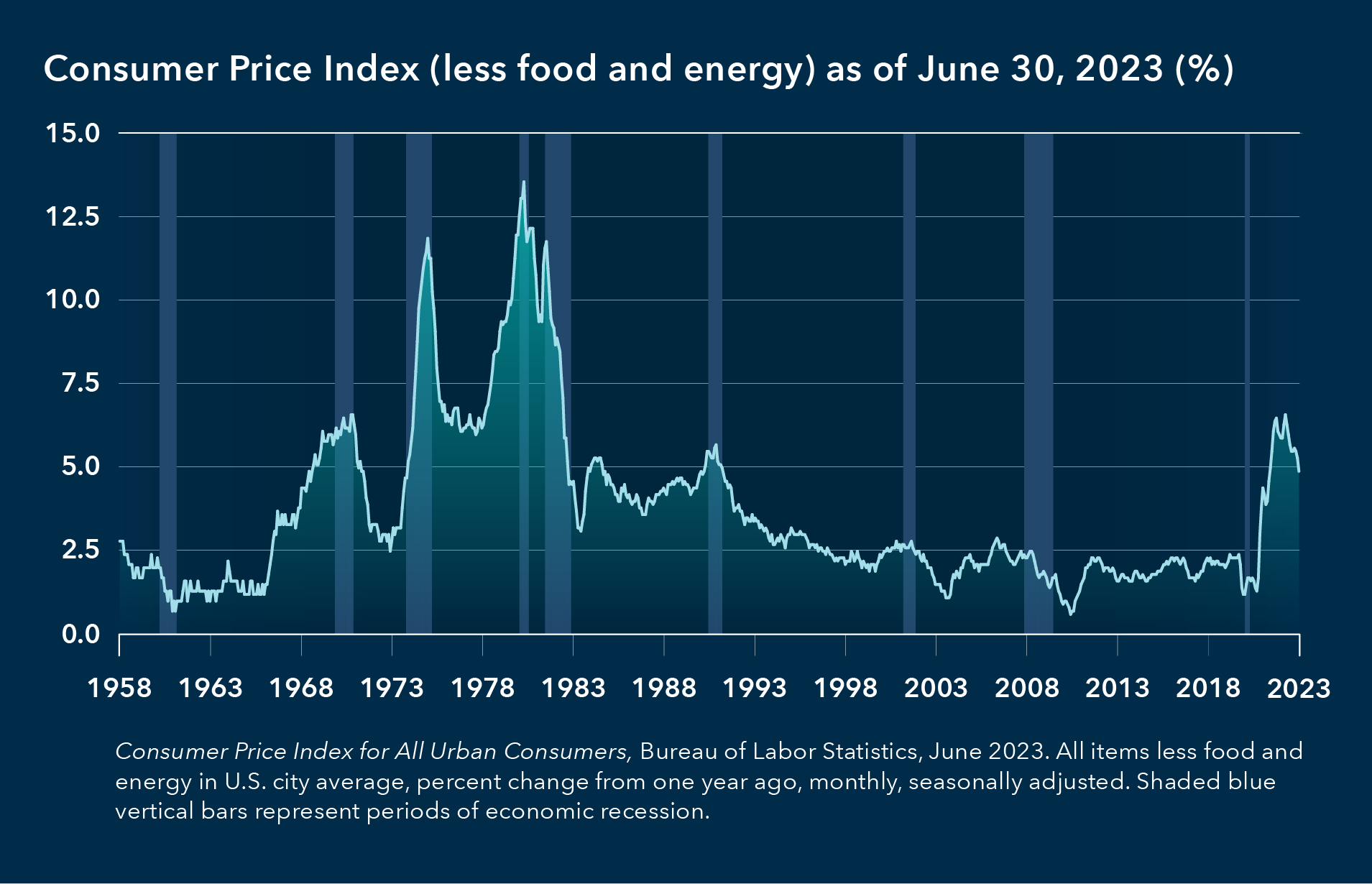

Investors continue to contend with persistently high core inflation, a stark contrast to the era of low and steady inflation rates of recent decades. There are familiar headwinds, especially for portfolios focused on generating real income, as higher inflation eats away at the value of dividends and bond coupons and disrupts asset prices.

August 9, 2023

Wesley Phoa is a solutions portfolio manager with 32 years of industry experience (as of 12/31/2024). He holds a PhD in pure mathematics from Trinity College at the University of Cambridge and a bachelor’s degree with honors from the Australian National University.

Steve Fox is a client analytics director with 30 years of industry experience (as of 12/31/2024). He holds a PhD in economics from the University of California, Santa Barbara and a bachelor’s degree in economics and mathematics from the University of California, Davis.