In our last “Simplifying retirement income” story, we wrote about the bucket system: a quick and easy framework for financial professionals and clients to visualize and manage spending in retirement. To recap: Retirement savings are allocated to different financial “buckets” based on when clients expect to need them for immediate, short-, medium- or long-term spending. Those buckets are then aligned with different investing strategies, with the most growth-oriented investments being put in the buckets with the longest time horizon, and the more immediate needs allocated to cash. Over time, regular rebalancing helps to move a portion of each bucket to fill the one below it. In short, it’s structured to help investors not only manage their spending but avoid market anxiety when markets fluctuate.

In their Capital Ideas article, “The bucket approach to retirement income,” Senior Retirement Income Strategist Kate Beattie, CFP, RICP, and Senior Wealth Planning Manager Aaron Peterson, CFP, note the strategy’s adaptability. The number of buckets, what they represent and whether assets are bucketed by a block of time or specific funding goal, for example, are all variable.

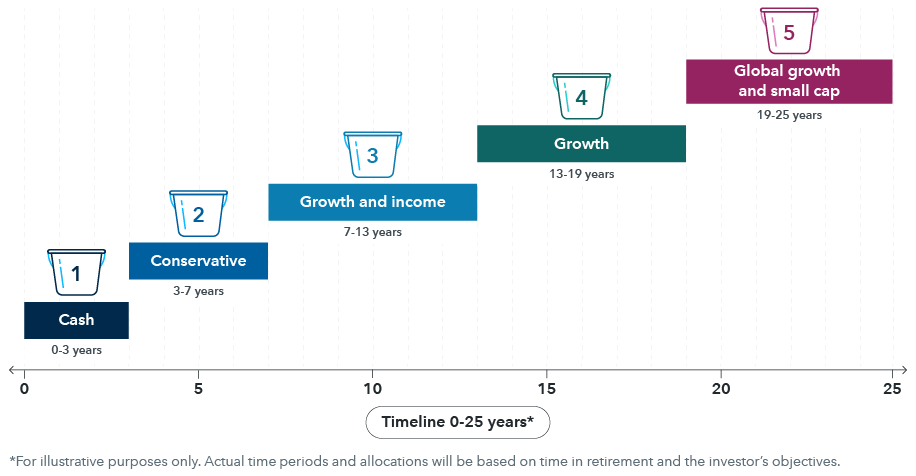

We interviewed financial professionals Joe Schoenhardt and Jim Hinchsliff on our PracticeLab podcast in 2021 about the approach their firm, Infinity Financial Concepts, takes to the system. They use a time-release model with buckets of spending apportioned depending on the expected time in retirement. Over 25 years, for example, they would look to fund roughly five broad buckets – and then rebalance over time.