American Funds College Target Date Series®

Our seven target date funds were designed to address the key challenges of saving for the rising cost of education. A single investment provides diversification and a glide path matched to your intended college enrollment date, making saving for college easier than ever.

Features and benefits

- Convenience — Our target date funds provide diversification in a single, easy-to-use, low-cost investment.

- Designed for educational savings — The funds are designed specifically for educational savings, with two needs in mind:

- Keeping pace with, if not exceeding, the rising cost of education.

- Preserving capital as the enrollment date approaches.

- Automatic asset reallocation — Each fund’s portfolio becomes heavily oriented toward bond funds as the expected target enrollment date nears and grows even more preservation-oriented when the date arrives.

- Time-tested American Funds investments — The American Funds College Target Date Series is the only 529 college savings plan target date option to solely feature American Funds.

- Experienced oversight — Members of the Target Date Solutions Committee monitor the Series, reviewing results and asset allocations to keep them aligned with each fund’s time horizon.

The glide path

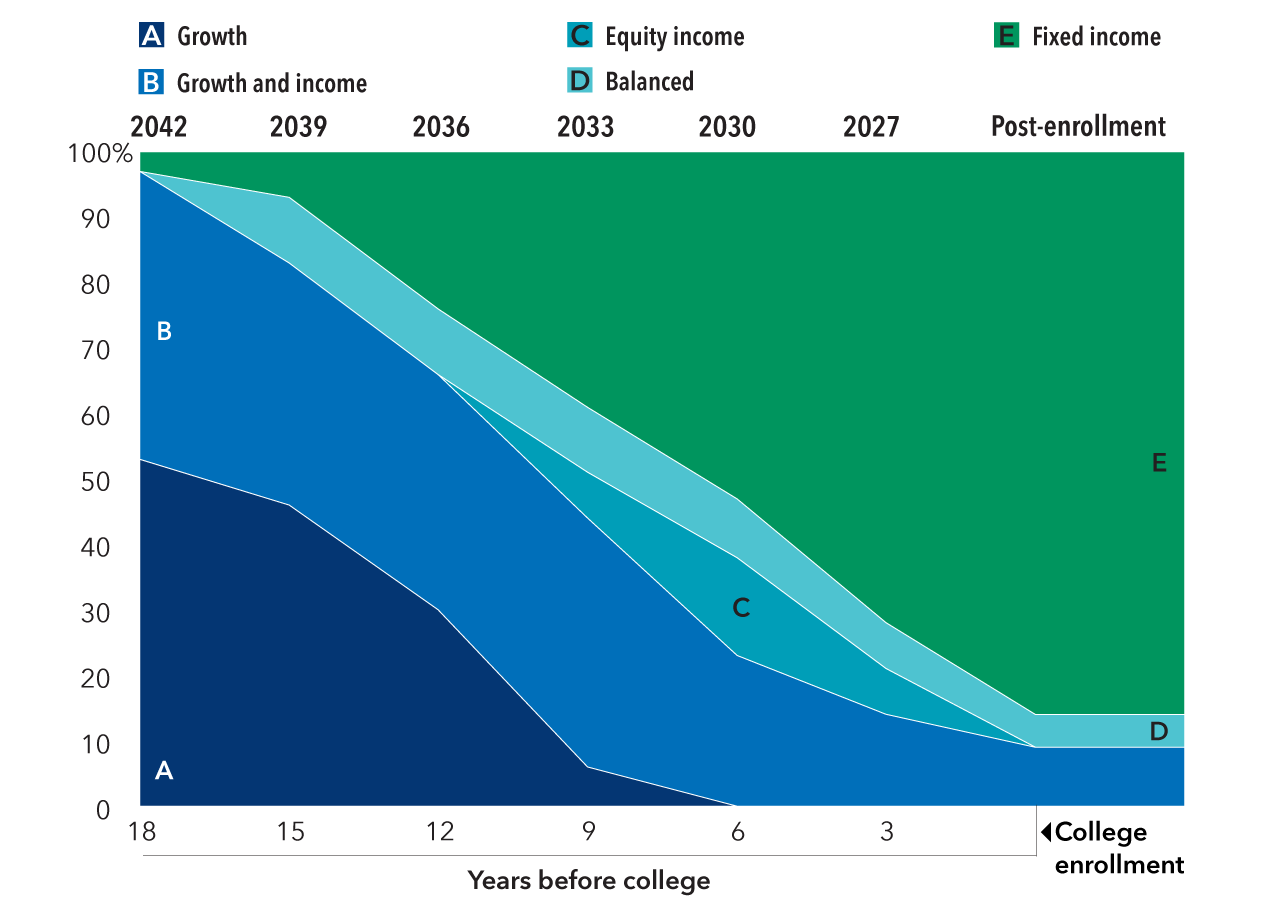

A glide path aligned with your college savings needs

- We offer seven target date funds in three-year increments. The target date is the year that corresponds roughly to the year the beneficiary will start withdrawing funds to meet education expenses.

- Our target date funds are monitored by the Target Date Solutions Committee, a seasoned group of investment professionals. They use a rigorous process to determine the glide path for the series and the combinations of American Funds in each “fund of funds.”

- As the fund moves along the glide path toward the enrollment date, managers modify the investment mix so that each fund’s portfolio gradually shifts from helping the assets grow to being more preservation-oriented.

- The allocation strategy does not guarantee that investors’ education savings goals will be met. Investors and their financial professionals should periodically evaluate their investment to determine whether it continues to meet their needs.

American Funds college target date glide path

The nearest dated fund merges with the College Enrollment Fund when it reaches its target enrollment date.

The target allocations shown are as of June 18, 2025, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

Availability and management

- Anyone can invest in the American Funds College Target Date Series. Investors generally choose the fund with the target date closest to the year the student is expected to enroll in college but are not precluded from investing in other funds in the same CollegeAmerica® account.

- The underlying American Funds in the American Funds College Target Date Series are managed using The Capital System™. The allocation percentages and underlying mutual funds within each Series fund are subject to the oversight committee's discretion and may evolve over time. Underlying funds may be added or removed at any time.