Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility.

Fiat currency is a national currency that is not pegged to the price of a commodity such as gold or silver.

The London Bullion Market Association (LBMA) is the international trade association that represents the over the counter (OTC) gold and silver bullion market. This market encompasses trading and refining physical precious metals, primarily gold and silver, but also extends to other precious metals like platinum and palladium.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

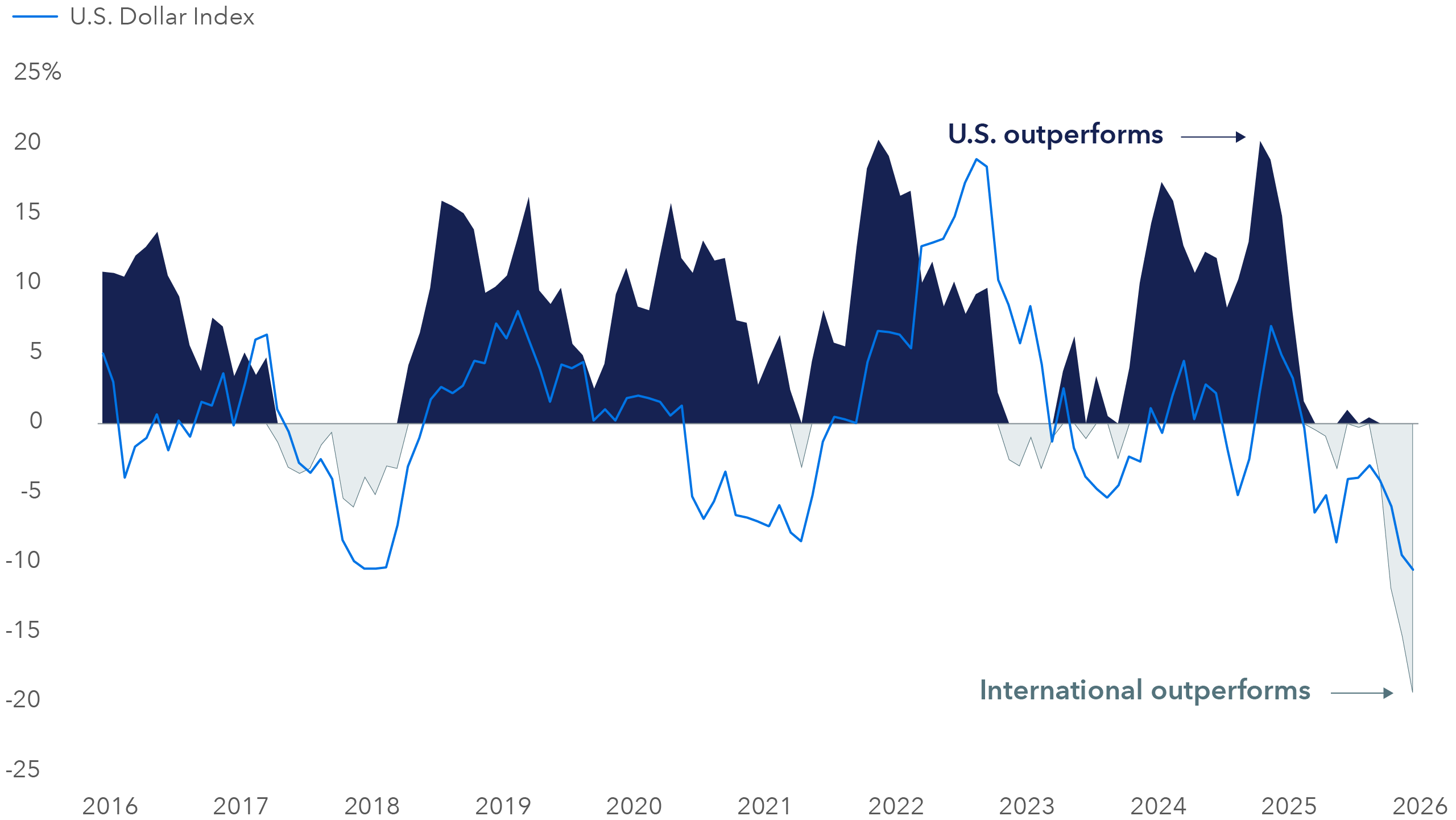

MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the performance of the large- and mid-cap segments of the U.S. market.

MSCI All Country World ex USA Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

MSCI Europe Banks Index is composed of large- and mid-cap stocks across Developed Markets countries in Europe. All securities in the index are classified in the Banks industry group (within the financials sector) according to the Global Industry Classification Standards (GICS®).

U.S. Dollar Index is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

S&P GSCI Industrial Metals Index provides investors with a reliable and publicly available benchmark for investment performance in the industrial metals market.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The S&P 500 Index and S&P GSCI Metals Index are products of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.