Capital World Growth and Income Fund®

INCEPTION DATE

March 26, 1993

IMPLEMENTATION

Consider for a core global allocation

OBJECTIVE

Seeks to provide long-term growth of capital while providing current income

VEHICLE

Capital World Growth and Income Fund

A FLEXIBLE APPROACH

Seeking growth and income around the world

For more than 32 years, Capital World Growth and Income Fund has focused on finding well-established companies around the world that regularly pay dividends or have attractive growth prospects. This approach may lead to lower volatility and relative downside resilience. The fund has the flexibility to invest in companies with a variety of dividend yields across a diverse range of regions and sectors to accomplish its investment objective.

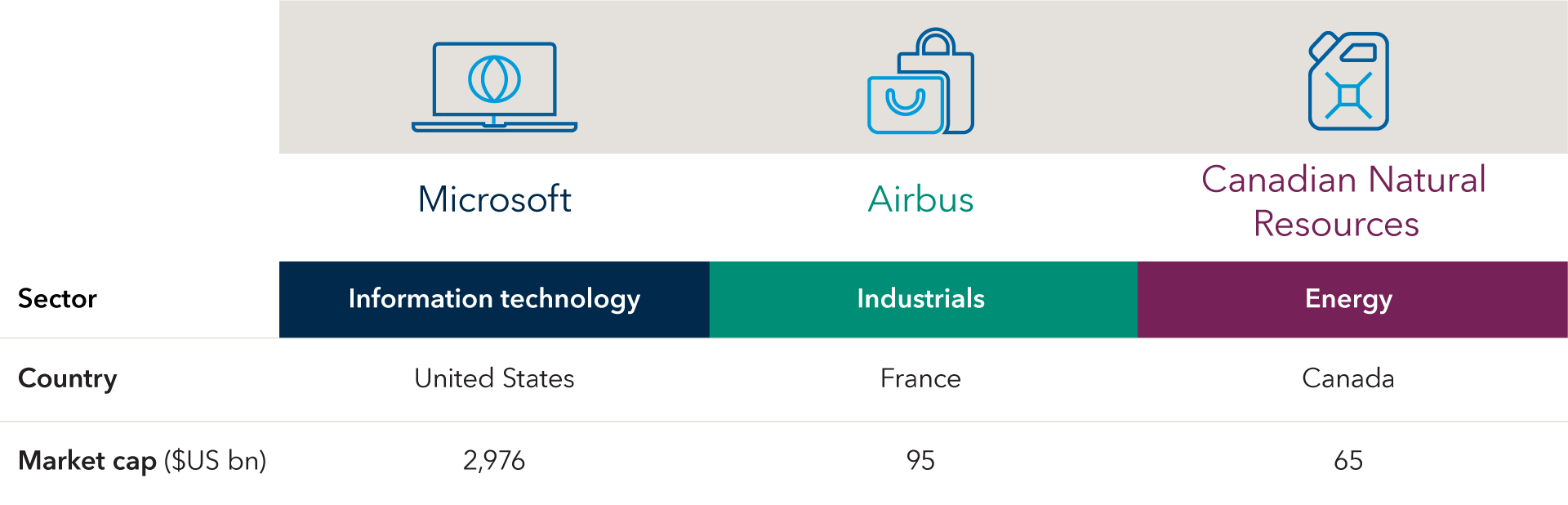

Identifying long-term leaders in a broad range of sectors

Examples of top holdings in the portfolio*

*Companies shown are among the top 20 holdings by weight in Capital World Growth and Income Fund as of 12/31/24 (Broadcom, Taiwan Semiconductor Manufacturing Company Limited, Microsoft, Alphabet, Apple, Amazon.com, Philip Morris International, Eli Lilly, Meta Platforms, NVIDIA, General Electric aka GE Aerospace, UnitedHealth Group, Abbott Laboratories, Airbus, Novo Nordisk, Vertex Pharmaceuticals, Canadian Natural Resources, Zurich, Home Depot, Trip.com Group).

Sources: Capital Group, FactSet. As of 12/31/24.