Model portfolios in market uncertainty

3Q25 market commentary and model portfolio asset allocation

Samir Mathur

Chair of the Portfolio Solutions Committee

Mario DiVito

Multi-asset investment director

Stanley Moy

Multi-asset investment specialist

Key takeaways for the quarter ended September 30, 2025

- Markets continued to exhibit their robustness in the third quarter, boosted by solid earnings reports and a rate cut from the U.S. Federal Reserve.

- The American Funds Model Portfolios all had strong, positive absolute gross and net results for the quarter, but nearly all of them lagged their custom benchmarks on both a gross and net basis.

- The Portfolio Solutions Committee (PSC) and the Capital Solutions Group (CSG) regularly monitor model portfolios for risks and to ensure alignment with their long-term portfolio objectives, while underlying fund managers use company- and security-specific research to make real-time decisions and identify timely opportunities in today’s ever-changing market environment.

Market review

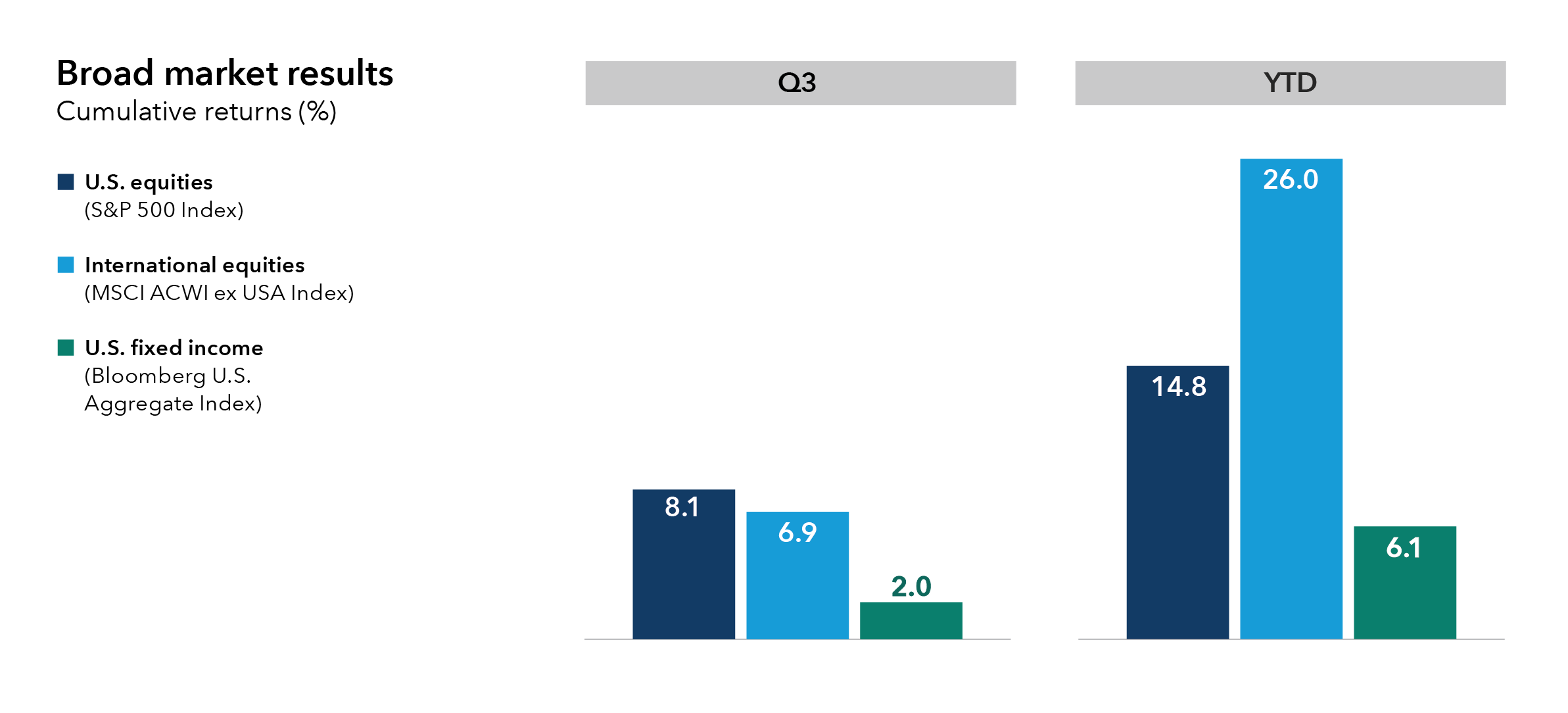

Markets held strong in the third quarter, with the bulk of the credit going to strong corporate earnings and the start of the U.S. rate-cutting cycle. The easing of global trade tensions also contributed, along with muted inflation data.

Equities broadly did well, led by both growth and small-cap stocks. The MSCI All Country World Index (ACWI) advanced 7.62% with both the growth and small-cap components outpacing value. Less-cyclical sectors and higher yielding equities continued to lag. Information technology was, once again, the top performing sector in the S&P 500 Index, followed by communication services and consumer discretionary. Consumer staples ended in negative territory. The broader U.S. bond market advanced, with investment grade and municipal bonds edging out other segments (based on results of the Bloomberg U.S. Aggregate, Bloomberg U.S. Corporate Investment Grade and Bloomberg Municipal Bond indexes). Declines were seen in some overseas debt (as measured by the Bloomberg Global Aggregate Index), especially the United Kingdom.

The Fed cut interest rates in September, and implied that further cuts would be coming before the end of the year. The Bank of Japan, the Bank of England and the European Central Bank all held their policy rates steady. The U.S. dollar stabilized, gaining against, or remaining in line with most major currencies, as measured by the U.S. Dollar Index.

Quarterly model results

All comments about model composite returns are true on a gross and net-of-fees basis, unless otherwise noted. All results are for the quarter unless otherwise specified.

Growth portfolios

American Funds Global Growth Model Portfolio

- Produced positive absolute returns, but trailed its respective benchmark.

- U.S. and non-U.S. equity selection weighed on relative results.

- Overall, negative selection in consumer discretionary and health care outweighed positive selection in information technology and industrials.

- All underlying funds produced positive absolute results. The Growth Fund of America® and The New Economy Fund® were the highest returning underlying funds, while SMALLCAP World Fund® was the least.

American Funds Growth Model Portfolio

- Registered positive absolute returns but trailed its benchmark.

- Negative U.S. equity selection in information technology, consumer discretionary and communication services weighed on relative results.

- Holdings in an entertainment streaming service, a certain biotech company and a multinational tobacco company were some of the largest individual detractors, while holdings in several semiconductor manufacturing companies were some of the biggest contributors.

- All underlying funds produced positive absolute results, led by The Growth Fund of America and The New Economy Fund. SMALLCAP World Fund and New Perspective Fund® had the smallest relative contributions.

American Funds Moderate Growth Model Portfolio

- Trailed its respective benchmark, fueled by negative U.S. equity selection.

- Negative selection in consumer discretionary, health care and information technology outweighed positive selection in non-U.S. materials and industrials.

- Less-than-benchmark exposure to a number of the mega-cap “Magnificent 7” tech holdings was the largest individual detractor.

- The Growth Fund of America was the highest returning underlying fund, while SMALLCAP World Fund was the least.

Growth-and-income portfolios

American Funds Growth and Income Model Portfolio

- Posted positive absolute returns, but lagged its benchmark, weighed down by negative security selection across U.S. and non-U.S. equities.

- Both U.S. and non-U.S. stock selection in consumer discretionary, health care and communication services outweighed positive selection in industrials and real estate.

- Within fixed income, contributions from Treasuries and corporates outweighed securitized debt's negative impact. Exposure to emerging market debt was also beneficial.

- All underlying funds produced positive absolute results. The Growth Fund of America contributed to equity returns on a relative basis while SMALLCAP World Fund was a relative detractor. American Funds® Multi-Sector Income Fund supported relative fixed income returns.

American Funds Moderate Growth and Income Model Portfolio

- Trailed its respective benchmark, driven by U.S. equity security selection.

- Selection in consumer staples, consumer discretionary and information technology were the primary drivers of negative relative results.

- Positive fixed income contributions from Treasuries, combined with favorable exposure to emerging market debt, outweighed negative selection in securitized debt.

- Asset allocation of this portfolio marginally ticked higher in favor of equities as a function of the flexibility from underlying funds like American Balanced Fund® and American Funds® Global Balanced Fund, ending the quarter at approximately 67% total equity.

American Funds Conservative Growth and Income Model Portfolio

- Posted positive absolute returns but lagged its benchmark given the income-focused objective on dividend payers, which lagged the broader S&P 500 Index.

- Less-than-benchmark exposure to information technology and communication services detracted; selection in consumer discretionary and consumer staples also hurt.

- Within fixed income, exposure to emerging market debt and selection in Treasuries were beneficial and helped offset negative selection in securitized and corporate debt.

- Capital World Growth and Income Fund® and American Funds Emerging Markets Bond Fund® were some of the stronger underlying relative contributors, whereas The Income Fund of America® and The Bond Fund of America® detracted.

American Funds Conservative Income and Growth Model Portfolio

- Trailed respective benchmark, weighed down by negative U.S. equity security selection.

- Negative selection in consumer discretionary and consumer staples was partially offset by positive selection in industrials.

- Fixed income was a contributor to relative results – mainly from exposure to emerging market debt and Treasuries.

- American Mutual Fund® and American Funds® Strategic Bond Fund were notable detractors.

Preservation and income portfolios

American Funds Conservative Income Model Portfolio

- Trailed respective benchmark over the quarter, hurt by the composition of its equities, which is mainly comprised of dividend-paying equities to align with the income objective and can help protect during market drawdowns.

- Negative security selection in consumer staples and less-than-benchmark exposure to information technology and communication services weighed on relative results.

- Fixed income selection contributed to relative results, particularly Treasuries. Securitized debt detracted.

- American Funds Multi-Sector Income Fund was a contributor, while American Mutual Fund and American Funds Strategic Bond Fund detracted.

American Funds Preservation Model Portfolio

- Positive absolute gross returns in line with the benchmark on a relative basis. Net returns were also positive but lagged their benchmark.

- Positive selection in securitized debt countered negative selection in Treasuries over the quarter.

Retirement income portfolios

American Funds Retirement Income Model Portfolios

- Posted positive absolute returns for the quarter but lagged their respective benchmarks.

- Deliberate implementation of dividend paying equities was a structural headwind to relative results but aligns to the models’ focus on sustainable income.

- In fixed income, exposure to emerging market bonds was beneficial to the portfolio as was Treasuries. However, exposure to Treasury Inflation-Protected Securities (TIPS) and selection in securitized debt were negative.

- American Funds Multi-Sector Income Fund was a strong contributor across the portfolios, whereas The Bond Fund of America was a detractor — but plays a pivotal role in portfolio diversification.

American Funds Tax-Aware model portfolios

- American Funds Tax-Aware Moderate Growth Model Portfolio trailed its benchmark, driven by U.S. equity selection, especially financials and communication services.

- Growth-and-income portfolios trailed their respective benchmarks. Selection in consumer discretionary and materials weighed on relative returns across all tax-aware growth-and-income models.

- Income and preservation model portfolios trailed their benchmarks, with the exception of the American Funds Tax-Exempt Preservation Model Portfolio, which was in line with its benchmark on a gross basis but trailed it net-of-fees. Security selection in municipal fixed income was generally positive over the quarter, helped by selection in general obligation, utility and special tax revenue bonds, while housing was a detractor.

The evolution of the American Funds Tax-Aware Model Portfolios

Several years ago, Capital Group set out to create a suite of tax-aware models that would essentially serve as a complement to the already existing American Funds Model Portfolios. While having the same objectives as their counterparts, these models took on an added goal of reducing the amount of income generated that was taxable.

This goal was pursued mainly through the implementation of fixed income mutual funds that focused on municipal bonds, which are generally tax-exempt at the federal level. As part of this process, some multi-asset balanced and income mutual funds using taxable bonds, and featured in the core series, were replaced with a combination of equity funds and tax-exempt bond funds. This preserved the desired equity-fixed income balance in each of the models while staying true to the overall model objectives.

When Capital Group introduced their active exchange-traded funds (ETFs), the Portfolio Solutions Committee (PSC) saw a new opportunity to boost the tax efficiency of their tax-aware models, as ETFs generally have a number of potential tax advantages over mutual funds, mainly due to externalization and in-kind redemptions. (This is particularly true for investors in non-qualified accounts; mutual funds continue to play a role in tax-advantaged accounts.)

Within the tax-aware models, the PSC began a multi-year journey to transition out of American Funds mutual funds to Capital Group ETFs, utilizing a diversified universe of 25 Capital Group ETFs. The research process focused on preserving overall asset allocation and model characteristics while enhancing tax efficiency and being mindful of portfolio turnover. While the American Funds Tax-Exempt Preservation Model Portfolio maintains some mutual fund exposure, following the recent re-allocations, six of the seven models have transitioned to 100% Capital Group ETFs.

Looking ahead

As we approach the end of 2025, we are still contending with many of the unknowns we started the year with, as well as new ones we acquired along the way. Geopolitical risks remain elevated. U.S. tariffs have become further implemented, but we are awaiting a U.S. Supreme Court decision on their legality. The U.S. Congress was unable to reach a budget agreement, and the federal government, at the time of this writing, has been shut down.

While we await resolution of these issues, the U.S. economy continues to grow. We have seen some retreat in corporate investment as companies have paused plans until they receive more clarity on tariffs. One exception to that is artificial intelligence (AI) investment, where companies feel pressured to keep spending to gain a competitive edge. Although currently robust, consumer spending is expected to slow, with holiday sales predicted to be at the low end. To help ward off potentially rising unemployment, the Fed instituted a rate cut in September, with the expectation of more on the way, which could boost the equity market.

Within equities, portfolio managers in the underlying funds are looking for opportunities in Europe, spurred by the recent increase in deregulation. In addition, higher defense spending, especially in Germany, should benefit defense stocks. Some portfolio managers have favored tech companies whose products support AI, including select semiconductor manufacturing firms. Managers are also seeking opportunities in health care stocks, regarding many as undervalued.

On the fixed income side, valuations across sectors are tight relative to history, but fundamentals and technicals are constructive. Within credit, underlying fund managers prefer agency mortgages and structured credit. They also favor higher credit quality given current valuation levels.

Amidst this uncertainty, portfolio managers and analysts continue to use deep fundamental analysis to unearth overlooked opportunities and pursue strong results for investors.

Analysts and portfolio managers mentioned above are references to Capital Group associates.

Results as of September 30, 2025. Past results are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month–end results, visit capitalgroup.com. Composite returns reflect changes, if any, in the underlying fund allocations over the model’s lifetime. Underlying funds may have been added or removed during a model’s lifetime. Rebalancing is performed in accordance with the investment adviser’s strategic asset allocation views for the model. Please refer to capitalgroup.com/advisor/investments/ model-portfolios.htm for historical underlying fund allocations. Composite net results are calculated by subtracting an annual 3% fee, (which is equal to or higher than the highest actual model portfolio wrap fee charged by a program sponsor) from the gross composite monthly returns, which are net of underlying mutual fund fees and expenses. Composite gross results are net of underlying mutual fund fees and expenses and gross of any advisory fees charged by model providers. Results would have been lower if such fees had been deducted. Results and results-based figures shown are preliminary and subject to change.

Investments are not FDIC–insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Advisory services offered through Capital Research and Management Company (CRMC) and its RIA affiliates.

Contribution to returns commentary is based on representative accounts of the model composites and is net of all fees and expenses applicable to the underlying funds and gross of any advisory fee charged by model providers. The net of fees composite results shown illustrate the impact of fees on the portfolio. Attribution for underlying ETFs is based on market price.

There may have been periods when the results lagged the index(es). Certain market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Model portfolios are subject to the risks associated with the underlying funds in the model portfolio. Investors should carefully consider investment objectives, risks, fees and expenses of the funds in the model portfolio, which are contained in the fund prospectuses. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Smaller company stocks entail additional risks, and they can fluctuate in price more than larger company stocks. The return of principal for bond bonds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Investments in mortgage-related securities involve additional risks, such as prepayment risk. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. A nondiversified fund has the ability to invest a larger percentage of assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor results by a single issuer could adversely affect fund results more than if the fund were invested in a larger number of issuers. See the applicable prospectus for details.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the portfolio's investment policies. Securities in the Unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with applicable investment policies.

For more information about the risks associated with each investment, go to its detailed information page or read the prospectus, if applicable.

Portfolios are managed, so holdings will change.

Model portfolios are provided to financial intermediaries who may or may not recommend them to clients. The portfolios consist of an allocation of funds for investors to consider and are not intended to be investment recommendations. The portfolios are asset allocations designed for individuals with different time horizons, investment objectives and risk profiles. Allocations may change and may not achieve investment objectives. If a cash allocation is not reflected in a model, the intermediary may choose to add one. Capital Group does not have investment discretion or authority over investment allocations in client accounts. Rebalancing approaches may differ depending on where the account is held. Investors should talk to their financial professional for information on other investment alternatives that may be available. In making investment decisions, investors should consider their other assets, income and investments. Visit capitalgroup.com for current allocations.

The underlying funds for each model portfolio as of September 30, 2025, are as follows (allocations may not equal 100% due to rounding):

American Funds Global Growth Model Portfolio: Growth (85%): New Perspective Fund 20%, SMALLCAP World Fund 15%, The Growth Fund of America 15%, The New Economy Fund 15%, EUPAC Fund* 8%, New World Fund 7%, American Funds Global Insight Fund 5%; Growth and income (15%): Capital World Growth and Income Fund 15%.

American Funds Growth Model Portfolio: Growth (80%): The Growth Fund of America 25%, AMCAP Fund 15%, New Perspective Fund 15%, SMALLCAP World Fund 15%, The New Economy Fund 10%; Growth and income (20%): Fundamental Investors 10%, The Investment Company of America 10%.

American Funds Moderate Growth Model Portfolio: Growth (45%): The Growth Fund of America 20%, AMCAP Fund 10%, SMALLCAP World Fund 10%, American Funds Global Insight Fund 5%; Growth and income (30%): Capital World Growth and Income Fund 15%, The Investment Company of America 10%, Fundamental Investors 5%; Balanced (25%): American Balanced Fund 13%, American Funds Global Balanced Fund 12%.

American Funds Growth and Income Model Portfolio: Growth (20%): SMALLCAP World Fund 8%, The Growth Fund of America 7%, American Funds Global Insight Fund 5%; Growth and income (45%): The Investment Company of America 20%, Capital World Growth and Income Fund 15%, Washington Mutual Investors Fund 10%; Equity Income (10%): Capital Income Builder 10%; Balanced (10%): American Balanced Fund 10%; Income (15%): The Bond Fund of America 5%, American Funds Strategic Bond Fund 5%, American Funds Multi-Sector Income Fund 5%.

American Funds Moderate Growth and Income Model Portfolio: Growth (10%): SMALLCAP World Fund 5%, New Perspective Fund 5%; Growth and income (25%): Washington Mutual Investors Fund 15%, Capital World Growth and Income Fund 10%; Equity income (10%): The Income Fund of America 10%; Balanced (40%): American Balanced Fund 25%, American Funds Global Balanced Fund 15%; Income (15%): The Bond Fund of America 5%, American Funds Strategic Bond Fund 5%, American Funds Multi-Sector Income Fund 5%.

American Funds Conservative Growth and Income Model Portfolio: Growth and income (27%): Washington Mutual Investors Fund 10%, American Mutual Fund 10%, Capital World Growth and Income Fund 7%; Equity Income (30%): Capital Income Builder 15%, The Income Fund of America 15%; Income (43%): American High-Income Trust 10%, American Funds Multi-Sector Income Fund 15%, The Bond Fund of America 15%, American Funds Emerging Markets Bond Fund 3%.

American Funds Conservative Income and Growth Model Portfolio: Growth and income (20%): American Mutual Fund 15%, Capital World Growth and Income Fund 5%; Equity income (10%): The Income Fund of America 10%; Balanced (15%): American Balanced Fund 10%, American Funds Global Balanced Fund 5%; Income (55%): The Bond Fund of America 19%, American Funds Multi-Sector Income Fund 14%, American Funds Strategic Bond Fund 10%, Intermediate Bond Fund of America 10%, American Funds Emerging Markets Bond Fund 2%.

American Funds Conservative Income Model Portfolio: Growth and income (10%): American Mutual Fund 10%; Equity income (10%): The Income Fund of America 10%; Balanced (5%): American Balanced Fund 5%; Income (75%): Intermediate Bond Fund of America 25%, The Bond Fund of America 20%, Short-Term Bond Fund of America 15%, American Funds Strategic Bond Fund 10%, American Funds Multi-Sector Income Fund 5%.

American Funds Preservation Model Portfolio: Income (100%): Short-Term Bond Fund of America 55%, Intermediate Bond Fund of America 45%.

American Funds Retirement Income Model Portfolio — Enhanced: Growth (5%): AMCAP Fund 5%; Growth and income (15%): Capital World Growth and Income Fund 10%, American Mutual Fund 5%; Equity Income (38%): The Income Fund of America 20%, Capital Income Builder 18%; Balanced (25%): American Balanced Fund 20%, American Funds Global Balanced Fund 5%; Income (17%): American Funds Multi-Sector Income Fund 7%, American High-Income Trust 5%, The Bond Fund of America 5%.

American Funds Retirement Income Model Portfolio — Moderate: Growth and income (12%): Capital World Growth and Income Fund 7%, American Mutual Fund 5%; Equity Income (38%): The Income Fund of America 20%, Capital Income Builder 18%; Balanced (20%): American Balanced Fund 15%, American Funds Global Balanced Fund 5%; Income (30%): American Funds Multi-Sector Income Fund 9%, The Bond Fund of America 8%, U.S. Government Securities Fund 7%, American Funds Strategic Bond Fund 6%.

American Funds Retirement Income Model Portfolio — Conservative: Growth and income (7%): American Mutual Fund 7%; Equity income (33%): Capital Income Builder 18%, The Income Fund of America 15%; Balanced (12%): American Balanced Fund 8%, American Funds Global Balanced Fund 4%; Income (48%): The Bond Fund of America 15%, American Funds Strategic Bond Fund 10%, American Funds Multi-Sector Income Fund 8%, American Funds Inflation Linked Bond Fund 5%, Intermediate Bond Fund of America 5%, U.S. Government Securities Fund 5%.

American Funds Tax-Aware Moderate Growth Model Portfolio: Growth (68%): CGGE - Capital Group Global Equity ETF 20%, CGGR - Capital Group Growth ETF 20%, CGGO - Capital Group Global Growth Equity ETF 12%, CGMM – Capital Group U.S. Small and Mid Cap ETF 10%, CGNG – Capital Group New Geography Equity ETF 6%; Growth and income (20%): CGUS – Capital Group Core Equity ETF 20%; Tax-exempt (12%): CGHM – Capital Group Municipal High-Income ETF 6%, CGMU – Capital Group Municipal Income ETF 6%.

American Funds Tax-Aware Growth and Income Model Portfolio: Growth (30%): CGGE – Capital Group Global Equity ETF 14%, CGGO – Capital Group Global Growth Equity ETF 8%, CGMM – Capital Group U.S. Small and Mid Cap ETF 5%, CGNG – Capital Group New Geography Equity ETF 3%; Growth and income (37%): CGUS – Capital Group Core Equity ETF 15%, CGDV – Capital Group Dividend Value ETF 15%, CGDG – Capital Group Dividend Growers ETF 7%; Tax-exempt (33%): CGHM – Capital Group Municipal High-Income ETF 18%, CGMU – Capital Group Municipal Income ETF 15%.

American Funds Tax-Aware Moderate Growth and Income Model Portfolio: Growth (30%): CGGE – Capital Group Global Equity ETF 14%, CGGO – Capital Group Global Growth Equity ETF 8%, CGMM – Capital Group U.S. Small and Mid Cap ETF 5%, CGNG – Capital Group New Geography Equity ETF 3%; Growth and income (37%): CGUS - Capital Group Core Equity ETF 15%, CGDV – Capital Group Dividend Value ETF 15%, CGDG — Capital Group Dividend Growers ETF 7%; Tax-exempt (33%): CGHM – Capital Group Municipal High-Income ETF 18%, CGMU — Capital Group Municipal Income ETF 15%.

American Funds Tax-Aware Conservative Growth and Income Model Portfolio: Growth (9%): CGGE –Capital Group Global Equity ETF 9%; Growth and income (41%): CGDV - Capital Group Dividend Value ETF 16%, CGDG – Capital Group Dividend Growers ETF 15%, CGCV – Capital Group Conservative Equity ETF 5%, CGUS – Capital Group Core Equity ETF 5%; Tax-exempt (50%): CGHM – Capital Group Municipal High-Income ETF 25%, CGMU – Capital Group Municipal Income ETF 21%, CGSM – Capital Group Short Duration Municipal Income ETF 4%.

American Funds Tax-Aware Moderate Income Model Portfolio: Growth (7%): CGGE – Capital Group Global Equity ETF 7%; Growth and income (30%): CGDV – Capital Group Dividend Value ETF 14%, CGDG - Capital Group Dividend Growers ETF 7%, CGCV – Capital Group Conservative Equity ETF 5%, CGUS – Capital Group Core Equity ETF 4%; Tax-exempt (63%): CGHM – Capital Group Municipal High-Income ETF 25%, CGMU – Capital Group Municipal Income ETF 25%, CGSM – Capital Group Short Duration Municipal Income ETF 13%.

American Funds Tax-Aware Conservative Income Model Portfolio: Growth and income (21%): CGCV – Capital Group Conservative Equity ETF 7%, CGDV – Capital Group Dividend Value ETF 6%, CGDG – Capital Group Dividend Growers ETF 5%, CGUS – Capital Group Core Equity ETF 3%; Tax-exempt (79%): CGSM – Capital Group Short Duration Municipal Income ETF 34%, CGMU – Capital Group Municipal Income ETF 30%, CGHM – Capital Group Municipal High-Income ETF 15%.

American Funds Tax-Exempt Preservation Model Portfolio: Tax-exempt (100%): Limited Term Tax-Exempt Bond Fund of America 40%, CGSM – Capital Group Short Duration Municipal Income ETF 30%, American Funds Short-Term Tax-Exempt Bond Fund 30%.

* Effective June 1, 2025, EuroPacific Growth Fund is now EUPAC Fund.

Model portfolio index/index blends

Index/Index blends for American Funds Model Portfolios are those that the Portfolio Solutions Committee believes most closely approximate the investment universe of a given model portfolio. The index/index blends do not specifically represent the benchmarks of the underlying funds in the American Funds model portfolio. The index/index blends for the model portfolios are a composite of the cumulative total returns for the indexes and respective weightings listed:

Global Growth — MSCI ACWI.

Growth — Index Blend: 75% S&P 500 and 25% MSCI ACWI ex USA indexes.

Moderate Growth — Index Blend: 60% S&P 500, 25% MSCI ACWI ex USA and 15% Bloomberg U.S. Aggregate indexes.

Growth and Income — Index Blend: 50% S&P 500, 25% MSCI ACWI ex USA and 25% Bloomberg U.S. Aggregate indexes.

Moderate Growth and Income — Index Blend: 45% S&P 500, 35% Bloomberg U.S. Aggregate and 20% MSCI ACWI ex USA indexes.

Conservative Growth and Income — Index Blend: 35% S&P 500, 35% Bloomberg U.S. Aggregate, 15% MSCI ACWI ex USA and 15% Bloomberg U.S. Corporate High Yield 2% Issuer Capped indexes.

Conservative Income and Growth — Index Blend: 65% Bloomberg U.S. Aggregate, 25% S&P 500 and 10% MSCI ACWI ex USA indexes.

Conservative Income — Index Blend: 50% Bloomberg U.S. Aggregate Index, 30% Bloomberg U.S. Government/Credit (1-3 years, ex BBB) and 20% S&P 500 indexes.

Preservation — Bloomberg 1-5 Years U.S. Government/Credit A+ Index.

Tax-Aware Moderate Growth — Index Blend — 60% S&P 500, 25% MSCI ACWI ex USA and 15% Bloomberg Municipal Bond indexes.

Tax-Aware Growth and Income — Index Blend: 50% S&P 500, 25% Bloomberg Municipal Bond and 25% MSCI ACWI ex USA indexes.

Tax-Aware Moderate Growth and Income — Index Blend: 45% S&P 500, 35% Bloomberg Municipal Bond and 20% MSCI ACWI ex USA indexes.

Tax-Aware Conservative Growth and Income — Index Blend: 35% Bloomberg Municipal Bond, 35% S&P 500, 15% Bloomberg High Yield Municipal and 15% MSCI ACWI ex USA indexes.

Tax-Aware Moderate Income — Index Blend: 65% Bloomberg Municipal Bond, 25% S&P 500 and 10% MSCI ACWI ex USA indexes.

Tax-Aware Conservative Income — Index Blend: 40% Bloomberg Municipal Bond, 40% Bloomberg Municipal Bond 1-7 Years Blend and 20% S&P 500 indexes.

Tax-Exempt Preservation — Bloomberg Municipal Bond 1-7 Years Blend.

Retirement Income — Enhanced — Index Blend: 45% S&P 500, 35% Bloomberg U.S. Aggregate and 20% MSCI ACWI ex USA indexes.

Retirement Income — Moderate — Index Blend: 50% Bloomberg U.S. Aggregate, 35% S&P 500 and 15% MSCI ACWI ex USA indexes.

Retirement Income — Conservative — Index Blend: 60% Bloomberg U.S. Aggregate, 30% S&P 500 and 10% MSCI ACWI ex USA indexes.

The index blends are rebalanced monthly. MSCI index results reflect dividends gross of withholding taxes through 12/31/00 and dividends net of withholding taxes thereafter. The indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. There have been periods when the model portfolio has lagged the index/index blend.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI All Country World ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non- investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg High Yield Municipal Bond Index is a market-value-weighted index composed of municipal bonds rated below BBB/Baa.

Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

Bloomberg U.S. Government/Credit 1-3 Years ex BBB Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to three years, excluding BBB-rated securities.

Bloomberg Municipal Bond 1-7 Year Blend Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to seven years.

Bloomberg 1-5 Year U.S. Government/Credit A+ Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to five years, including A- rated securities and above.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Capital market assumptions are long-term projections of the future performance of asset class returns based on their respective benchmark indexes or other proxies that incorporate analysis and observations. This analysis represents the views of a small group of investment professionals based on their individual research and are approved by the Capital Market Assumptions Oversight Committee. They should not be interpreted as the view of Capital Group as a whole. As Capital Group employs The Capital System, the views of other individual analysts and portfolio managers may differ from those presented here. They are provided for informational purposes only and are not intended to provide any assurance or promise of actual returns. They reflect long-term projections of asset class returns and are based on the respective benchmark indexes, or other proxies, and therefore do not include any outperformance gain or loss that may result from active portfolio management. Note that the actual results will be affected by any adjustments to the mix of asset classes. All market forecasts are subject to a wide margin of error.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only.