The resilience of the U.S. economy never fails to amaze me. Despite all the turmoil in the world, the U.S. economy somehow manages to look past it, power through it, and come out stronger on the other side.

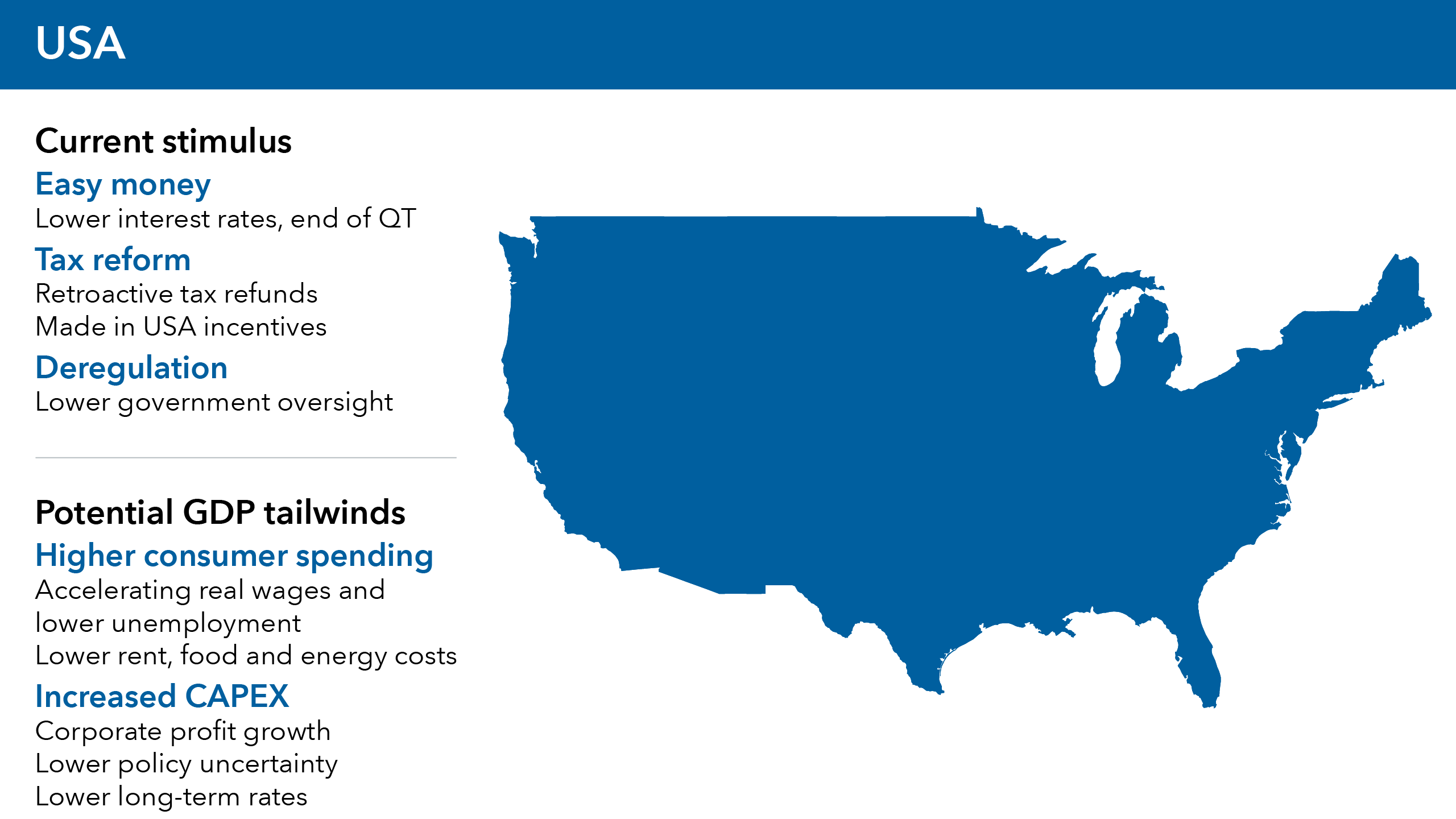

Along those lines, there is a lively debate among economists these days over whether U.S. economic growth could accelerate to 5% this year. That’s a number we haven’t seen on a sustained, multiyear basis since the 1960s and 1970s. Over the last two decades, U.S. gross domestic product (GDP) growth has generally been less than half that amount — averaging roughly 2.1%.

What needs to happen to return to the days of 5% growth? A lot. But based on my analysis, it is within the realm of possibility. And we really aren’t that far off, given that the most recent GDP print (3Q 2025) came in last week at 4.4% annualized.