Portfolio Construction

ETF

The first bond exchange-traded funds (ETFs) hit the market in 2002 — nearly a decade after the first U.S.-listed stock ETF launched. Partly due to that delayed start, fixed income ETFs represent less than 20% of overall market share as of December 31, 2022, according to Morningstar. But recent trends suggest they are catching up with their equity ETF counterparts.

This article examines what is driving the recent uptick in bond ETF listings and assets, the rise of active fixed income ETFs, some common portfolio uses and key things for advisors to know about them.

- Bond ETFs have a 20-year track record and are catching up to equity ETFs in both assets and number of offerings.

- The rise of active ETFs is driving fixed income ETF growth as many advisors prefer active management in bond allocations.

- Choosing a bond ETF requires both an understanding of the ETF structure and the underlying investment strategy.

The first bond ETFs hit the market in 2002 — nearly a decade after the first U.S.-listed stock ETF launched. Partly due to that delayed start, fixed income ETFs represent less than 20% of overall market share today.1 But recent trends suggest they are catching up with their equity ETF counterparts.

This article examines what is driving the recent uptick in bond ETF listings and assets, the rise of active fixed income ETFs, some common portfolio uses and key things for advisors to know about them.

Fixed income ETFs are making up for lost time

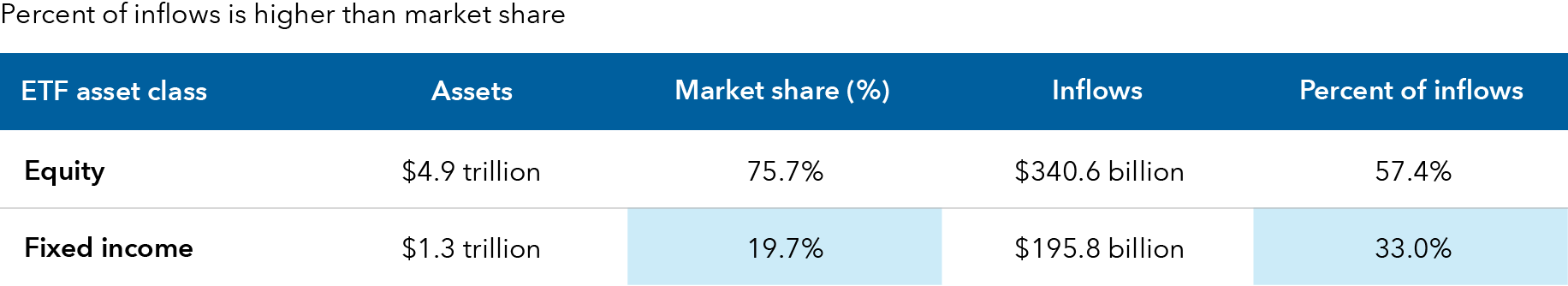

Equity ETFs’ nearly 10-year head start over bond ETFs is evident in their variety of offerings, assets under management and investor adoption levels. However, fixed income ETFs were punching above their weight at the end of 2022. Although fixed income ETFs account for only about 20% of industry assets, they pulled in over 30% of inflows through December 2022.1

Meanwhile, fixed income ETF assets overall have grown at a compound annual growth rate (CAGR) of 17% over the last five years, and active fixed income ETFs have grown at a CAGR of 33% over the same period of time.1

Fixed income ETFs hit above their weight in 2022

Source: Morningstar, as of December 31, 2022. Market share values do not total 100% because of other asset classes not shown.

The bond ETF inflows point to broad solid demand even in a highly volatile market, and rising interest rates may also be attracting investors to higher yields in bond fixed income ETFs. While bond mutual funds had $531 billion of outflows in 2022, bond ETFs had inflows of $197 billion.1

The rise of active bond ETFs

Another major factor driving the growth of bond ETFs is the proliferation and adoption of actively managed ETFs. Advisors may opt for active management in fixed income allocations rather than an index-based approach, for several reasons. First, fixed income markets are often viewed as more opaque than equity markets, while credit research and trading acumen can create an edge in areas like municipal and corporate bonds. Also, some advisors prefer to let active managers handle asset allocation within fixed income with core, core plus and multisector strategies being among the most frequent fixed income asset allocations among advisors.

“For the third straight year, active ETF launches outnumbered new passive ETFs.”

Early ETFs predominantly featured equity funds that followed indexes. Now advisors and investors are getting more comfortable using the ETF structure for both bonds and active management.

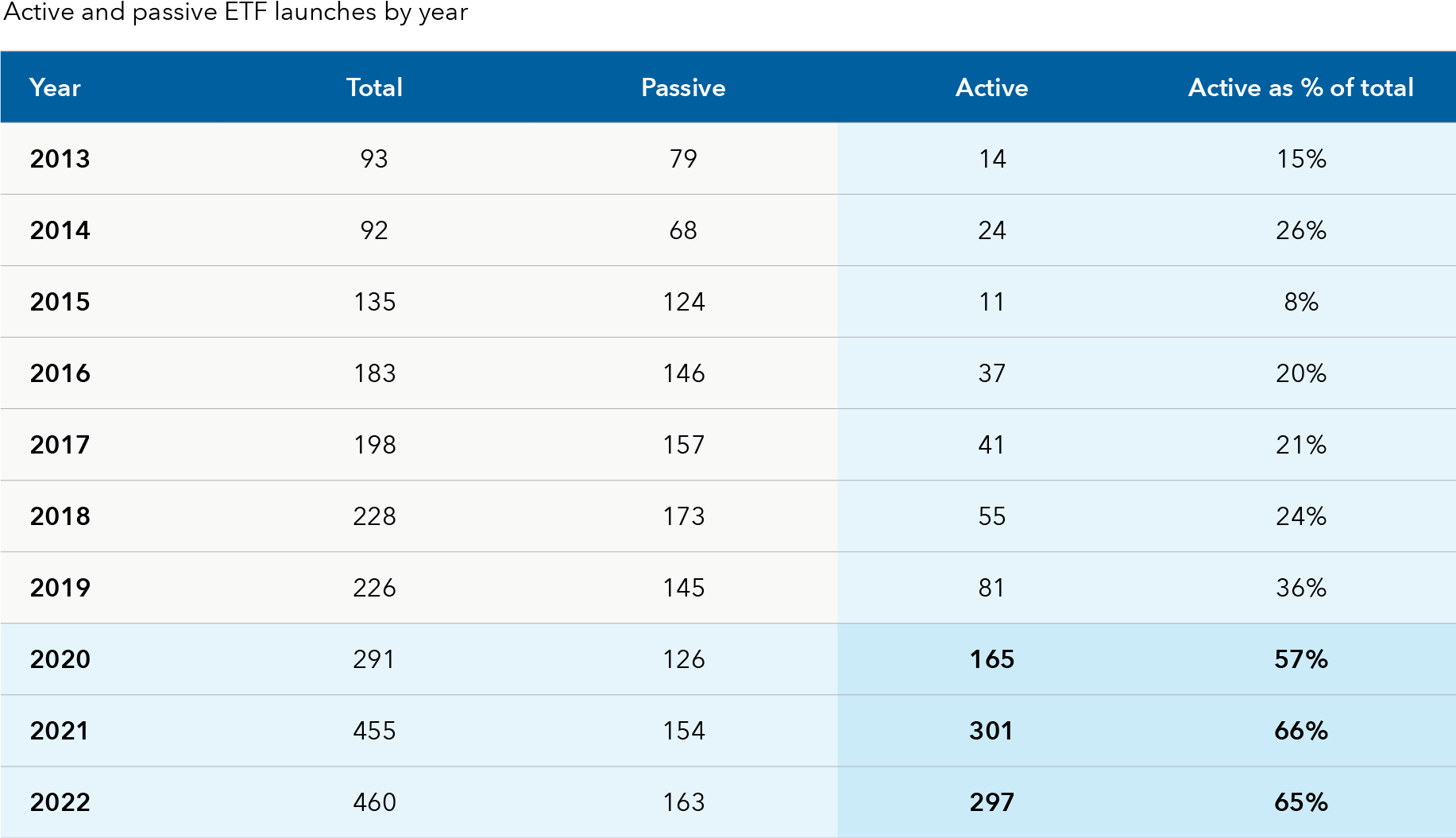

Advisors certainly have many more active ETFs to choose from today. For the third straight year, active ETF launches outnumbered new passive ETFs.

More than 50% of new ETFs were active for a third straight year

Source: Morningstar, as of December 31, 2022. Data reflect ETFs that are still in existence.

In 2021 and 2022, there were 173 fixed-income ETF launches, and 118 of them were active, or about 68% of the total.1 In the U.S. actively managed ETF category, there were $343 billion of assets, with $141 billion — or 41% — in fixed income, which includes taxable and municipal bond ETFs.1

To provide some comparisons with mutual funds, about 80% of the assets in fixed income mutual funds is in actively managed funds, versus just 11% for fixed income ETFs.1 The dominance of active in bond mutual funds demonstrates that investors and advisors have tended to gravitate to active management in fixed income. And with more active fixed income ETFs to choose from now, they have more opportunities to take an active approach in the ETF structure. “We think more choice is a good thing for investors and advisors who prefer active management in fixed income and want the additional benefits of the ETF vehicle,” said Scott Davis, ETF product lead at Capital Group.

What advisors need to know about bond ETFs before investing

Even before active bond ETF launches started picking up, advisors’ comfort level with fixed income ETFs in general was on the rise. Specifically, myths about bond ETF liquidity and potentially exacerbating market volatility have been debunked.

“It’s important to remember that the liquidity of any ETF is based on more than just trading volume,” Davis said. “We encourage advisors to perform due diligence on the liquidity of the assets within the ETF. Whether the ETF invests in U.S. large-cap equities or municipal bonds, understanding a manager’s philosophy and capabilities will help advisors assess the liquidity of any ETF.”

ETFs are known for their tax efficiency, but there are important nuances when it comes to bond ETFs. Much of the tax efficiency that investors expect from ETFs comes in the form of minimal capital gains distributions. This is primarily due to the in-kind creation and redemption features of ETFs. However, this mechanism doesn’t impact income from dividends or bonds.

“Advisors may continue to fuel the growth of fixed income ETFs.”

Generally speaking, total return in stocks is driven more by capital gains than by income paid as dividends.2 Meanwhile, more of bonds’ total return tends to come from income than capital gains.3 The bottom line is that bond ETFs have all the advantages of the ETF structure, including generally lower administrative costs, transparency and the ability to trade during the day. However, the tax efficiency of the ETF structure doesn’t apply to income, which is taxed at ordinary income rates if held in a taxable account.

Certainly, taxes were top of mind for advisors when looking at fixed income portfolios after a very tough year for bonds. This tax-loss harvesting season, some advisors may have looked for opportunities to harvest losses in bond mutual funds and move into fixed income ETFs.

“Now may be a good time for advisors to reassess their fixed income allocation going forward, as there may be less tax consequences to making bigger changes than in previous years,” Davis said. “This hasn’t been the case for a while and investors can make the most of the opportunity to move into ETFs.”

With more bond ETFs to choose from, including actively managed strategies, advisors may continue to fuel the growth of fixed income ETFs in 2023 and beyond.

Capital Group recently expanded its fixed income ETF lineup with the launch of three new fixed income ETFs:

- Capital Group Short Duration Income ETF (CGSD)

- Capital Group U.S. Multi-Sector Income ETF (CGMS)

- Capital Group Municipal Income ETF (CGMU)

Learn more about our full suite of active ETFs.

1Source: Morningstar, as of December 31, 2022.

2 “S&P 500 Dividend Aristocrats: The Importance of Stable Dividend Income,” S&P Global. September 23, 2021.

3 “Which Investments to Keep Out of Your Taxable Account,” Morningstar. July 13, 2022.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

For financial professionals only. Not for use with the public.

©2023 Morningstar, Inc. All Rights Reserved. Except for Lipper rating information, the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

Each S&P Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

Scott Davis

Scott Davis