Past results are not predictive of results in future periods.

There have been periods when the results lagged the index(es) and/or average(s). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

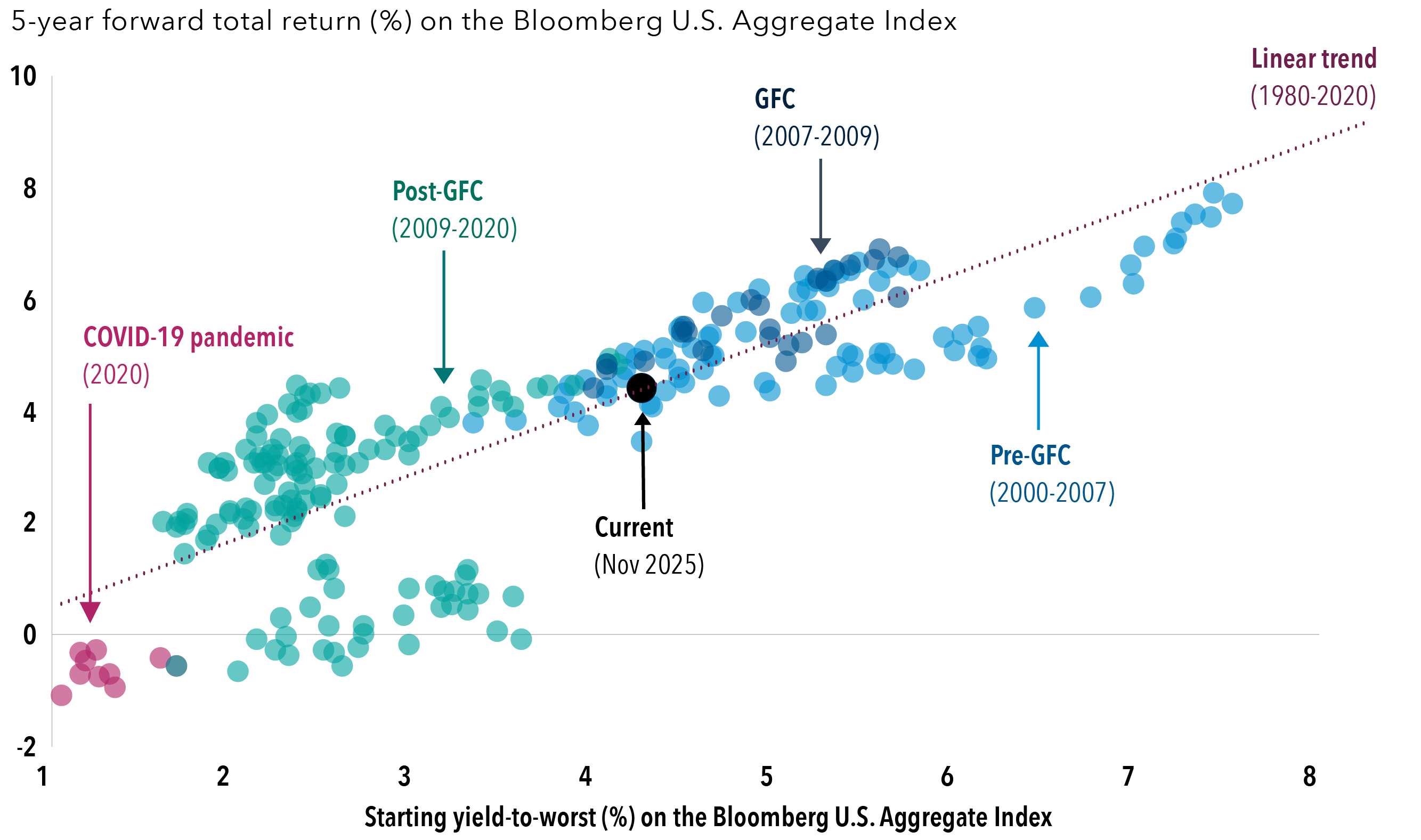

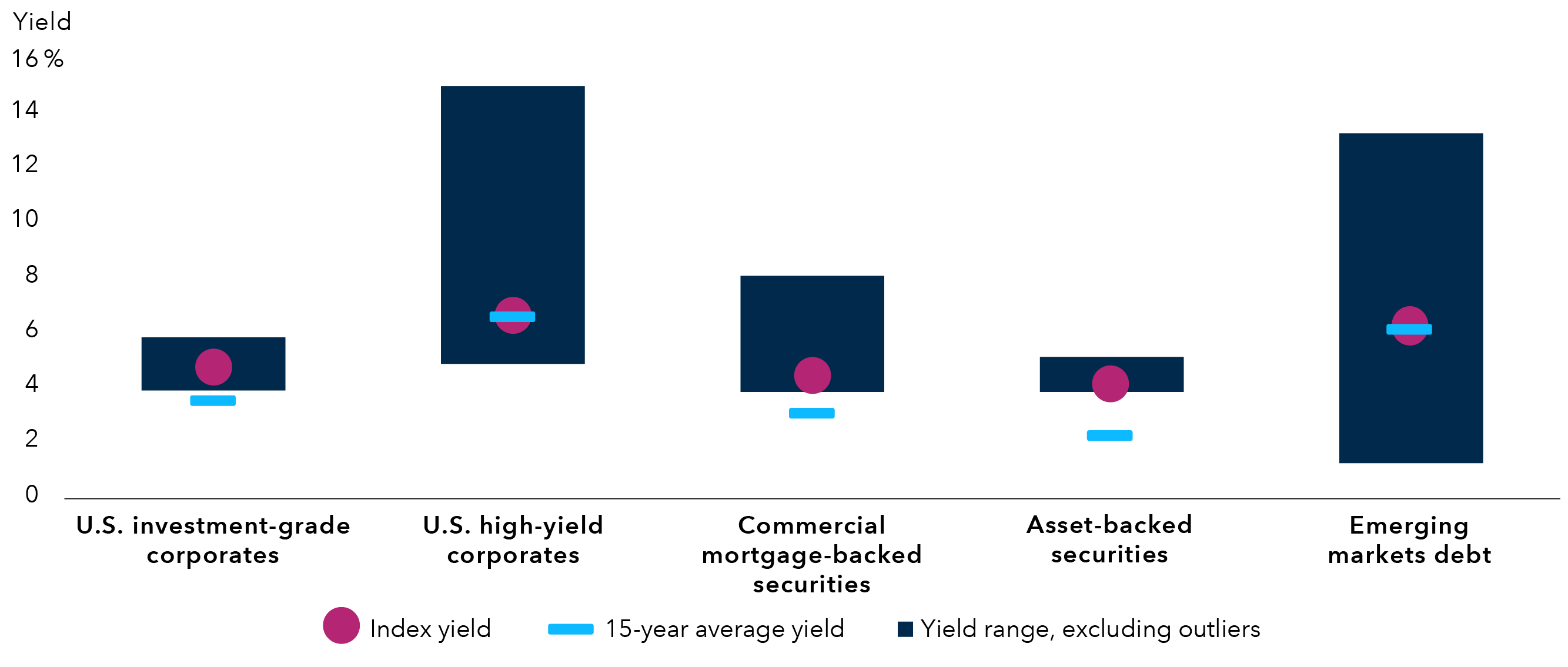

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

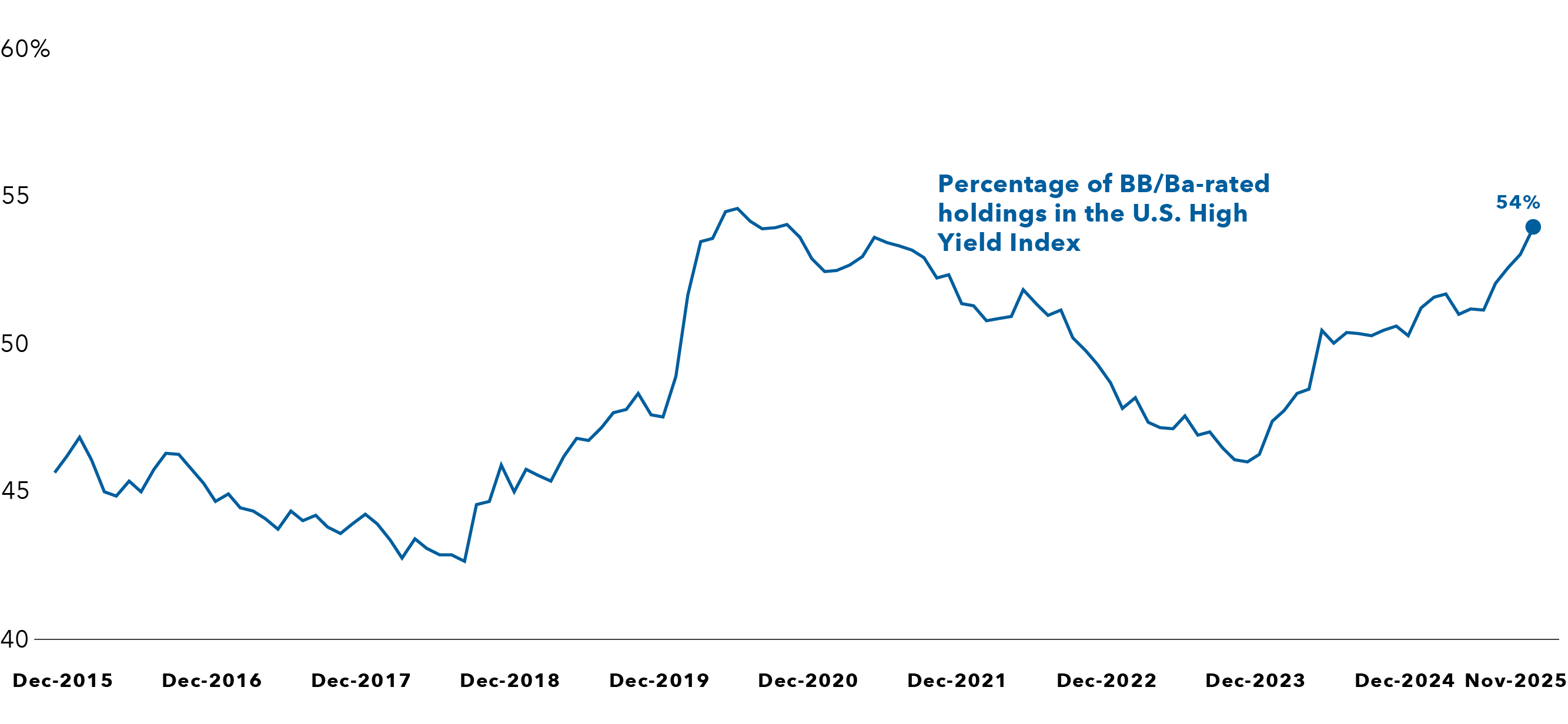

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements.

Bloomberg CMBS Index represents the universe of U.S. commercial mortgage-backed securities.

Bloomberg ABS Index represents the universe of U.S. asset-backed securities.

JP Morgan Government Bond Index – Emerging Markets (GBI-EM) Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

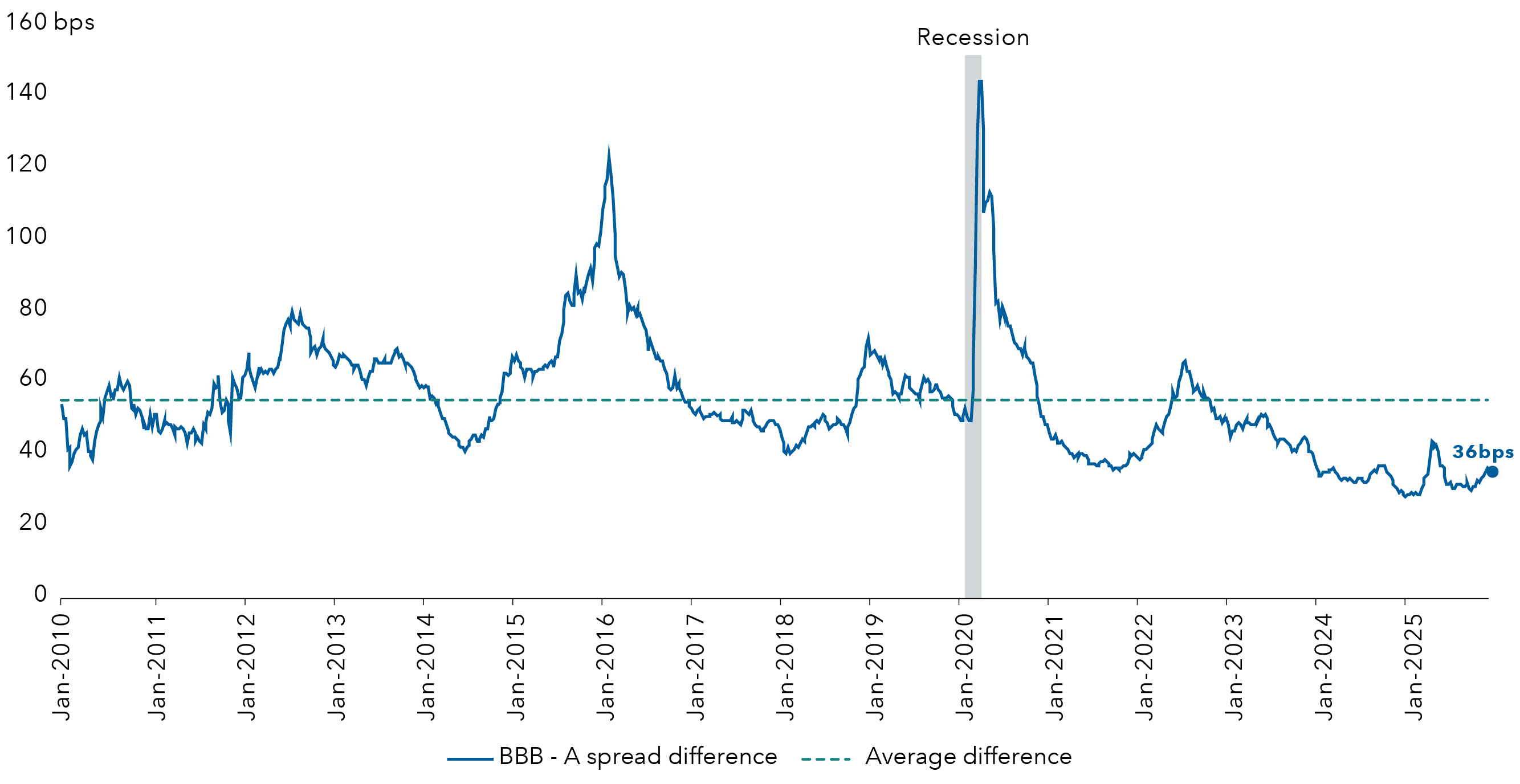

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

A spread over Treasuries is the difference between the yield of a bond and the yield of a similar maturity Treasury bond.

Duration measures a bond’s sensitivity to changes in interest rates. Generally speaking, a bond's price will go up 1% for every year of duration if interest rates fall by 1% or down 1% for every year of duration if interest rates rise by 1%.

Stagflation is an economic condition characterized by slowing economic growth, high unemployment and rising prices that occur simultaneously.

Carry refers to the income or cost from holding an investment.

Risk-off environment refers to a market environment where investors prioritize the preservation of capital over seeking higher returns, usually due to heightened economic concerns or uncertainty.

Alpha is a measure of an investment's performance that indicates its ability to generate returns in excess of its benchmark.