A diversified approach to international growth

Capital Group EUPAC strategy

INCEPTION DATE

April 16, 1984

IMPLEMENTATION

Consider as a core international allocation

OBJECTIVE

Seeks to provide long-term growth of capital

VEHICLES

EUPAC FundTM

Capital Group International Growth SMA

Effective June 1, 2025, Capital Group EuroPacific Growth strategy is now Capital Group EUPAC strategy and EuroPacific Growth Fund® is now EUPAC Fund.

SEEKING OPPORTUNITIES ABROAD

A flexible investment approach

For Over 40 years, the Capital Group EUPAC strategy has taken a flexible approach to investing in attractively valued companies in developed and emerging markets. Many of these companies appear positioned to benefit from innovation, global economic growth and increasing consumer demand. The strategy’s portfolio managers and investment analysts seek to identify these long-term leaders across a broad range of regions and sectors around the world.

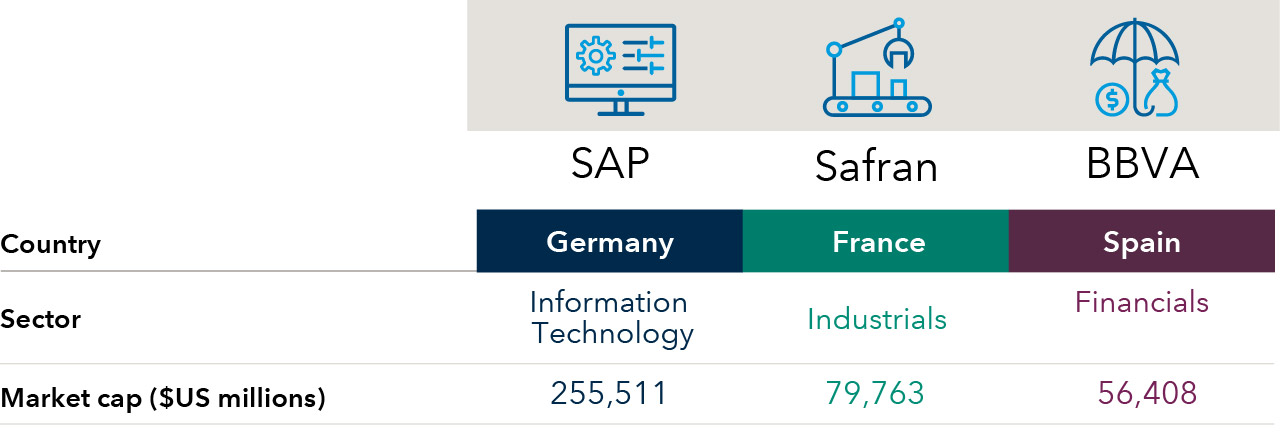

IDENTIFYING LONG-TERM LEADERS IN A BROAD RANGE OF SECTORS AND INDUSTRIES

Examples of top holdings in the fund*

Sources: Bloomberg Index Services Limited and FactSet. As of June 30, 2025.

DEEP, COMPREHENSIVE RESEARCH

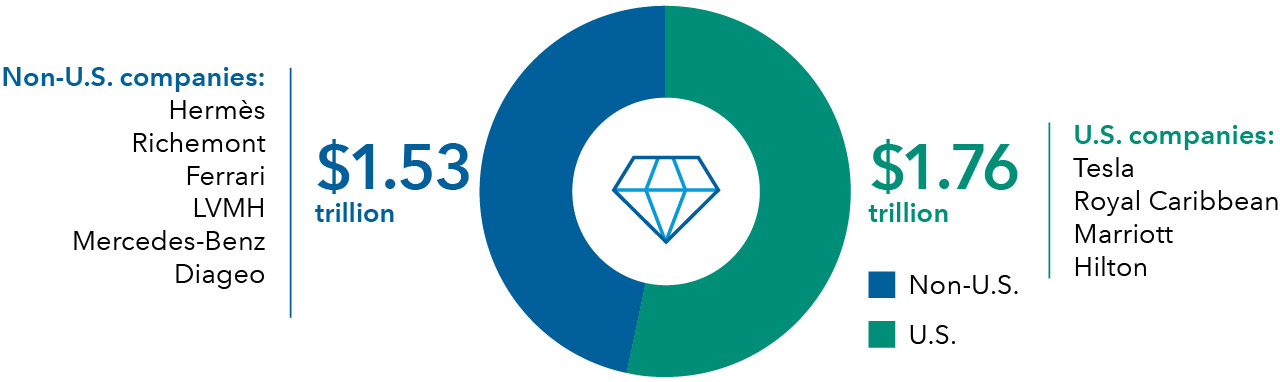

A focus on European luxury goods

The emphasis is on companies, not regions or countries. In-depth, bottom-up research is used to identify companies with attractive long-term growth opportunities. International companies are market leaders in many industries. In certain sectors, European companies are among the world’s most dominant players. The luxury goods industry is one example, centered in Europe, with companies such as Hermès, Richemont and Ferrari leading the luxury market.

EUROPEAN COMPANIES LEAD THE GLOBAL LUXURY GOODS INDUSTRY

S&P Global Luxury Index market capitalization (top 10 companies shown)

Source: S&P Dow Jones Indices LLC. As of June 30, 2025. Companies listed represent the 10 largest by market capitalization.

One investment strategy, multiple ways to invest

The first is EUPAC Fund, which is offered in various share classes designed for retirement plans, nonprofits and other institutional and individual investors.

For high-net-worth clients, consider the Capital Group International Growth SMA, which has the same objective and is managed by the same team of portfolio managers.

*Companies shown are among the top 15 holdings by weight in EUPAC Fund as of June 30, 2025 (TSMC, Airbus, Novo Nordisk, SAP, UniCredit, MercadoLibre, Banco Bilbao Vizcaya Argentaria, EssilorLuxottica, SK hynix, Flutter, Entertainment, 3i Group, ASML,Safran, Reliance Industries, NEC).

The S&P Global Luxury Index is comprised of 80 of the largest publicly-traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P Global Luxury Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.