Paying for college requires a comprehensive strategy that can include a mix of dedicated savings, current income, grants, loans and 529 education plan investments. When investing in a 529 plan, it is easy to focus on maximizing returns and assume that other funding sources can provide a backstop in the event of poor market performance. However, volatility returned to markets in 2025, creating implications for 529 plan asset allocation.

Capital Group’s latest research – based on our analysis of 2.5 million CollegeAmerica beneficiaries and how they save, invest and spend for college – found that 529 investors don’t save enough, spend quickly and have low tolerance for losses.

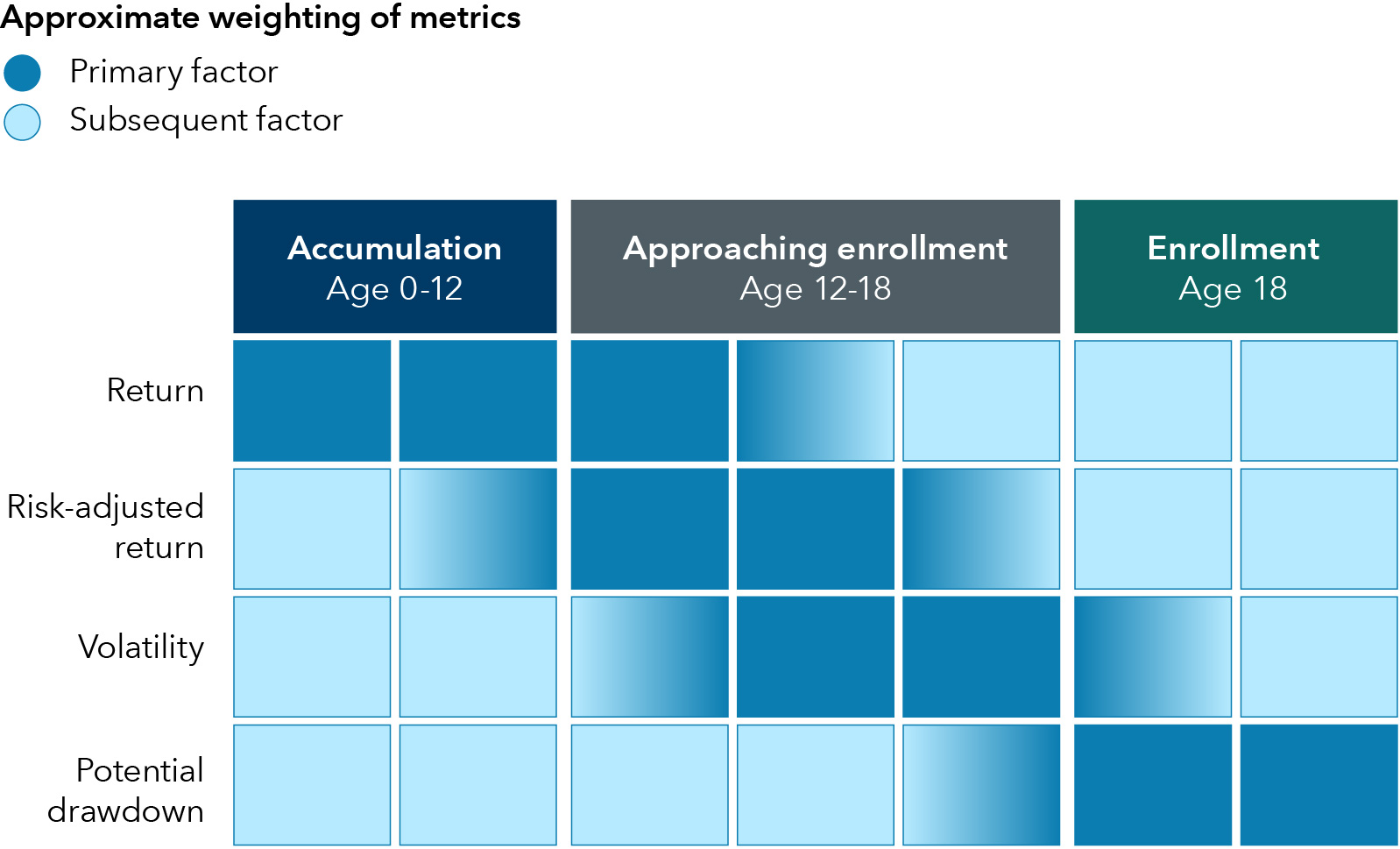

We studied the behavior of 529 plan investors, how advisors build 529 plan portfolios and the relationships among various college funding sources. Our conclusion? A conservative asset allocation in the years approaching college enrollment may be critical to successfully funding educational goals. Market volatility can present a great opportunity for advisors to retest their clients’ approach to educational savings and investing. Here are some of the trends we discovered, along with action steps for advising 529 plan investors.