- Investments

- / American Funds College Enrollment Fund®

Investment Fund

American Funds College Enrollment Fund® (CENAX)

Summary

Internal Prompt

Price at NAV

$9.71

as of 2/25/2026 (updated daily)

Fund Assets (millions)

$3,252.1

Target Date Solutions

Committee Members

8

Expense Ratio

(Gross/Net %)

0.66 / 0.66%

(Gross/Net %)

-

Underlying Funds

-

Current Allocation

| Growth-and-Income | 8.9% | |

| American Mutual Fund® | 8.9% | |

| Equity-Income/Balanced | 5% | |

| American Balanced Fund® | 5% | |

| Bond | 86% | |

| American Funds Mortgage Fund® | 10% | |

| American Funds® Strategic Bond Fund | 5% | |

| Intermediate Bond Fund of America® | 31% | |

| Short-Term Bond Fund of America® | 40% |

As of 1/31/2026

(updated monthly)

| Growth and Income | 9% | |

| Equity Income/Balanced | 5% | |

| Bond | 86% |

As of 1/31/2026 (updated annually at minimum).

Asset Mix

| U.S. Equities10.6% | Non-U.S. Equities1.0% | ||

| U.S. Bonds77.2% | Non-U.S. Bonds3.2% | ||

| Cash & Equivalents |

| U.S. Equities10.6% | |

| Non-U.S. Equities1.0% | |

| U.S. Bonds77.2% | |

| Non-U.S. Bonds3.2% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

-

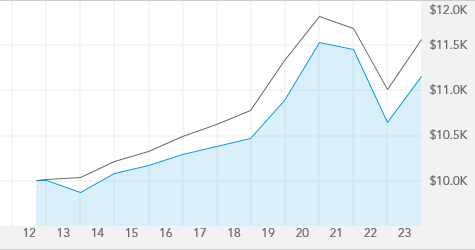

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class 529-A Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class 529-A Shares, this chart tracks the high and low prices at NAV for CENAX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/25/2026.

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Description

Fund Objective

The fund's investment objective is to provide current income, consistent with preservation of capital.

Fund Facts

| Fund Inception | 9/14/2012 |

|

Fund Assets (millions) As of 1/31/2026

|

$3,252.1 |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

92,590 |

|

Regular Dividends Paid |

Dec |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 10% |

| Fiscal Year-End | Oct |

| Prospectus Date | 01/01/2026 |

| CUSIP | 02629M 64 5 |

| Fund Number | 1088 |

Returns LEARN ABOUT THE SYSTEM BEHIND OUR RESULTS

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Target Date Solutions Committee

Michelle Black

31

24

6

David Hoag

38

34

6

Samir Mathur

33

13

6

Raj Paramaguru

21

13

2

Wesley Phoa

33

27

13

Will Robbins

34

31

2

Jessica Spaly

27

22

3

Shannon Ward

33

9

5

| Michelle Black | 6 | 24 | 31 | |

| David Hoag | 6 | 34 | 38 | |

| Samir Mathur | 6 | 13 | 33 | |

| Raj Paramaguru | 2 | 13 | 21 | |

| Wesley Phoa | 13 | 27 | 33 | |

| Will Robbins | 2 | 31 | 34 | |

| Jessica Spaly | 3 | 22 | 27 | |

| Shannon Ward | 5 | 9 | 33 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Risk Measures

| Fund | |||

|

Standard Deviation

|

3.06 | ||

|

Sharpe Ratio

|

-0.05 | ||

|

For the 10 Years ending 1/31/26

(updated monthly).

|

|||

|

American Funds Benchmark |

Morningstar Benchmark |

||

|

Bloomberg U.S. Aggregate 1-5 Years Index

|

Bloomberg US Agg Bond TR USD

|

||

| R-squared | 87 | 87 | |

| Beta | 0.56 | 0.56 | |

| Capture Ratio (Downside/Upside) | 43/61 | 43/61 | |

|

American Funds Benchmark for the 10 Years ending 1/31/26

(updated monthly).

Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

|||

Quality Summary

U.S. Treasuries/Agencies

28.4%

AAA/Aaa

19.0%

AA/Aa

19.5%

A

7.3%

BBB/Baa

3.0%

BB/Ba

0.4%

B

0.2%

CCC & Below

0.0%

Unrated

2.5%

Cash & equivalents

8.0%

%

of net assets as of 1/31/2026

(updated monthly)

Holdings

-

Equities Breakdown

-

Bonds Breakdown

Equities Breakdown

Equity Fund Holdings

| Information technology 2.6% | |

| Health care 1.7% | |

| Industrials 1.5% | |

| Financials 1.4% | |

| Consumer staples 1.0% | |

| Consumer discretionary 0.7% | |

| Communication services 0.7% | |

| Utilities 0.7% | |

| Energy 0.6% | |

| Materials 0.5% | |

| Real estate 0.3% |

% of net assets as of 1/31/2026 (updated monthly)

No top industries data is available at this time.

Bonds Breakdown

Bond Details

Total bond holdings

| U.S. Treasury bonds & notes 27.2% | |||||||||||||||||||||||

Mortgage-backed obligations

+

27.0%

|

|||||||||||||||||||||||

| Asset-backed obligations 15.8% | |||||||||||||||||||||||

Corporate bonds, notes & loans

+

9.6%

|

|||||||||||||||||||||||

| Non-U.S. government/agency securities 1.0% |

% of net assets as of 12/31/2025 (updated quarterly)

Go to the underlying fund pages to see detailed holdings information.

- Growth-and-Income Funds

- Equity-Income/Balanced Funds

- Bond Funds

Top Fixed-Income Issuers

U.S. Treasury

25.4%

Fannie Mae

7.6%

Federal Home Loan Mortgage

7.4%

UMBS

3.0%

Ginnie Mae II

0.8%

JPMorgan Chase

0.5%

New Economy Assets - Phase 1 Sponsor

0.3%

Mars

0.3%

Morgan Stanley

0.3%

Ford Motor

0.3%

% of net assets as of 11/30/2025 (updated monthly)

Geographic Breakdown

United States

87.8%

Europe

1.5%

Asia & Pacific Basin

0.8%

Other (Including Canada & Latin America)

1.9%

Cash & equivalents

8.0%

%

of net assets as of 1/31/2026

(updated monthly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/24/2025 |

| 0.00000000 | 12/26/2025 |

| 0.00000000 | 12/29/2025 |

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| 0.00000000 | 02/23/2026 |

| 0.00000000 | 02/24/2026 |

| 0.00000000 | 02/25/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/24/2025 | |

| 0.00000000 | 12/26/2025 | |

| 0.00000000 | 12/29/2025 | |

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 | |

| 0.00000000 | 02/23/2026 | |

| 0.00000000 | 02/24/2026 | |

| 0.00000000 | 02/25/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.00% |

| Other Expenses | 0.16% |

| Acquired (Underlying) Fund Fees and Expenses | 0.27% |

| Service 12b-1 | 0.23% |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| CENAX | 0.66% |

|

Lipper Short-Intmdt Investment Grade Debt

Funds Average

|

0.63% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Prospectuses & Reports for CENAX

Growth of a hypothetical $10,000 investment

This chart tracks a Class 529-A share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class 529-A Shares, this chart tracks the total returns since the fund's inception date (Friday, September 14, 2012) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (2012), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Standard Deviation as of 01/31/2026. Annualized return as of 01/31/2026

Volatility & Return chart is not available for funds less than 10 years old.