Announcements

January 2, 2026

Annual required minimum distribution (RMD) amounts now included on client quarterly statements

Investors age 73 and older with Capital Bank and Trust Company (CB&T) retirement accounts, including traditional IRAs, SIMPLE IRAs, SEP IRAs, SARSEP IRAs and 403(b)s (including Texas ORPs), can review their quarterly statement to verify their annual RMD amount.

To set up automatic distributions for your client’s RMD, have your client complete and return the Required Minimum Distribution (RMD) Request. Once established, CB&T will calculate and send the distribution to your client each year.

Key information about the RMD amount included on quarterly statements:

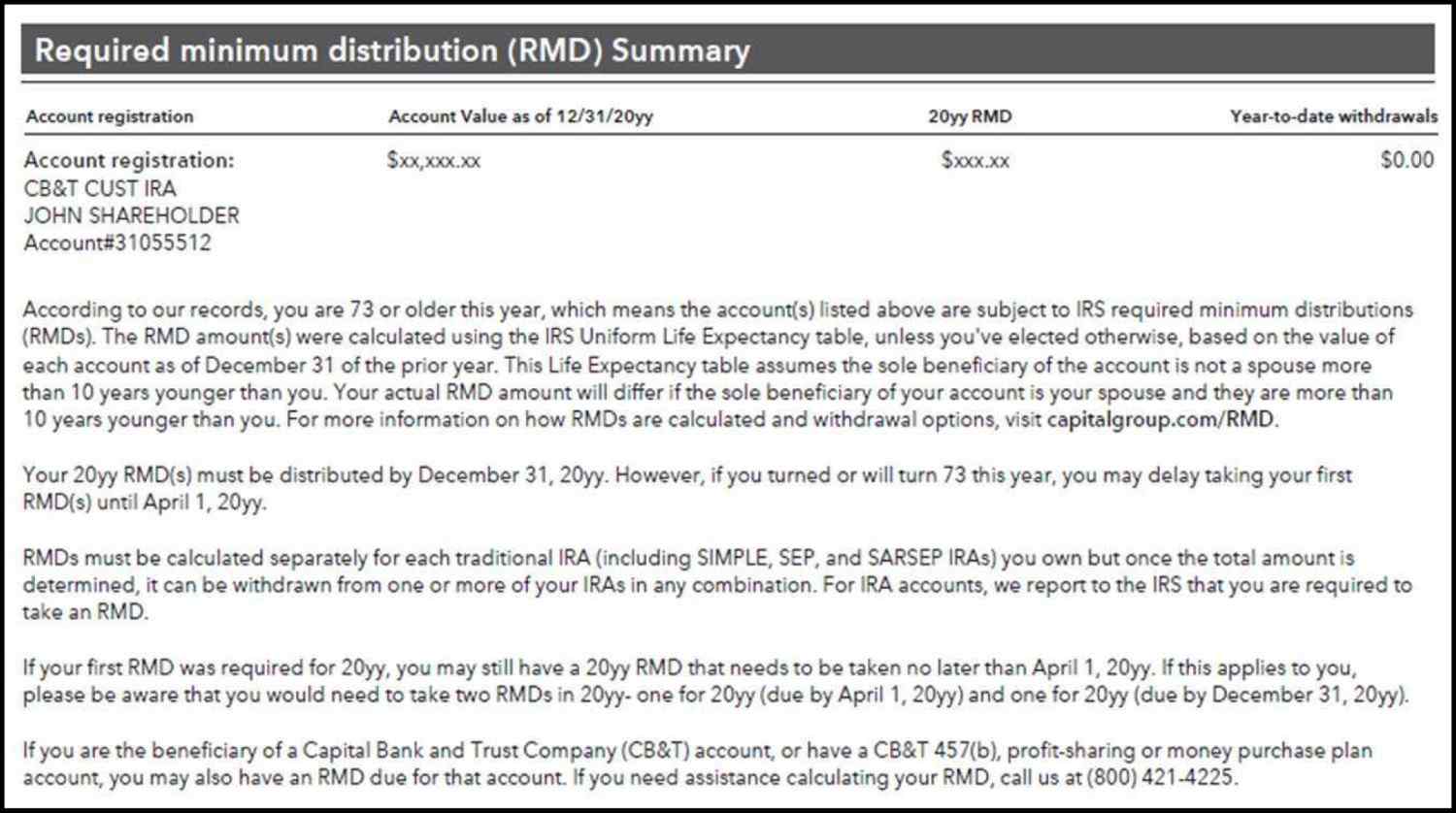

- Where to locate: The Required minimum distribution (RMD) Summary section on quarterly statements can be found after the Fund results from a long-term perspective section. In most cases, this section will fall on page 2 or 3 of the statement.

Image of the Required minimum distribution (RMD) Summary section of a quarterly statement.

- What’s included: The RMD section provides information by account number. If your client has more than one retirement account, RMD amounts will be provided for each account. Other details provided in the RMD section include:

- The account’s prior year-end balance

- The RMD amount

- Distributions taken in the calendar year that count toward meeting the RMD

- How the RMD is calculated: The RMD amount displayed on statements is calculated based on the Internal Revenue Service (IRS) Uniform Lifetime Table, unless your client elected otherwise, using the account’s value as of December 31 of the prior year and the investor’s date of birth.

This table assumes the sole beneficiary of the account is not a spouse more than 10 years younger than the IRA owner. The actual RMD amount will differ if the sole beneficiary of the account is the IRA owner’s spouse and they are more than 10 years younger.

Note: If your client is turning 73 in 2026, their 2026 RMD amount will not be provided on the statement. At your request, we can calculate your RMD; please contact us for assistance.

Deadlines to keep in mind:

- If your client turned 73 in 2025, they may delay taking their first RMD until April 1, 2026. However, they will then need to take two RMDs in 2026 — one for 2025 (due by April 1, 2026) and one for 2026 (due by December 31, 2026).

- Future RMDs must be taken by December 31 of that calendar year, or the investor will be subject to IRS penalties.

For more information, visit the Required Minimum Distribution (RMD) Guide.

Other resources

Required Minimum Distribution (RMD) Guide

RMD Planner™

IRA reports

The guidelines and procedures provided in the Account Resource Center may not apply to networked accounts or accounts not directly held by American Funds. The guidelines and procedures provided also apply only to those retirement accounts or Coverdell ESAs invested in American Funds with Capital Bank and Trust Company (CB&T) as custodian. The guidelines and procedures provided in the Account Resource Center do not apply to plans held in our retirement plan solutions — PlanPremier, PlanPremier-TPA or RecordkeeperDirect. Information on the Account Resource Center may change periodically, and previously printed information may not be current. Please refer to capitalgroup.com for the most current information available.

Financial professionals should always contact their back office to determine if there are any restrictions on the use of American Funds products, tools, services, websites and literature.