Chronic metabolic diseases are arguably the greatest public health burden of this generation. Obesity, along with diabetes and kidney, liver and cardiovascular diseases, are some of the most common chronic metabolic diseases. Globally, over 650 million people are clinically obese and around 2 billion are considered overweight.1 For adults, the World Health Organization (WHO) defines obese as a body mass index (BMI) of 30 or over and overweight as a BMI of 25 or over.

February 14, 2023

Global obesity rates are steadily rising

.png)

.png)

Source: World Health Organization (WHO). Data as of 2016 (published in 2021).

More than 5 million people are estimated to die each year from diseases linked to obesity, according to 2019 Global Burden of Disease data.2 Meanwhile, obesity rates continue to grow in adults and children: From 1975 to 2016, the prevalence of overweight or obese children and adolescents aged five to 19 increased more than fourfold, from 4% to 18% globally.3

Obesity is associated with a range of medical issues (including heart disease, stroke, various forms of cancer and diabetes, as well as severe COVID-19 outcomes) that can have a significant economic impact on health care systems and society. The Centers for Disease Control and Prevention (CDC) estimates annual obesity-related medical costs in the U.S. were nearly $173 billion as of 2019, and nationwide productivity costs of obesity-related absenteeism range from $3.38 billion to $6.38 billion annually.4

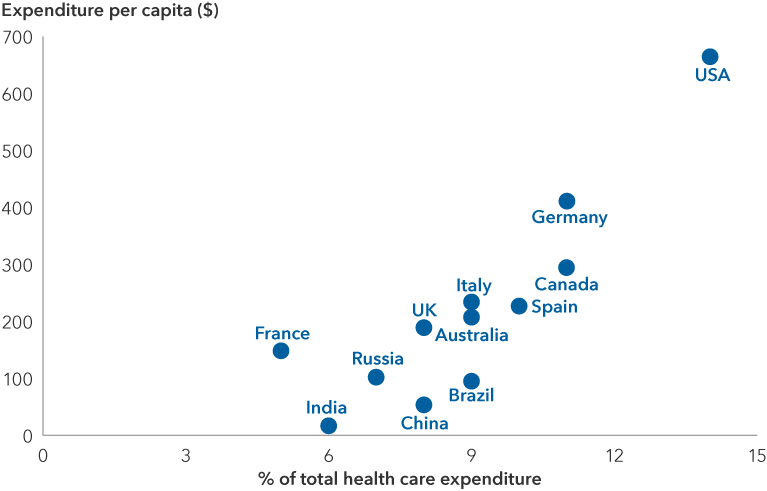

Expected obesity-related health care spending through 2050

Source: Organization for Economic Co-operation and Development (OECD). Expected annual obesity-related health expenditure per capita (based on current trends) between 2020 and 2050. U.S. dollars at purchasing power parity. Purchasing power parity is the rate of currency conversion that attempts to equalize the purchasing power of different currencies by eliminating the differences in price levels between countries. Health expenditure measures the final consumption of health care goods and services for personal health care including curative care, rehabilitative care, preventative care, ancillary services and medical goods but not long-term care

Despite these economic consequences, there has been little headway in helping reduce obesity levels globally. Existing drug options have had limited long-term success and a range of negative side effects. Treatments such as bariatric surgery have been more effective in terms of weight loss, but they are invasive and available to fewer people due to risks and potential complications.

Compounding this is an institutional and societal bias against overweight people. Doctors can end up stigmatizing patients, making them more reluctant to seek treatment, and society at large has tended to view obesity as a lifestyle, character or behavioral issue rather than a medical one.

Greater understanding of obesity’s root causes, however, and the shift to classify it as a chronic disease are driving new research into developing treatments, including a range of next-generation medications to manage weight. New research from Morgan Stanley suggests the market for obesity treatment could climb above $54 billion by 2030, with treatment for high blood pressure a precedent, having gone from a nascent therapy category in the 1980s to a $30 billion market in the 1990s.5

A new generation of drugs

Drug innovations aimed at helping obese adults manage their weight are coming to market, led by Danish multinational Novo Nordisk (Nordisk) and U.S.-based Eli Lilly (Lilly).

Just over a year ago, Nordisk launched a new drug, Wegovy®, for chronic weight management in adults. The weekly injection, which mimics naturally occurring hormones that help people feel full after eating, is part of a drug class already approved and used in the U.S. to treat Type 2 diabetes.

Wegovy potentially solves the two biggest problems with previous generations of obesity medications: efficacy and safety. In a clinical trial that lasted 68 weeks, average weight loss achieved by participants was 15%6 with tolerable side effects. Given strong demand since its launch, Nordisk announced new medium-term guidance ($3.7 billion in total obesity drug sales by 2025) that is nearly double what it indicated in 2019.7

Importantly, the company has also reported strong commercial reimbursement in the U.S. with nearly 70% access secured through pharmacy benefits managers and 50% of employers opting in so far.8 While government plans do not yet reimburse the drug, Nordisk’s clinical trials may soon provide evidence that weight loss with Wegovy leads to a reduction in risk for various cardiovascular problems. This could open the door to wider reimbursement, including through Medicare and Medicaid.

Meanwhile, Lilly has also delivered promising data for its injectable high dose treatment. In a 72-week trial, the company’s drug tirzepatide, sold under the name Mounjaro®, induced higher weight loss than Wegovy (on average 22% at its highest dose).9 This data has led many to believe Lilly could seek regulatory approval for the drug as an obesity treatment sooner than previously expected.

In addition, Nordisk and Lilly are already working on next-generation weight loss drugs, including several oral medications and other formulations. While Nordisk has more than a year’s head start, Nordisk and Lilly are expected to again split the obesity market evenly, forming a dominant, stable duopoly as they have with Wegovy and Mounjaro.

These developments come at a time when attitudes toward obesity are changing, and technological advances make outcomes from medicines easier to measure. COVID-19 brought the health inequity of obesity into greater focus, and there is growing understanding that treating obesity can have real health and economic significance. Additionally, weight loss and the impact of obesity therapies have become easier to monitor through tools like online connected scales, enabling physicians and payers to see the benefits. These dynamics are important in driving reimbursement rates in the U.S.

Health warning: Understanding the risks

The magnitude of weight loss connected to the new class of drugs, along with a more manageable safety profile, is driving optimism about the potential size of the market. That is not to say there are no risks, however: Market expectations have risen fast, and the price-to-earnings multiple of both companies has expanded as a result. With higher growth, better visibility on future growth and no major patent expirations in the coming years, this valuation may be warranted, but it is a risk, especially if demand disappoints.

Other concerns include reimbursement rates and access to treatment. Medicare does not cover any branded obesity medications, at least for now (but may start to if ongoing cardiovascular outcomes trials are positive), and questions remain about length of treatment and whether discontinuing the drugs might lead to regaining weight.

Access could be a major challenge from an equity point of view, as obesity is skewed disproportionately toward low-income populations. Wegovy is currently priced at $1,350 a month,10 and even when these drugs are reimbursed, many people under standard health care arrangements in the U.S. may not be able to afford them.

Finally, there is the complicated role of messaging. Today, when people are looking for information about weight loss, many rely on social media and word of mouth rather than medical professionals. Instead of being a purely medical market, use of obesity medications may turn out to be more consumer driven. For companies to succeed in such an environment, they may need to do far more targeting on social media. This is an opportunity to drive awareness and demand but is also a potential risk, as it may cause regulators to raise concerns about misinformation and off-label uses.

Strong catalysts for growth

Companies that produce obesity medicine have the potential to benefit from these treatments; the market for obesity drugs could ultimately be much larger than predicted, especially if payers get on board with reimbursement.

Estimates suggest 37% of the world's adult population will be overweight and 19% obese by 2030, with the latter equating to more than a billion people.11 These findings highlight that not only will most countries miss WHO targets for zero increase in the prevalence of adult obesity and diabetes between 2010 and 2025, but in fact the number of people with obesity is on course to double across the globe.

Against this backdrop, there is a worldwide call to end the misunderstanding, fragmentation, underinvestment and stigmatization surrounding obesity. Significant effort is required to reduce the rates of illness and death associated with this epidemic, suggesting this market could support more meaningful top- and bottom-line growth for innovative companies ahead.

Judith Finegold is an equity investment analyst with eight years of industry experience (as of 12/31/2023). She holds a PhD from Imperial College London, an MBA from INSEAD and a degree in medicine from the University of Cambridge and University College London.

Laura Nelson Carney is an equity investment analyst with nine years of industry experience (as of 12/31/22). She holds a PhD in neurosciences from Imperial College London and a bachelor's degree in human biology from Stanford University.

Emily Liao is an equity investment director with 20 years of industry experience (as of 12/31/23). She holds a bachelor's degree in sociology from the University of Chicago.