- Investments

- / U.S. Government Securities Fund®

Investment Fund

U.S. Government Securities Fund® (GVTFX)

Purchase Restrictions: Class F-2 shares are available through certain registered investment advisor and fee-based programs, but are not available for purchase in most employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

A quality foundation.

Invests primarily in securities guaranteed or sponsored by the U.S. government and manages allocations between government and mortgage securities. Seeks to outpace the Treasury and mortgage-backed securities markets while maintaining low correlation to equities and minimal credit risk.

Price at NAV

$12.21

as of 2/23/2026 (updated daily)

Fund Assets (millions)

$24,407.7

Portfolio Managers

4

Expense Ratio

(Gross/Net %)

0.39 / 0.36%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Asset Mix

| U.S. Equities0.0% | Non-U.S. Equities0.0% | ||

| U.S. Bonds89.5% | Non-U.S. Bonds0.0% | ||

| Cash & Equivalents |

| U.S. Equities0.0% | |

| Non-U.S. Equities0.0% | |

| U.S. Bonds89.5% | |

| Non-U.S. Bonds0.0% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Fixed-Income

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Description

Objective

The fund's investment objective is to provide a high level of current income consistent with prudent investment risk and preservation of capital.

Distinguishing Characteristics

Invests primarily in securities guaranteed or sponsored by the U.S. government and mortgage-backed securities.

Types of Investments

Primarily invests in direct obligations of the U.S. Treasury and securities issued by U.S. government agencies, and cash and equivalents.

Maturity

Not required to maintain any particular maturity.

Portfolio Restrictions

At least 80% of the fund's assets will be invested in securities that are guaranteed or sponsored by the U.S. government.

Fund Facts

| Fund Inception | 10/17/1985 |

|

Fund Assets (millions) As of 1/31/2026

|

$24,407.7 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

38+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

46,854 |

|

Regular Dividends Paid |

Monthly |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Dec |

| Portfolio Turnover (2025) | 309% |

| Fiscal Year-End | Aug |

| Prospectus Date | 11/01/2025 |

| CUSIP | 026300 82 2 |

| Fund Number | 622 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

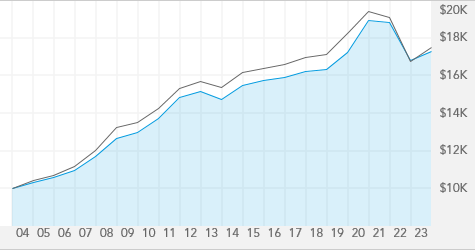

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class F-2 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class F-2 Shares, this chart tracks the high and low prices at NAV for GVTFX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/23/2026.

Portfolio Management

LEARN ABOUT THE CAPITAL SYSTEMSM

David Betanzos

28

24

11

Fergus MacDonald

33

22

16

Pratyoosh Pratyoosh

19

13

1

Ritchie Tuazon

26

15

11

| David Betanzos | 11 | 24 | 28 | |

| Fergus MacDonald | 16 | 22 | 33 | |

| Pratyoosh Pratyoosh | 1 | 13 | 19 | |

| Ritchie Tuazon | 11 | 15 | 26 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(57) |

(57) |

(55) |

(46) |

|

Expense Within Category Funds Rated |

(226) |

(226) |

(219) |

(167) |

|

Preservation Within Category Funds Rated |

(5993) |

(5993) |

(5574) |

(4238) |

|

Tax Efficiency Within Category Funds Rated |

(57) |

(57) |

(55) |

(46) |

|

Total Return Within Category Funds Rated |

(57) |

(57) |

(55) |

(46) |

Category | General US Govt Funds |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | |||

|

Standard Deviation

|

4.80 | ||

|

Sharpe Ratio

|

-0.12 | ||

|

For the 10 Years ending 1/31/26

(updated monthly).

|

|||

|

American Funds Benchmark |

Morningstar Benchmark |

||

|

Bloomberg U.S. Government/Mortgage Backed Securities Indx

|

Bloomberg US Agg Bond TR USD

|

||

| R-squared | 86 | 86 | |

| Beta | 0.89 | 0.89 | |

| Capture Ratio (Downside/Upside) | 84/85 | 84/85 | |

|

American Funds Benchmark for the 10 Years ending 1/31/26

(updated monthly).

Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

|||

Quality Summary

U.S. Treasuries/Agencies

48.5%

AAA/Aaa

1.1%

AA/Aa

39.8%

Unrated

0.1%

Cash & equivalents

10.1%

%

of net assets as of 1/31/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

61.1%

5-9.9 Years

19.6%

10-19.9 Years

3.5%

20-29.9 Years

6.8%

30+ Years

--

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

Bonds Breakdown

Bond Details

Total bond holdings

| U.S. Treasury bonds & notes 47.6% | |

| Mortgage-backed obligations 43.4% |

% of net assets as of 12/31/2025 (updated quarterly)

Top Fixed-Income Issuers

U.S. Treasury

47.2%

Federal Home Loan Mortgage

21.2%

Fannie Mae

17.1%

Ginnie Mae II

2.1%

UMBS

2.0%

Federal Home Loan Bank

0.2%

Freddie Mac Multifamily Structured Pass Throug ...

0.2%

Tennessee Valley Authority

0.2%

Freddie Mac - SLST SLST_18-2

0.2%

Seasoned Loans Structured Transaction Trust SL ...

0.2%

% of net assets as of 12/31/2025 (updated monthly)

Geographic Breakdown

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 02/23/26

Historical Distributions as of 02/23/26

| 2026 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| Daily | 01/30/26 | 02/02/26 | $0.0387053 | $0.00 | $0.00 | $0.00 | $12.11 |

| 2026 Year-to-Date: | Dividends Subtotal: $0.03870533 | Cap Gains Subtotal: $0.00 | |||||

| Total Distributions: $0.03870533 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00282947 | 02/02/2026 |

| 0.00171879 | 02/03/2026 |

| 0.00141402 | 02/04/2026 |

| 0.00141566 | 02/05/2026 |

| 0.00140263 | 02/06/2026 |

| 0.00405135 | 02/09/2026 |

| 0.00151783 | 02/10/2026 |

| 0.00139782 | 02/11/2026 |

| 0.00137930 | 02/12/2026 |

| 0.00139036 | 02/13/2026 |

| 0.00545794 | 02/17/2026 |

| 0.00155848 | 02/18/2026 |

| 0.00140061 | 02/19/2026 |

| 0.00139671 | 02/20/2026 |

| 0.00408829 | 02/23/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00282947 | 02/02/2026 | |

| 0.00171879 | 02/03/2026 | |

| 0.00141402 | 02/04/2026 | |

| 0.00141566 | 02/05/2026 | |

| 0.00140263 | 02/06/2026 | |

| 0.00405135 | 02/09/2026 | |

| 0.00151783 | 02/10/2026 | |

| 0.00139782 | 02/11/2026 | |

| 0.00137930 | 02/12/2026 | |

| 0.00139036 | 02/13/2026 | |

| 0.00545794 | 02/17/2026 | |

| 0.00155848 | 02/18/2026 | |

| 0.00140061 | 02/19/2026 | |

| 0.00139671 | 02/20/2026 | |

| 0.00408829 | 02/23/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.24% |

| Other Expenses | 0.15% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| Gross | Net | |

| GVTFX | 0.39% | 0.36% |

|

Lipper General U.S. Government

Funds Average

|

0.59% | |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for GVTFX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class F-2 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class F-2 Shares, this chart tracks the total returns since the fund's inception date (Thursday, October 17, 1985) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (1985), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.