VOLATILITY WATCH

Keeping an eye on market volatility is essential

SCORECARD

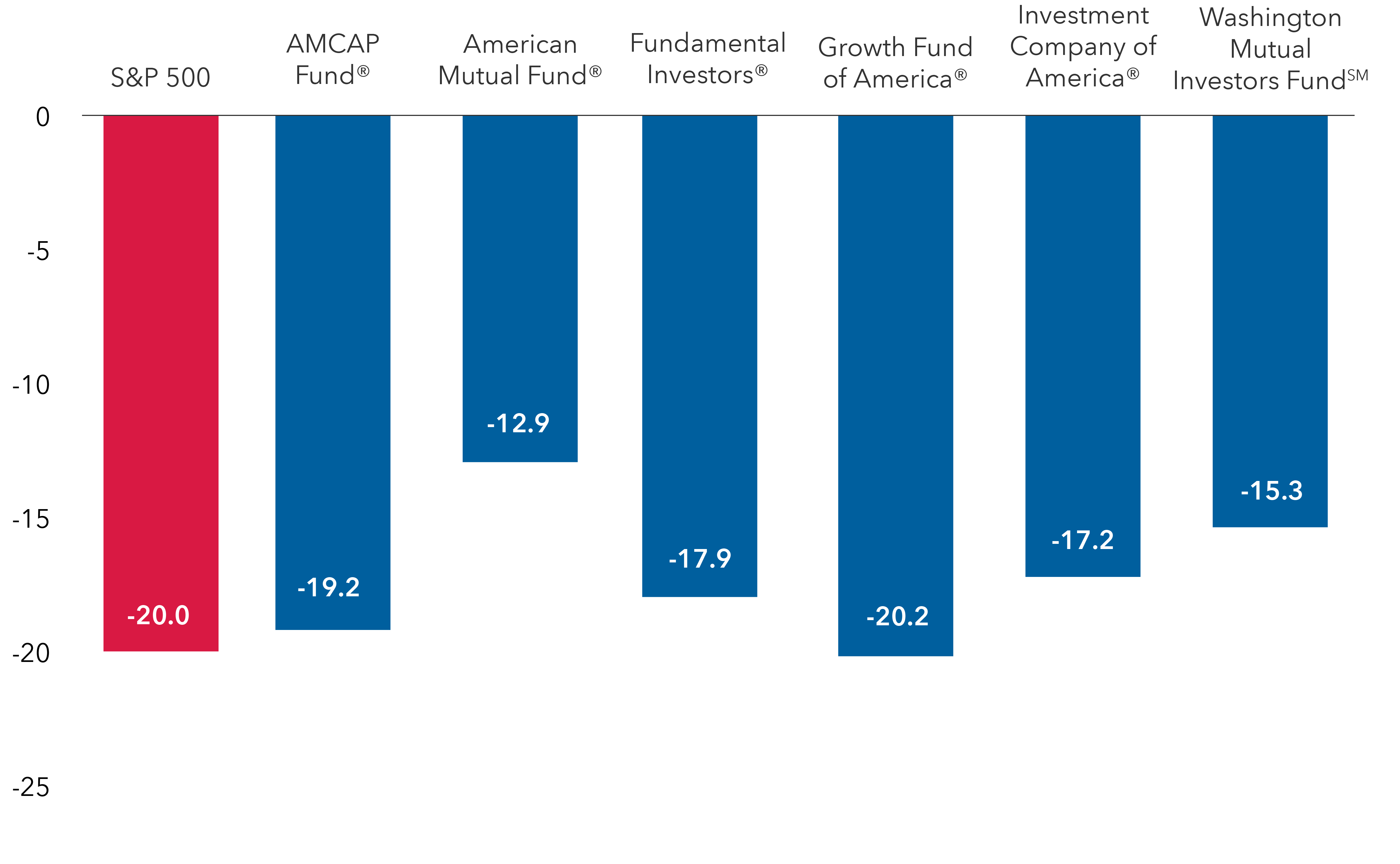

American Funds® results in the current downturn

While it can be nerve-wracking for clients to see investments drop in volatile markets, active management backed by deep, fundamental research can help preserve wealth during bad times. Importantly, focusing clients on their long-term goals can help them keep calm and avoid common mistakes.

Our U.S.-focused equity funds compared to the S&P 500

EXHIBIT DETAILS

- Cumulative returns for the current downturn, starting 02/19/2020 and ending xx/xx/2020

- Includes U.S.-focused equity funds benchmarked against the Standard & Poor's 500 Composite Index

- Class F-2 shares, net of all expenses

Source: Capital Group

Results for class F-2 shares as of 02/19/2020

Weathering volatile markets?

Act on insight not instinct. Help clients stay invested.

With market volatility, do you stay invested?

Help clients preserve wealth. Uncover The Capital Advantage®.

ROLLING RESULTS

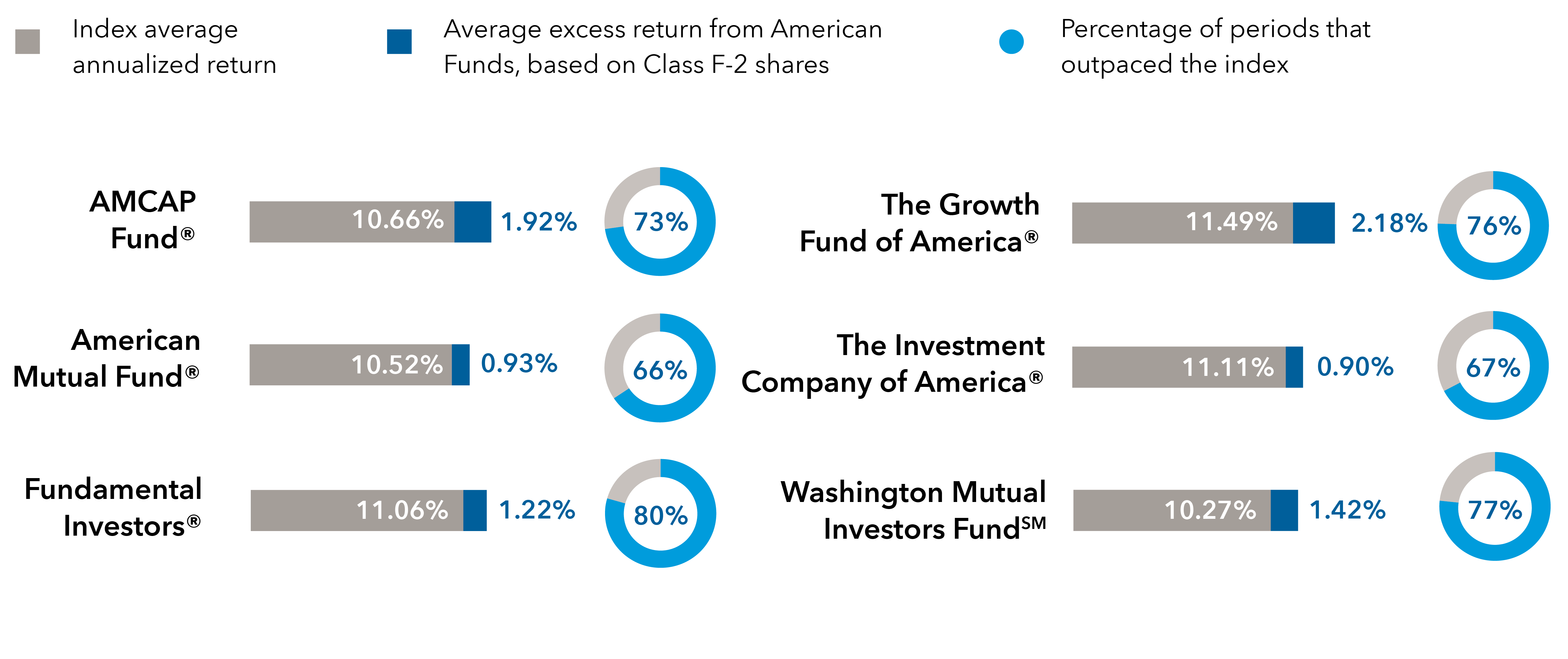

Staying invested is powerful

Keeping long-term results in mind can help your clients focus on their goals and understand that their investments have time to recover. Showing long-term rolling returns paints a fuller picture for your clients that may help overcome a single snapshot of a difficult period.

-

-

LIFETIME

Rolling results of our U.S.-focused equity funds

EXHIBIT DETAILS

- Monthly rolling 10-year periods starting from the fund inception date through 12/31/19

- Includes U.S.-focused equity funds benchmarked against the Standard & Poor's 500 Composite Index

- Class F-2 shares, net of all expenses

Source: Capital Group

Both fund and index annualized returns reflect the average of the average annual total returns for 10-year monthly rolling periods. Data from published sources were calculated internally. Fund returns, which are based on Class F-2 shares, are from the first month-end following each fund's inception date through December 31, 2019. Read more about the percentage of time the fund outpaced the index methodology and each fund's comparable index.

-

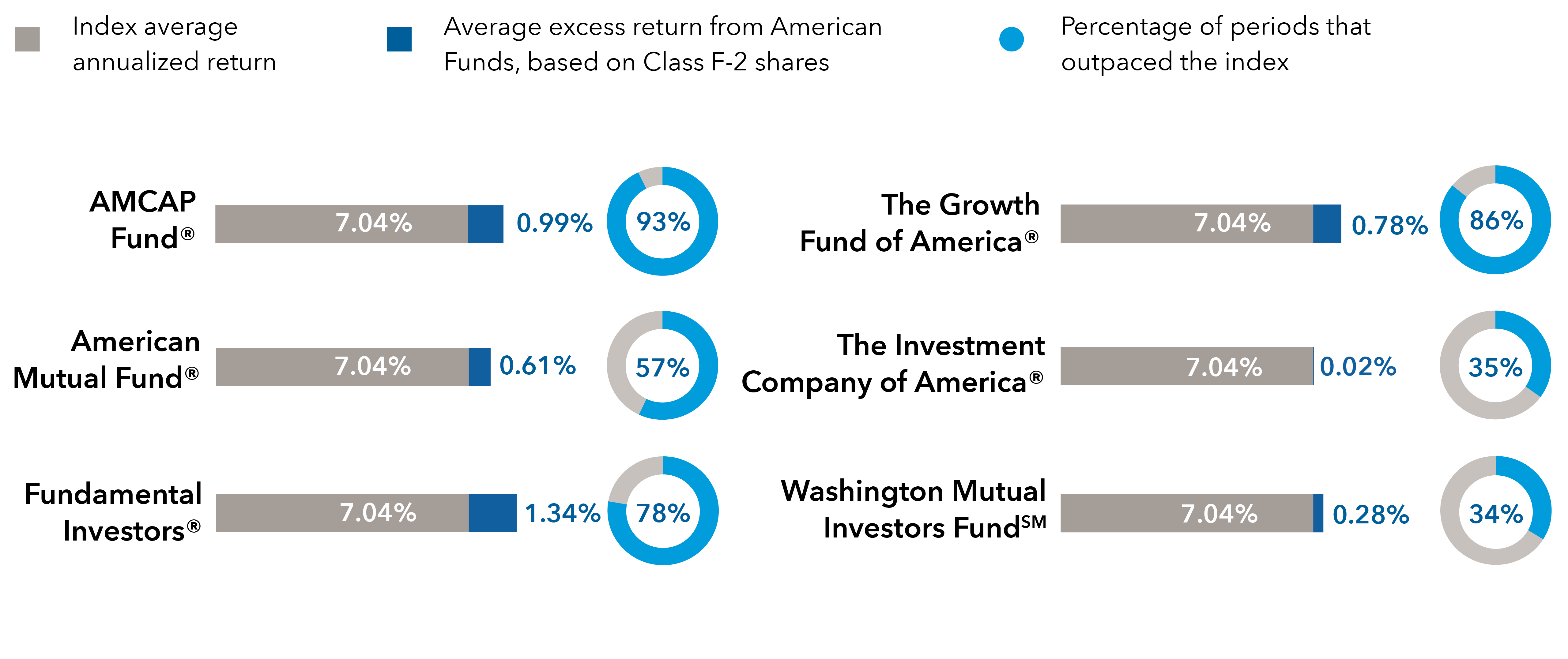

LAST 20 YEARS

Rolling results of our U.S.-focused equity funds

EXHIBIT DETAILS

- Monthly rolling 10-year periods starting from 12/31/99 through 12/31/2019

- Includes U.S.-focused equity funds benchmarked against the Standard & Poor's 500 Composite Index

- Class F-2 shares, net of all expenses

Source: Capital Group

Both fund and index annualized returns reflect the average of the average annual total returns for 10-year monthly rolling periods. Data from published sources were calculated internally. Fund returns, which are based on Class F-2 shares, are from the first month-end following the start date december 31, 1999, through December 31, 2019. Data are not shown for periods when funds were not in existence.

-

For financial professionals only. Not for use with the public.

METHODOLOGY: The 6 American Funds U.S. equity-focused funds used in our analysis (as compared to the Standard & Poor's 500) are measured from the following fund inception dates: AMCAP Fund 5/1/67, American Mutual Fund 2/21/50, Fundamental Investors 8/1/78, The Growth Fund of America 12/1/73, The Investment Company of America 1/1/34 and Washington Mutual Investors Fund 7/31/52.

Standard & Poor's 500 composite Index is a market capitalization-weighed index based on the average weighted results of approximately 500 widely held common stocks.

The S&P indexes are products of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Past results are not predictive of results in future periods.

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Share prices and returs will vary, so investors may lose money. Investing for short periods makes losses more likely. View fund expense ratios and returns.

Returns shown at net asset value (NAV) have all distributions reinvested.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which the results would have been lower. Read details about how waivers and/or reimbursements affect the results for each fund. View results and yields without fee waiver and/or expense reimbursement.

There may have been periods when the results lagged the index(s).

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Use fo this website is intended for U.S. residents only.

American Funds Distributors, Inc., member FINRA.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.