Practice Management

Born into the age of smartphones, tablets and virtual reality, today’s teens are the most technologically savvy generation thus far. But when it comes to finances, most of them are barely getting a passing grade. That makes some sense, since only six states mandate a stand-alone financial literacy course as a required part of their core high school curriculum.1

But they know the importance of financial literacy and want to learn.

A recent survey found that the majority (73%) of teens want financial education, and a whopping 86% of respondents are interested in investing.2 Still, many haven't started because they (and their parents) lack the knowledge or confidence to do so.

That’s where you can make a difference. As a workplace professional and through the employers and participants you serve, there is an opportunity to prepare the next generation for financial independence and break the cycle of low financial literacy.

Financial independence versus retirement

Teenagers may not care about something so far in the future as retirement. But what if you reframed the conversation toward becoming financially independent? To be sure, many people equate financial freedom with the ability to stop working. But it can mean so much more, such as:

- Starting a business — Many teens may reject the notion of working a decades-long, 9-to-5 job. Financial resources could give them the freedom to start a business they care about and be their own boss.

- Following a passion — Let’s face it, most teens will have to work at some point in their lives. But being financially independent could mean having the ability to find a job that they feel passionate about rather than one that simply pays the bills.

- Furthering their education — We’ve all heard the stories of the mounting student debt facing today’s teens and young adults. The ability to attend college or otherwise advance their education without debt can put them ahead of the game and free up resources to finance other goals.

- Giving back — Having grown up with social media, many of today’s teens are socially aware and are interested in making a difference. Financial independence could mean helping family, their communities and people in need. With the advent of environmental, social and governance (ESG) investing, they can target their investments toward those that do good and avoid those that do harm.

- Enjoying life — Today’s teens have a reputation for being more frugal than previous generations, but they still want to enjoy their lives. Having financial resources could give them the ability to travel, buy a boat or splurge on other big-ticket items.

The concept of saving may sound boring to teenagers and young adults but reframing it as a pathway to achieving financial freedom to do what they want may resonate better with a younger audience and pique their interest.

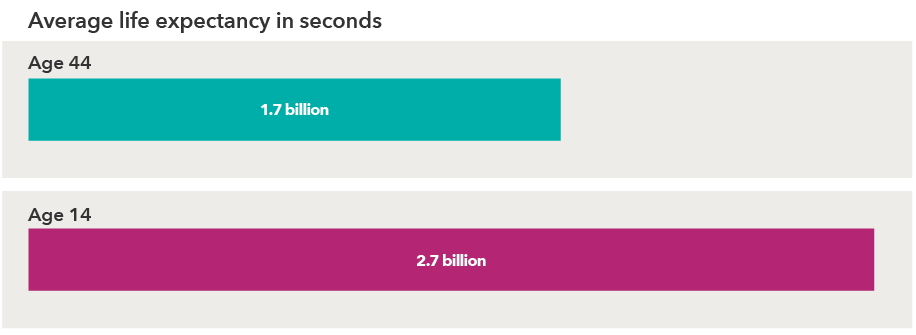

Measuring wealth in seconds, not dollars

While few teenagers may have a million dollars in the bank, they are exponentially richer in something else: time. Consider this: A 14-year-old with a life expectancy of 100 years essentially “owns” more than 2.7 billion seconds, while the average 44-year-old with a life expectancy of 100 years has approximately 1.7 billion seconds (See Figure 1). The 14-year-old has the 44-year-old beat by one billion seconds. With the raw material of time, teenagers are already multi-billionaires. Think about how those extra seconds can translate to dollars thanks to compound interest.

Figure 1. Today's teens are time billionaires

Source: Capital Group.

Emphasize the value of time over the value of money

Financial professionals understand the concept of compound interest, but most teenagers don’t know what it is and what a powerful tool it can be for reaching their financial goals. Emphasize that the earlier they start saving and investing, the more time their savings will have the potential to grow. And maybe just as important, how little they need to get started.

To a typical teenager, $100 may seem like a windfall that could be spent on the latest tech device or trendy sneakers. But, with a little patience, that $100 could turn into so much more. Consider the hypothetical example of a custodial account opened for a 14-year-old with $100 invested monthly over 50 years. Assuming an 8% rate of return, that account could reach over $800,000 by the time she reaches age 65.3 The 44-year old who follows the same investing parameters but only invests for 21 years would only have $66,000!4

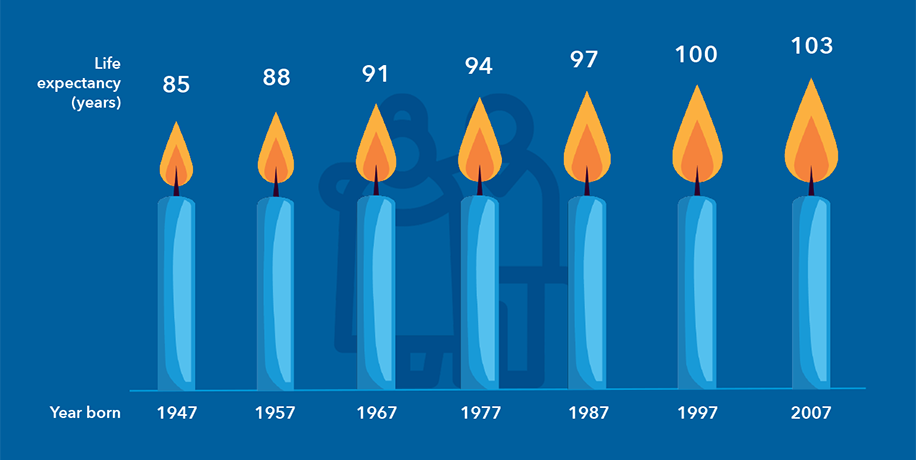

If the thought of living to age 100 sounds far-fetched, think again. Americans are living longer than ever, and the 14-year-old in the example could even reach 103 years!5 As life expectancy continues to increase, so will the amount of money people will need in retirement. That’s why it’s so important to encourage teenagers to get those “billions" working as soon as possible.

Figure 2. Today's teens could live more than 100 years

Source: 100yearlife.com

Helping teenagers put their billions to work

Teaching teens to save is a valuable first step, but the path to their financial independence may be to invest their savings. When explaining the high-level concept of investing to kids, keep these three things in mind:

- Start with the basics — Help them understand investing terminology and break down complicated words and topics into simpler terms. Familiarize them with the concept of asset allocation (stocks, bonds and mutual funds) and why what they invest in matters.

- Discuss their time horizons — Encourage teens to think about when, where and how they will need to convert their “time’’ into money. They may have multiple time horizons.

- Advocate continuous learning — Social media and the internet are great places to start as most major financial institutions have content on their own sites and LinkedIn, Twitter and Facebook. There are also numerous nonprofits dedicated to advancing financial literacy for all Americans, not just teens.

Resources to help

Still wondering about ways to teach financial literacy to teens? Capital Group offers a variety of resources to help educate a new generation of investors, such as:

- National speakers

- An impactful and relatable presentation for next-generation investors

- Multiple digital platforms

- Invites and program overviews

- Follow-up resources

Reach out to me at ryan.tiernan@capgroup.com to learn more about our program and how you can play a role in helping the next generation of American investors.

Mutual funds: A great introduction to investing

Teens younger than 18 will need to have a parent or guardian set up a custodial account and make transactions on their behalf. But here are some tips to deliver the message that mutual funds might be the way to for them to start their investment journey:

- Simplicity: It’s easy to buy and sell mutual funds. And many mutual fund companies “have an app for that,” which may make it easier for parents or guardians of today’s teens to make transactions.

- Diversification: The term may make a teen’s eyes glaze over, but not if the importance of variety in buying decisions is pitched to products and preferences they can relate to.

- Professional oversight: Explain to them how mutual funds provide them with essentially their own personal portfolio manager whose job is to seek the most attractive investments in support of the fund’s objectives.

- Time: Teens are busy. Point out to them that with mutual funds, a professional manager monitors the fund, so they don’t have to spend their own time looking at stock websites and other news to make their own investment decisions. They can even ask their parent or guardian to set up automatic investing, which is great for young investors trying to establish a pattern of consistent investing.

To provide some additional information on mutual funds, consider sharing these articles:

Master the basics of mutual funds

What Are the Different Types of Mutual Fund Asset Classes?

1 Source: CNBC.com, States that require personal finance classes should not overlook teacher training, experts say, April 5, 2021.

2 Source: Valuepenguin.com, 3 in 4 Teens Lack Knowledge and Confidence in Personal Finance, April 7, 2021.

3 Source: NerdWallet Compound Interest Calculator, https://www.nerdwallet.com/banking/calculator/compound-interest-calculator, accessed August 16, 2021. Assumes 8% rate of return, with $100 monthly investment and monthly compounding.

4 Source: NerdWallet Compound Interest Calculator, https://www.nerdwallet.com/banking/calculator/compound-interest-calculator, accessed August 16, 2021. Assumes 8% rate of return, with $100 monthly investment and monthly compounding.

5 Source: World Economic Forum and 100yearlife.com. We’ll Live to 100 – How Can We Afford It?, May 2017.

Our latest insights

RELATED INSIGHTS

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Ryan Tiernan

Ryan Tiernan