President Trump picked former fed governor Kevin Warsh to lead the U.S. Federal Reserve, elevating a recently dovish voice at a moment when policymakers are trying to decide how far and how fast to cut interest rates. The choice caps months of speculation and sets the stage for a pivotal chapter in the central bank’s history.

Warsh recently penned an op-ed in the Wall Street Journal advocating for lower interest rates, arguing the U.S. economy can have growth without inflation. However, he has been viewed as more hawkish in the past, particularly during the global financial crisis.

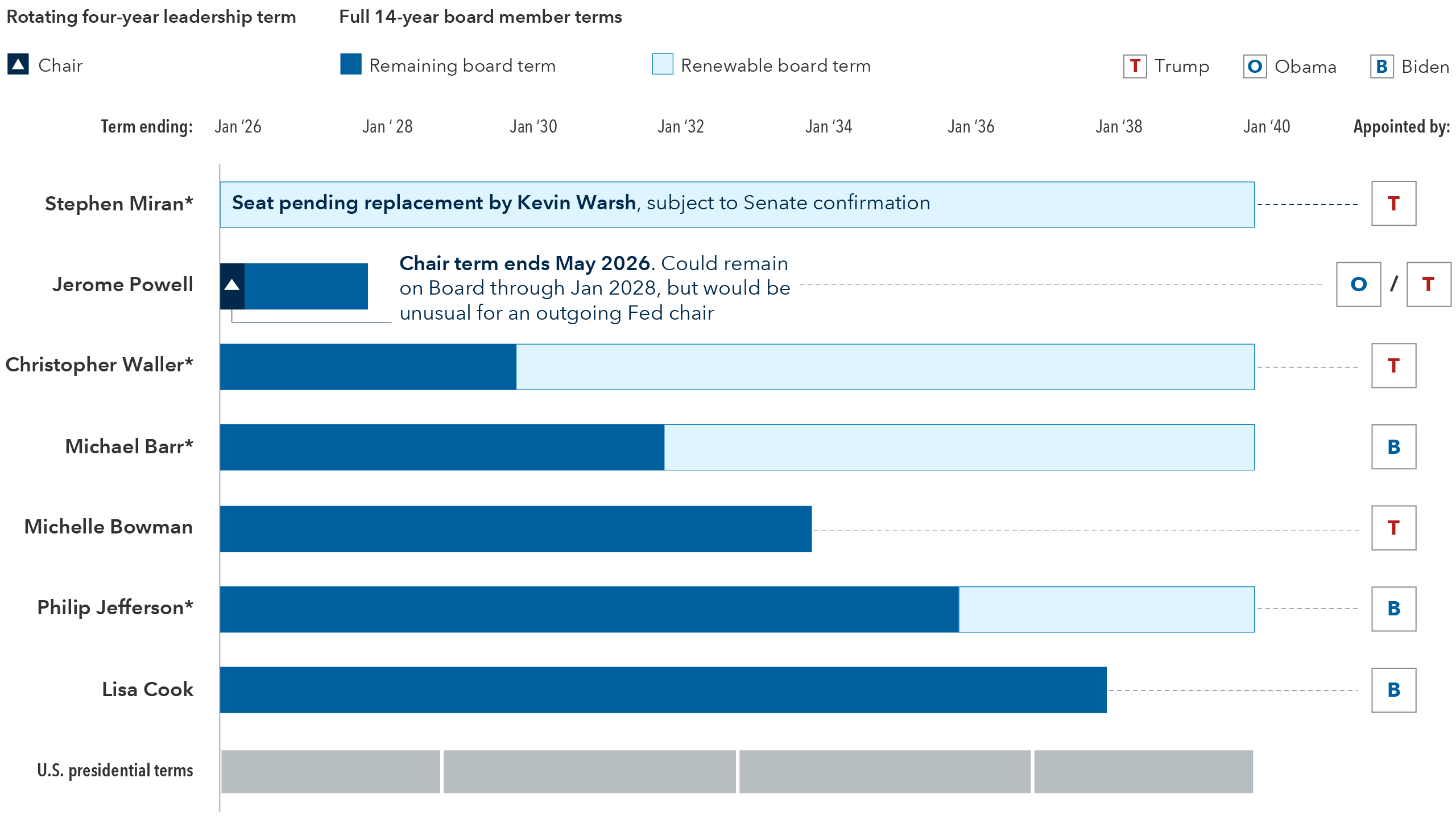

Assuming Senate confirmation, whether the Fed under Warsh will deliver substantially lower interest rates by year-end 2026 will likely still come down to jobs and inflation data, says Ritchie Tuazon, bond manager for American Funds® Strategic Bond Fund. “The scenario of an extreme Fed capture, or loss of Fed independence, is unlikely as it would require all board members to follow the Fed chair. However, I do think the Fed will be more dovish, particularly as Trump appoints more governors.”