F-2 Direct-at-Fund program

American Funds® F-2 Direct-at-Fund program highlights

Capital Group, home of American Funds®, offers a direct-at-fund investment option for retail accounts with the F-2 and 529-F-2 share classes. Class F-2 and 529-F-2 shares have no 12b-1 fees and include an optional fee-debiting service.

F-2 and 529-F-2 shares are available for accounts with fund minimums of $250 ($1,000 for money market or tax-exempt funds) as specified in the prospectus.

Why choose the F-2 Direct-at-Fund program?

- Ability to invest direct at American Funds, with fee-based options

- Cost-effective, direct access to objective-based funds and portfolios

- Convert existing commissionable accounts to an advisory relationship with fee-neutral impact to the investor

- ·Serve your clients’ small businesses through SEPs/SIMPLEs

- Nurture younger relationships while their assets grow

Is American Funds a custodian of the assets?

- American Funds Service Company® (AFS) is a transfer agent, not a qualified custodian. The SEC Custody Rule permits mutual fund transfer agents holding fund shares to serve in lieu of a qualified custodian (Adviser’s Act Rule 206(4)-2(b)). Consult with your Legal and Compliance Departments to determine how this exception applies to your firm.

How can your firm access this option for clients?

- If your firm is registered as an RIA or is a dually registered firm that is not restricted, you may hold F-2 and 529-F-2 accounts.

- If you would like to use any of the fee debiting options, your firm must sign a Fee Debiting Agreement.

What types of funds and accounts will offer Class F-2 shares direct-at-fund?

- All American Funds and funds of funds (a minimum investment of $250 per fund is required for most funds)

- All new and existing retail accounts in a fee-based program, including retail taxable, IRA (traditional, Roth, payroll deduction, SEP, SIMPLE) and college savings (Coverdell ESA and UGMA/UTMA) are offered in F-2 shares

- 529 accounts are offered in 529-F-2 shares

How are advisory fees reported for tax purposes to the firm?

- AFS doesn’t provide a tax form to firms for debited fees paid to the firm.

What is the pricing beyond the fund(s) expense ratios?

- No additional fees for retail taxable or 529 accounts.

- For IRAs and Coverdell ESA accounts: a one-time $10 setup fee for new accounts and a $10 annual custodial fee app.

What are the available services?

- AFS offers optional fee debiting with quarterly payments via ACH, including 529 plans.

- Accounts held in Class F-2 or 529-F-2 shares with fee debiting will have a fee applied in basis points as designated by your firm.

- Fees will be calculated in arrears by applying the designated fee schedule to the eligible account’s average daily balance.

- Financial professionals will be able to designate accounts to include or exclude in the fee calculation.

- Financial professionals will continue to enjoy the same 24/7 website account access, marketing support, planning and fund selection tools that they already receive from American Funds.

- Investors will receive quarterly statements from American Funds, as well as have access to their accounts via our website.

- Automatic rebalancing is available.

Frequently asked questions

Getting started

If your firm is eligible for the program, a principal or other authorized individual at your firm must sign an F-2 Share Class Fee Debiting Agreement with Capital Group. You may begin this process by calling us at (800) 421-5450.

Once your firm has signed an F-2 Share Class Fee Debiting Agreement, you will receive a link to account applications and supplements.

Fee debiting

There are multiple options from which a firm can choose to select its lineup of available fee-debiting options:

1. Multiple flat rates – your firm can select up to five different flat rates anywhere between 5 bps and 200 bps (rates should end in “0” or “5”, e.g., 0, 25, 60, 100, 115)

2. Tiered advisory fee schedule (nonblended breakpoint)

Once the firm has selected its desired combination of the above options, financial professionals can select which rate or schedule is most appropriate for each of their accounts. Each option is an annual rate, billed quarterly in arrears.

The advisory fee rate that applies to each eligible client’s account is determined by the cumulative asset value on the last day of the quarter. The cumulative asset value is determined based on all account types and share classes that are held by AFS. If the account is fully depleted prior to quarter end, the cumulative asset value of the account the day prior to the all-share transaction applies.

The firm has the option to outline a tiered fee schedule within the following guidelines:

- Maximum of five tiers

- Set in increments ending in “0” or “5,” not to exceed 200 bps*

*The schedule is NOT blended. All assets will be assessed at whichever fee level the client has reached. Be sure to keep this in mind when designing the schedule.

Tiered fee schedule example:

Step 1: Identify the cumulative asset value for the client.

An investor has four accounts with the following asset values:

Fund |

Value |

The Income Fund of America® |

$240,000 |

The Growth Fund of America® |

$120,000 |

Capital World Bond Fund® |

$10,000 |

American Funds® U.S. Government Money Market Fund |

$5,000 |

The cumulative asset value for this client will be $375,000 based on our aggregation policies. All commissionable and noncommissionable shares of American Funds U.S. Government Money Market Fund are included in the total cumulative asset value. External assets are excluded.

Step 2: Identify the advisory fee rate, based on the client’s total cumulative asset value.

The firm’s tiered advisory fee schedule is:

Cumulative asset value |

Advisory fee rate |

$0.00 to $249,999.99 |

1.00% (annual rate of 100 bps) |

$250,000.00 to $499,999.99 |

0.75% (annual rate of 75 bps) |

$500,000.00 to $999,999.99 |

0.50% (annual rate of 50 bps) |

$1,000,000.00 to $2,999,999.99 |

0.35% (annual rate of 35 bps) |

$3,000,000.00 and above |

0.25% (annual rate of 25 bps) |

Based on the firm’s tiered fee schedule, a client with a cumulative asset value of $375,000 on the last day of the quarter would be subject to the 0.75% advisory fee on all their assets.

Step 3: Identify the average eligible assets for each fund variable (average daily balance ÷ number of days in the quarter).

Step 4: Calculate the advisory fee amount for the quarter for each fund variable.

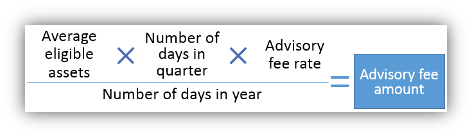

Advisory fee payment formula (per fund variable):

Total average eligible assets = $375,000

Number of days in the quarter = 90

Advisory fee rate = 75 bps

Number of days in the year = 365

Advisory fee amount = $693.49

All fees, whether flat or tiered, are calculated quarterly in arrears by applying the selected fee to a client’s eligible accounts' Average Daily Balance (ADB). To exclude accounts from the calculation process, submit your request in writing.

Your firm will receive fee payments via ACH the month after the off-calendar quarter-end. (For example, fees for December–February are deducted and paid in March.) The quarterly payout schedule is March, June, September and December.

Firm payment

We send advisory fee payments via ACH. Supporting compensation details are only available electronically via SS&C Internet Dealer Commissions (IDC).

The following information is generally included in the IDC statement:

- Dealer name

- Dealer number

- Dealer branch

- Representative name

- Account number (non-RecordkeeperDirect®)

- CUSIP

- Plan ID (RecordkeeperDirect only)

- Average eligible assets

- Rate

- Compensation amount

Note: Some states require registered investment advisor firms to create separate invoicing specific to the fees they charge. IDC provides a way to export all data points that financial professionals need for the required invoices.

For questions on where to locate specific information on the statement, call SS&C IDC at (844) 279-2005.

Any fees that need to be returned should be sent to AFS via check or wire.

Why choose Capital Group?

Since 1931, Capital Group, home of American Funds, has helped investors pursue long-term investment success. Our consistent approach — in combination with The Capital System™ — has resulted in superior outcomes.

Aligned with investor success We base our decisions on a long-term perspective, which we believe aligns our goals with the interests of our clients. Our portfolio managers average 28 years of investment industry experience, including 22 years at our company, reflecting a career commitment to our long-term approach.¹ |

The Capital System The Capital System combines individual accountability with teamwork. Funds using The Capital System are divided into portions that are managed independently by investment professionals with diverse backgrounds, ages and investment approaches. An extensive global research effort is the backbone of our system. |

American Funds’ superior outcomes Equity-focused funds have beaten their Lipper peer indexes in 84% of 10-year periods and 97% of 20-year periods.2 Relative to their peers, our fixed income funds have helped investors achieve better diversification through attention to correlation between bonds and equities.3 Fund management fees have been among the lowest in the industry.4 |

1 Investment industry experience as of December 31, 2023.

2 Based on Class F-2 share results for rolling monthly 10- and 20-year periods starting with the first 10- or 20-year period after each mutual fund’s inception through December 31, 2023. Periods covered are the shorter of the fund’s lifetime or since the comparable Lipper index inception date (except Capital Income Builder and SMALLCAP World Fund, for which the Lipper average was used). Expenses differ for each share class, so results will vary. Past results are not predictive of results in future periods.

3 Based on Class F-2 share results as of December 31, 2023. Thirteen of the 18 fixed income American Funds that have been in existence for the three-year period showed a three-year correlation lower than their respective Morningstar peer group averages. S&P 500 Index was used as an equity market proxy. Correlation based on monthly total returns. Correlation is a statistical measure of how two securities move in relation to each other. A correlation ranges from –1 to 1. A positive correlation close to 1 implies that as one security moves, either up or down, the other security will move in “lockstep,” in the same direction. A negative correlation close to –1 indicates that the securities have moved in the opposite direction.

4 On average, our mutual fund management fees were in the lowest quintile 55% of the time, based on the 20-year period ended December 31, 2023, versus comparable Lipper categories, excluding funds of funds.

Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on the results of the original share class of the fund without a sales charge, adjusted for typical estimated expenses. Results for certain funds with an inception date after August 1, 2008, also include hypothetical returns because those funds’ Class F-2 shares sold after the funds’ date of first offering. Refer to capitalgroup.com for more information on specific expense adjustments and the actual dates of first sale.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The guidelines and procedures provided in the Service Center may not apply to networked accounts or accounts not directly held by American Funds. The guidelines and procedures provided also apply only to those retirement accounts or Coverdell ESAs invested in American Funds with Capital Bank and Trust Company (CB&T) as custodian.

The guidelines and procedures provided in the Service Center do not apply to plans held in our retirement plan solutions — PlanPremier, PlanPremier-TPA or RecordkeeperDirect. Information on the Service Center may change periodically and previously printed information may not be current. Please refer to capitalgroup.com for the most current information available.

Financial professionals should always contact their back office to determine if there are any restrictions on the use of American Funds products, tools, services, websites and literature.