MARKET VOLATILITY

Navigating markets and volatility

Resources, insights and support to guide you

Market insights and analysis

Timely and actionable insights to help you make sense of the markets and guide your investment decisions

Investment results

See how our mutual funds are doing, including current results for all our different fund types.

See how our mutual funds are doing, including current results for all our different fund types

Experience matters

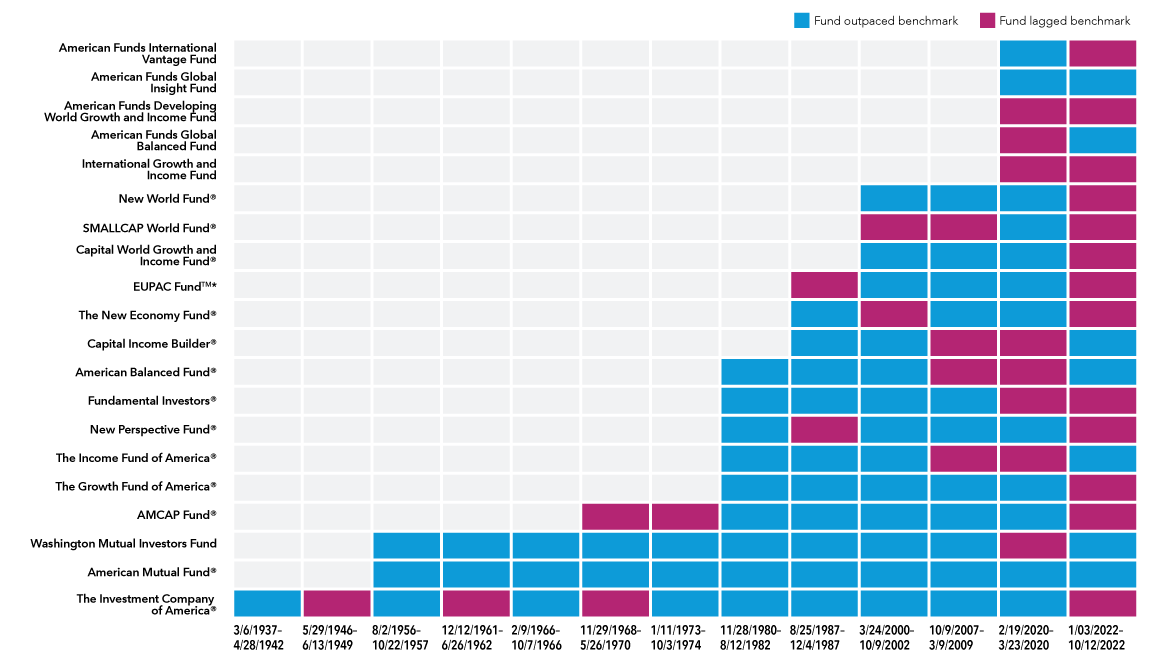

Throughout our history, we've weathered past storms. In fact, our equity-focused funds have outpaced their benchmark indexes during the biggest downturns of the last nine decades.

Across 17 bear markets, the equity-focused American Funds outpaced their benchmarks 77% of the time.

Experience matters

Throughout our history, we've weathered storms. In fact, our equity-focused funds have outpaced their benchmark indexes during the biggest downturns of the last nine decades.

Across 13 bear markets, the equity-focused American Funds outpaced their benchmarks 69% of the time.

*Effective June 1, 2025, EuroPacific Growth Fund® is now EUPAC Fund.

Sources: Capital Group, Morningstar. Class F-2 shares with all distributions reinvested. View fund expense ratios and returns.

Dates shown for bear markets are based on price declines of 20% or more (without dividends reinvested) in the unmanaged S&P 500 with 100% recovery between declines. Funds shown are the equity-focused American Funds in existence at the time of each decline. Fund and benchmark returns are based on total returns.

Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on Class A share results without a sales charge, adjusted for estimated annual expenses. The results shown are before taxes on fund distributions and sale of fund shares. Past results are not predictive of results in future periods. Results for other share classes may differ.

Benchmark indexes for the funds: S&P 500 (The Investment Company of America, American Mutual Fund, Washington Mutual Investors Fund, AMCAP Fund, The Growth Fund of America, American Funds Fundamental Investors); MSCI World (New Perspective Fund, Capital World Growth and Income Fund, American Funds Global Insight Fund); 60% S&P 500 / 40% Bloomberg U.S. Aggregate (American Balanced Fund); 65% S&P 500 / 35% Bloomberg U.S. Aggregate (The Income Fund of America); 70% MSCI ACWI / 30% Bloomberg U.S. Aggregate (Capital Income Builder); S&P 500 prior to the 2020 bear market, MSCI ACWI thereafter (The New Economy Fund); MSCI EAFE prior to the 2007-09 bear market, MSCI ACWI ex USA thereafter (EuroPacific Growth Fund); MSCI All Country World Small Cap (SMALLCAP World Fund); MSCI ACWI (New World Fund); MSCI ACWI ex USA (International Growth and Income Fund), 60% MSCI ACWI / 40% Bloomberg Global Aggregate (American Funds Global Balanced Fund); MSCI Emerging Markets (American Funds Developing World Growth and Income Fund); MSCI EAFE (American Funds International Vantage Fund).

Support

These resources can help you maintain your financial plan no matter how the market behaves

Manage your finances now

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg Global Aggregate Index represents the global investment-grade fixed income markets.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. Results reflect dividends net of withholding taxes. MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. Results reflect dividends net of withholding taxes. MSCI All Country World ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. MSCI All Country World Small Cap Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results of smaller capitalization companies in both developed and emerging markets. Results reflect dividends net of withholding taxes. MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter.

These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.