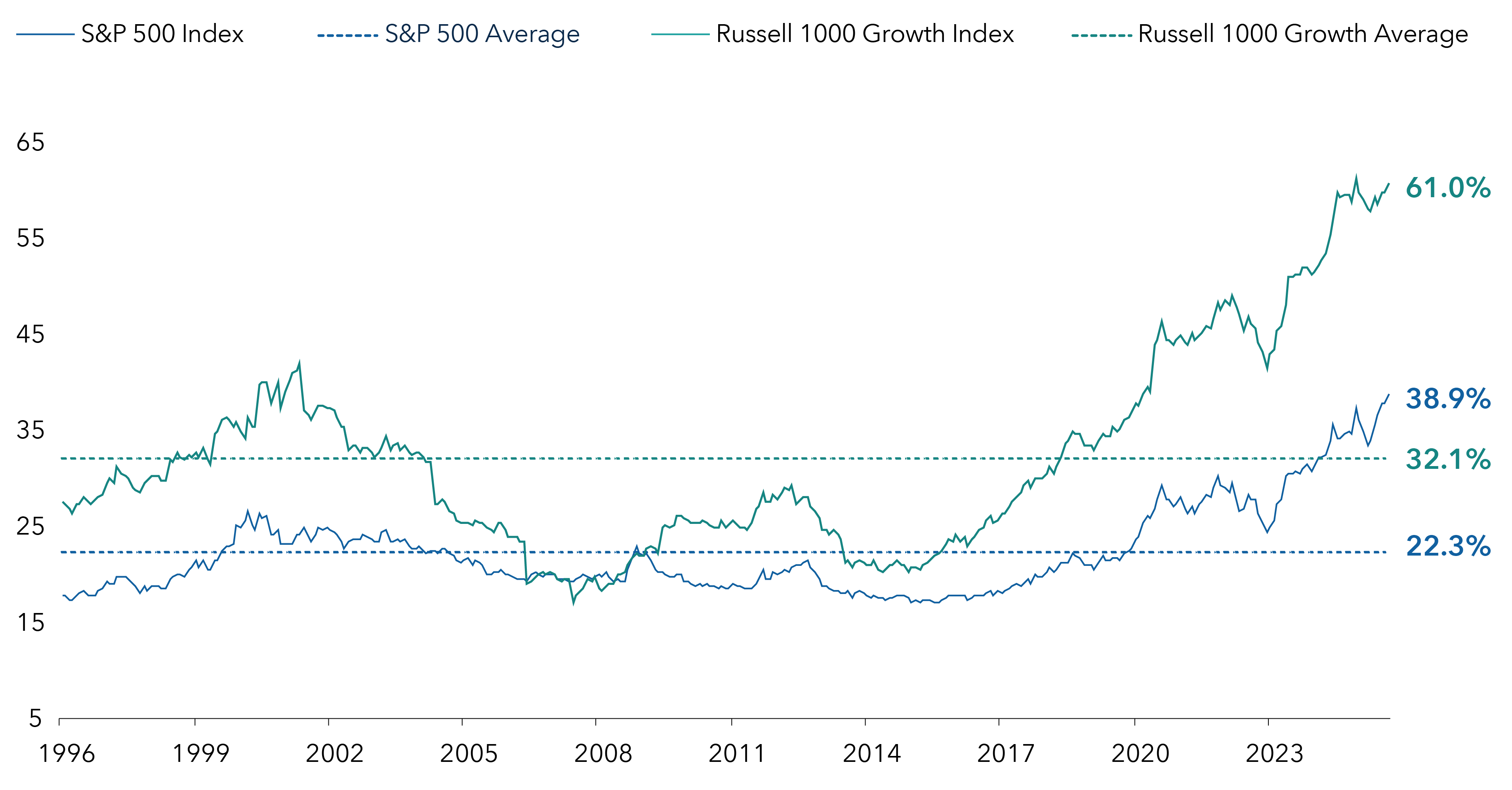

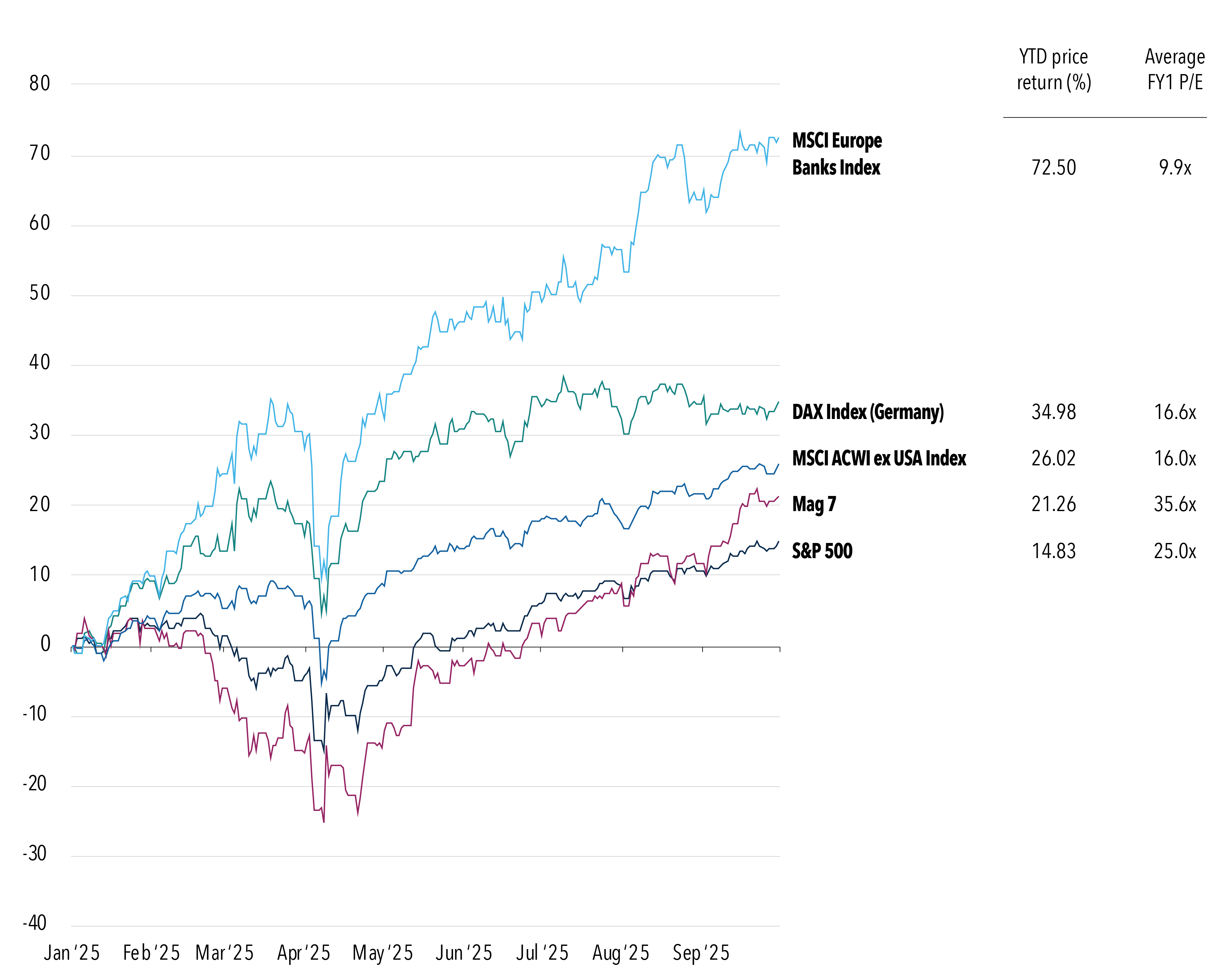

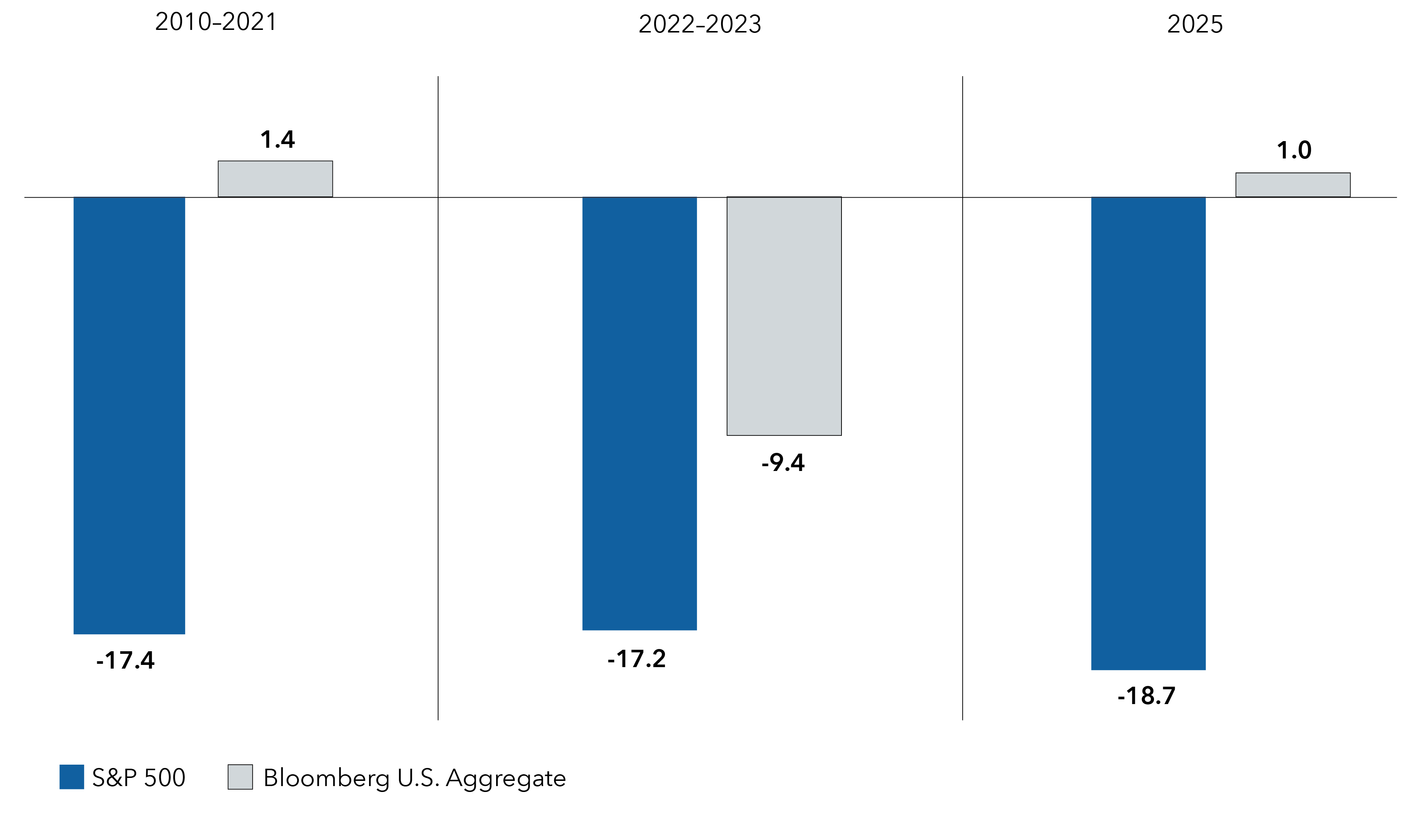

Managing downside risk is arguably even more important in today’s environment given the heightened level of economic uncertainty. U.S. equity markets have climbed amid high valuations, historically tight credit spreads and uncertain economic data. Meanwhile, U.S. passive indexes have become ever more concentrated in the “Magnificent 7.” Are advisors’ portfolios positioned to manage these risks while still pursuing growth?

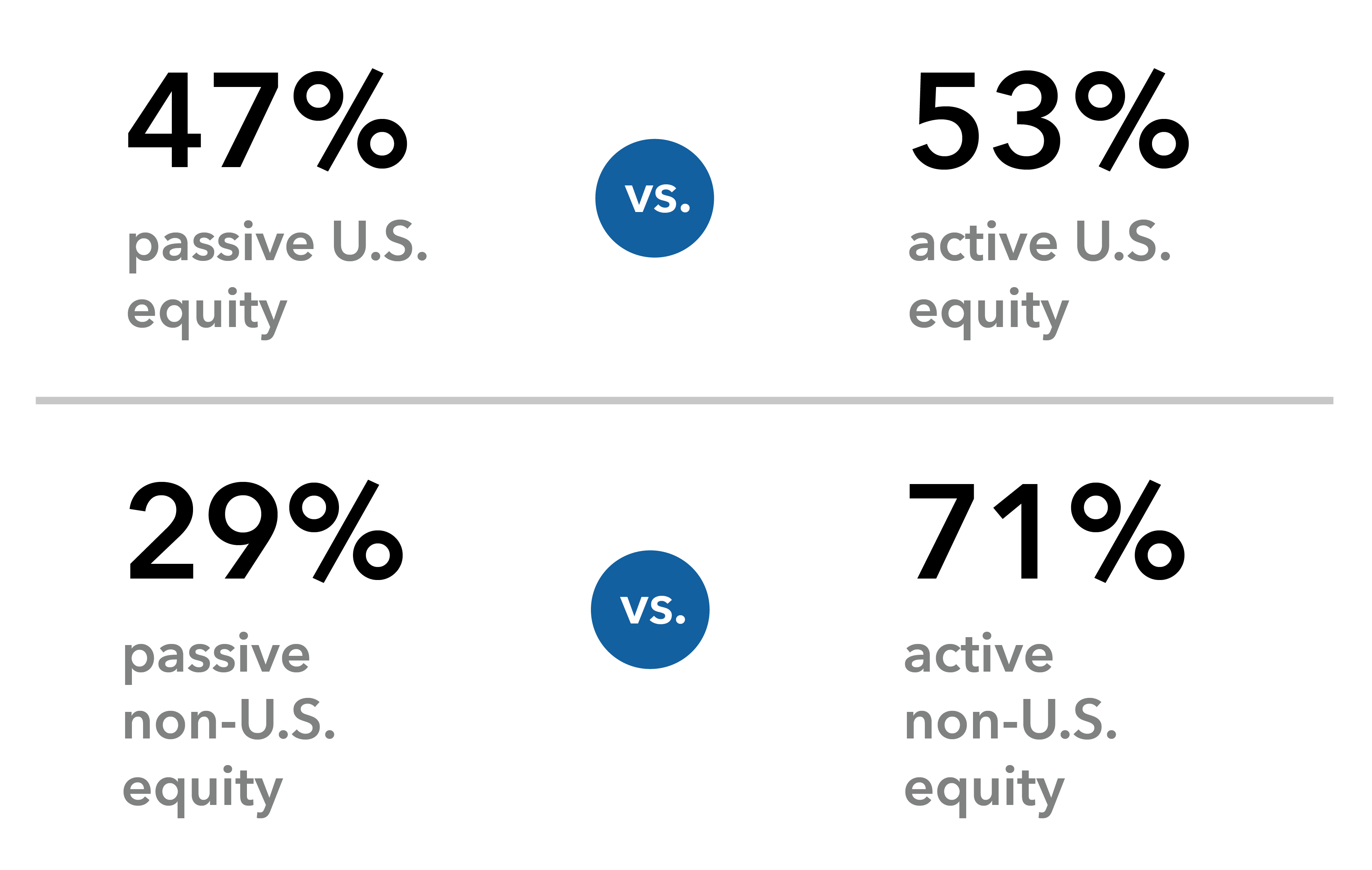

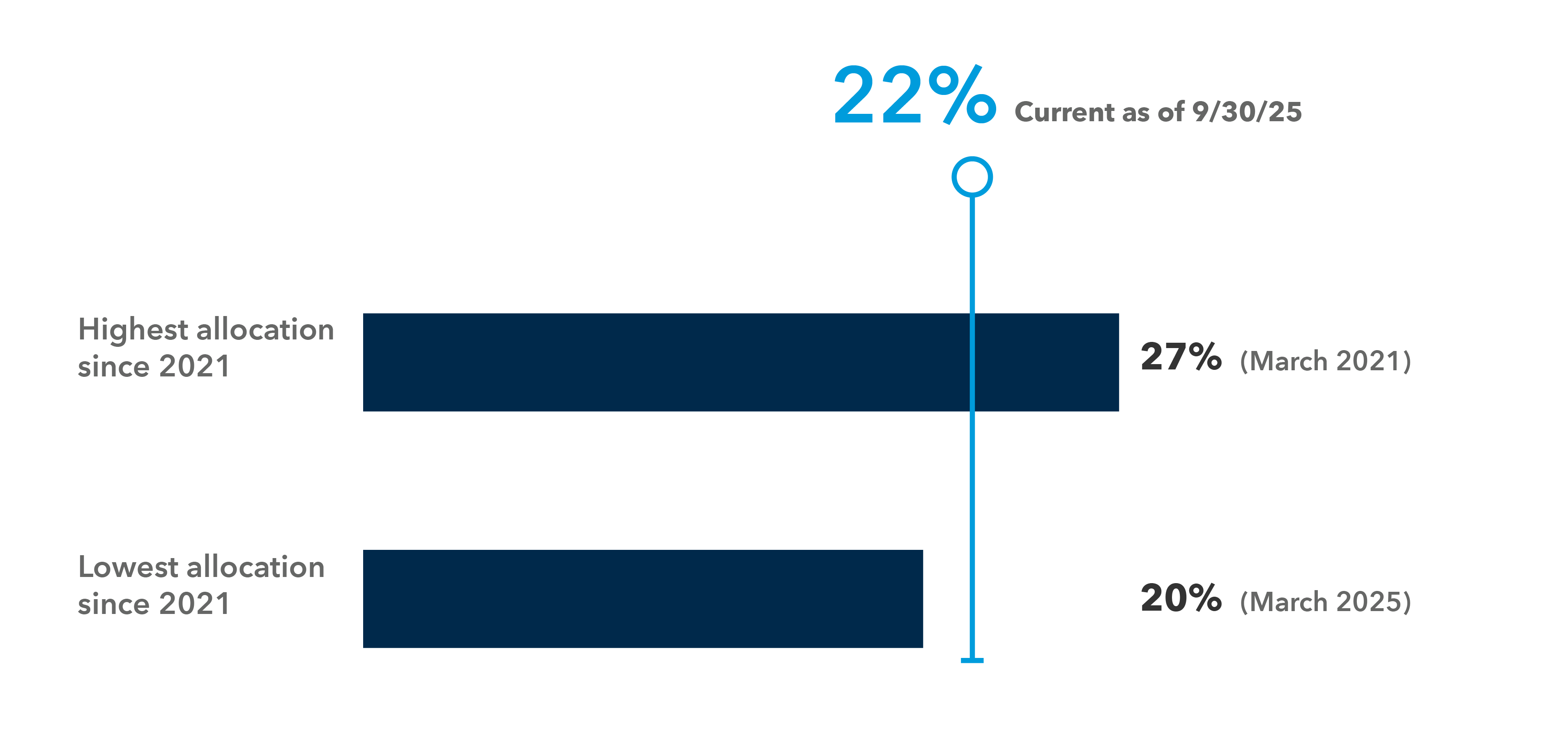

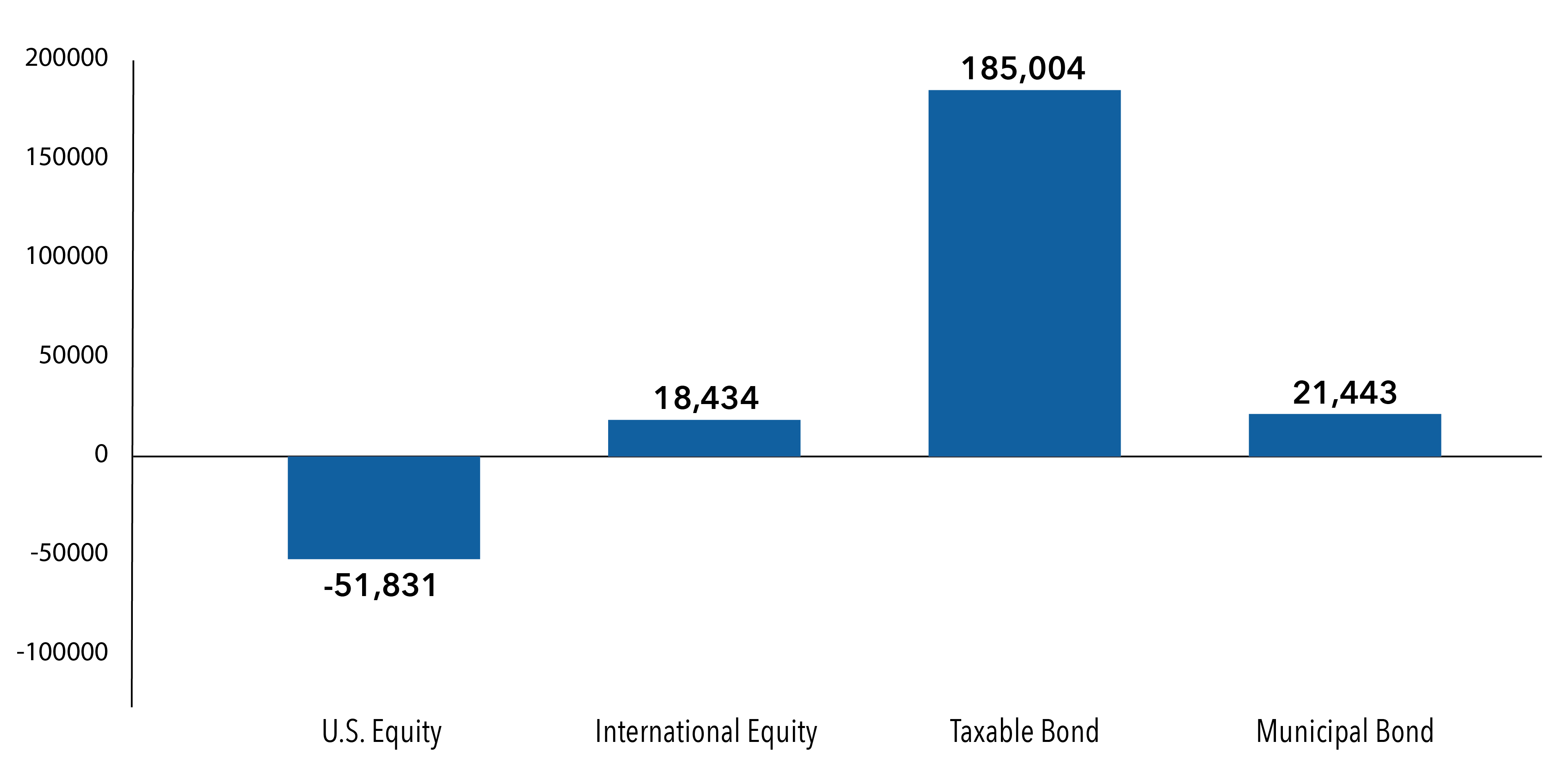

Our analysis of nearly 1,200 actual advisor portfolios for the quarter ending September 30, 2025, suggests that portfolios may have too much passive U.S. equity exposure, leaving them vulnerable to greater volatility and market downturns, while also missing out on potential opportunities to diversify both internationally and into other assets. Here are four trends we observed that argue for taking a more active posture in portfolios:

(The “Magnificent 7” are seven high-performing technology stocks comprised of: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla.)