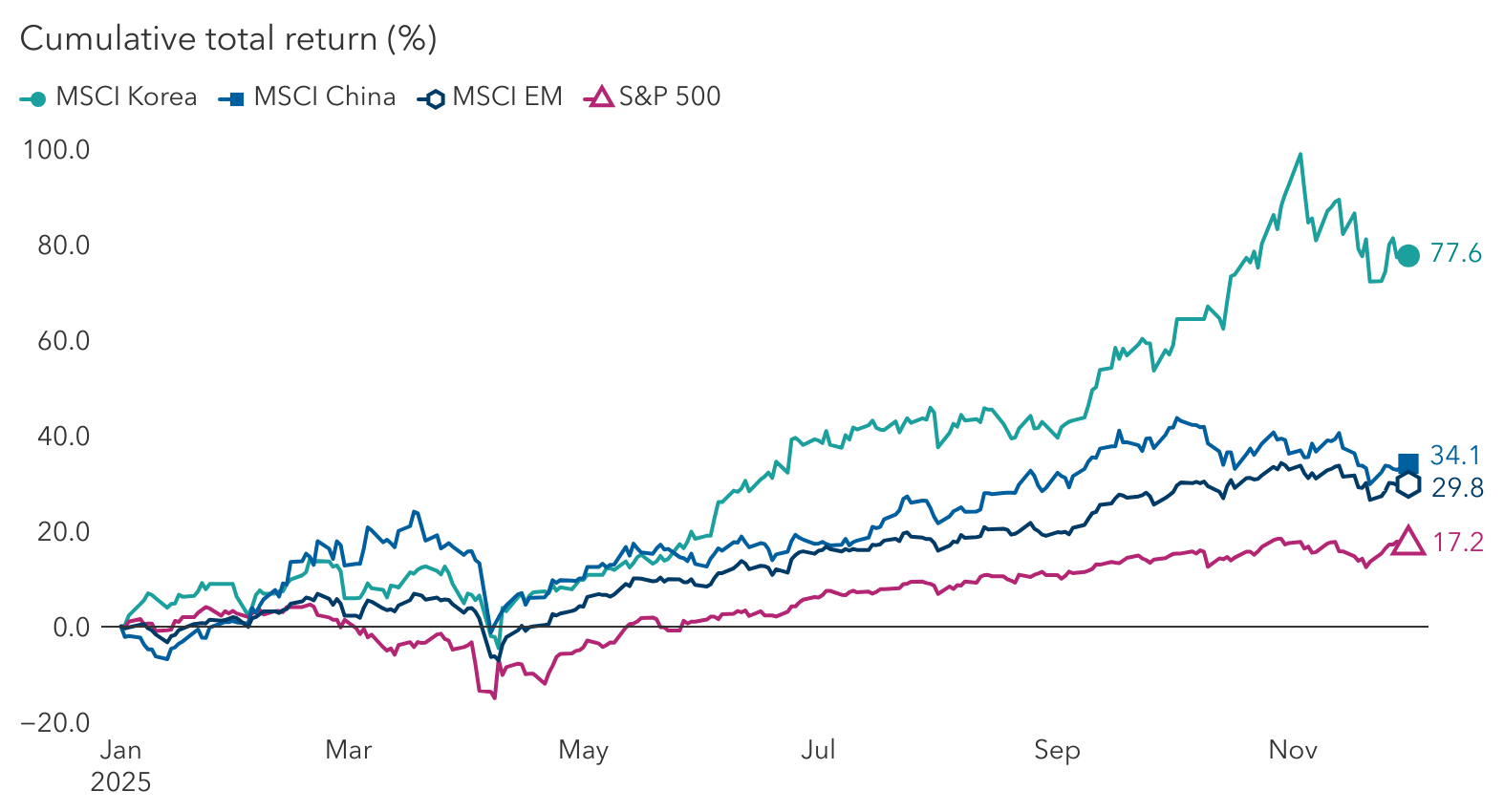

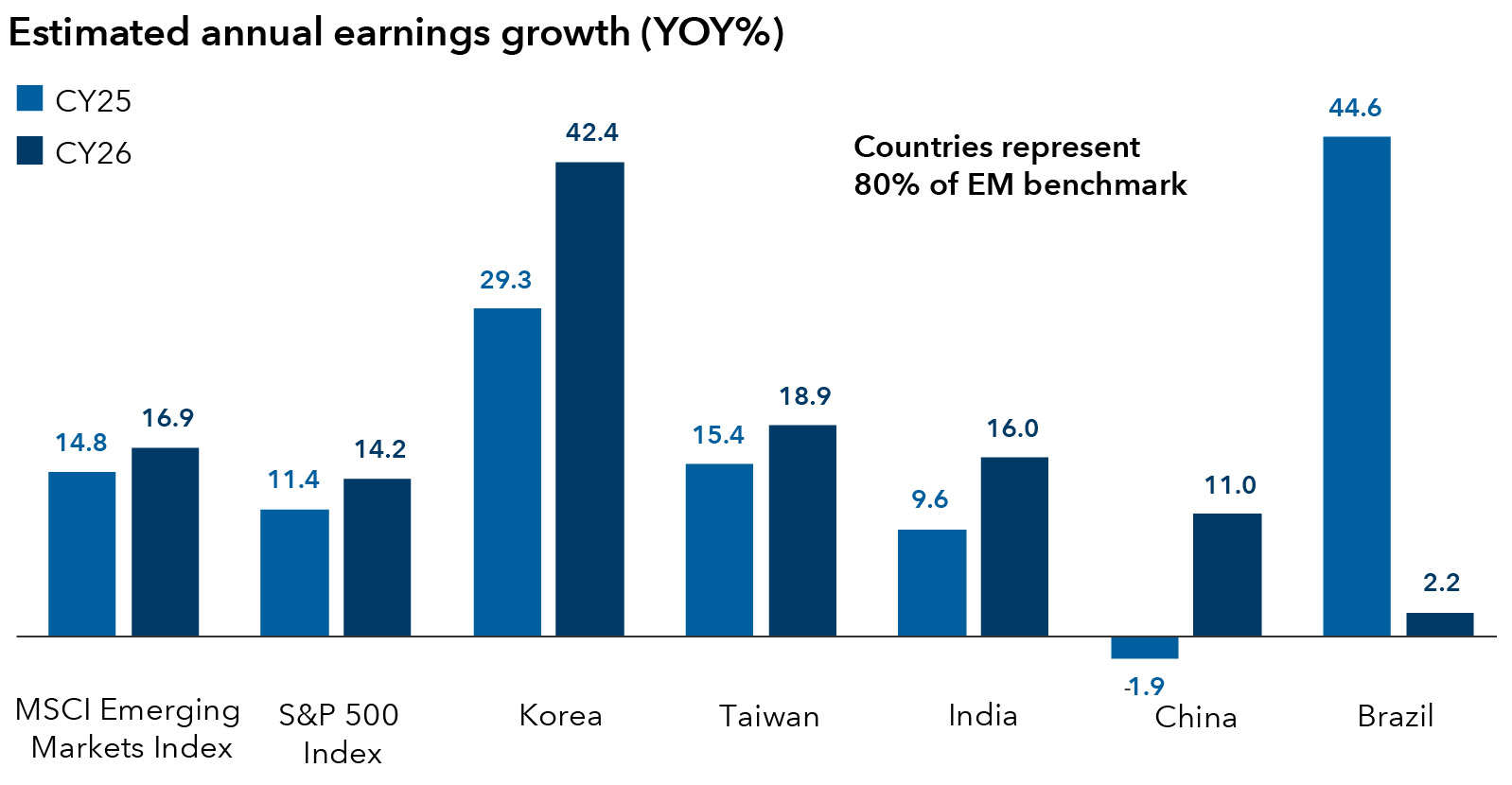

Emerging markets (EM) are on track for their strongest annual return since 2017, driven by a weaker U.S. dollar and a global rotation into non-U.S. stocks. As we look ahead to 2026, can the rebound continue? Several catalysts — from accelerating earnings growth to AI-driven demand — suggest the outlook is promising.

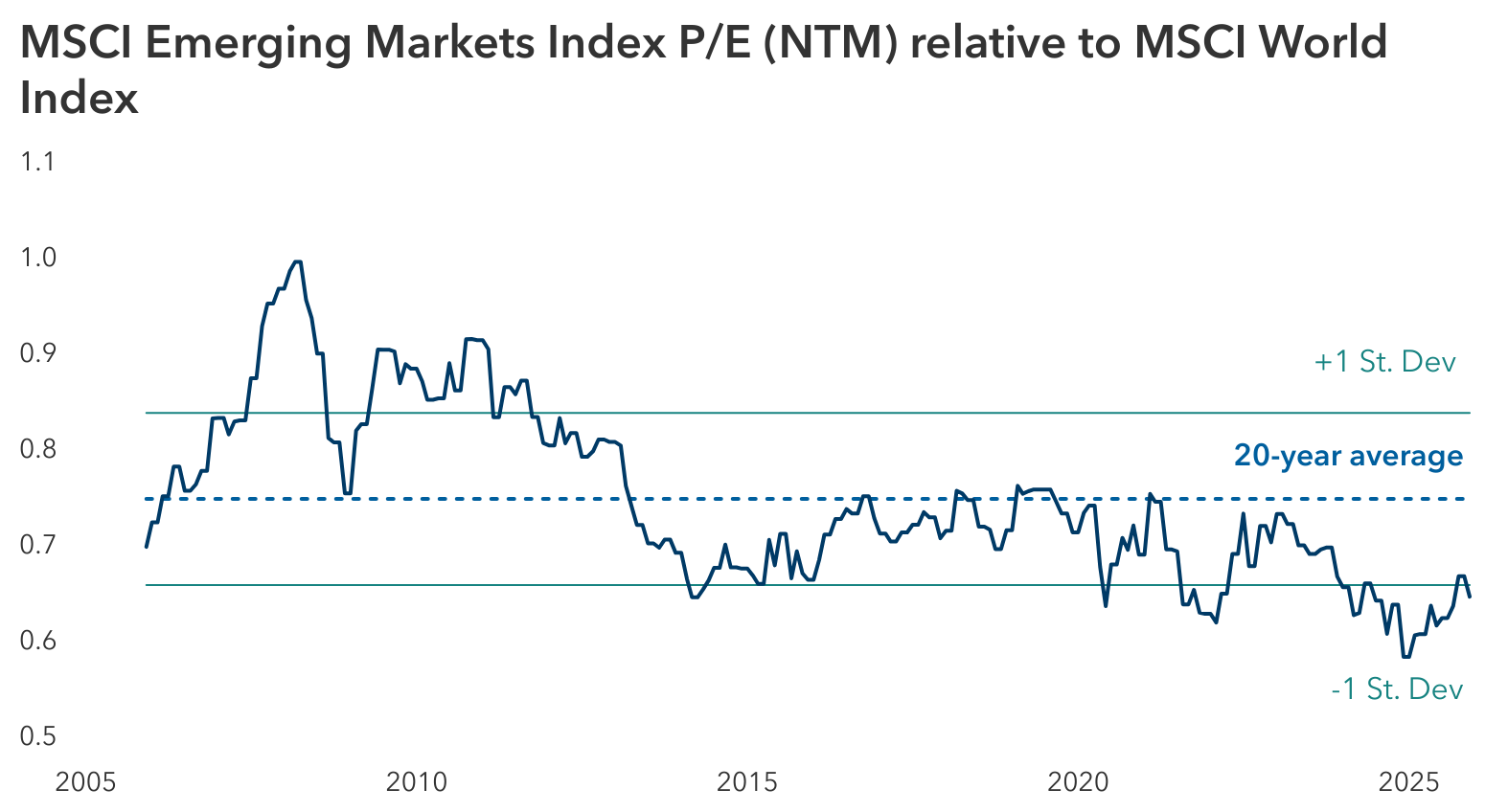

For an asset class that has long been out of favor, it would be a welcome sign. For 15 years, emerging markets, as measured by the MSCI Emerging Markets Index, have trailed global benchmarks like the S&P 500 Index and MSCI World Index by a wide margin. Among the reasons: slowing growth in China, a strong U.S. dollar and the dominance of U.S. tech companies.

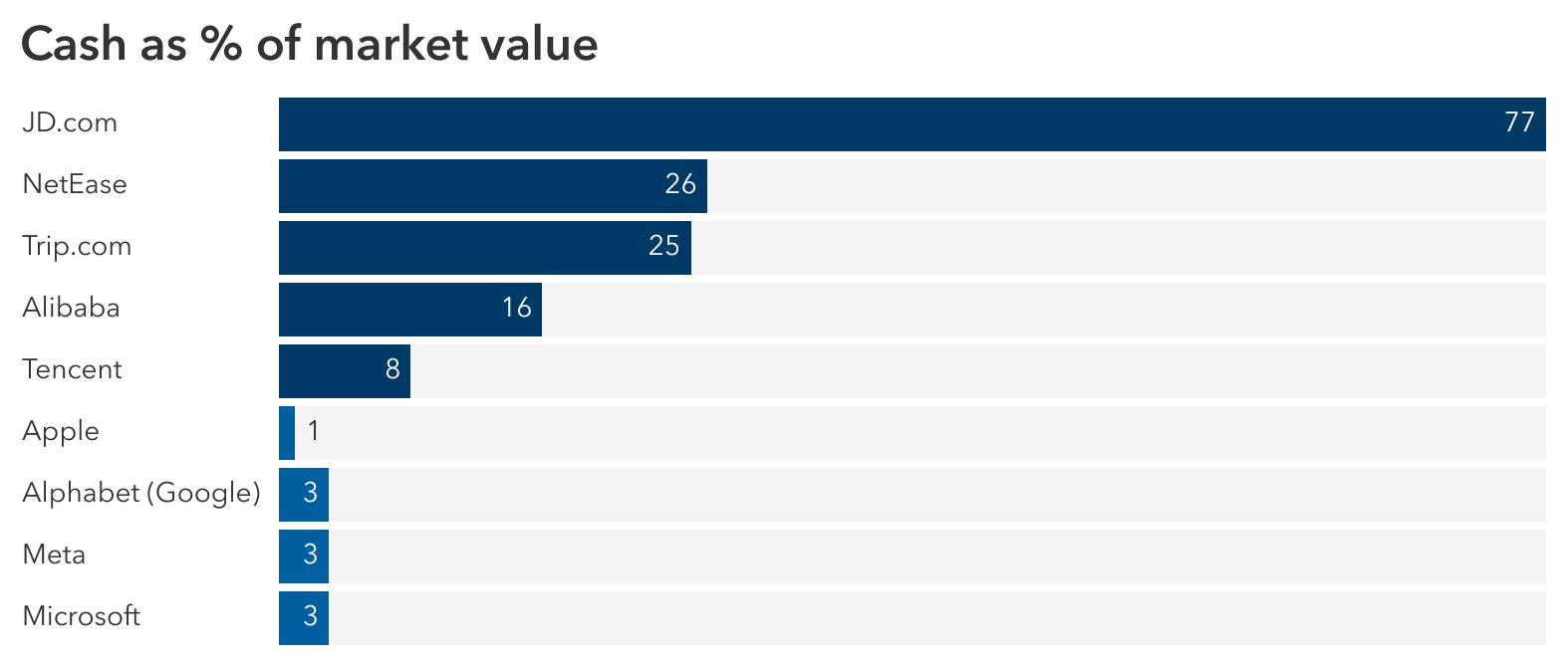

Today, the picture is shifting in a more positive direction for emerging markets. After strong gains this year, here are key factors that could drive further interest.