Welcome to +, investment solutions from Capital Group and KKR that focus on unlocking broad access to private markets by blending public securities and private investments.

April 28, 2025

KEY TAKEAWAYS

- The average investor has largely been left out of the expansion of private markets (known as alternatives) in recent decades.

- Capital Group and KKR have partnered to develop a series of public-private investment solutions to thoughtfully and responsibly unlock private market access for the average investor.

- The two Public-Private+ Funds focus on public fixed income and private credit to pursue distinct investment objectives.

Private markets aren’t so “private” anymore

For years, private markets, including private credit, real assets and private equity grew with little involvement from individual investors.

Institutions, endowments and some sophisticated high net worth investors increasingly pursued higher returns in private markets as the Global Financial Crisis reshaped areas like commercial lending and public capital markets.

Financial professionals see the potential value of these investments in portfolios, with portfolio diversification, volatility dampening and income generation the three leading reasons for allocating to private investments, according to a 2024 Cerulli Associates report.1 Yet, financial professionals noted lack of liquidity, complexity of products and expenses as challenges to implementing these investments in portfolios for individuals.

Now, it may be time for financial professionals and investors to access private investments and their potential benefits with new investments solutions from Capital Group and KKR that seek to help address these challenges.

1Source: Cerulli Associates. The Cerulli Report: U.S. Alternative Investments 2024. Advisors who reported an allocation to alternative investments for moderate-risk clients were asked to select all choices that applied from the choices: Portfolio diversification, volatility dampening/downside risk protection, income generation, growth/enhanced return opportunity, inflation hedge, reduce exposure to public markets, demonstrate own advisory practice value proposition, client requests.

A powerful partnership to unlock private market access

Capital Group and KKR have formed an exclusive partnership to help financial professionals and investors thoughtfully and responsibly access private markets. Capital Group and KKR each bring decades of experience, breadth and scale with a shared investor-first approach. This partnership reflects rigorous due diligence by both firms to help address what has been an increasingly common question among financial professionals and investors: how to invest in private markets.

The investment solutions intend to blend public investments (such as stocks and bonds) with private investments in holistic portfolios to help address challenges of investing directly into private markets. The two Capital Group KKR Public-Private+ Funds focus on public fixed income and private credit, tapping into Capital Group’s public fixed income capabilities that manage more than $500 billion in assets as of December 31, 2024, and KKR’s proprietary private credit origination platform and management, responsible for more than $100 billion in assets as of December 31, 2024.

We’re delivering these investments via interval funds, a vehicle which combines the ability to access less-liquid investments through a fund regulated by The Investment Act of 1940 (like mutual funds and ETFs). We believe interval funds are a prudent and responsible way for financial professionals and investors to access public-private investments. This is due to interval funds offering share repurchases quarterly and at a predetermined percentage of the fund’s outstanding shares, helping existing long-term shareholders pursue the benefits of private credit investments without the manager having to exit private credit positions at unattractive valuations to satisfy shareholder redemptions. An interval fund that blends public and private investments can help provide enhanced liquidity and simplicity compared to other vehicles that are commonly used to access private investments.

Key features of the first Capital Group KKR funds include:

- No investor eligibility requirements (non-accredited investors can invest)

- Low investment minimums ($1,000)

- Compelling fee structure

- Simplified tax reporting (compared to other private market investment vehicles) with IRS 1099 forms

Meet the funds

Introducing the first two Public-Private+ Funds that can fit into the fixed income allocation of an investor’s portfolio.

Objective: The fund’s investment objective is to provide a high level of current income and seek maximum total return, consistent with preservation of capital.

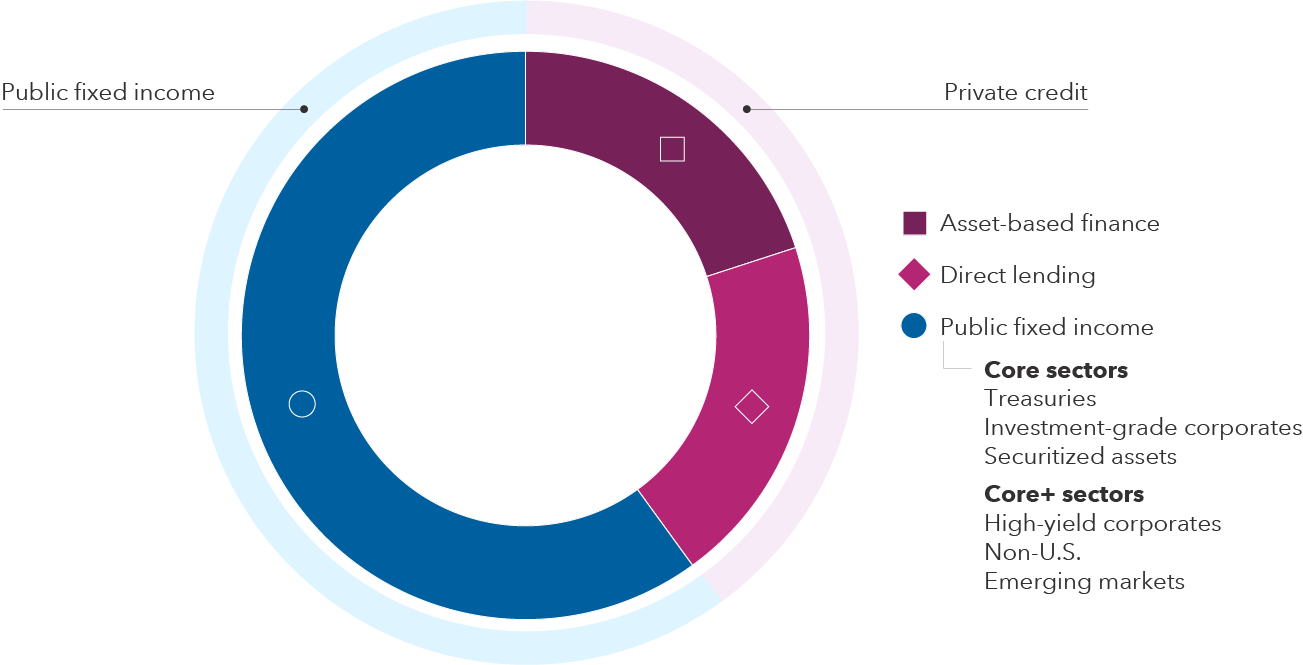

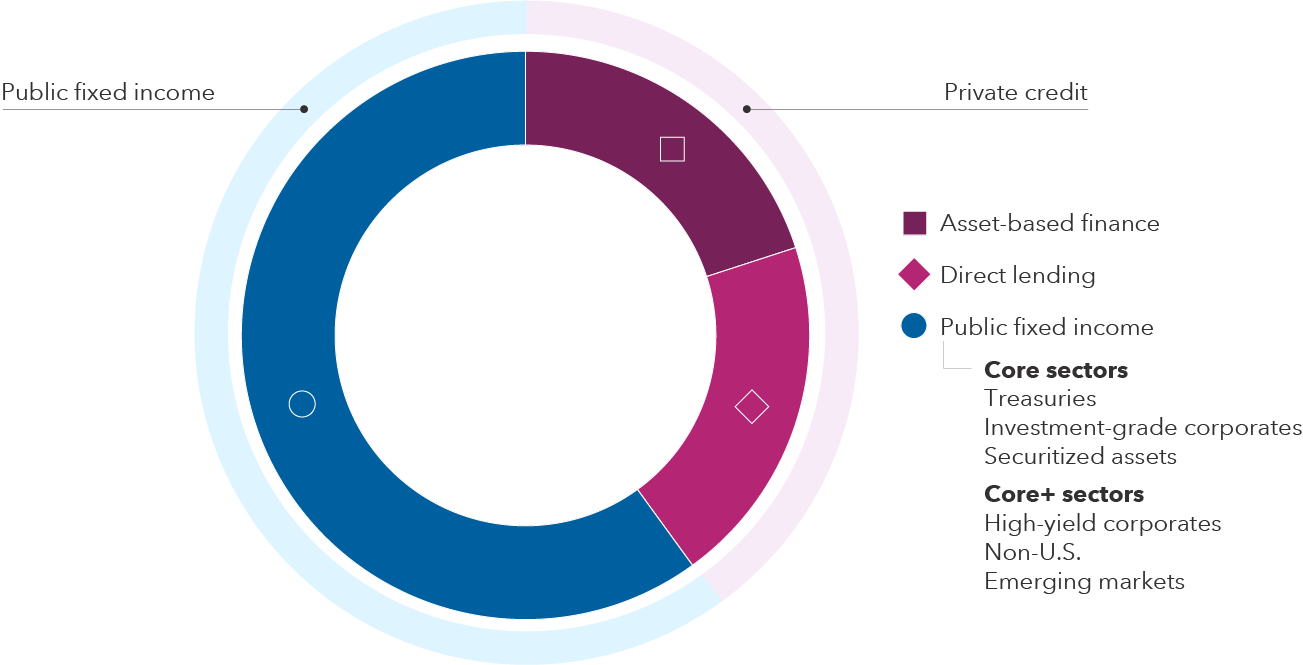

Investing across fixed income sectors to pursue the fund's objectives

For illustrative purposes only. Actual allocations to sectors may vary depending on portfolio managers’ bottom-up security selection and/or market conditions.

Key takeaways

Capturing a broader opportunity set: Invests across public and private markets, allowing investors opportunities to pursue higher income and total return across the full credit spectrum. The fund will seek to generally invest 60% in traditional fixed income and 40% in private credit under normal circumstances.

Wide range of potential sources of income: Seeks to identify income opportunities in public fixed income sectors such as securitized assets, investment-grade and high yield corporates, and in private credit, specifically direct lending to upper middle market companies and asset-based finance.

Active risk management: Capital Group's ongoing risk analysis and management at the fund level along with Capital Group and KKR's respective embedded risk analysis and mitigation processes at the individual investment level seek to create a multi-layer risk ecosystem.

Capital Group KKR Multi-Sector+

Objective: The fund's investment objective is to provide a high level of current income.

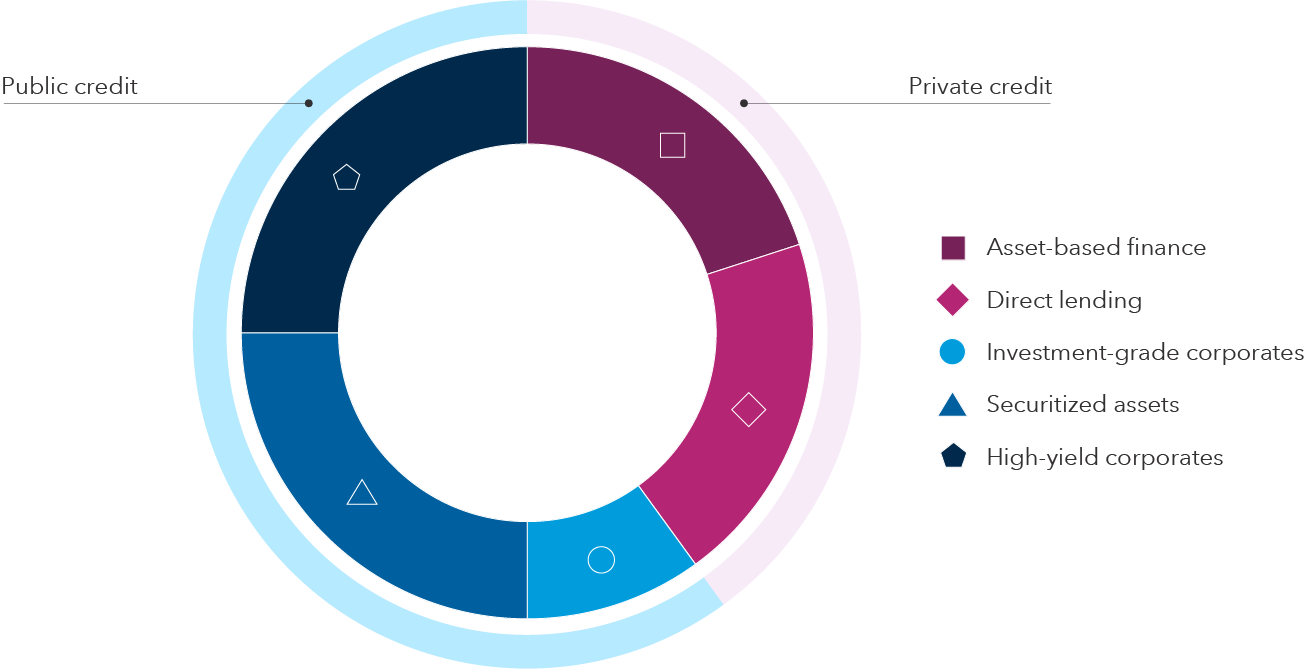

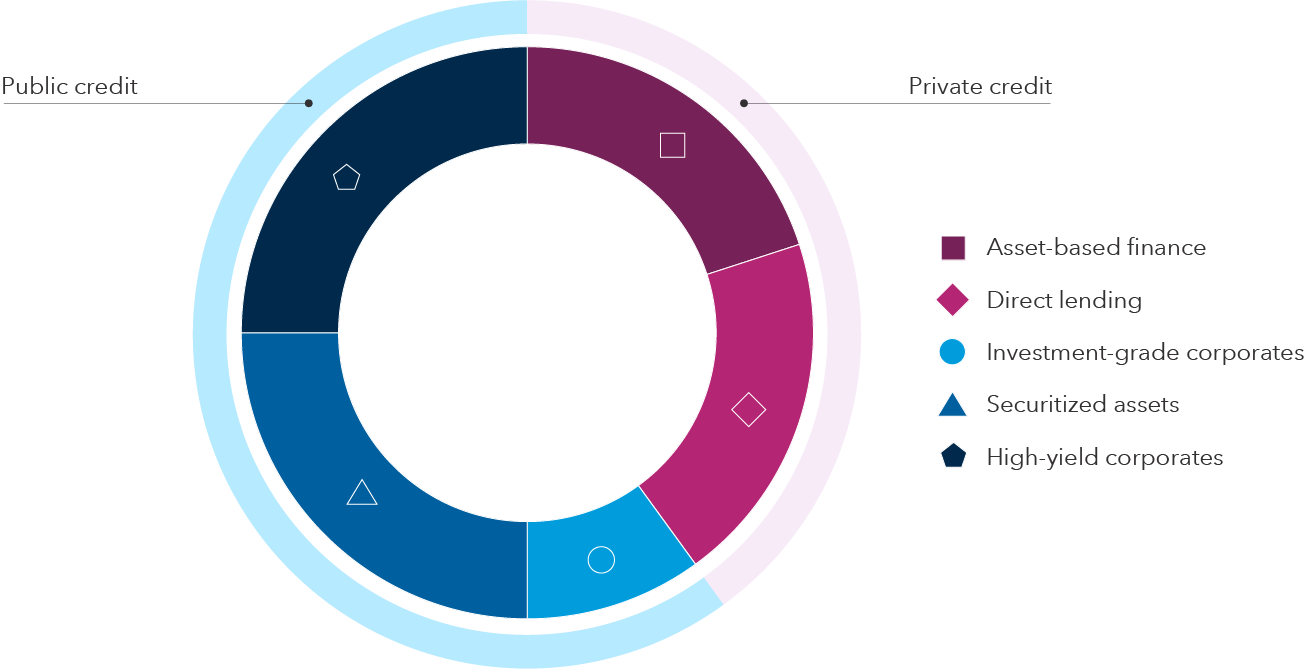

Seeks diversification across public and private income sectors

For illustrative purposes only. Actual allocations to sectors may vary depending on portfolio managers’ bottom-up security selection and/or market conditions.

Key takeaways

High income seeking: Offers strategic active exposure to various higher income-focused sectors in the public fixed income markets with a target of 40% of assets to be invested across higher income seeking private credit sectors under normal circumstances.

Flexibility: A broad portfolio that invests across investment-grade and high-yield corporates, securitized assets, as well as private loans to direct upper middle-market companies and asset-based finance instruments.

Enhanced opportunity set: With KKR's well-established private credit platform, investors can pursue potentially higher yielding credit opportunities that have not been historically available to the typical investor.

Dig deeper into +

Financial professionals — we have a variety of resources available to help you dig deeper into the world of public-private investments:

- Our Capital Ideas Pro educational program, a three-module self-directed course that covers topics such as what are private markets and private credit, positioning public-private solutions for investors and other interesting areas of this growing investment category.

- Capital Group’s Portfolio Consulting and Analytics Team can help evaluate opportunities to optimize portfolio construction to pursue investor’s goals, including how to consider public-private investments with a detailed portfolio analysis.

- Sign up for additional updates on Capital Group KKR Public-Private+ Solutions that include product updates, thought leadership and more educational information.

Reach out to your Capital Group sales representative who will be able to help guide your journey in learning more about these funds and the partnership with KKR.

Investors — Please reach out to your financial professional to learn more about public-private investments and whether they may be a fit to help pursue your investment goals.

Key terms

Fixed income — Fixed income refers to types of investment securities that typically pay investors fixed interest or dividend payments until their maturity date. Private credit — Private credit refers to non-bank lending where investors provide loans or other financing options directly to private companies or projects, outside of traditional public markets. Private credit is typically used by businesses seeking capital without issuing public debt or equity. Credit — A contractual arrangement in which a borrower (such as an individual or corporation) receives cash and agrees to repay, usually with interest, at a later point. In financial markets, this can be in the form of a loan, bond or similar type of debt note. Institutional investor — Typically a large pool of professional investors or an organization such as a corporation, sovereign wealth fund or endowment who invests cash in financial markets for the benefit of the organization. Endowment — A legal structure managed by nonprofit organizations to invest money gifted from donors to support initiatives such as capital improvements, academic scholarships or other programs to support a nonprofit’s mission. Sovereign wealth fund — Typically a foreign state- or government-owned investment fund that is financed from budget savings, tax/tariff revenue or profits from state-sponsored enterprises. Public-private fund — A public-private fund (or solution) is a fund that invests in a mixture of public and private assets, with a goal of potentially outperforming the returns of public-only investment. Public-private solutions often use the vehicle of an interval fund to offer periodic liquidity while holding illiquid private assets. Interval fund — An interval fund is a closed-end, registered investment company that offers liquidity to investors at pre-scheduled "repurchase windows," with limits on the total repurchase allowed at any one such window. These funds are used as a mechanism to bring periodic, interval-based liquidity to investors while holding illiquid assets such as private credit. Repurchase window — A repurchase window refers to a specific period during which investors in certain investment vehicles, such as interval funds, can sell back their shares to the fund at the current net asset value (NAV). These windows occur at predetermined intervals, providing limited liquidity to investors. Investment Company Act of 1940 —The Investment Company Act of 1940 is a federal law that regulates the organization and activities of registered investment companies, including mutual funds and closed-end funds. Its primary purpose is to protect investors by minimizing conflicts of interest and ensuring transparency in the investment industry. Subadviser – An independent investment adviser who is contracted by another investment adviser to manage all or part of a fund’s portfolio, typically providing investment analysis and selection in a particular, sometimes niche area of the investment universe. Agency mortgage-backed securities — Securities backed by pools of mortgage loans originating and guaranteed, as to timely payment of principal and interest, by Ginnie Mae, a government agency, or Fannie Mae and Freddie Mac, government-sponsored entities. Asset-backed securities — Securities that are backed by a pool of assets that generate cash flows, such as loans, leases, credit card balances or receivables. Investment grade corporate bonds — Debt instruments issued by corporations, often thought to have a higher credit quality and lower risk of default compared to lower rated debt securities, based on rating agency valuations. Securitized credit — Debt securities that are backed by pools of individual loans — such as mortgages, auto loans, or credit card debt — and sold to investors. This process provides liquidity to lenders and offers investors exposure to diversified debt instruments. High-yield bonds — Debt issued by entities with credit ratings that are below investment grade. This type of debt usually carries greater default risk but typically offers higher investment yield potential compared to higher rated debt securities. Direct lending — Direct lending involves non-bank financial institutions providing loans directly to companies without intermediaries like traditional banks. Asset-based finance — Asset-based finance (ABF) is a broad form of non-bank lending backed by a variety of collateral, including tangible and financial assets owned by corporations and individuals.