It has become a truism that the pandemic changed the way we work. But aside from the more obvious changes (hello sweatpants!), there’s also been a marked increase in model portfolio use among financial advisors.

Updated onDecember 22, 2023

6 MIN ARTICLE

Some advisors use model portfolios to help reduce time spent on investment management and save on operating costs. But there are several things to consider when choosing a model provider.

TABLE OF CONTENTS

Current model portfolio trends

According to a Cogent study,1 27% of advisors using model portfolios report increasing their role since the pandemic took hold. That figure is set to rise even further, with 22% of advisors expecting to rely more on model portfolios and spend less time on portfolio construction over the next year.

The increase is partly a generational shift. Cogent found that advisors younger than 45 are the most likely of any age group to rely on models from third-party providers, and are more than twice as likely as the most seasoned advisors to rely on home office models. And there’s a wide range of models used, with most advisors opting for a mixture of third-party models, models provided by their home office, and models they’ve built themselves.

Why use model portfolios?

The clear driving force behind model adoption, however, is efficiency. It’s little wonder that model use is on the rise if you look at a 2019 study by AssetMark.2 A whopping 98% of financial professionals surveyed who outsource asset management said they delivered better investment solutions due to outsourcing, with 87% saying the benefits met or exceeded their expectations.

Outsourcing even just 20%-49% of assets saved almost six hours per week, survey participants said, giving them more time to focus on deepening existing client relationships and reaching out to new clients. A majority of participants also reported experiencing 17% lower operating costs on average.

Capital Group’s Pathways to Growth: Advisor Benchmark Study3 reconfirms some of those reported benefits. The highest growth advisors in our survey spent 18% less time on investment management but 35% more time on team management and nearly 24% more time on marketing and client acquisition compared to the average advisor. These high-growth advisors were also 24% more likely to use model portfolios than the average advisor.

Still, some advisors are reticent to embrace models. One common concern raised by advisors around model use is that they might be sacrificing part of their value proposition. “We like to pick and choose the funds and fund families we invest in, and not have it decided by another person,” one regional advisor told Cogent.

According to a separate independent advisor: “I felt that I needed to be more involved in which funds to use as the market seems to be more volatile, and I felt specific funds would be better in a pandemic then a more generic model situation.”

But increased model use doesn’t mean the advisor is any less important, and the time saved could be allocated to provide a higher level of service. Even the highest growth advisors, who were more likely to use models, didn’t outsource their entire book of business. It only takes a small portion of model use to potentially begin realizing benefits.

Build, buy or borrow

But the “why” is just one part of due diligence. In deciding to use models, advisors must also figure out the “when” and “with whom.” To that end, consider a “build, buy, borrow” approach: A built model portfolio is just that — one where advisors are responsible for asset allocation and security selection. In contrast, with a “buy” portfolio, advisors fully outsource portfolio construction to a third party or to the home office. “Borrowed” portfolios sit in the middle, where advisors might determine the security selection but defer on asset allocation.

Source: Capital Group

Source: Capital Group

Turn device sideways for larger view

According to Cogent, relatively few advisors fit cleanly into just one of these categories, but instead use some combination of the approaches, with custom-built or home office-provided models being the most common.

When to use models

Client segmentation may help in the decision-making process. Say you’ve got a client whose assets under management are lower than average for your firm. What if that person consistently refers new high net worth clients every year? Do you share a philosophy and have a strong connection? Is this person highly respected in the community, or perhaps with your top prospects? This client might be more valuable to your practice than individual revenue generation would suggest.

Many advisors feel that model portfolios are only appropriate for smaller clients. According to Cogent, a third maintain that third-party models don’t meet the specific needs of their high net worth client base. It’s important to keep in mind that there’s more to a build, buy or borrow decision than just total assets. Focusing too narrowly on asset-level risks may cause you to overlook other value that a particular client might bring.

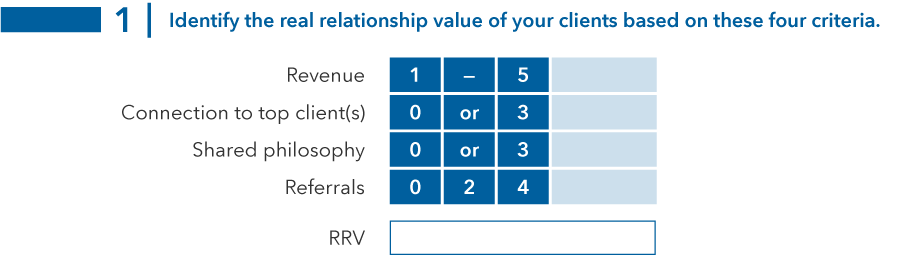

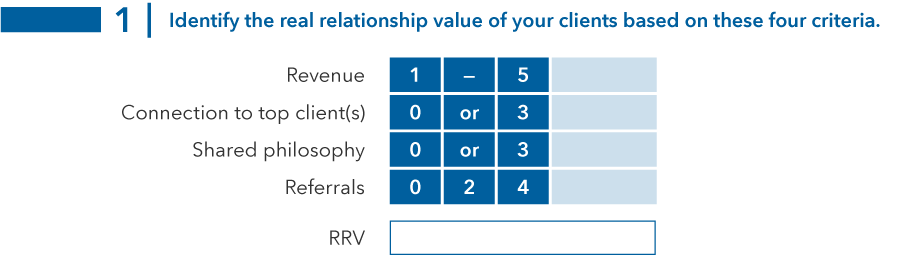

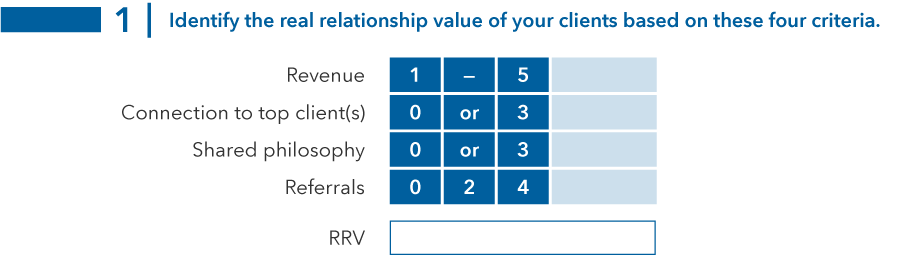

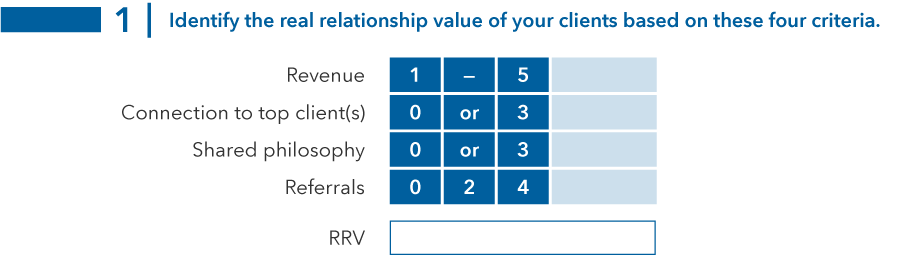

To help you decide how to segment your clients, we developed a framework for valuing client relationships called real relationship value (RRV). Use this system to determine each client’s score.

Source: Capital Group

Source: Capital Group

Turn device sideways for larger view

Using this scoring system, we suggest dividing clients into three buckets.

Source: Capital Group

Source: Capital Group

Turn device sideways for larger view

This segmentation can help you prioritize your time and aid in the build, buy or borrow decision. If one group of clients needs more touch points, then the time savings from increased model use might make sense.

Source: Capital Group

Source: Capital Group

Turn device sideways for larger view

Model due diligence

When selecting model portfolio providers, it helps if financial advisors have a repeatable and defensible due diligence process. Knowing whom to partner with is its own form of expertise, and another way that advisors can add value for clients.

With all the providers currently in the market, how do you know who meets your needs? Here are some key areas to keep in mind:

- What is their competitive advantage?

- What are the model portfolio managers’ Morningstar ratings?

- How do advisors rate the model portfolio manager?

- Do they have sufficient marketing materials?

- Can they support your account?

- What is their cost?

To determine a provider’s competitive advantage, consider how experienced their people are. What are their credentials? Do they have a diverse range of backgrounds? These are all factors in determining a firm’s attractiveness relative to their peers. One must also consider their investment process. Is it tactical, or strategic? How is asset allocation determined? What sort of monitoring do they do?

Here, size can be an advantage. Larger firms have more resources to find and retain top investment talent. That longevity in turn can lead to organizational stability and a well-defined process.

You also want a manager whose philosophy aligns with your own, as well as your clients.’ Your client will look to you to explain the provider and why you picked them. It’s important to understand what sets that manager apart, and to have confidence in those differentiators.

To aid in that storytelling, the second key consideration is whether this manager has tools and marketing resources you can share with clients. Proposals, model fact sheets and model brochures are all ways to aid client (and your own) understanding. You can’t defend what you don’t understand.

And, of course, advisors need to ask if the manager has the tools and resources to help them properly service accounts. Beyond the nitty-gritty details of the model in question, does the manager offer any economic and market insights? Do they have practice management insights, or commentary on models and allocation changes more broadly?

Returns are great, but they don’t happen in a vacuum. A manager that offers additional context around their model portfolios can make for an attractive partner, and leveraging their experience can mean more time to dedicate to your clients.