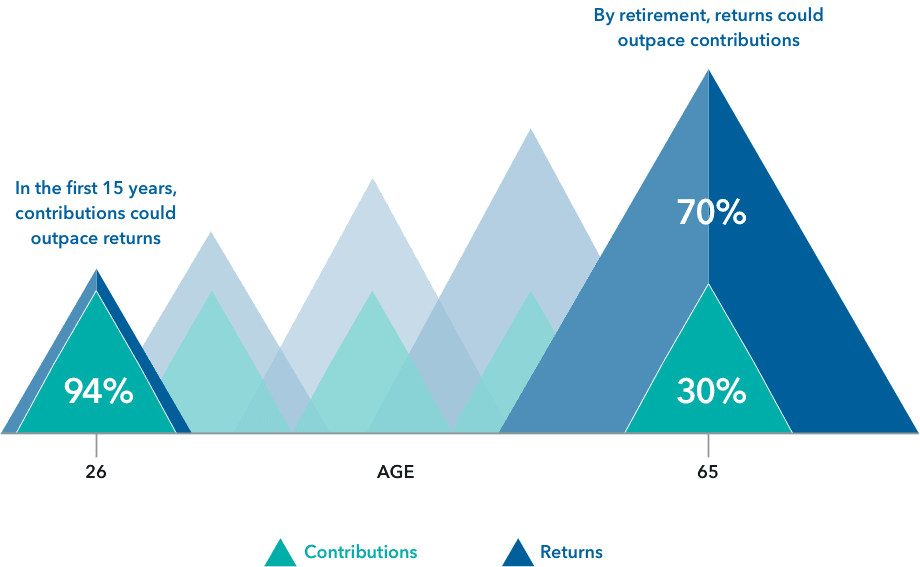

Our 70/30 hypothetical illustration shows how returns grow

By the time participants retire, as much as 70% of their account value could come from returns, not contributions.

The demographic assumptions, returns and ending balances are hypothetical and provided for illustrative purposes only, and are not intended to provide any assurance or promise of actual returns and outcomes. Returns will be affected by the management of the investments and any adjustments to the assumed contribution rates, salary or other participant demographic information. Actual results may be higher or lower than those shown. Based on an exhibit by CBS MoneyWatch.

It’s why investment selection matters

Share our 70/30 returns story with clients

Download and share a PDF of this hypothetical illustration

Contributions should work as hard as participants

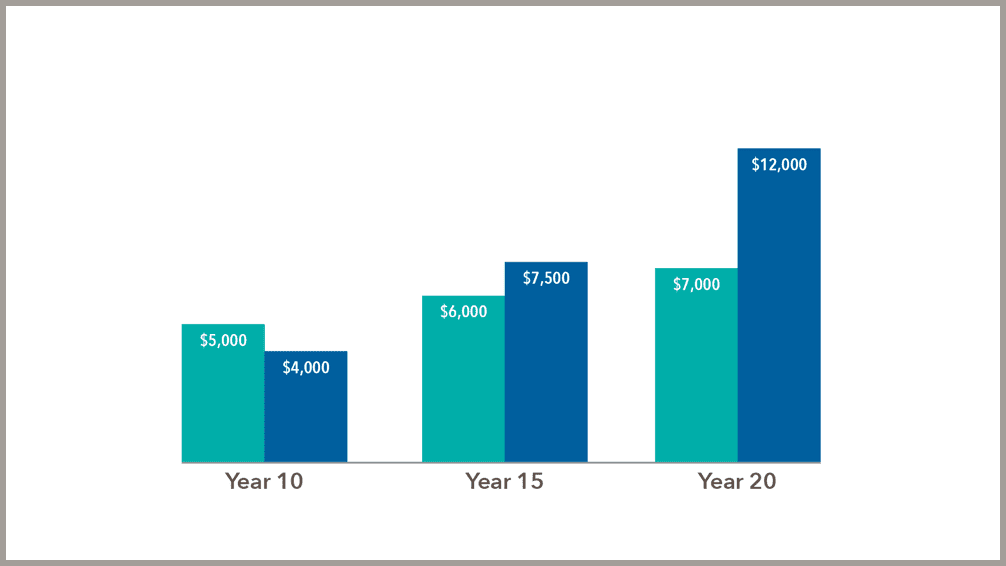

The following hypothetical example assumes a $40,000 starting salary with a 3% increase each year, and a 6% annual investment return.

The starting point

The participant contributes 10% of their income throughout their career starting at age 26

The turning point

The participant could earn an annual return of $7,500 in year 15, more than the $6,000 contribution that year

The retirement point

By age 65, the participant earning 6% could accrue about $1 million, with 70% of the account derived from returns

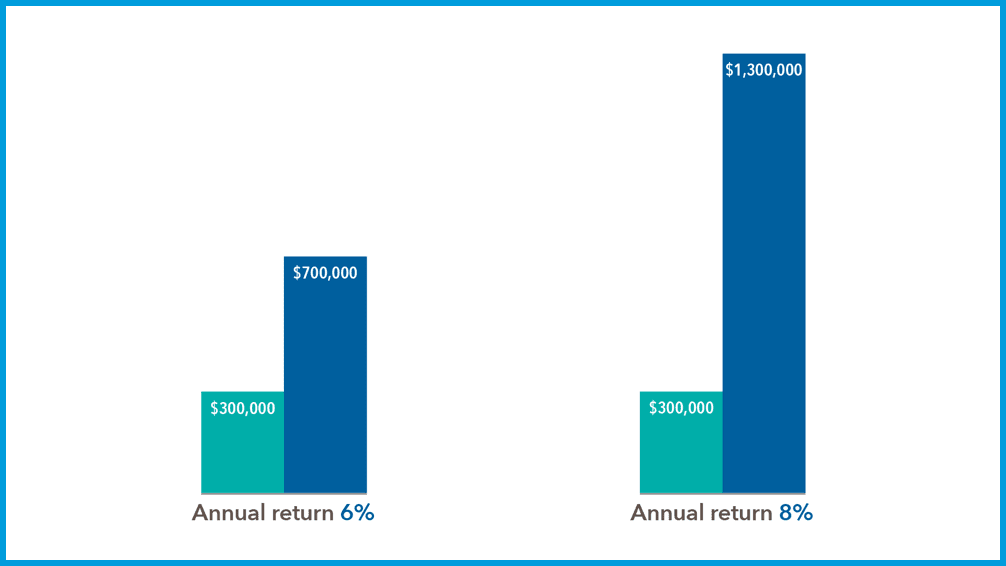

Earning 8%, returns could make up 81%, accruing $602,479 more — double the overall contribution

Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment. Your investment experience will differ.

Put choice of manager top of mind

The quality of the investments starts with who is managing them. Active managers that have a history

of beating market indexes may give participant contributions the biggest boost.

Reach Capital Group at

(800) 421-9900

See the impact

Learn how even a 1% increase in annual returns can significantly impact retirement outcomes

Evaluate target date series

Compare up to four target date funds using our Target Date ProView tool