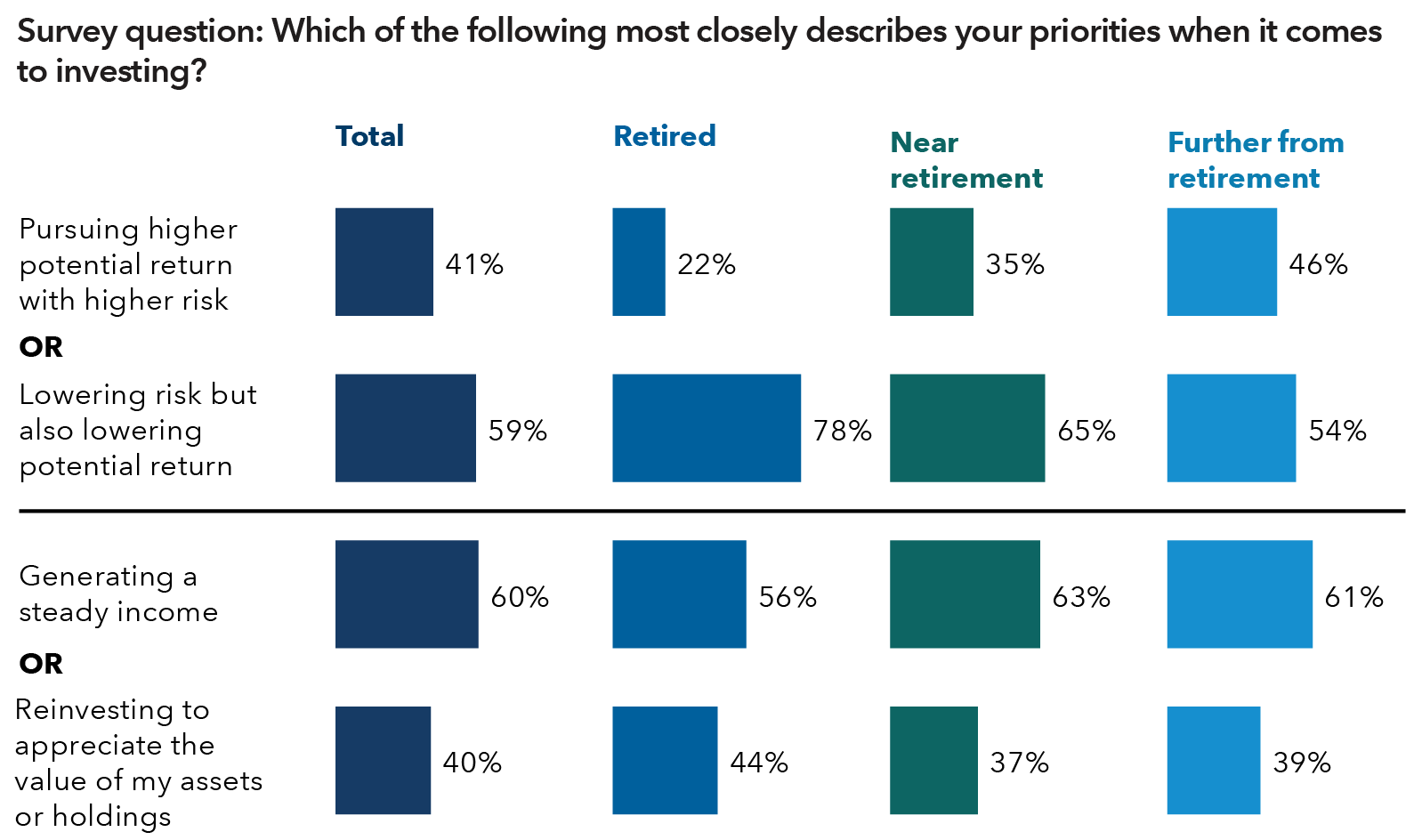

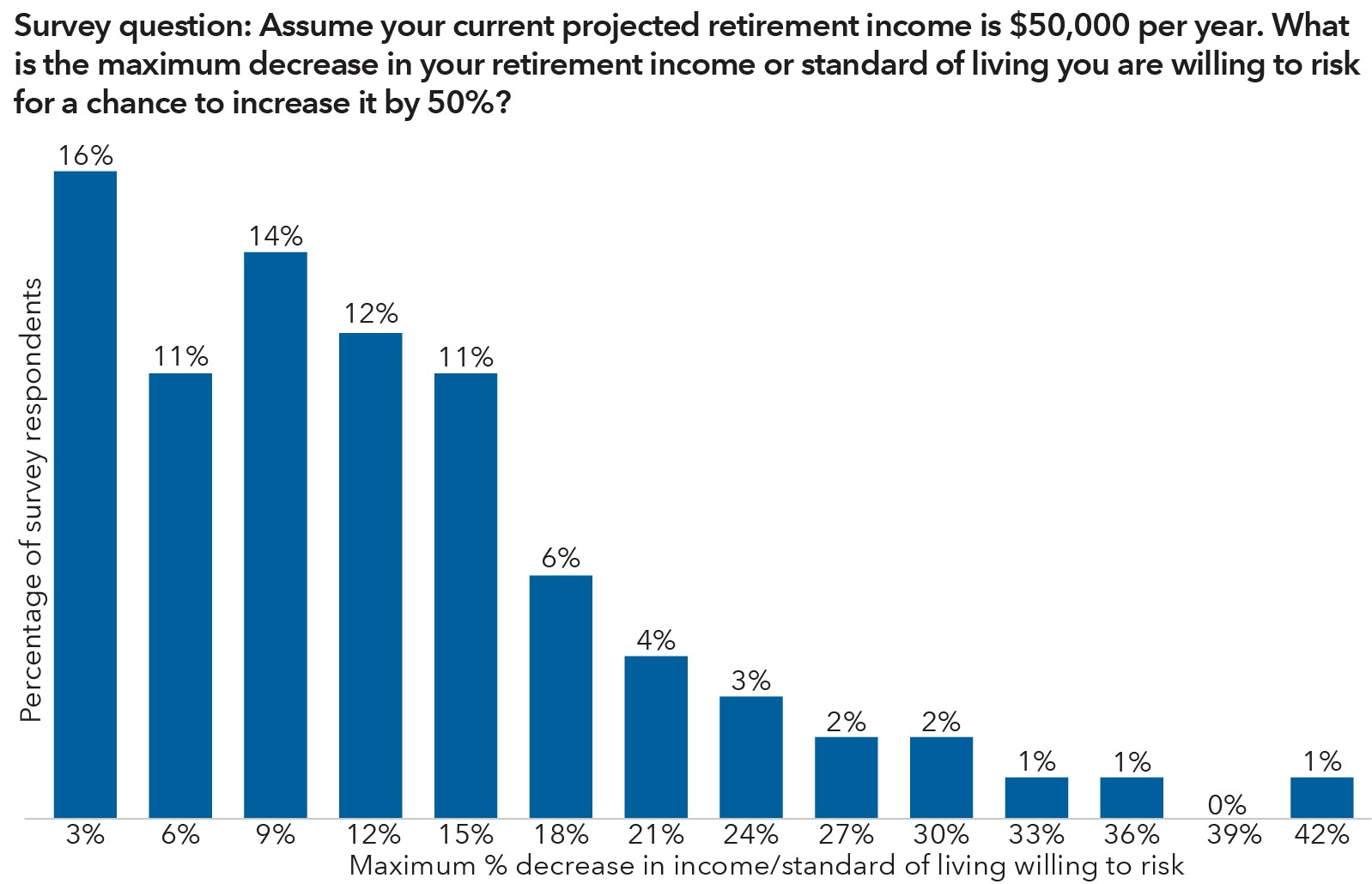

More risk, more reward? When it comes to retirement income, investors say: "No, thank you." A new Capital Group survey reveals investors prefer generating steady income and minimizing risk in retirement, even if that means accepting lower returns on their investments.

“The survey shows investors are risk-averse in retirement planning across a number of areas,” says portfolio manager Samir Mathur, who is also a member of the Capital Solutions Group. “Regarding retirement income, we find a marked preference for lower risk and steady income over higher risk and the potential for higher returns.”

Partly as a result, older investors appear to want to preserve as much of their savings as possible and tend to be more risk-averse and short-term oriented than financial advisors, who we separately surveyed. Advisors may have more work to do to help their clients pursue their retirement income objectives.

The survey asked investors to choose from among several hypothetical retirement income investment strategies with different withdrawal rates, withdrawal time periods (20 or 30 years), probabilities of loss and ending account balances.

Their choices yielded insights into how investors might behave once their long-planned retirement arrives and they must decide how to invest and spend their nest egg. Here’s what we found: