Some of the fastest growing RIA practices have embraced ETFs as client portfolio building blocks. This finding is supported by Capital Group’s recent Pathways to Growth: 2023 Advisor Benchmark Study. But how exactly are RIAs using ETFs?

September 11, 2023

KEY TAKEAWAYS

- ETFs have characteristics such as tax efficiency and liquidity that make them potentially useful tools for many investment strategies used by RIAs in client portfolios.

- RIAs may use ETFs to potentially limit risk through the use of stop-loss and limit orders, as well as selecting actively managed ETFs, to let an asset manager oversee asset allocation and cash levels within the funds.

- Rising RIA adoption of active ETFs, particularly in clients’ core portfolios, could be a key trend driving overall ETF growth in coming years.

This article shares five common strategies RIAs employ when using ETFs in client portfolios, including mitigating taxes and building diversified core portfolios.

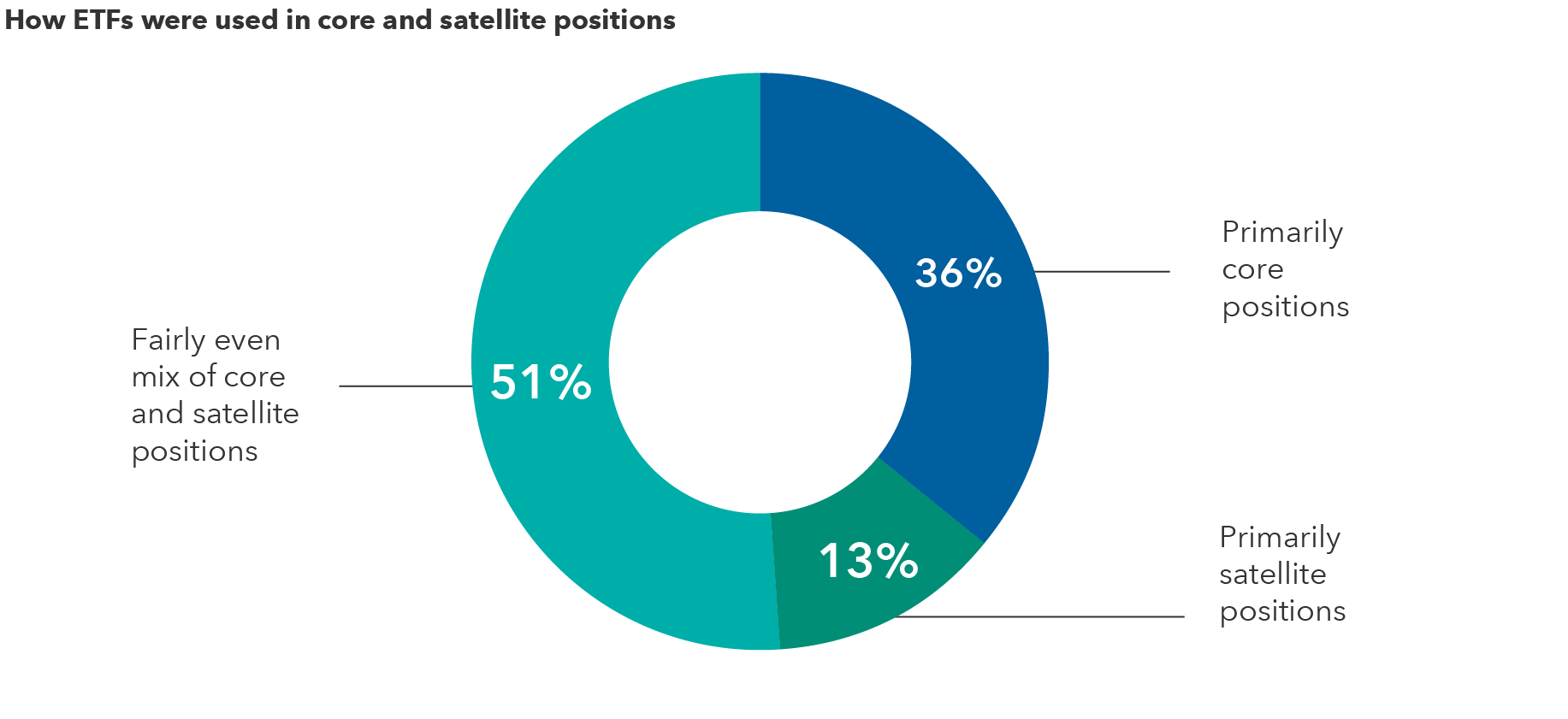

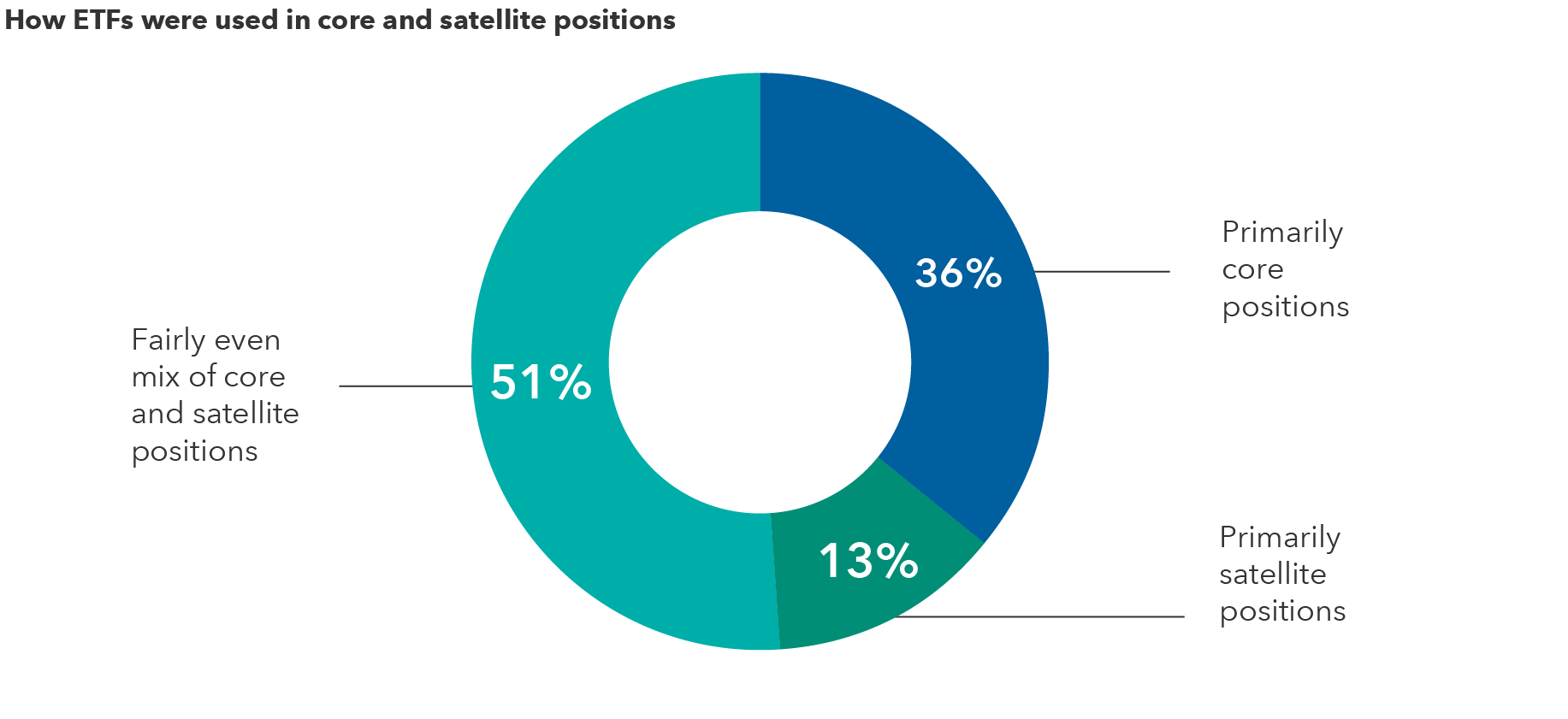

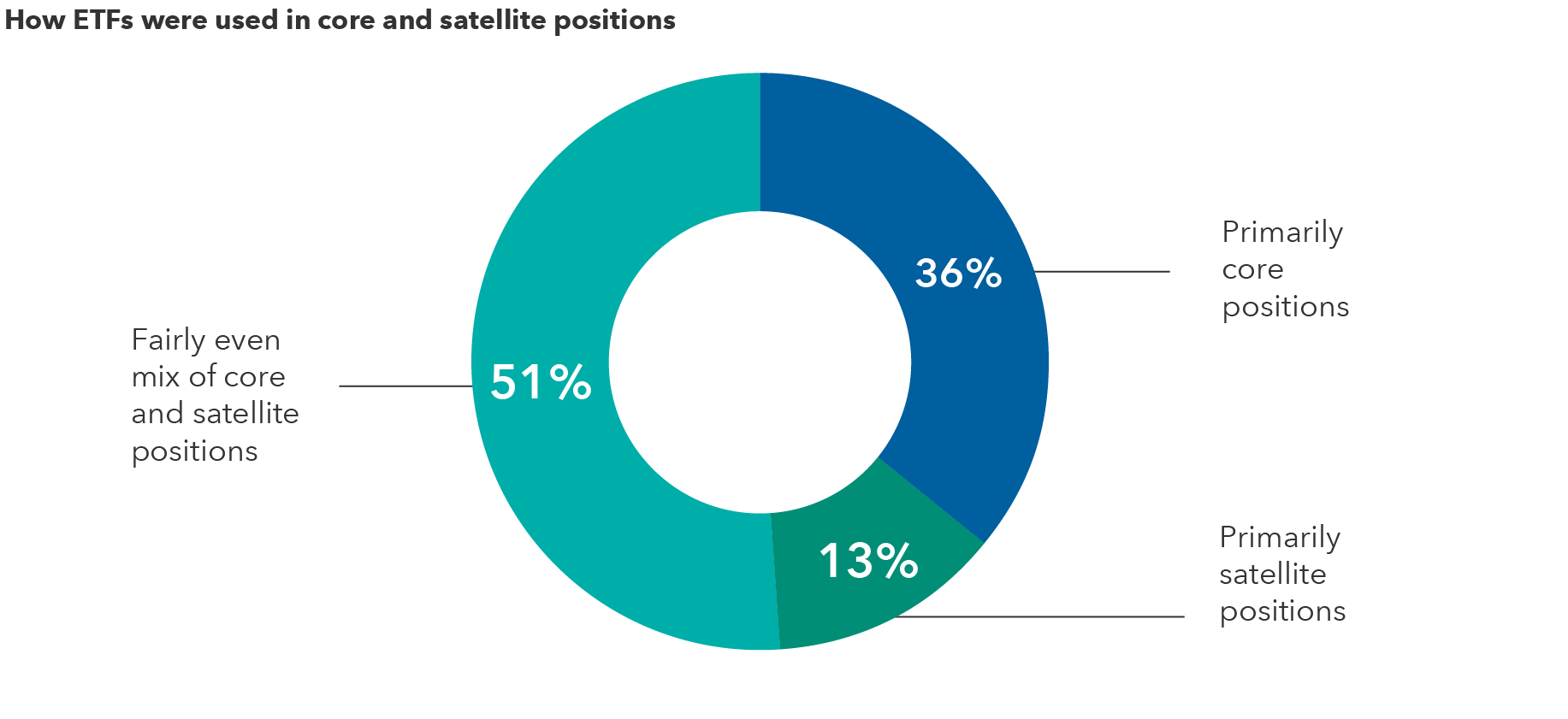

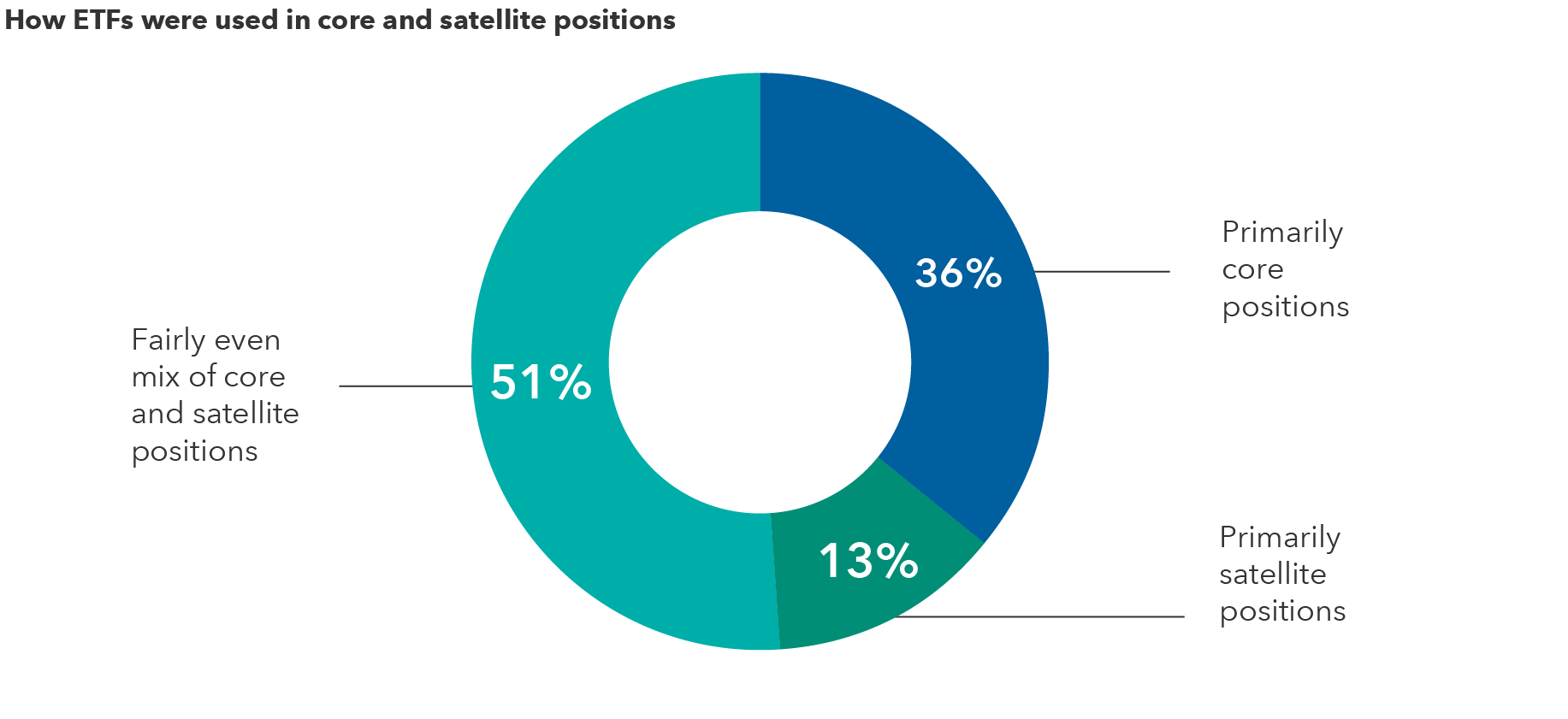

1. Asset allocation and core satellite

ETFs are often used in so-called core-satellite strategies. The tax efficiency and diversification of ETFs can be beneficial for constructing the core of client portfolios. Actively managed ETFs are also seeing more usage by advisors in core portfolios as more well-known active managers make their strategies available in the ETF structure.

Still, some advisors use narrower niche and thematic ETFs in the satellite portion in search of potential outperformance. The liquidity of ETFs may be particularly important in satellite strategies that can require more trading and rebalancing.

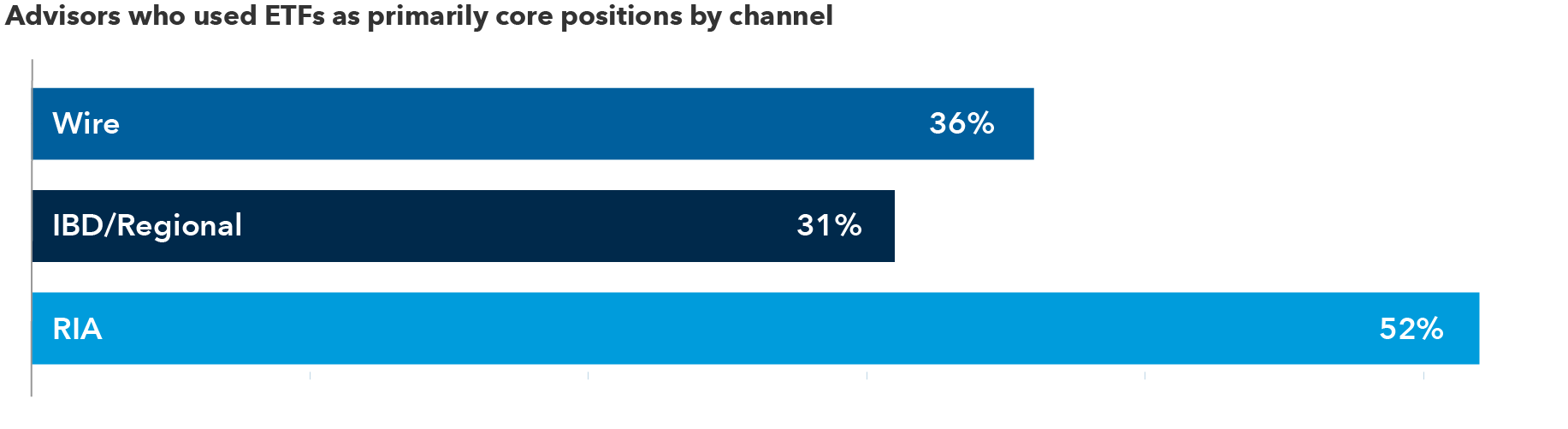

A look at how advisors are building portfolios with ETFs

A look at how advisors are building portfolios with ETFs

Turn device sideways for larger view

Source: Broadridge ETF Outlook 20201

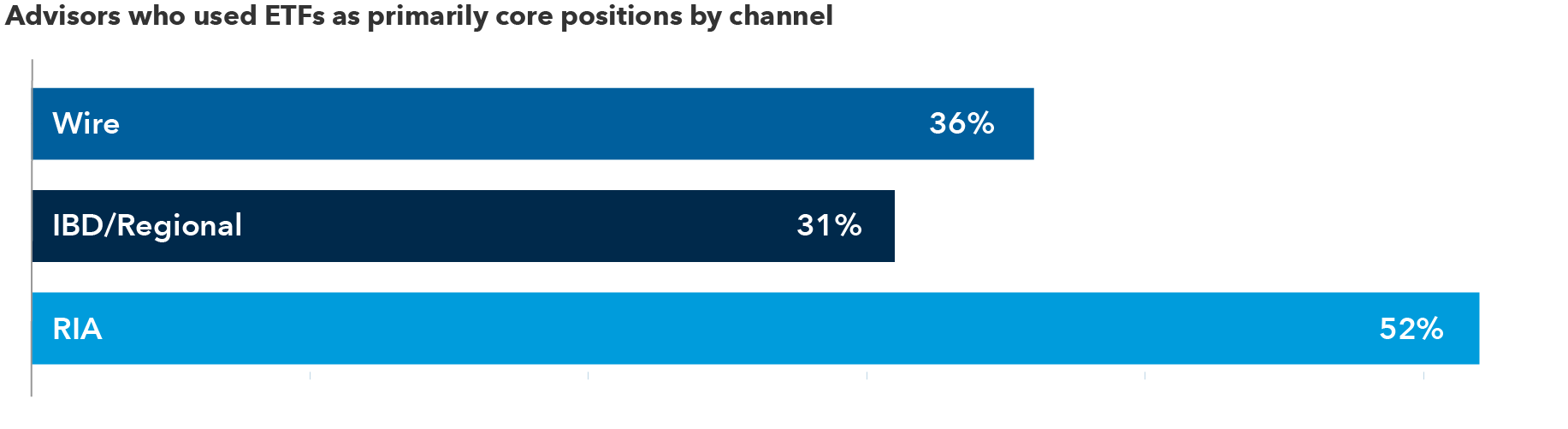

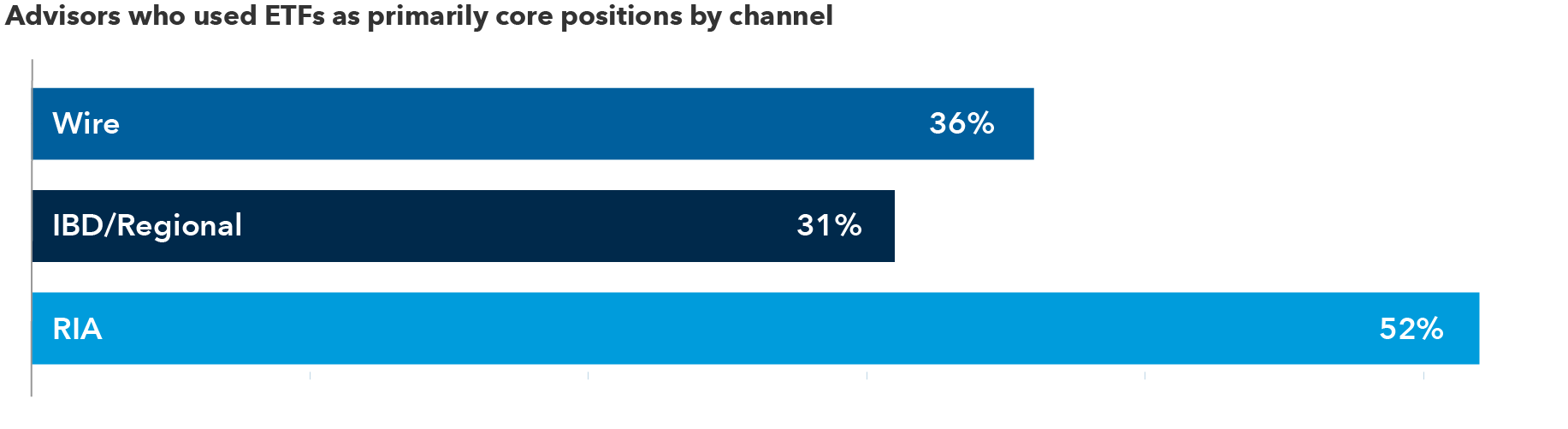

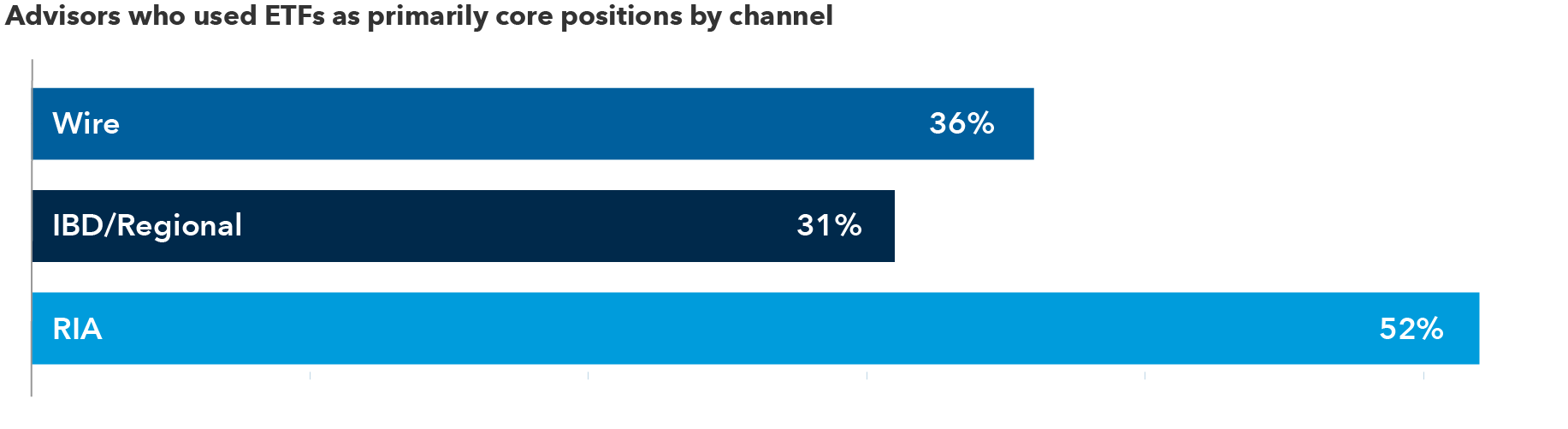

When looking at RIAs specifically, however, they are more likely than other types of advisors to use ETFs primarily in clients’ core portfolios.1

RIAs gravitate to core ETFs

RIAs gravitate to core ETFs

Turn device sideways for larger view

Source: Broadridge ETF Outlook 20201

Additionally, our most recent Pathways to Growth: 2023 Advisor Benchmark Study revealed that advisors with the highest asset growth are using active ETFs for U.S. equities across the market-cap spectrum as core holdings.

“Our strategy is to use ETFs in portfolio construction and then seek to add value for clients at the portfolio level by managing the overall asset allocation,” said Michael McClary, chief investment officer, Valmark Financial Group.

2. Limiting taxes

Another common ETF approach with RIAs is to help limit taxes in client portfolios. The ETF structure is designed to avoid cash-generating transactions and resulting capital gains distributions.

ETFs can also be used in tax-loss harvesting strategies that can turn market volatility into opportunity. RIAs can sell an investment that has lost value and book a loss that can be used to offset gains in the current year or even carried forward. The proceeds from the sale can then be reinvested into an ETF.

“Ultimately, tax-loss harvesting can allow investors to keep more of what they’ve earned while preserving the portfolio allocation to help them stay on track to realizing their long-term financial goals,” said Anthony Wingate, Capital Group ETF specialist.

3. Growth and value investing

Advisors familiar with the ETF market know that they can choose from many “style” ETFs that target stocks with value or growth characteristics. For example, there are over 460 growth and value ETFs listed in the U.S., with about $1.5 trillion in total assets.2

Along with size (e.g., small-cap stocks), growth and value are among the major classifications when RIAs think about portfolio construction. Allocating to potentially undervalued stocks or fast-growing companies (or a blend of both) can help advisors tailor portfolios to meet a client’s particular needs.

For example, Capital Group manages Capital Group Growth ETF (CGGR) and Capital Group Global Growth Equity ETF (CGGO) that seek to invest in companies with potential growth and capital appreciation. We take an active approach to growth investing rather than an index-based approach.

4. Generating income

Although fixed income ETFs are newer than their equity counterparts, more advisors are getting comfortable with incorporating bond ETFs into their practices. Among advisors, 70% said they used fixed income ETFs in 2022, up from 63% the previous year.3

In the first half of 2023, U.S.-listed equity ETFs gathered inflows of $107.2 billion compared with $99.4 billion for bond ETFs, although bond ETFs had a higher organic growth rate due to a smaller asset base.4

“Among advisors, 70% said they used fixed income ETFs in 2022, up from 63% the previous year.”

Within fixed income ETFs, actively managed strategies have been growing faster in recent years than the overall fixed income ETF category. Fixed income ETF assets overall have grown at a compound annual growth rate (CAGR) of 17% over the last five years, while active fixed income ETFs — a category that includes Capital Group Core Plus Income ETF (CGCP) — have grown at a CAGR of 33% over the same time period.5

Meanwhile, years of low interest rates have led some investors to seek yield in equities. Dividend-focused ETFs, like Capital Group Dividend Value ETF (CGDV), have been popular options for equity income.

5. Risk management

Some RIAs also find ETFs helpful tools to manage risk in client portfolios. One example is the use of stop-loss orders and triggers that can be used to help limit client losses in down markets.

“ETFs allow us to be nimble with the ability to buy and sell efficiently through mechanical stop-loss triggers as part of our investment philosophy,” said Chris Cook, founder and CEO of Beacon Capital Management.

Since ETFs trade on an exchange like an individual stock, they can be bought and sold with limit orders, which allow investors to specify the price at which the order is executed and thereby allow for more control over pricing, instead of market orders (which are executed immediately, and at the current price).

Finally, the growth of active ETFs suggests there is rising demand for ETFs overseen by active managers that can make portfolio changes based on volatility and market conditions. Active ETFs can change their asset allocations and cash levels in response to market dynamics, while passive ETFs typically replicate the holdings of a particular index.

RIA usage of ETFs may continue to rise

Although these five strategies are among the most common for RIAs using ETFs, they are by no means the only ones. Rising RIA adoption of active ETFs, particularly in clients’ core portfolios, could be a key trend driving overall ETF growth in the coming years.

Learn more about our full suite of active ETFs.