Total Return Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

Category | Mixed-Asset Target Allocation Growth |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | |||

|

Standard Deviation

|

11.70 | ||

|

Sharpe Ratio

|

0.77 | ||

|

For the 10 Years ending 1/31/26

(updated monthly).

|

|||

|

American Funds Benchmark |

Morningstar Benchmark |

||

|

S&P 500 Index

|

Morningstar Mod Tgt Risk TR USD

|

||

| R-squared | 94 | 96 | |

| Beta | 0.76 | 1.16 | |

| Capture Ratio (Downside/Upside) | 80/76 | 116/123 | |

|

American Funds Benchmark for the 10 Years ending 1/31/26

(updated monthly).

Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

|||

Quality Summary

U.S. Treasuries/Agencies

4.2%

AAA/Aaa

1.2%

AA/Aa

3.9%

A

2.8%

BBB/Baa

3.3%

BB/Ba

1.8%

B

0.8%

CCC & Below

0.2%

Unrated

0.6%

Cash & equivalents

3.6%

%

of net assets as of 1/31/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

9.3%

5-9.9 Years

5.9%

10-19.9 Years

1.0%

20-29.9 Years

1.6%

30+ Years

0.1%

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

-

Equities Breakdown

-

Bonds Breakdown

Equities Breakdown

Equity Fund Holdings

| Information technology 19.4% | |

| Industrials 11.9% | |

| Financials 10.4% | |

| Health care 8.2% | |

| Consumer discretionary 7.4% | |

| Communication services 6.6% | |

| Consumer staples 4.9% | |

| Materials 3.1% | |

| Energy 2.7% | |

| Utilities 2.1% | |

| Real estate 1.0% |

% of net assets as of 1/31/2026 (updated monthly)

Semiconductors & semiconductor equipment

11.8%

Aerospace & defense

5.0%

Interactive media & services

4.6%

Software

4.3%

Banks

3.8%

Tobacco

3.2%

Pharmaceuticals

2.8%

Hotels, restaurants & leisure

2.8%

Biotechnology

2.6%

Oil, gas & consumable fuels

2.3%

% of net assets as of 1/31/2026 (updated monthly)

Bonds Breakdown

Bond Details

Total bond holdings

Corporate bonds, notes & loans

+

7.0%

|

|||||||||||||||||||||||

Mortgage-backed obligations

+

4.5%

|

|||||||||||||||||||||||

| U.S. Treasury bonds & notes 3.7% | |||||||||||||||||||||||

| Asset-backed obligations 1.3% | |||||||||||||||||||||||

| Non-U.S. government/agency securities 0.7% |

% of net assets as of 12/31/2025 (updated quarterly)

Go to the underlying fund pages to see detailed holdings information.

- Growth Funds

- Growth-and-Income Funds

- Equity-Income Funds

- Balanced Funds

- Bond Funds

Top Fixed-Income Issuers

No top issuers data is available at this time.

Geographic Breakdown

United States

73.3%

Europe

11.7%

Asia & Pacific Basin

7.0%

Other (Including Canada & Latin America)

4.3%

Cash & equivalents

3.6%

%

of net assets as of 1/31/2026

(updated monthly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| 03/26/25 | 03/26/25 | 03/27/25 | $0.0577 | $0.00 | $0.00 | $0.00 | $19.14 |

| 06/25/25 | 06/25/25 | 06/26/25 | $0.0818 | $0.00 | $0.00 | $0.00 | $20.40 |

| 09/25/25 | 09/25/25 | 09/26/25 | $0.0655 | $0.00 | $0.00 | $0.00 | $21.55 |

| 12/29/25 | 12/29/25 | 12/30/25 | $0.1698 | $0.00 | $0.8535 | $0.00 | $21.40 |

| 2025 Year-to-Date: | Dividends Subtotal: $0.3748 | Cap Gains Subtotal: $0.8535 | |||||

| Total Distributions: $1.2283 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| 0.00000000 | 02/23/2026 |

| 0.00000000 | 02/24/2026 |

| 0.00000000 | 02/25/2026 |

| 0.00000000 | 02/26/2026 |

| 0.00000000 | 02/27/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 | |

| 0.00000000 | 02/23/2026 | |

| 0.00000000 | 02/24/2026 | |

| 0.00000000 | 02/25/2026 | |

| 0.00000000 | 02/26/2026 | |

| 0.00000000 | 02/27/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.00% |

| Other Expenses | 0.06% |

| Acquired (Underlying) Fund Fees and Expenses | 0.33% |

| Service 12b-1 | 0.26% |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| GAIOX | 0.65% |

|

Lipper Mixed-Asset Target Allocation Growth

Funds Average

|

0.99% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for GAIOX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class A share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class A Shares, this chart tracks the total returns since the fund's inception date (Friday, May 18, 2012) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (2012), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Standard Deviation as of 01/31/2026. Annualized return as of 01/31/2026

Volatility & Return chart is not available for funds less than 10 years old.