At first glance, the emergency savings provision of SECURE 2.0 Act of 2022, effective 2024, could appear to divert savings from retirement accounts. But what if, instead, it is an opportunity to attract new savers and help them develop better habits? With this provision, plan sponsors may have a new outlet for bolstering participants’ savings in the long term — and potentially for reducing hardship withdrawals and loans from the retirement plan.

October 31, 2023

KEY TAKEAWAYS

- SECURE 2.0 allows the creation of a “sidecar” emergency savings account tied to a participant’s retirement account.

- Hardship withdrawals from retirement plans are at a record high.

- The emergency savings account may help bolster retirement savings, promote better habits and avoid hardship withdrawals.

Details of the emergency savings provision

To start, here is a quick review of the provision’s key features:

- It allows the creation of a “sidecar” emergency savings account tied to a participant’s retirement account.

- An individual can contribute to the account if the balance attributed to contributions is below $2,500 (or a lower amount set by the sponsor).

- Contributions are Roth after-tax.

- Individuals may withdraw from this account without qualifying their emergency to the IRS or plan sponsor.

- There are no penalties for early withdrawals, and while there may be reasonable administrative fees, there would be no fee for the first four withdrawals within a calendar year.

- Employers may auto-enroll employees at a rate of up to 3% of pay.

- Employers who match employee contributions to the retirement plan would also need to match emergency savings contributions, and this match must go into the employee’s retirement savings account.

- Highly compensated employees, as defined by the IRS, are ineligible.

With these parameters, SECURE 2.0 helps create the necessary conditions for individuals to develop a safety net, create a saving habit and seed a retirement account at the same time. This is especially important at a moment when hardship withdrawals are at an all-time high.

Record hardship withdrawals

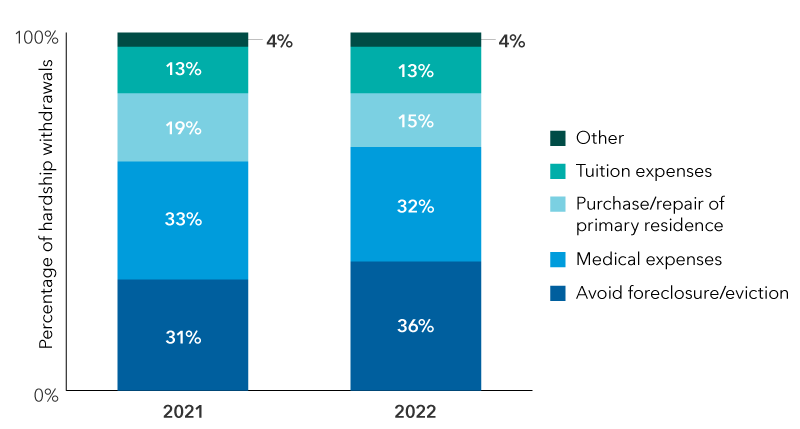

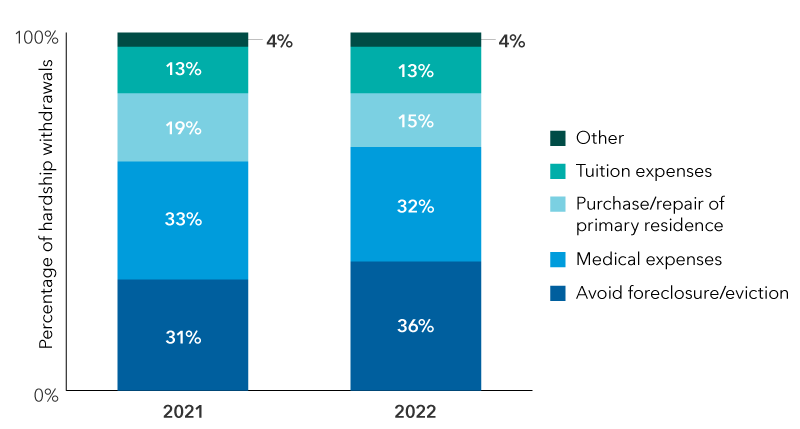

According to Vanguard research, hardship withdrawals from its defined contribution clients’ plans in 2022 reached a record high of 2.8%, with non-hardship withdrawals coming in at 3.6%. Of the hardship withdrawals, the most common reason (36%) was to avoid a home foreclosure or eviction. The second most common reason (32%) was to cover medical expenses.

Trend in hardship withdrawal reasons

Vanguard defined contribution plans

Source: How America Saves 2023, Vanguard.

SECURE 2.0 does address withdrawals specifically by broadening the umbrella of hardships, as well as allowing participants to self-certify that their hardships exist. While these are helpful allowances for those in need, it’s obviously best to avoid withdrawals that may come with penalties and long-term consequences to retirement savings. The emergency savings account provides one avenue to help avoid this.

Focus on now, provide for later

What makes the emergency savings provision of SECURE 2.0 a unique opportunity is the way employer matching works. Because the employer’s match goes into the retirement account, an employee whose contributions are matched may focus on funding her emergency savings while simultaneously receiving a boost to her retirement savings.

Here’s how that might look:

- A small retail business, Family Store, is compelled by state mandate to start a retirement savings plan for its employees.

- Employees like Jane are not interested in diverting funds to retirement just now, because more immediate needs are pressing. Jane is worried about what would happen in an emergency.

- Family Store opens a sidecar emergency savings account for Jane and auto-enrolls her at 3% of her pay.

- Family Store matches Jane’s emergency contributions, and the Family Store contribution goes into Jane’s retirement account.

- Jane may contribute up to $2,500 into her emergency savings account. Once that limit is reached, she may feel more comfortable continuing contributions into her retirement account.

- Jane gets in the habit of saving, and Family Store has a more financially stable employee whose retirement account is seeded.

In industries where employees are not high earners, this could be an appealing way both to encourage savings and to grow new retirement plans. This could also be a differentiator in recruiting employees.

Help businesses see potential

An ideal world would be one where plan participants are not making difficult choices between saving for retirement and saving for emergencies. For many businesses and industries, that will hopefully be the case, and sidecar savings accounts may not be necessary. For other industries and businesses, these accounts may be a key to promoting better saving habits.

Of course, effort will need to go into building administrative capabilities for emergency accounts. But, as you work with businesses that seek to help employees address inflation, as well as those that may be compelled to start new retirement plans, consider how an emergency account program could be used advantageously in the future.

John Doyle is a senior retirement strategist with 39 years of investment industry experience (as of 12/31/2025). He holds an MBA from the F.W. Olin Graduate School of Business at Babson College and a bachelor’s degree in economics from Georgetown University.