Long-Term Investing

Municipal Bonds

- Tax reform has boosted the popularity and usefulness of tax-exempt bonds in surprising ways.

- Municipal bonds are one of the best remaining tax-advantaged vehicles.

- A variety of muni strategies can help investors control their tax liabilities.

Changes brought by the Tax Cuts and Jobs Act of 2017, being felt for the first time as individuals prepare their 2018 returns, are turning municipal bonds into a sought-after asset class. As investors realize that tax-advantaged moves are harder to find under the new rules, municipal bonds may be their best bet.

“Everyone kind of had their heads in the sand last year as to what this tax law really meant,” says Marilyn Cohen of El Segundo, California-based Envision Capital Management, a firm known for its focus on municipal bonds with more than $400 million in assets under management. “Now reality is hitting them.”

Prices of municipal bonds are rising as buyers jump into the market. The Bloomberg Barclays Municipal Bond Index, which moves opposite of yield, is up more than 2% this year. Compare that with the roughly 1% decline for the same period in 2018.

Why all the muni madness? It’s a bit of a course correction from the initial impression that tax reform would hurt munis, which pay interest that’s generally tax exempt from federal (and sometimes state) taxes. Tax reform cut the top tax bracket to 37% from 39.6%, and business owners with pass-through income scored a tax break. It was logical to think that lower taxes for high net worth individuals could hurt the relative appeal of munis, especially for those in the very highest brackets.

In reality the opposite happened. Tax reforms took away several important deductions, most importantly capping the deductibility of state and local taxes at $10,000 annually. Meanwhile, the standard deduction doubled, meaning very few tax payers will still take advantage of itemized deductions. That leaves muni bonds as one of the last legitimate tax-advantaged vehicles for many investors.

“You can’t deduct as much as you once could,” explains Jeff Brooks, wealth strategist at Capital Group, home of American Funds. “That makes tax-exempt income strategies all the more appealing.”

That’s why many advisors building portfolios see even more relative value from munis. “We can look at REITs and preferreds and that kind of thing, but if [you] want to reduce taxable income, then munis are the way to go,” Cohen says.

To help investors asking about municipal bonds, we spoke with several financial advisors who we consider “muni masters” to learn their best strategies. Here are six ways investors can use munis to navigate the new tax law.

1. Put munis in the right place.

Clients often need both taxable and tax-exempt bonds in their portfolio. Knowing where to put them is a key role for the advisor, says James Frazier, managing director and CPA at Frazier Financial Advisors. After determining what a portfolio’s fixed income allocation should be, Frazier heavily weights taxable bonds in IRA accounts and the tax-exempt portion in non-IRA accounts. Treating municipal bonds separately and uniquely can give clients an opportunity for high-yield bond-type yields at a fraction of the risk.

Why treat munis as their own asset class? Taxes on taxable bonds held in an IRA can be controlled by deciding when to take distributions. As for the muni portion? Let’s say you have a client in the 37% tax bracket who also pays the 3.8% Medicare tax plus 5% state tax, Frazier explains. Adjusting for taxes, a state muni bond yielding 3% sees its tax-equivalent yield jump to nearly 6%. That’s the 3% yield divided by 1 minus the total tax rate as shown.

“We feel very comfortable using non-IRA money for the tax-exempt portion of client portfolios,” Frazier says.

2. Consider munis rather than cash, even in smaller accounts.

Darrell Pesek, director of the Ashcroft Pesek Group in Houston, finds a variation of this strategy can also be beneficial. A vast majority of the firm’s $2 billion in assets under management are held in ExxonMobil employees’ IRAs. Where municipal bonds come in is when clients receive large taxable distributions in the form of non-qualified pensions and executive compensation benefits at retirement. Sometimes this cash piles up after clients begin taking required minimum distributions at age 70½. Pesek uses municipal bonds as a way to drive higher yields than a savings account would offer, while controlling the tax impact.

He says municipals are solid choices even for clients not in the highest tax brackets. “You get a lot of bang for your buck on the muni side,” Pesek states.

3. Use munis to reduce taxable events during equity downturns.

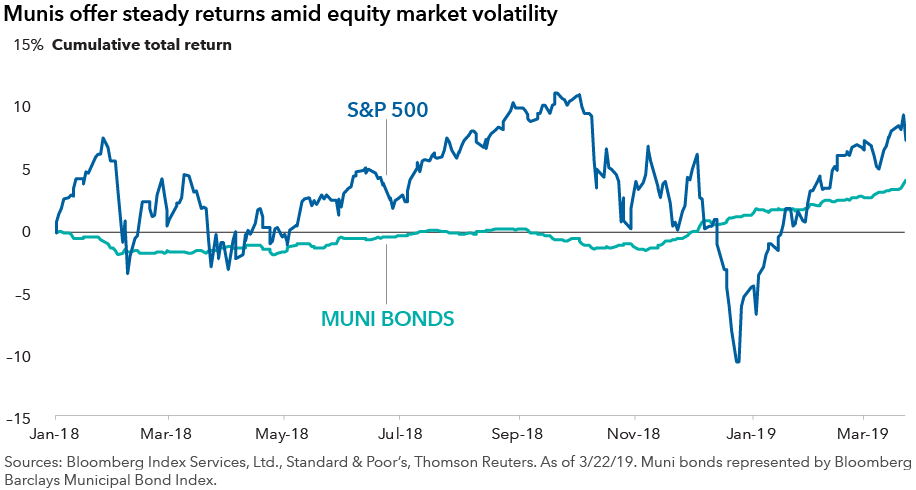

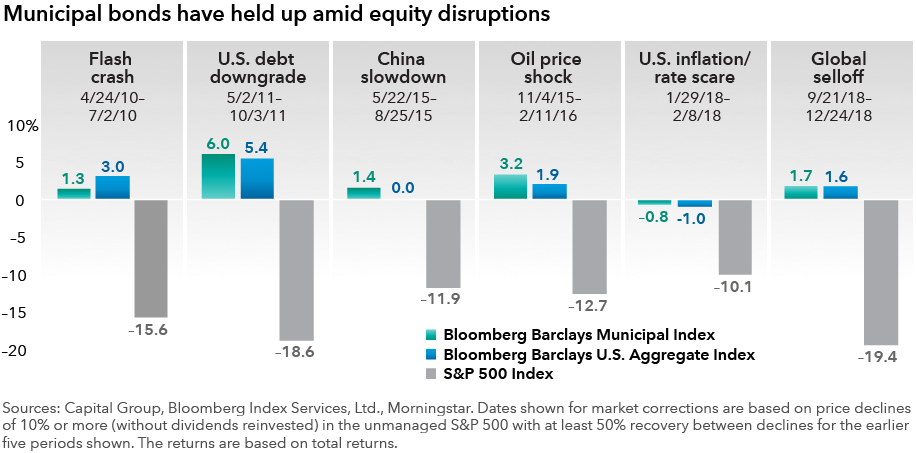

Munis can help temper client emotions, which offers a tangential — call it a behavioral — tax benefit. Because municipal bond prices have tended to move independently of stocks, a portfolio cushioned with munis will likely be less volatile during periods of market disruption.

When clients see a more tranquil overall portfolio, they may be less tempted to rashly sell stock holdings. In that way, muni bonds’ historically lower correlation with stocks can help to reduce taxable capital gains generated from emotionally selling during market volatility.

“[Munis have tended to be] less volatile, especially in corrections, so clients are more likely to stay the course and not sell out of equity positions,” Frazier adds.

4. Pay special attention to munis for trusts.

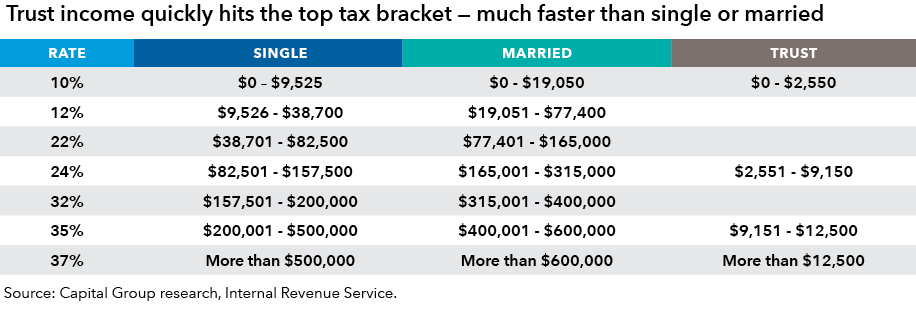

The tax rates for trusts ramp up quickly. For 2018 the highest 37% tax rate applied when the taxable income of a trust topped $12,500 (that 37% bracket income threshold rose to $12,750 in 2019). So holding tax-exempt municipal bonds in a trust, versus other taxable investments, can help lower taxable income and delay hitting the 37% rate, Frazier explains.

According to Brooks, these “compressed” tax brackets apply to retained income in non-grantor trusts. In other words, income in trusts responsible for paying their own taxes benefit from the tax-exempt aspect of muni bond income.

In some trusts the creator or “grantor” of the trust or the beneficiaries are responsible for the income tax liability generated by trust-earned income. There’s additional good news for munis in these trusts. Even if the grantor or beneficiary is responsible for paying income tax on trust-earned income, the “character” of that income — tax-exempt income in the case of municipal bonds — is retained. The income may be tax free no matter who the responsible taxpayer is.

5. Set investors' expectations about municipal bonds' tax powers.

It’s important for investors to understand that municipal bond funds can still incur taxes. The interest paid by municipal bond funds is typically tax exempt, but that’s not the case with capital gains. When funds sell municipal bonds it may incur a capital gain, which should be explained to investors in advance. “We see a lot of confusion [from clients],” says Frazier, adding that he believes it’s worth the trade-off.

Medicare premiums for investors aged 65 or older are another important consideration. These premiums are deducted monthly from Social Security payments based on adjusted gross income. But interest paid by municipal bonds is added back to income for Medicare premium calculation purposes — just as is the interest paid by taxable bonds. “Tax-exempt bonds are very favorable for income tax and Medicare tax purposes,” Frazier adds. “However, when it comes to your Medicare premium, [the interest] is added back in.”

It’s also important to note that income from certain municipal bonds — those typically used to fund private projects like stadiums — may still be taxable for taxpayers subject to the alternative minimum tax (AMT). But tax reform raised the AMT income thresholds, meaning fewer taxpayers will be subject to it. Income from municipal bonds can also increase how much of your Social Security benefit is taxable.

6. Don't let the tax tail wag the municipal bond dog.

There can be additional state tax benefits from buying in-state municipal bonds, but doing so can increase exposure to state-specific risks. To adjust, Frazier typically invests in funds that buy municipal bond securities issued by multiple states.

“Diversification is primary. Tax savings is secondary,” he says. “Tax is not the only driver.”

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

Our latest insights

Related Insights

-

Municipal Bonds

-

Municipal Bonds

-

Municipal Bonds

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Jeffrey Brooks

Jeffrey Brooks