4 Box Crucial Client Conversations

Description: Financial advisors play an important role in helping put investor concerns into context. The 4 Box Crucial Client Conversations framework can help. Paul Cieslik, at home in Florida, walks through the proven steps, providing specific language and useful phrases you can use in discussions with your clients.

Featuring: Paul Cieslik, Senior Vice President, Advisor Practice Management

Paul Cieslik: Hello. My name is Paul Cieslik. I'm a senior vice president/national speaker with Capital Group/American Funds.

One of the most difficult aspects of an advisor's job is managing clients through challenging times, keeping them from acting on instincts that may get in the way of their real-life financial goals. What we face today seems so momentous it's hard to know where to start. That's why it helps to have a framework to guide you through difficult client conversations and make the most of them.

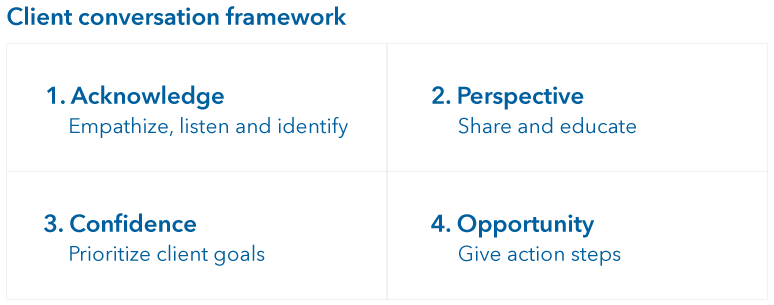

There are four steps to an effective, efficient client conversation, and each has a distinct goal. First, acknowledge where the client stands. Second, provide your perspective, and third, build confidence. Finally, fourth, share opportunities. We call our framework the Four-Box Crucial Client Conversations because it's just that simple, four boxes (laughs). You can draw a line vertically and horizontally on a piece of paper, and there, you have it. We also have downloadable Four-Box PDFs available for you and for you to use with your clients. (We also have downloadable 4 Box PDFs available for you and for you to use with your clients.)

The simplicity of this framework allows you to use it for any conversation. The Four-Box is a proven tool used by thousands of advisors to help clients through the great financial crisis, the tech bubble, and other periods of volatility during the past two decades.

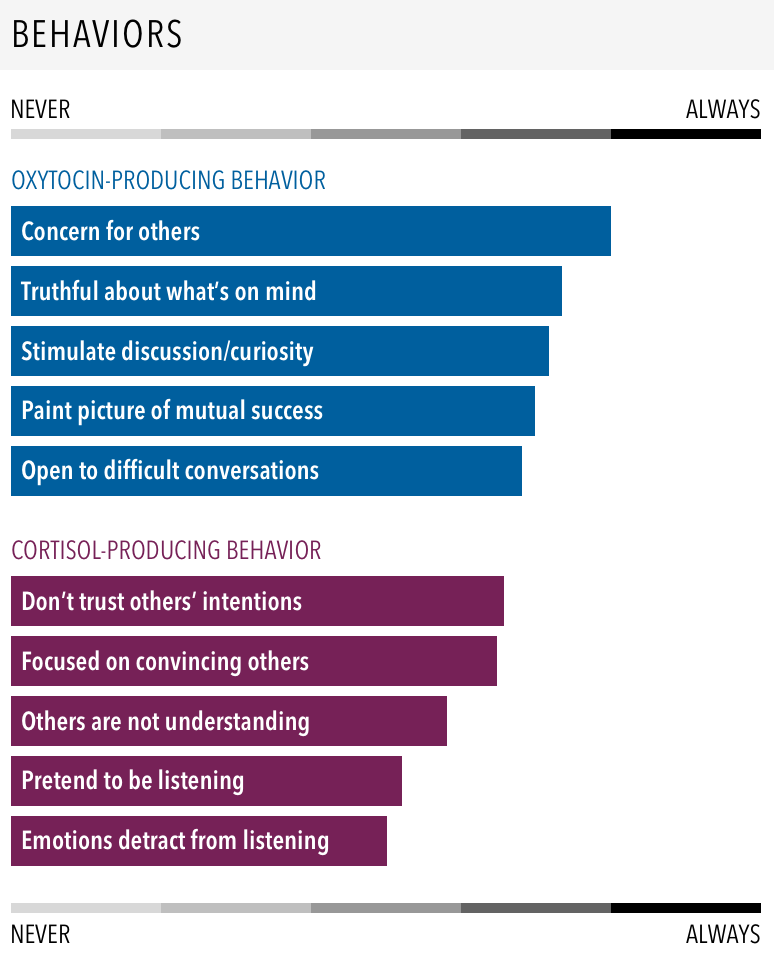

The first step is to acknowledge the client. The goal is to empathize, listen to, and identify client concerns. In other words, check in before you step in. Empathize. Acknowledge that you understand whatever they're feeling. Say to them, "I know that these are unsettling times." Let them know you care. "I wanna make sure you're doing okay." Demonstrating empathy begins by listening. Be careful not to presume to know what their concerns are going into the conversation. Find out what they are. Let them empty their emotional bucket. Ask them, "How are you holding up? How are you feeling?"

Then, identify. Try to get at what's specifically on their mind. "I'm sure you have questions for me. What concerns you most?" Repeat back what you've heard. Ensure that they know that you are listening.

Now, it's time to move from acknowledge to sharing your perspective. To do so, it's important to acknowledge the realities of the market and the economy while reminding clients of the importance of keeping a long-term perspective. We don't know when the market will recover or what the full impact will. What we do know is investors that stay the course have historically benefited over the long run. I'm not sure if we're at a market [bottom], but I can tell you we're probably not at a market [top].

Then, set the agenda for the conversation. This is critical as it creates an accountability standard ensuring that you're having a productive call connecting emotionally with your client. I believe if we share our perspective, it can help. "I remain confident about your goals and know that opportunities exist."

The perspective goal is to share and educate. The further back you look, the further ahead you can see. Of course, this doesn't mean we know what's going to happen in the future, but it's important to help clients put current events into context.

There are different types of perspective you can share and use to educate clients. The first step is perspective on the current market. For example, there are three broad challenges. First is biological. This is seventh virus in two decades. Second is economic, with global supply chains' stress setting the backdrop for a recession. Third is psychological, with the demand-side realities of reduced travel, new work protocols, and social distancing. It's just as important to offer a historical perspective. Remind clients, maybe a few who have never lived through a bear market, that we have been through market turmoil before and that we're prepared for this. Share. Market declines are normal, natural, and expected. Remind them, "We've been here before, and markets have always recovered."

If you need supporting documentation to make the case, know we offer informative materials that can help put these three broad challenges into perspective. For example, Capital Group's CEO Tim Armour's update on weathering the coronavirus in which he discusses the implications for the broader economy and what investors should be thinking about now. We also offer plenty of market perspective. This Weathering Market Declines chart shows intra-year declines in the Standard & Poor's 500 Index and how annual price returns have been positive in 51 of 70 years.

Moving through our conversations, remind clients that volatility is factored into the decisions they've made so far. Shift to a focus on goals, which is a key component to reinforcing confidence. "You have made smart, responsible decisions in managing your money, so now let's discuss what matters to you most, your goals."

The confidence step is to remind the client with specificity that you know what matters to them. It's all about prioritizing goals and focusing on what you can control. Reassure the client that a plan is still in place, but it may be time to reconfirm priorities.

Get the client talking about their goals. Provide reassurance when so much feels out of control. Let them know, "I remain confident about your goals. You've shared with me the things that matter to you. I'd like to walk through each one and reconfirm your goals. Let's start with your needs, followed by your wants, and lastly, your wishes."

Once you've instilled confidence, remind them that you're here to help and shift to sharing an opportunity. "My role, my responsibility is to share with you a few opportunities that are aligned with your goals."

The opportunity goal is to take action. It's to provide of point of view to act on, not a fence to sit on. The action steps may differ depending upon the client's concerns. We know that for most clients, there's great opportunity in sticking to the long-term plan and staying invested.

The primary message we want to send is to follow the plan. Follow the plan that we've built. We've designed a plan to stay with in good times and bad, but this may also be a good time to consider financial moves that have nothing to do with the market like reducing or f- refinancing debt. Act on smart financial moves. Consider reducing debt, maximizing 401(k) contributions, or buy undervalued assets.

For clients who are concerned about volatility, maybe this is an opportunity for a portfolio review either to consider rebalancing or making the investments more defensive on the downside. Review your portfolio with an eye towards investment quality and risk. Alternately, some clients may see this as a buying opportunity and wanna take on more risk. Either way, a portfolio review can remind them that the plan they built was based on careful consideration of their goals and risk tolerance.

Again, if you need support, our literature on how to handle market declines can help you calm fears, move the client away from thinking emotionally, and make the case for staying invested.

In closing, it's important to check in with your client. I hope you have found this conversation helpful and remain as confident as I am that you're on track to achieve your goals.

If you need it, we offer downloadable versions of the Four-Box Framework. There's a version that includes action steps and links to material designed to help you guide client conversations in this environment. As mentioned earlier, there's also a blank client worksheet that you can fill in online for your use with your clients.

Thank you. Thank you for what you do, for improving investor outcomes by providing the advice, the support, and the guidance they need. You change people's lives for the better, and on behalf of Capital Group, thank you.