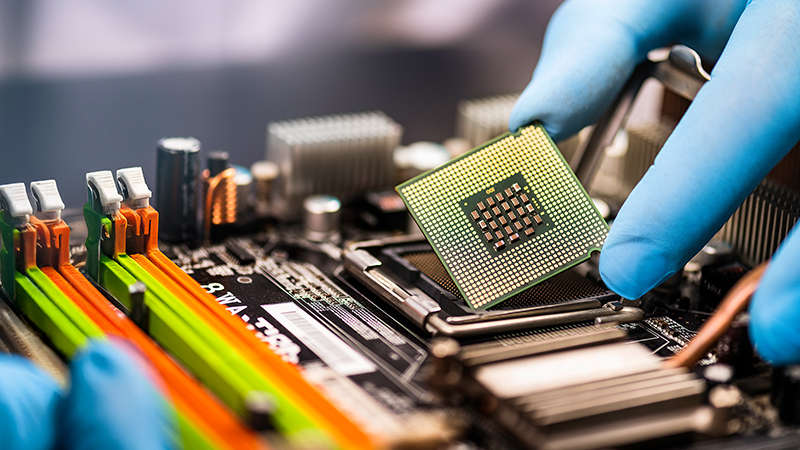

Powering AI: Energy crunch sparks investment surge

Made in America is making a comeback

What investors want for retirement

WHO WE ARE

Since 1931, we’ve been working with advisors like you to help achieve client goals

COURSES

Build and lead a high-performing advisory practice

An interactive course to help you lead with vision, scale with confidence and run a practice with clarity and purpose. Sign in for access.

Practice Management

How to talk with clients about AI

Clients anxious about AI and their portfolios, jobs or even how your practice is using it? Use this conversation guide.

Explore more investment and practice management insights

PORTFOLIO STRATEGIES & SOLUTIONS

Capital Group can help you and your business.

Portfolio Construction

See how our objective-based approach fits into your portfolio

RETIREMENT PLANS

Explore retirement plan solutions to help improve participant outcomes

FINRA’s BrokerCheck | Check the background of Capital Client Group, Inc., on FINRA’s BrokerCheck.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses.

This and other important information is contained in the mutual fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

Capital Client Group, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

Contact American Funds

No result for ZIP Code

There isn't a representative

assigned to this ZIP code. Please

enter another ZIP code or call us.

Your retirement plan counselor

We’re unable to display your retirement plan counselor's information at this time. Please try again later or

call us.

Find your retirement plan representative

Enter another ZIP Code

Advisor Marketing

(800) 421-9900