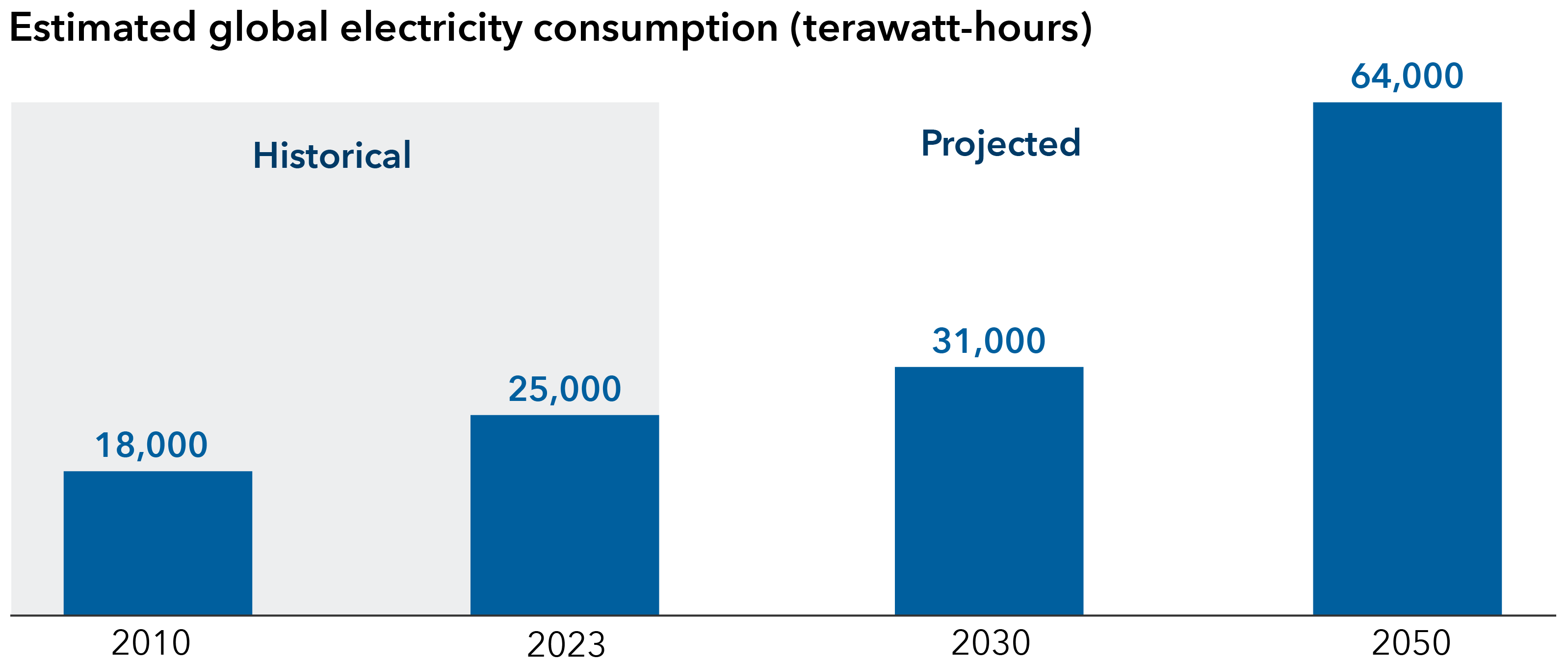

If there is any one element that underpins the development of artificial intelligence and reindustrialization of America, it might be electric power.

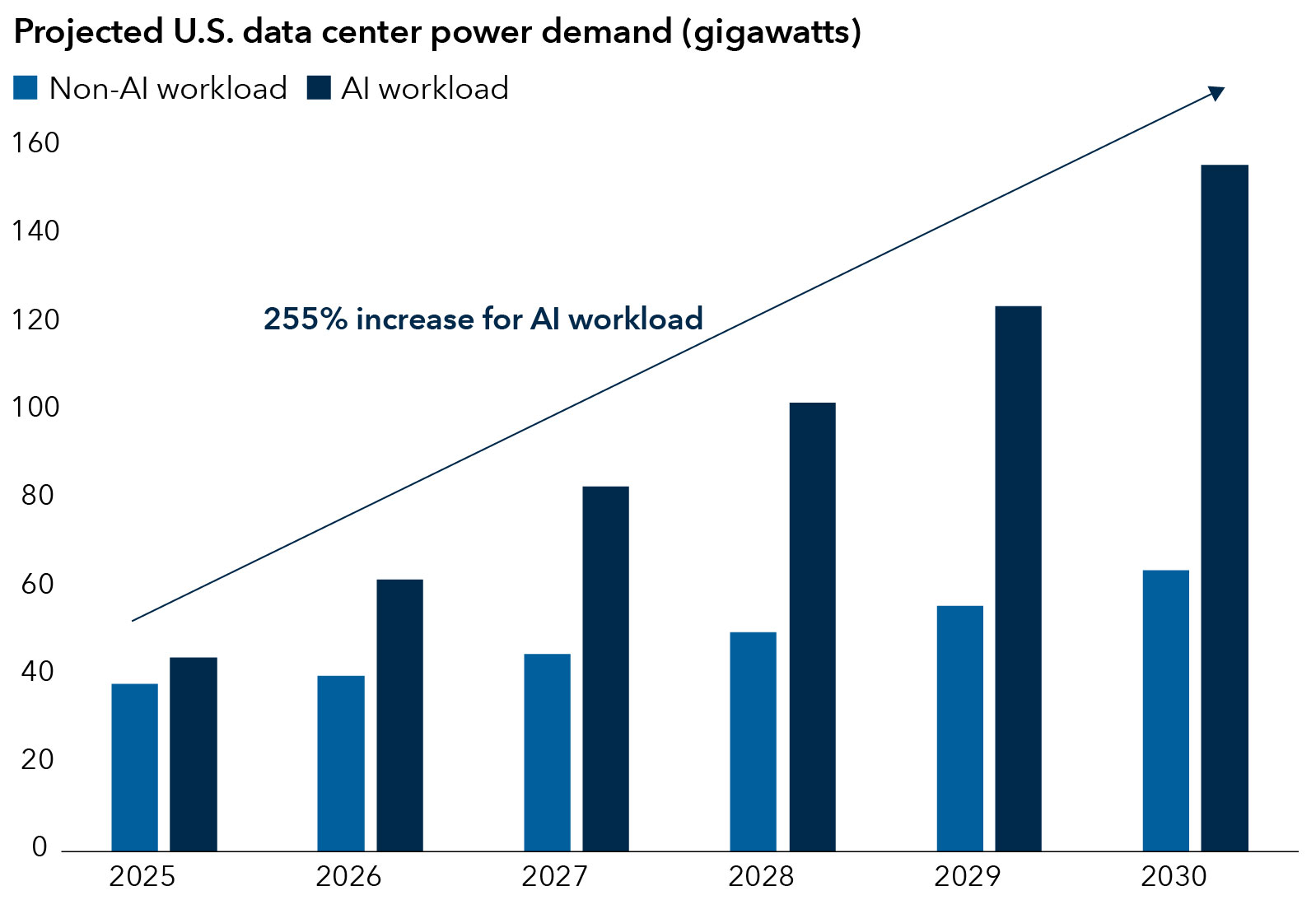

Power demand in the U.S. is set to surge over the next decade, driven by rapid expansion of AI data centers, new manufacturing facilities and electric vehicle networks. Take data centers, which account for about 4% of U.S. electricity use, with estimates suggesting that figure could climb to 9–14% by 2030.

Overall, what’s unfolding is a fundamental shift for the power industry, which has undergone a decade of stagnant consumption. Power providers are transforming into critical enablers of growth as technology giants and others race to secure more energy.

U.S. power markets will experience accelerating demand and structural constraints limiting supply. This will offer a spectrum of potential investment opportunities.