Updated onDecember 23, 2023

3 MIN ARTICLE

This Q&A can help explain how investing for the long haul can help put the power of time on your side.

TABLE OF CONTENTS

One of the advantages associated with long-term investing is the potential for compounding. Here’s how it works: When your investments produce earnings, those earnings get reinvested and can earn even more. The more time your money stays invested, the greater the opportunity for compounding and growth. Keep in mind that while compounding, overall, can have a significant long-term impact, there may be periods when your money won’t grow. While there are no guarantees, the value of compounded investment earnings can turn out to be far greater over many years than your contributions alone.

What is the advantage of getting an early start when investing?

By starting to save early, you can benefit from the power of compounding, whereby the earnings of your account earn additional earnings. Over the course of decades, compounding can make a significant difference.

Take the example of two hypothetical co-workers, Jill and Edwin. Let's say they contributed the same amount of money to their firm's retirement plan for the same number of years ($100 a month for 20 years, for a total of $24,000 invested) and earned the same average annual return (8%). The only difference is that Jill begins making contributions at age 35, while Edwin waits until he is 45 to start. By age 65, Jill would have accumulated $130,519 while Edwin's balance would be $58,902.

Is it a good idea to try to time the markets?

In general, it’s a poor idea to attempt to time the markets. Too often, investors are spooked by a stock market downturn and flee the market. This can lock in losses and prevent investors from reaping the rewards when the market rebounds.

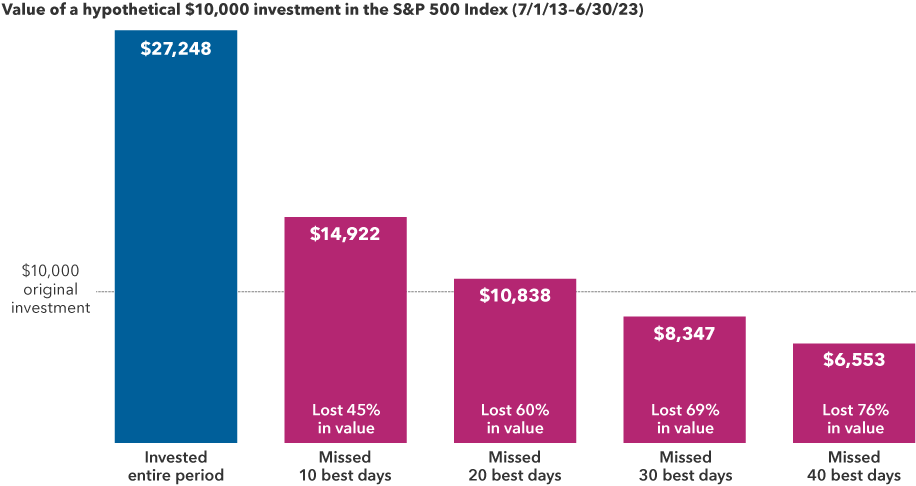

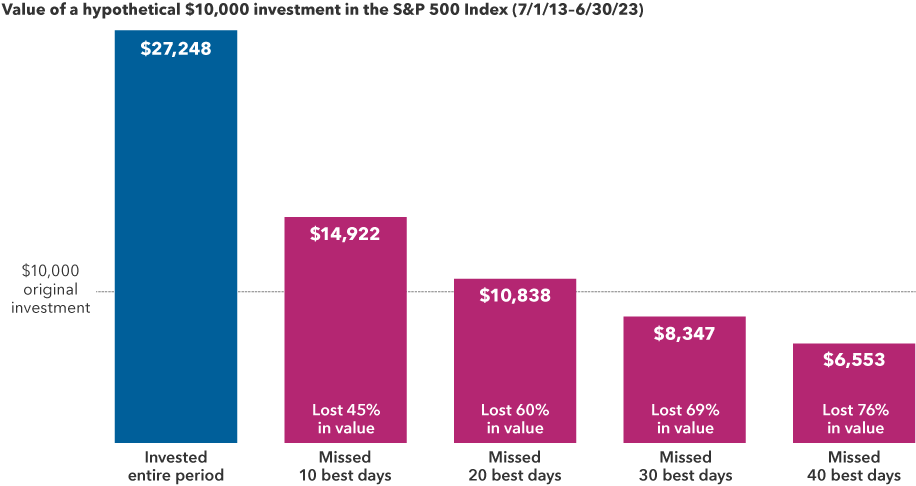

Consider the example of a hypothetical $10K investment in the S&P 500 Index made on July 1, 2013 and held for 10 years. Staying invested through the two bear markets during that period may have been tough, but this patient investor's portfolio would have nearly trippled. If that investor had instead tried to time the market and missed even some of the best days, it would have significantly hurt their long-term results — and the more missed "good" days, the more missed opportunities. While you may hear a lot of talk about timing the market, successful investing is more about time than timing.1

Missing just a few of the market’s best days can hurt investment returns

Sources: Standard & Poor's, RIMES, as of 06/30/2023. Values in USD. Past performance is not indicative of future results.

When is the best time to begin a long-term investment program?

No one has figured out the best time to invest. You can take the guesswork out of it by making a regular fixed-dollar investment, for example, every month or every paycheck. This is called dollar cost averaging. If you’re contributing to your retirement plan, you’re probably already using this strategy.

Because the prices of investments fluctuate, dollar cost averaging allows you over the long term to:

- Buy more shares when prices are lower

- Buy fewer shares when prices are higher

Dollar cost averaging can lower your average cost per share of an investment, but it doesn’t guarantee a profit or protect against loss. You should consider your willingness to keep investing when share prices are declining.