Retirement Income

Tax & Estate Planning

There are very few ways to put a positive spin on market volatility and net loss for investors. But one option that may provide some relief is tax loss harvesting — selling one investment at a loss to offset gains on the sale of another, thereby reducing the tax impact. While no replacement for investment performance, harvesting can make losses easier to accept for investors facing, in some cases, tax rates of more than 23% on long-term capital gains and as much as 37% for gains on short-term holdings for those in the highest federal tax bracket.

Taxes can also be a drag on investment performance. Tax loss harvesting offers an opportunity to add efficiency to an investment portfolio, if you replace the investment with one that’s higher quality, has a lower expense ratio or is more tax efficient — or a combination of the three. Indeed, the benefits of tax loss harvesting can be even greater if there is a chance that gains in the future will be taxed at a lower rate than the losses are today.

“The end of the year is always a good time to look back and assess potential tax liability,” says Leslie Geller, senior wealth strategist at Capital Group. “But at any time of year, if you have or are expecting a large capital gain, you might look to an investment portfolio to see if there are losses to harvest to help mitigate them. Tax loss harvesting can be a great strategy if it makes sense in terms of the client’s overall financial picture.”

Geller recommends careful consideration of the strategy before making a move. By selling an asset at a loss, an investor misses out on future potential gains. Furthermore, the timing of loss harvesting can be tricky, and finding quality replacement assets is key. If you are considering tax loss harvesting for your clients, here are a few things to know.

Tax loss harvesting basics

As a strategy, tax loss harvesting is pretty straightforward: You sell an investment that has lost value, reinvest the proceeds, and use the capital loss to offset capital gains on another investment (today or in the future). But some complex details can make all the difference in the strategy’s success.

For example, there’s a pecking order. Long-term losses must first be applied to long-term capital gains before they can be applied to short-term gains, and vice versa. If an investor’s losses exceed capital gains at the end of the year, the losses can be applied to offset up to $3,000 of ordinary income tax. Even if investors have no gains to offset this year, or have losses greater than current gains, today’s taxable losses can be carried forward to reduce taxes in the future. (To be sure, the strategy works best when there are gains to realize in the same year.)

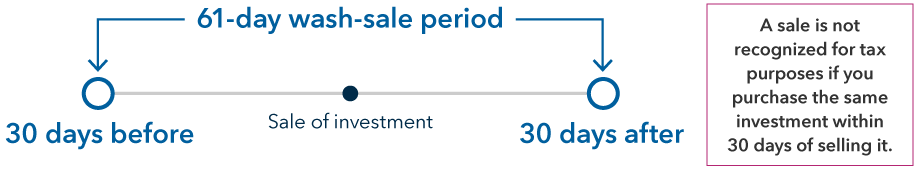

Then there is the waiting period. Tax loss harvesting can be used on different types of investments, from individual equity securities to mutual funds and exchange traded funds (ETFs). If you sell this type of investment at a loss, however, you may not buy the same (or a “substantially identical”) investment back within 30 days. Under the Internal Revenue Service’s wash-sale rule, there would be no capital loss if the same security is purchased within 30 days before or 30 days after the sale. Interestingly, the wash-sale rule does not apply to cryptocurrency investments, which can also be harvested for losses.

Source: Internal Revenue Service

Optimizing your replacement investments

While some portfolio managers might hold a replacement investment just long enough for the wash-sale period to end before repurchasing the initial investment, harvesting provides an opportunity to consider other options to replace that investment in favor of something entirely new. Selecting those replacement investments — for the short and the long term — can be key to the strategy’s success.

For example, a strategic investment swap may help in:

- Shifting away from individual or concentrated holdings in favor of mutual funds or ETFs to increase portfolio diversification

- Maintaining your asset/geographic/style exposure, but with investments that you believe are better suited for your portfolio in the long term

- Moving from investment vehicles that are less focused on tax efficiency to those that are more tax efficient

- Reducing passive index funds at the core of portfolios in favor of active core holdings

- Lowering investment expenses

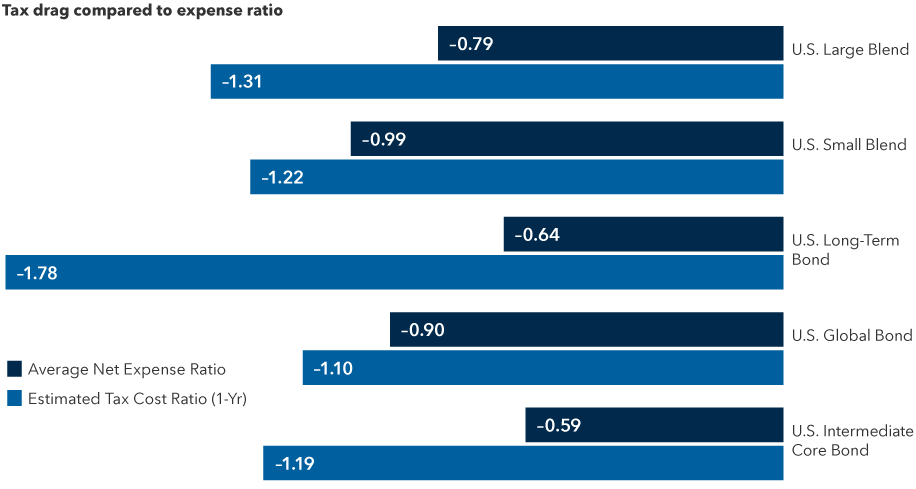

While expense ratios are important, taxes can be even more of a drag on performance returns. If you compare the average net expense ratios from Morningstar’s universe of investment products, including mutual funds, index funds and ETFs, to their tax cost ratios (which Morningstar uses to measure how much the annualized return is reduced by taxes*), it’s clear that taxes have more of an impact on long-term gains than fees.

Tax drag compared to expense ratio

Source: Morningstar, as of 9/30/2023.

Mutual funds and ETFs that hold similar (or many of the same) assets are not considered substantially identical, which makes it easy to swap one investment for another during the wash-sale period and beyond, without significantly changing the portfolio allocation or profile. With an increasing number of ETFs offering similar asset profiles as diversified mutual funds, with both passive (which aim to track the risk/return profile of an index and rebalance on the same schedule as their underlying index) and actively managed options, more advisors are considering ETFs as one solution for reinvesting harvested positions in taxable portfolios.

ETFs for tax loss harvesting

Along with being generally lower cost investments, ETFs tend to be tax efficient, because investors buy and sell them in a secondary market, like a stock exchange. This helps insulate ETFs from the trading activity of individual investors. Investor redemptions from ETFs do not generally create taxable events for remaining shareholders. This can be an important source of tax efficiency, and make a difference in returns over the long term.

In 2022, just 4.5% of equity ETFs paid out capital gains, according to Morningstar† — mostly those that hold derivatives (which tend to be less tax efficient) and/or trade frequently, meaning they have a high turnover rate. However, even active ETFs can be more tax efficient than other actively managed investments.

Actively managed ETFs can offer the oversight of experienced professionals, helping to manage downside risk and volatility. As with any actively managed investment, it’s important to consider the manager’s approach, transparency, track record and consistency, along with taxes and fees.

ETFs are not completely without tax drag, however. The IRS taxes dividends and interest payments on ETFs as ordinary income, just as they would income from the underlying stocks and bonds. And capital gains are realized when you sell an ETF, just as with any other type of investment.

“While providing more precision around tax planning can be an effective way to demonstrate your value to clients,” says Geller, tax-loss harvesting may not be right for every investor. “You are effectively just deferring your gain.” Kicking that can down the road can be the best tax solution in some cases. But there are other ways to reduce your tax bill, including charitable giving, Geller says.

But in cases where loss-harvesting does make sense, it provides an opportunity to rethink the position. ETFs are worth considering among other replacement assets to help improve the efficiency of the overall portfolio.

How to identify the clients that may benefit most from tax-loss harvesting

Depending on the complexity of your clients' portfolios and tax needs, harvesting losses may not be right for every client. So, how can you identify the clients that may benefit most from tax-loss harvesting?

“Advisors looking for tax-loss harvesting opportunities in their clients' portfolios can sort their book according to clients who have added the most money to their accounts in the last year or two,” explains Max McQuiston, an advisor practice management consultant at Capital Group.

Look at your book of business. Who has invested most in recent years? Sorting your book by clients who have added the most cash to their accounts over the last 12 or 24 months, or since the most recent market cycle peak, can help determine who may have the highest cost basis for securities or funds in their portfolios.

Screen your portfolios for serial capital gain distributors. These funds may present opportunities to realize losses — and potentially offset gains in other areas of the portfolio — while avoiding an unexpected tax bill from required capital gain distributions that can even occur when markets (and/or the fund) are down.

Evaluate whether a portfolio's investments fit a client's tax needs. For tax-sensitive clients, using tax-loss harvesting to shift into a more tax-efficient vehicle, such as an ETF, can help pursue greater tax efficiency and potentially avoid yearly taxable capital gain distributions that may lead to difficult conversations with clients about a surprise tax bill in a down market.

“Reach out proactively to these clients and include their accountant in the discussion to decide whether offsetting current gains in the portfolio, or carrying forward, would be more impactful for the client,” McQuiston says.

Proactively seeking tax-loss harvesting opportunities could also have an impact on your business, McQuiston says. He recalls one advisor who contacted a client's certified public accountant for a tax-loss harvesting discussion. The CPA was thrilled to talk, and said no financial advisor had ever reached out to him on a mutual client's behalf. After that, the CPA started referring tax clients to the advisor. “Showing that he would go the extra mile for his client really made an impression,” McQuiston says.

*Per the SEC's guidance, after-tax returns are calculated with the highest tax rates prevailing at the time of the distribution, as if the investor were in the highest tax bracket (37% maximum federal tax rate on capital gains and ordinary income). Because Morningstar uses after-tax returns to calculate the tax cost ratio, those assumptions also apply to the tax cost ratio. Therefore, the tax cost ratio is an estimate of what investors may have experienced. Investors in lower tax brackets will not experience the full tax costs implied by the tax cost ratio.

†Source: Morningstar, "How to Maximize the Tax Efficiency of ETFs," February 2023.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Standard & Poor’s 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

©2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Leslie Geller

Leslie Geller