Financial professionals are using RILAs to meet diverse client needs, from conservative investors seeking downside protection to growth-oriented investors looking for market participation with guardrails. Yet, when it comes to portfolio positioning, opinions diverge.

Some financial professionals present RILAs as a fixed income option, citing their potential to offer more upside with protection. “I sell it as a bond alternative,” one professional shared with researchers.

Others see them as an equity investment, particularly when tied to familiar benchmarks like the S&P 500 Index or Nasdaq-100 Index. “I see it as an equity sleeve,” another explained.

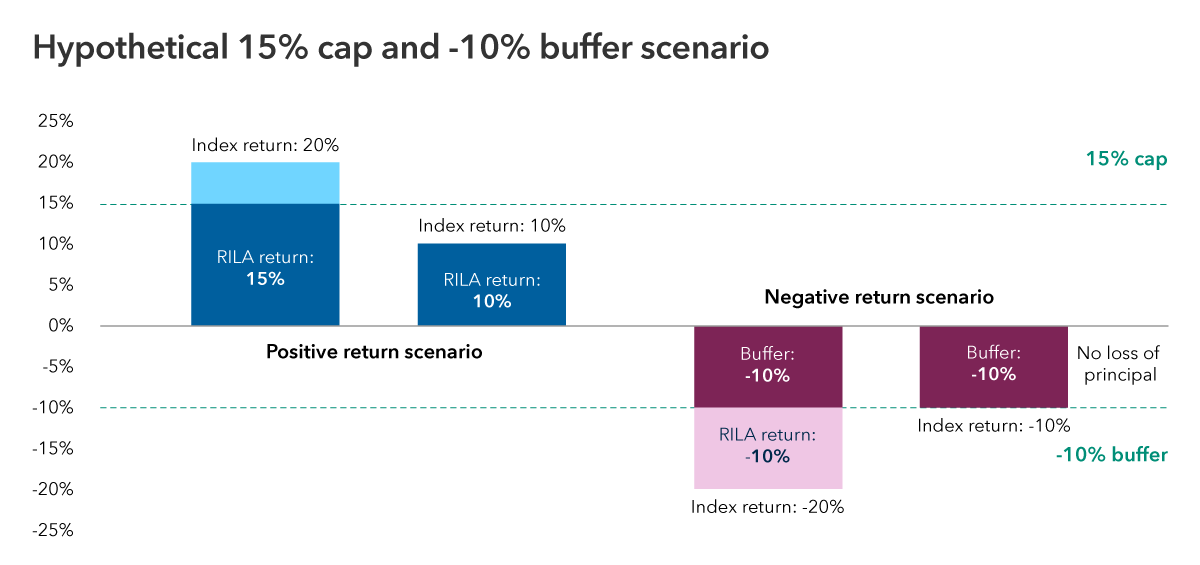

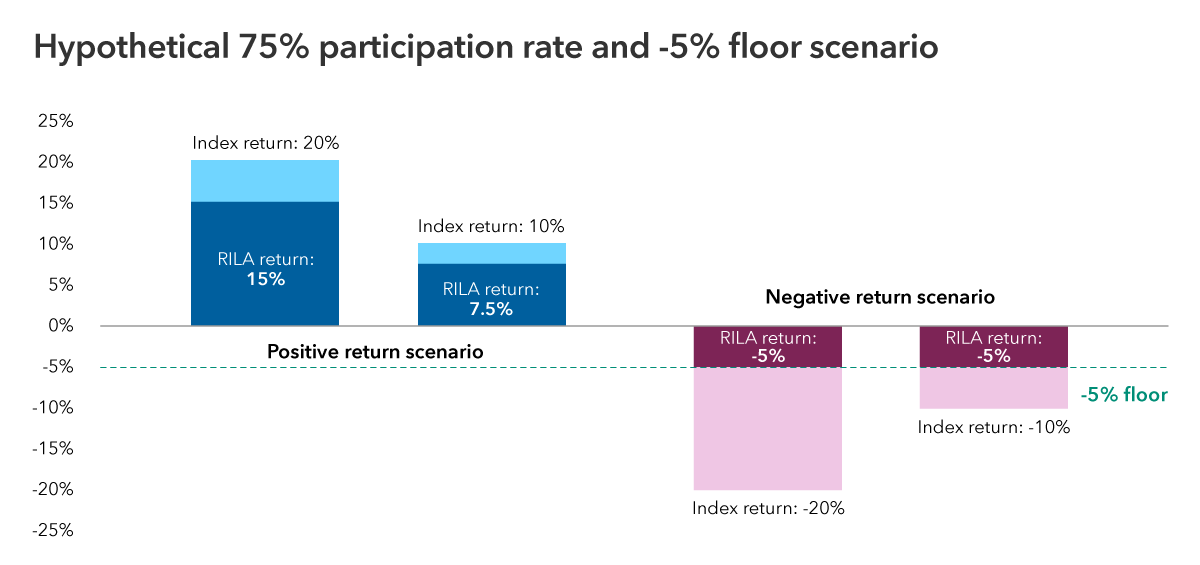

This dual perspective highlights the versatility of RILAs, but our research also showed that RILA use doesn’t stop there: As one financial professional put it, “Personally, I love them. I think they’ve gained a lot of popularity in the recent years, and I think it’s a great option for someone who is looking to participate in the market with a level of protection and a level of comfort.”

Other advantages financial professionals cited include:

- Risk management: Downside protection for pre-retirees and clients with lower risk tolerance.

- Tax deferral: For clients seeking tax-deferred growth outside of retirement accounts. “I think the low-cost tax deferral for some of the younger clients makes a lot of sense,” one RILA seller noted.

- Diversification: Blend of passive and active strategies to reduce market inefficiencies and broaden results.

“I think it’s a good product that solves a specific need for a client. It’s got almost the best of both worlds, if you will. It’s got some downside protection and upside growth as opposed to one or the other.” –Survey respondent