- Investments

- / American Balanced Fund®

Investment Fund

American Balanced Fund® (AMBFX)

Purchase Restrictions: Class F-2 shares are available through certain registered investment advisor and fee-based programs, but are not available for purchase in most employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

A balanced approach to growth-and-income investing.

With a diversified portfolio of quality stocks and bonds, this balanced strategy invests between 50% and 75% in equities, with flexible exposure to growth-oriented and dividend-paying stocks. The fixed income portion generally invests in investment-grade bonds, providing diversification from equities.

Price at NAV

$38.95

as of 2/20/2026 (updated daily)

Fund Assets (millions)

$274,832.3

Portfolio Managers

12

Expense Ratio

(Gross/Net %)

0.35 / 0.35%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Read important investment disclosures

Returns as of 1/31/26 (updated monthly).

Yield as of 1/31/26 (updated monthly).

Asset Mix

| U.S. Equities53.3% | Non-U.S. Equities10.3% | ||

| U.S. Bonds28.2% | Non-U.S. Bonds2.4% | ||

| Cash & Equivalents |

| U.S. Equities53.3% | |

| Non-U.S. Equities10.3% | |

| U.S. Bonds28.2% | |

| Non-U.S. Bonds2.4% | |

| Cash & Equivalents |

As of 1/31/2026

(updated monthly)

Internal Prompt

Volatility & Return

VIEW LARGER CHART

Standard Deviation as of 01/31/2026

(updated monthly)

. Annualized return as of 01/31/2026

(updated monthly)

.

Market Capitalization

81.7%

Large

17.2%

Medium

1.1%

Small

$891,900.00 Million

Weighted Average

As of

12/31/2025 (updated quarterly).

FactSet data as of

12/31/2025 (updated quarterly).

Morningstar Ownership ZoneTM

Moderate Allocation

Moderate Allocation

Weighted average of holdings

75% of fund's stock holdings

Morningstar data as

of 12/31/25

(updated quarterly)

Morningstar Style BoxTM— Fixed-Income

High Quality

Moderate Interest-Rate Sensitivity

Morningstar data as

of 12/31/25

(updated quarterly)

Description

Objective

The investment objectives of the fund are: (1) conservation of capital, (2) current income and (3) long-term growth of capital and income.

Distinguishing Characteristics

With a diversified portfolio of quality stocks and bonds, this balanced fund generally invests between 50% and 75% of its assets in equities, with flexible exposure to growth-oriented and dividend-paying stocks. The fixed income portion of the portfolio, which generally invests in investment-grade bonds, provides diversification from equities. This approach has the potential to provide consistent results, and to limit volatility.

Types of Investments

Common stocks and preferred stocks, bonds, convertibles and cash.

Holdings Outside the U.S.

The fund may invest up to 20% of its assets in securities of issuers domiciled outside the United States.

Portfolio Restrictions

May not invest more than 75% of assets in common stocks. All of the fund's fixed-income investments must be investment-grade at the time of purchase.

Fund Facts

| Fund Inception | 7/26/1975 |

|

Fund Assets (millions) As of 1/31/2026

|

$274,832.3 |

|

Companies/Issuers

Holdings are as of 1/31/2026 (updated monthly).

|

1134+ |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

831,933 |

|

Regular Dividends Paid |

Mar, Jun, Sep, Dec |

| Minimum Initial Investment | $250 |

|

Capital Gains Paid

|

Jun, Dec |

| Portfolio Turnover (2025) | 106% |

| Fiscal Year-End | Dec |

| Prospectus Date | 03/01/2025 |

| CUSIP | 024071 82 1 |

| Fund Number | 611 |

Returns

Internal Prompt

-

Month-End Returns as of 1/31/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 1/31/26

Quarter-End Returns as of 12/31/25

-

Growth of 10K

-

High & Low Prices

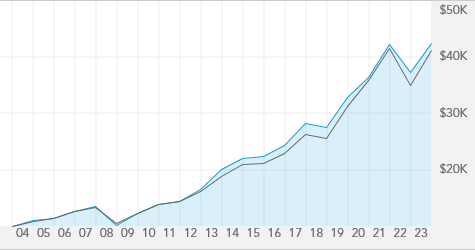

Growth of 10K

Read important investment disclosures

For Class F-2 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class F-2 Shares, this chart tracks the high and low prices at NAV for AMBFX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 2/20/2026.

Portfolio Management

LEARN ABOUT THE CAPITAL SYSTEMSM

Hilda Applbaum

42

31

26

Pramod Atluri

22

10

8

Paul Benjamin

20

20

11

Alan Berro

40

35

20

Mathews Cherian

29

22

4

Irfan Furniturewala

25

25

0

Jin Lee

30

29

7

Chit Purani

22

4

3

John Queen

36

24

9

Anirudh Samsi

25

21

6

Ritchie Tuazon

26

15

5

Alan Wilson

35

35

10

| Hilda Applbaum | 26 | 31 | 42 | |

| Pramod Atluri | 8 | 10 | 22 | |

| Paul Benjamin | 11 | 20 | ||

| Alan Berro | 20 | 35 | 40 | |

| Mathews Cherian | 4 | 22 | 29 | |

| Irfan Furniturewala | 0 | 25 | ||

| Jin Lee | 7 | 29 | 30 | |

| Chit Purani | 3 | 4 | 22 | |

| John Queen | 9 | 24 | 36 | |

| Anirudh Samsi | 6 | 21 | 25 | |

| Ritchie Tuazon | 5 | 15 | 26 | |

| Alan Wilson | 10 | 35 |

A boldface number indicates that years of experience with Capital Group is equal to years of experience with investment industry.

Ratings & Risk

Morningstar Rating TM

Ratings are based on risk-adjusted returns as of 1/31/2026 (updated monthly).

Lipper Leader Scorecard

| Overall Over-all | 3 yr. | 5 yr. | 10 yr. | |

|

Consistent Return Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

|

Expense Within Category Funds Rated |

(237) |

(237) |

(229) |

(183) |

|

Preservation Within Category Funds Rated |

(4130) |

(4130) |

(3873) |

(2775) |

|

Tax Efficiency Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

|

Total Return Within Category Funds Rated |

(432) |

(432) |

(412) |

(350) |

Category | Mixed-Asset Target Allocation Growth |

HIGHEST

LOWEST

LOWEST

As of 1/31/2026

(updated monthly)

Risk Measures

| Fund | |||

|

Standard Deviation

|

9.54 | ||

|

Sharpe Ratio

|

0.87 | ||

|

For the 10 Years ending 1/31/26

(updated monthly).

|

|||

|

American Funds Benchmark |

Morningstar Benchmark |

||

|

60%/40% S&P 500 Index/Bloomberg U.S. Aggregate Index

|

Morningstar Mod Tgt Risk TR USD

|

||

| R-squared | 93 | 94 | |

| Beta | 0.61 | 0.94 | |

| Capture Ratio (Downside/Upside) | 63/65 | 90/106 | |

|

American Funds Benchmark for the 10 Years ending 1/31/26

(updated monthly).

Morningstar Benchmark for the 10 Years ending 1/31/26

(updated monthly).

|

|||

Quality Summary

U.S. Treasuries/Agencies

32.5%

AAA/Aaa

10.2%

AA/Aa

26.2%

A

15.9%

BBB/Baa

14.0%

BB/Ba

0.0%

Unrated

1.1%

%

of net assets as of 1/31/2026

(updated monthly)

Average Life Breakdown

0-4.9 Years

16.1%

5-9.9 Years

10.3%

10-19.9 Years

1.8%

20-29.9 Years

2.3%

30+ Years

0.2%

%

of net assets as of 12/31/2025

(updated monthly)

Holdings

-

Equities Breakdown

-

Bonds Breakdown

Equities Breakdown

Equity Fund Holdings

| Information technology 18.6% | |

| Industrials 7.7% | |

| Financials 7.3% | |

| Health care 7.2% | |

| Communication services 5.8% | |

| Consumer discretionary 5.5% | |

| Consumer staples 4.5% | |

| Materials 3.1% | |

| Energy 2.3% | |

| Utilities 0.8% | |

| Real estate 0.7% |

% of net assets as of 1/31/2026 (updated monthly)

Semiconductors & semiconductor equipment

13.2%

Interactive media & services

4.6%

Aerospace & defense

3.5%

Software

3.4%

Tobacco

2.9%

Biotechnology

2.8%

Metals & mining

2.5%

Hotels, restaurants & leisure

2.3%

Pharmaceuticals

1.9%

Insurance

1.8%

% of net assets as of 1/31/2026 (updated monthly)

Bonds Breakdown

Bond Details

Total bond holdings

Mortgage-backed obligations

+

9.6%

|

|||||||||||||||||||||||

| U.S. Treasury bonds & notes 8.9% | |||||||||||||||||||||||

Corporate bonds, notes & loans

+

8.8%

|

|||||||||||||||||||||||

| Asset-backed obligations 2.6% | |||||||||||||||||||||||

| Non-U.S. government/agency securities 0.5% | |||||||||||||||||||||||

| General obligation bonds 0.1% | |||||||||||||||||||||||

| Revenue bonds 0.1% |

% of net assets as of 12/31/2025 (updated quarterly)

Top Equities

Alphabet

3.6%

Broadcom

3.5%

TSMC

2.9%

Microsoft

2.6%

Philip Morris International

2.4%

NVIDIA

2.1%

Micron Technology

2.0%

Eli Lilly

1.5%

SK hynix

1.1%

Visa

1.1%

% of net assets as of 1/31/2026 (updated monthly)

Top Fixed-Income Issuers

U.S. Treasury

9.0%

Fannie Mae

3.1%

Federal Home Loan Mortgage

2.7%

UMBS

1.3%

Ford Motor

0.5%

Ginnie Mae II

0.5%

PG&E

0.4%

Morgan Stanley

0.3%

Edison International

0.3%

Goldman Sachs

0.2%

% of net assets as of 12/31/2025 (updated monthly)

Geographic Breakdown

United States

81.5%

Europe

4.2%

Asia & Pacific Basin

4.5%

Other (Including Canada & Latin America)

4.1%

Cash & equivalents

5.8%

%

of net assets as of 1/31/2026

(updated monthly)

The New Geography of Investing ®

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 01/26/26

Historical Distributions as of 01/26/26

| 2025 |

| Record Date |

Calculated Date |

Pay Date | Reinvest NAV | ||||

| 03/10/25 | 03/10/25 | 03/11/25 | $0.1271 | $0.00 | $0.00 | $0.00 | $34.06 |

| 06/09/25 | 06/09/25 | 06/10/25 | $0.1266 | $0.00 | $0.195 | $0.00 | $35.53 |

| 09/15/25 | 09/15/25 | 09/16/25 | $0.1279 | $0.00 | $0.00 | $0.00 | $38.61 |

| 12/15/25 | 12/15/25 | 12/16/25 | $0.131 | $0.34 | $2.125 | $0.00 | $37.04 |

| 2025 Year-to-Date: | Dividends Subtotal: $0.8526 | Cap Gains Subtotal: $2.32 | |||||

| Total Distributions: $3.1726 | |||||||

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00000000 | 12/16/2025 |

| 0.00000000 | 12/17/2025 |

| 0.00000000 | 12/18/2025 |

| 0.00000000 | 12/19/2025 |

| 0.00000000 | 12/22/2025 |

| 0.00000000 | 12/23/2025 |

| 0.00000000 | 12/24/2025 |

| 0.00000000 | 12/26/2025 |

| 0.00000000 | 12/29/2025 |

| 0.00000000 | 12/30/2025 |

| 0.00000000 | 12/31/2025 |

| 0.00000000 | 01/02/2026 |

| 0.00000000 | 01/05/2026 |

| 0.00000000 | 01/06/2026 |

| 0.00000000 | 01/07/2026 |

| 0.00000000 | 01/08/2026 |

| 0.00000000 | 01/09/2026 |

| 0.00000000 | 01/12/2026 |

| 0.00000000 | 01/13/2026 |

| 0.00000000 | 01/14/2026 |

| 0.00000000 | 01/15/2026 |

| 0.00000000 | 01/16/2026 |

| 0.00000000 | 01/20/2026 |

| 0.00000000 | 01/21/2026 |

| 0.00000000 | 01/22/2026 |

| 0.00000000 | 01/23/2026 |

| 0.00000000 | 01/26/2026 |

| 0.00000000 | 01/27/2026 |

| 0.00000000 | 01/28/2026 |

| 0.00000000 | 01/29/2026 |

| 0.00000000 | 01/30/2026 |

| 0.00000000 | 02/02/2026 |

| 0.00000000 | 02/03/2026 |

| 0.00000000 | 02/04/2026 |

| 0.00000000 | 02/05/2026 |

| 0.00000000 | 02/06/2026 |

| 0.00000000 | 02/09/2026 |

| 0.00000000 | 02/10/2026 |

| 0.00000000 | 02/11/2026 |

| 0.00000000 | 02/12/2026 |

| 0.00000000 | 02/13/2026 |

| 0.00000000 | 02/17/2026 |

| 0.00000000 | 02/18/2026 |

| 0.00000000 | 02/19/2026 |

| 0.00000000 | 02/20/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00000000 | 12/16/2025 | |

| 0.00000000 | 12/17/2025 | |

| 0.00000000 | 12/18/2025 | |

| 0.00000000 | 12/19/2025 | |

| 0.00000000 | 12/22/2025 | |

| 0.00000000 | 12/23/2025 | |

| 0.00000000 | 12/24/2025 | |

| 0.00000000 | 12/26/2025 | |

| 0.00000000 | 12/29/2025 | |

| 0.00000000 | 12/30/2025 | |

| 0.00000000 | 12/31/2025 | |

| 0.00000000 | 01/02/2026 | |

| 0.00000000 | 01/05/2026 | |

| 0.00000000 | 01/06/2026 | |

| 0.00000000 | 01/07/2026 | |

| 0.00000000 | 01/08/2026 | |

| 0.00000000 | 01/09/2026 | |

| 0.00000000 | 01/12/2026 | |

| 0.00000000 | 01/13/2026 | |

| 0.00000000 | 01/14/2026 | |

| 0.00000000 | 01/15/2026 | |

| 0.00000000 | 01/16/2026 | |

| 0.00000000 | 01/20/2026 | |

| 0.00000000 | 01/21/2026 | |

| 0.00000000 | 01/22/2026 | |

| 0.00000000 | 01/23/2026 | |

| 0.00000000 | 01/26/2026 | |

| 0.00000000 | 01/27/2026 | |

| 0.00000000 | 01/28/2026 | |

| 0.00000000 | 01/29/2026 | |

| 0.00000000 | 01/30/2026 | |

| 0.00000000 | 02/02/2026 | |

| 0.00000000 | 02/03/2026 | |

| 0.00000000 | 02/04/2026 | |

| 0.00000000 | 02/05/2026 | |

| 0.00000000 | 02/06/2026 | |

| 0.00000000 | 02/09/2026 | |

| 0.00000000 | 02/10/2026 | |

| 0.00000000 | 02/11/2026 | |

| 0.00000000 | 02/12/2026 | |

| 0.00000000 | 02/13/2026 | |

| 0.00000000 | 02/17/2026 | |

| 0.00000000 | 02/18/2026 | |

| 0.00000000 | 02/19/2026 | |

| 0.00000000 | 02/20/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.21% |

| Other Expenses | 0.14% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| AMBFX | 0.35% |

|

Lipper Balanced

Funds Average

|

0.78% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Literature for AMBFX

About Our Funds

Growth of a hypothetical $10,000 investment

This chart tracks a Class F-2 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class F-2 Shares, this chart tracks the total returns since the fund's inception date (Saturday, July 26, 1975) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (1975), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Standard Deviation as of 01/31/2026. Annualized return as of 01/31/2026

Volatility & Return chart is not available for funds less than 10 years old.