- Investments

- / American Funds® Strategic Bond Fund

Investment Fund

American Funds® Strategic Bond Fund (RANGX)

Purchase Restrictions: Class R-6 shares are available in certain employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

A differentiated approach to core plus investing.

This fund seeks higher returns than core bond funds with generally low equity correlation. It aims to drive returns primarily through interest rate, yield curve and inflation positioning, generally resulting in liquid investments with high credit quality. Flexibility to invest in extended bond sectors on an opportunistic basis.

Price at NAV

$9.51

as of 2/26/2026 (updated daily)

Fund Assets (millions)

$21,496.3

Portfolio Managers

4

Expense Ratio

(Gross/Net %)

0.31 / 0.31%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Asset Mix

| U.S. Equities0.0% | Non-U.S. Equities0.0% | ||

| U.S. Bonds73.4% | Non-U.S. Bonds13.9% | ||

| Cash & Equivalents |

| U.S. Equities0.0% | |

| Non-U.S. Equities0.0% | |

| U.S. Bonds73.4% | |

| Non-U.S. Bonds13.9% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

Volatility & Return chart is not available for funds less than 10 years old.

Description

Objective

The fund’s investment objective is to provide maximum total return consistent with preservation of capital.

Distinguishing Characteristics

This differentiated core plus fund seeks higher returns than core bond funds while maintaining a low equity correlation. This fund aims to drive returns primarily through interest rate, yield curve and inflation positioning, generally resulting in liquid investments with high credit quality. With the flexibility to hold a broad range of debt securities, it can invest in emerging markets, high-yield bonds and non-U.S. dollar markets on an opportunistic basis.

Types of Investments

Government debt and agency bonds, corporate bonds, mortgage- and asset-backed securities, emerging markets debt, non-U.S., municipals and high-yield.

Maturity

The bond maturities that the fund targets will vary depending on the current strategy being implemented.

Portfolio Restrictions

The fund may invest no more than 35% of its assets in securities rated below investment grade (BB+/Ba1 and below, or unrated, but determined by the fund’s investment adviser to be of equivalent quality) at the time of purchase, including high-yield corporate bonds or those issued by developing country governments and companies. The fund may invest up to 10% of its assets in equity securities and certain securities with a combination of debt and equity characteristics. The fund may invest up to 35% of its assets in securities denominated in currencies other than the U.S. dollar. The fund may invest up to 35% of its assets in securities of emerging market issuers.

Fund Facts

| Fund Inception | 3/18/2016 |

|

Fund Assets (millions) As of 1/31/2026

|

$21,496.3 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

945+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

713 |

|

Regular Dividends Paid |

Mar, Jun, Sep, Dec |

| Minimum Initial Investment | $0 |

|

Capital Gains Paid

|

Jun, Dec |

| Portfolio Turnover (2025) | 216% |

| Fiscal Year-End | Dec |

| Prospectus Date | 03/01/2025 |

| CUSIP | 02631E 78 9 |

| Fund Number | 26112 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

Growth of 10K

-

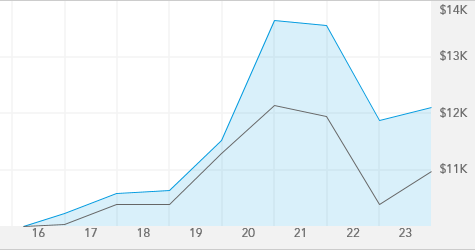

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class R-6 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class R-6 Shares, this chart tracks the high and low prices at NAV for RANGX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/26/2026.

Portfolio Management

LEARN ABOUT THE CAPITAL SYSTEMSM

Xavier Goss

22

5

4

Damien McCann

26

26

10

Tim Ng

19

12

3

Ritchie Tuazon

26

15

10

| Xavier Goss | 4 | 5 | 22 | |

| Damien McCann | 10 | 26 | ||

| Tim Ng | 3 | 12 | 19 | |

| Ritchie Tuazon | 10 | 15 | 26 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(302) |

(302) |

(288) |

|

|

Expense Within Category Funds Rated |

(170) |

(170) |

(166) |

|

|

Preservation Within Category Funds Rated |

(5993) |

(5993) |

(5574) |

|

|

Tax Efficiency Within Category Funds Rated |

(302) |

(302) |

(288) |

|

|

Total Return Within Category Funds Rated |

(302) |

(302) |

(288) |

|

Category | Core Plus Bond Funds |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | ||

|

Standard Deviation

|

6.81 | |

|

Sharpe Ratio

|

-0.56 | |

|

For the 5 Years ending 1/31/26

(updated monthly).

|

||

|

American Funds/ Morningstar Benchmark |

||

|

Bloomberg US Agg Bond TR USD

|

||

| R-squared | 90 | |

| Beta | 1.03 | |

| Capture Ratio (Downside/Upside) | 107/103 | |

|

American Funds and Morningstar Benchmark for the 5 Years ending 1/31/26

(updated monthly).

|

||

Quality Summary

U.S. Treasuries/Agencies

18.1%

AAA/Aaa

5.2%

AA/Aa

17.5%

A

14.6%

BBB/Baa

15.3%

BB/Ba

7.7%

B

3.4%

CCC & Below

0.9%

Unrated

4.4%

Cash & equivalents

13.6%

%

of net assets as of 1/31/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

31.5%

5-9.9 Years

31.1%

10-19.9 Years

7.9%

20-29.9 Years

12.7%

30+ Years

0.5%

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

Bonds Breakdown

Bond Details

Total bond holdings

Corporate bonds, notes & loans

+

31.4%

|

|||||||||||||||||||||||

Mortgage-backed obligations

+

24.5%

|

|||||||||||||||||||||||

| U.S. Treasury bonds & notes 14.1% | |||||||||||||||||||||||

| Non-U.S. government/agency securities 6.5% | |||||||||||||||||||||||

| Asset-backed obligations 5.8% | |||||||||||||||||||||||

Revenue bonds

+

1.0%

|

|||||||||||||||||||||||

| General obligation bonds 0.4% |

% of net assets as of 12/31/2025 (updated quarterly)

Top Fixed-Income Issuers

U.S. Treasury

12.4%

Fannie Mae

10.6%

Federal Home Loan Mortgage

6.6%

UMBS

3.5%

Japan, Government of

2.3%

Brazil, Federal Government of

1.0%

PG&E

0.8%

América Móvil

0.7%

Amgen

0.7%

Ford Motor

0.6%

% of net assets as of 11/30/2025 (updated monthly)

Geographic Breakdown

United States

73.4%

Europe

3.5%

Asia & Pacific Basin

3.3%

Other (Including Canada & Latin America)

7.0%

Cash & equivalents

12.7%

%

of net assets as of 1/31/2026

(updated monthly)

Non-U.S. Dollar Denominated

39.5%

Euros

6.2%

Mexican peso

0.8%

Japanese yen

0.0%

British pounds

0.0%

Polish zloty

0.0%

Other currencies

32.5%

U.S. Dollar

60.5%

Data as of 12/31/2025

United States

71.3%

Japan

2.6%

Mexico

1.8%

Brazil

1.5%

United Kingdom

1.0%

Hungary

0.6%

Canada

0.5%

Colombia

0.4%

Supranational

0.4%

Israel

0.4%

Percentage of net assets as of 12/31/2025 (updated quarterly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| 03/14/25 | 03/14/25 | 03/17/25 | $0.0892 | $0.00 | $0.00 | $0.00 | $9.18 |

| 06/13/25 | 06/13/25 | 06/16/25 | $0.0942 | $0.00 | $0.00 | $0.00 | $9.18 |

| 09/19/25 | 09/19/25 | 09/22/25 | $0.099 | $0.00 | $0.00 | $0.00 | $9.38 |

| 12/17/25 | 12/17/25 | 12/18/25 | $0.0984 | $0.00 | $0.00 | $0.00 | $9.34 |

| 2025 Year-to-Date: | Dividends Subtotal: $0.3808 | Cap Gains Subtotal: $0.00 | |||||

| Total Distributions: $0.3808 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/18/2025 |

| 0.00000000 | 12/19/2025 |

| 0.00000000 | 12/22/2025 |

| 0.00000000 | 12/23/2025 |

| 0.00000000 | 12/24/2025 |

| 0.00000000 | 12/26/2025 |

| 0.00000000 | 12/29/2025 |

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| 0.00000000 | 02/23/2026 |

| 0.00000000 | 02/24/2026 |

| 0.00000000 | 02/25/2026 |

| 0.00000000 | 02/26/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/18/2025 | |

| 0.00000000 | 12/19/2025 | |

| 0.00000000 | 12/22/2025 | |

| 0.00000000 | 12/23/2025 | |

| 0.00000000 | 12/24/2025 | |

| 0.00000000 | 12/26/2025 | |

| 0.00000000 | 12/29/2025 | |

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 | |

| 0.00000000 | 02/23/2026 | |

| 0.00000000 | 02/24/2026 | |

| 0.00000000 | 02/25/2026 | |

| 0.00000000 | 02/26/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.27% |

| Other Expenses | 0.04% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| RANGX | 0.31% |

|

Lipper Core Plus Bond

Funds Average

|

--% |

Fund as of most recent prospectus.

Lipper Category as of -- (updated quarterly).

Resources

Literature for RANGX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class R-6 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class R-6 Shares, this chart tracks the total returns since the fund's inception date (Friday, March 18, 2016) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (2016), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.