Core fixed income reaffirmed its role as a cornerstone of well-balanced portfolios in 2025, delivering meaningful diversification alongside strong total returns. Supported by a resilient yet moderating economy, easing inflationary pressures and the start of a rate-cutting cycle, core bonds (as measured by the Bloomberg U.S. Aggregate Index) posted their strongest performance since 2019. The index advanced over 7% and generally provided positive returns during episodes of stock market volatility and drawdowns.

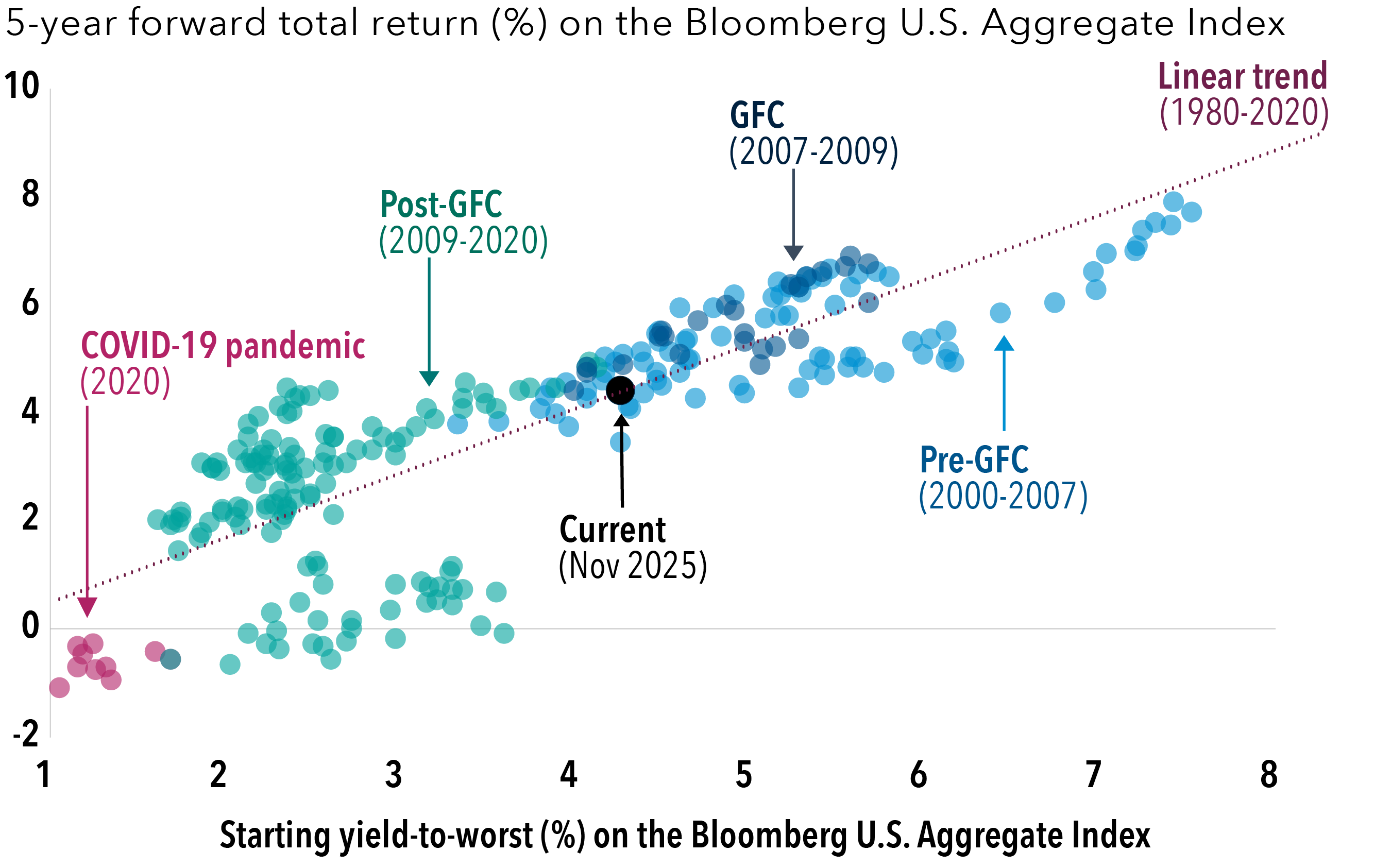

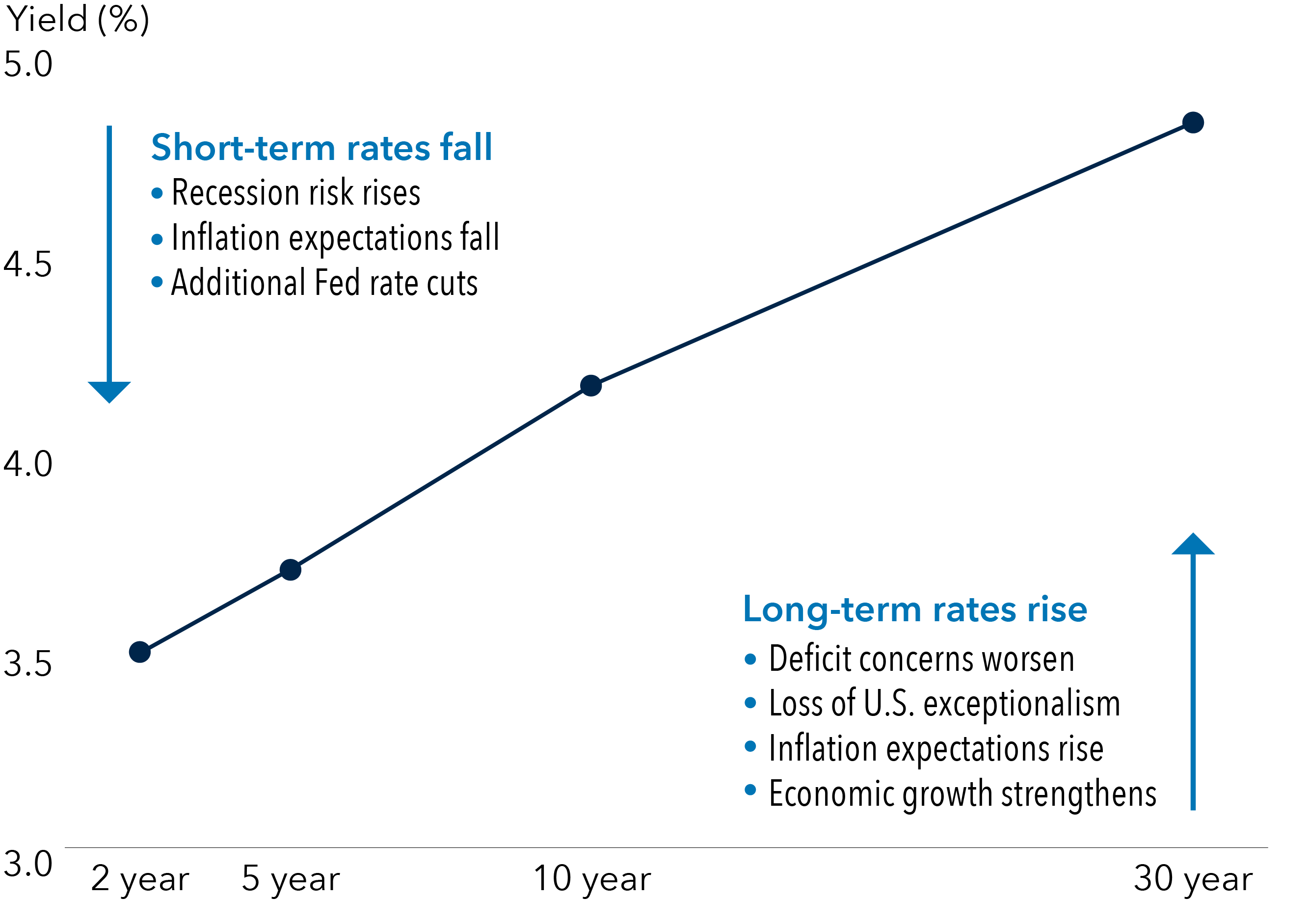

As we enter 2026, core bond yields have moderated from their October 2023 peak, but remain materially above their average over the past 15 years. With the Federal Reserve (Fed) expected to continue its easing cycle amid a soft labor market and inflation slowly trending toward their 2% target, conditions appear favorable for fixed income investors. In this environment, I expect total returns could once again exceed starting yields, which at the time of writing stand at 4.3%, reinforcing the attractiveness of core bonds as both an income source and a potential driver of capital appreciation.